Three Things We’re Hearing

- Personal loan “randos”

- We review our 2024 predictions!

- Education lending sluggish

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Personal Loan “Randos”

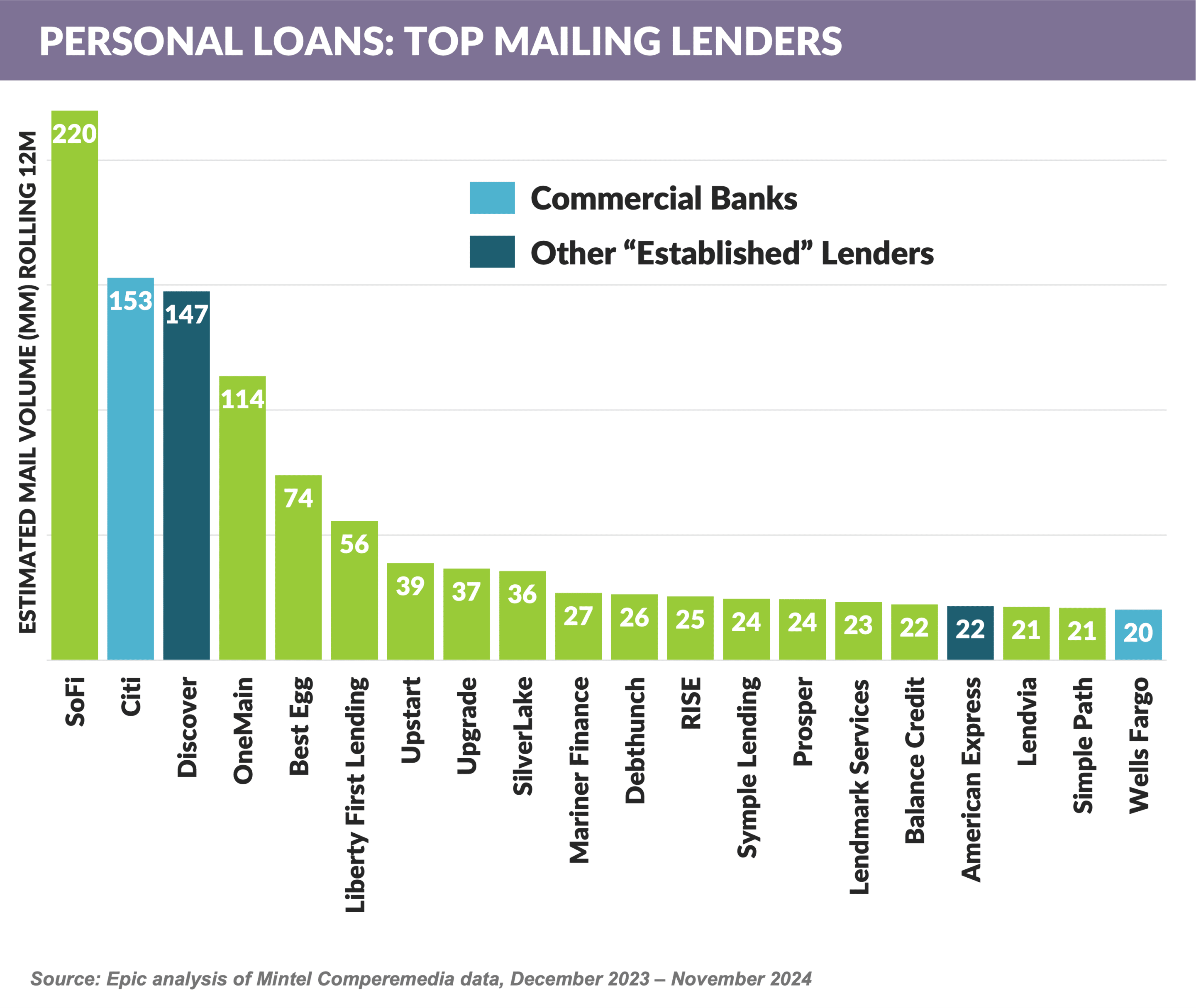

- We have written frequently about the personal loan market – specifically the absence of traditional commercial banks in a segment now dominated by fintechs

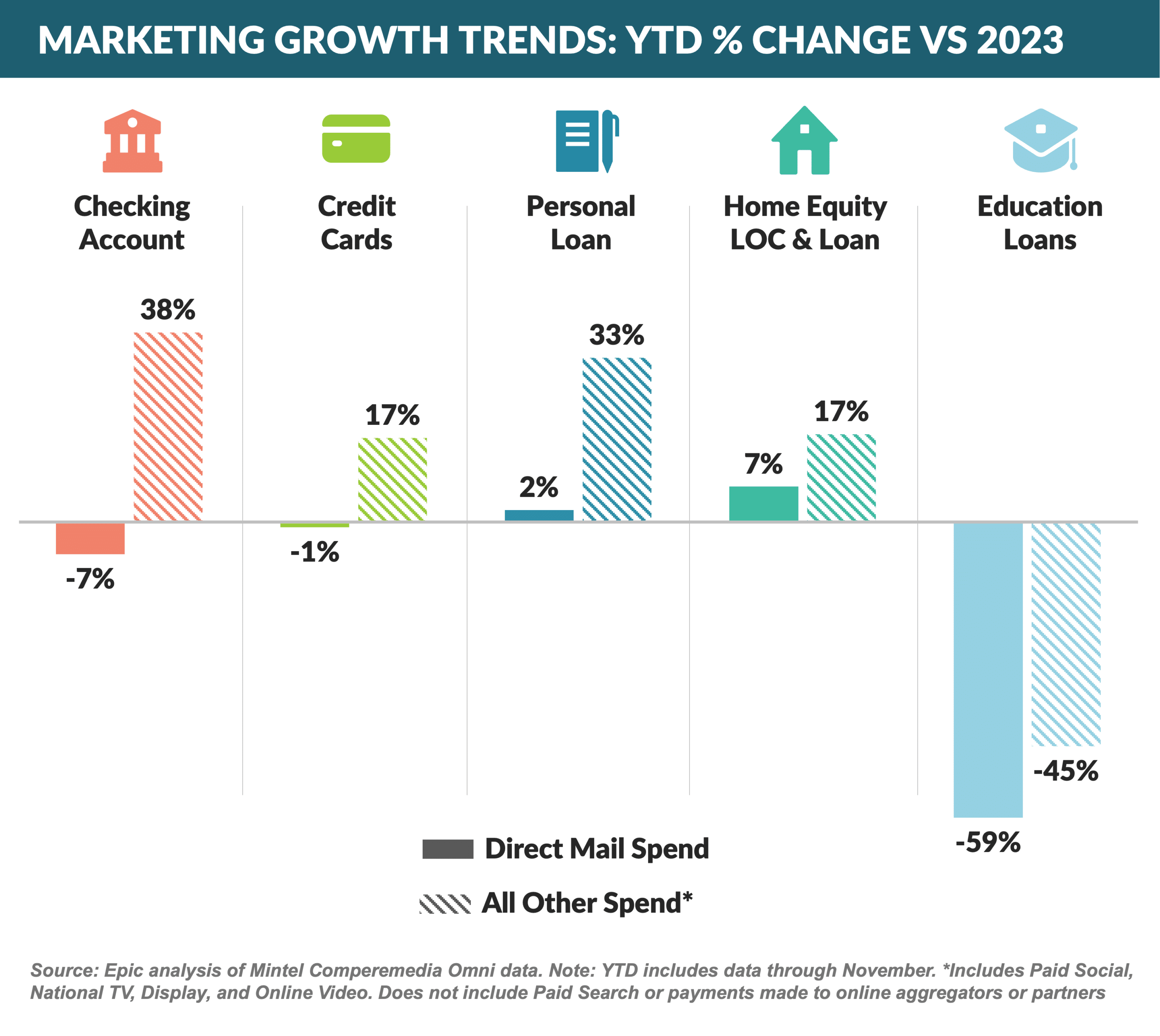

- Direct mail volume, the dominant personal loan acquisition channel, is up only 2% YTD through November

- Commercial banks represent only two of 2024’s top mailers (Citi and Wells Fargo)

- Discover and Amex are the only other “established” lenders in the top 20

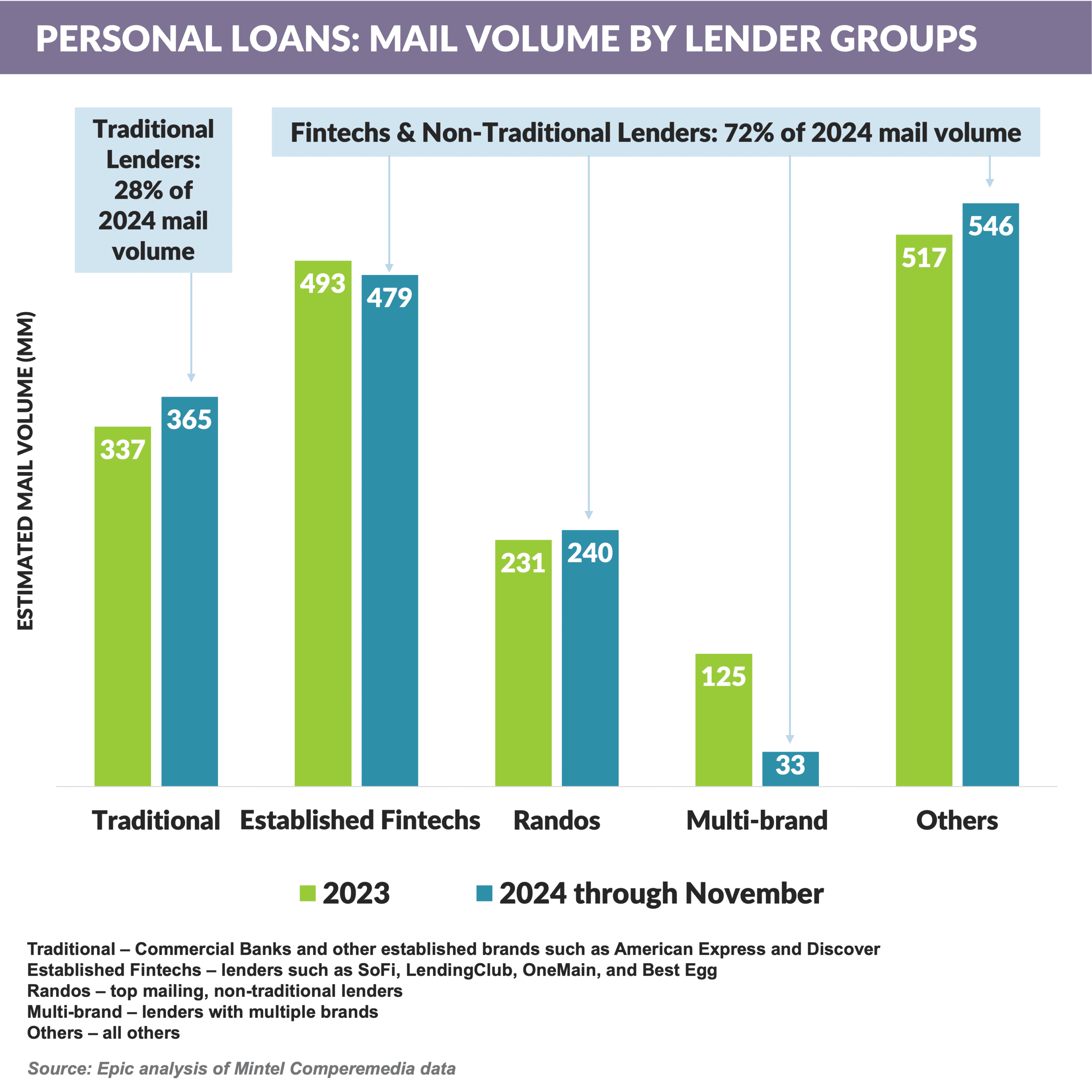

- “Traditional” lenders – e.g., commercial banks, Amex, Discover – account for only 28% of YTD 2024 mail volume, with fintechs and non-traditional lenders owning the balance

- While some major fintech personal loan advertisers have a degree of brand recognition (e.g., SoFi, Lending Club, Best Egg) other large volume mailers may not

- Mariner Finance is a Baltimore-based licensed consumer finance company that has been “serving consumers since 1927” with branches in 27 states

- Balance Credit (loans funded by Capital Community Bank) is a brand used by Chicago-based SunUp Financial that was founded in 2014

- Lendmark Financial Services, owned by private equity firm Lightyear Capital, was founded in 1996 and has over 500 branches offering personal loans and auto loans

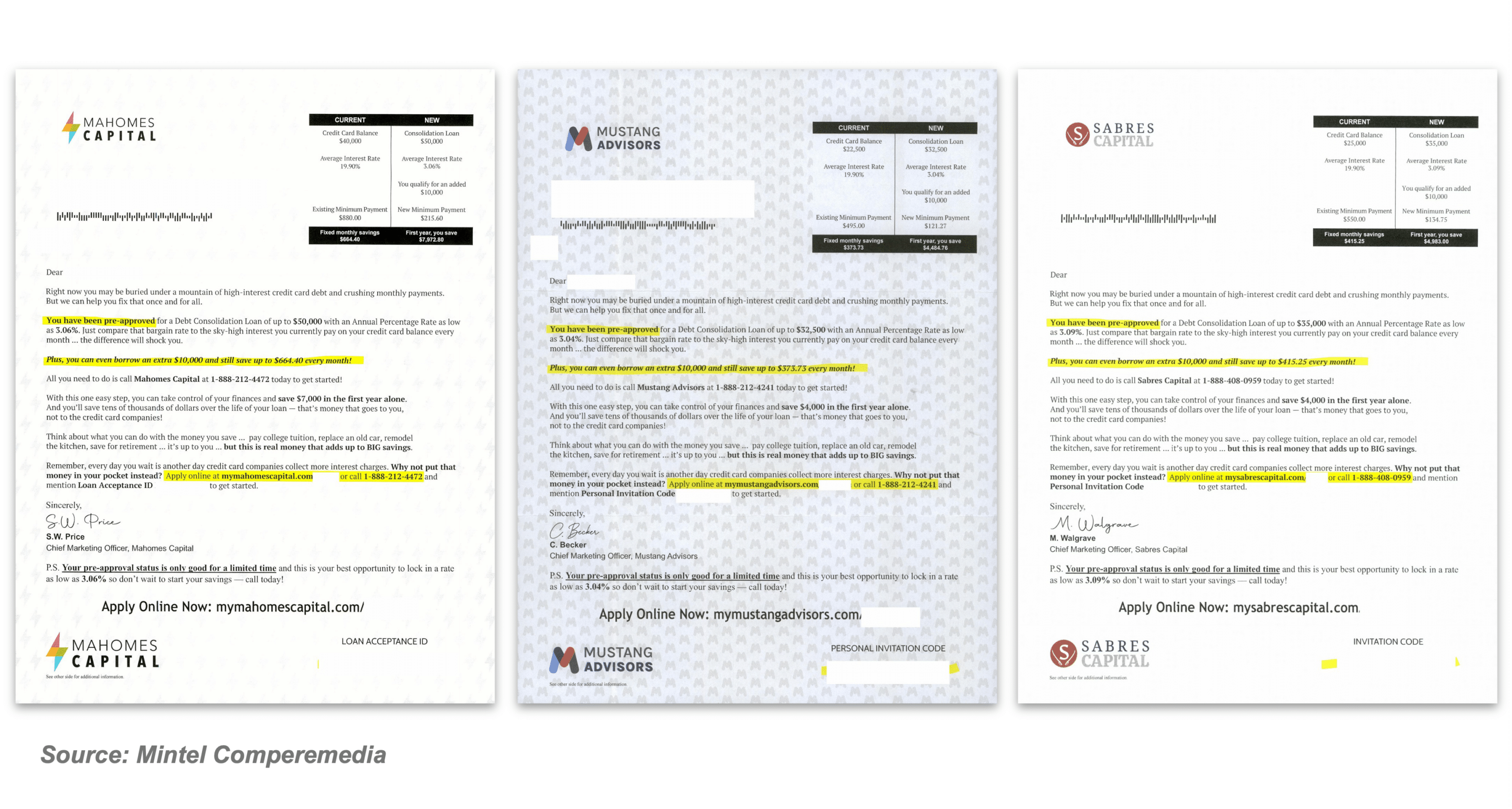

- Another interesting company appears to use “multi-brands” with as many as 15 different brands – typically sports related (e.g., Bronco Partners, Bruins Capital, Patriot Funding, Mahomes Capital) – with similar creative, similar interest rates, with some of the offers having the same address

- None of the URLs for the above samples were working at the time of this report

- Mail volume for these “multi-brands” dropped off in 2024 after accounting for close to 10% of all 2023 direct mail

2024 Prediction Review

- This time of year, everyone likes to make predictions and why shouldn’t we? We have published our annual predictions since 2021, and since we hold ourselves accountable, we’ll start with our review of our January 2024 bold (and entertaining, but not necessarily accurate) predictions for last year

- Our first 2024 prediction was that “Low interest credit cards will make a comeback”

- Our reasoning was that since most credit card products in the market feature either cash-back, credit building, or cobrand rewards and with credit card APRs at an all-time high (mid-20s), there was an opening for issuers to attract revolvers with new products featuring low ongoing rates

- A few issuers have adopted a low rate positioning, such as this offer from number 10 issuer and top 25 mailer Navy Federal Credit Union

- USAA and BECU have also highlighted low rate offers and we still think this is a viable strategy for an issuer, as interest rates on existing cards continue to reach all-time highs

- We’ll classify the results of this prediction as “early”

- Next, we predicted that “Discover’s student lending business will be sold to a private equity investor” citing the belief that no commercial bank will be able to get beyond the reputational hangover of the student loan business, leaving a private equity entity as the most logical buyer

- 💥 Bang! This one was a clear winner

July 17, 2024 RIVERWOODS, Ill.–(BUSINESS WIRE)– Discover Financial Services (NYSE: DFS) announced today that Discover Bank (“Discover”) has entered into an agreement to sell its private student loan portfolio to one or more strategic partnerships comprised of investment vehicles and accounts managed by Carlyle (NASDAQ: CG) and KKR (NYSE: KKR)

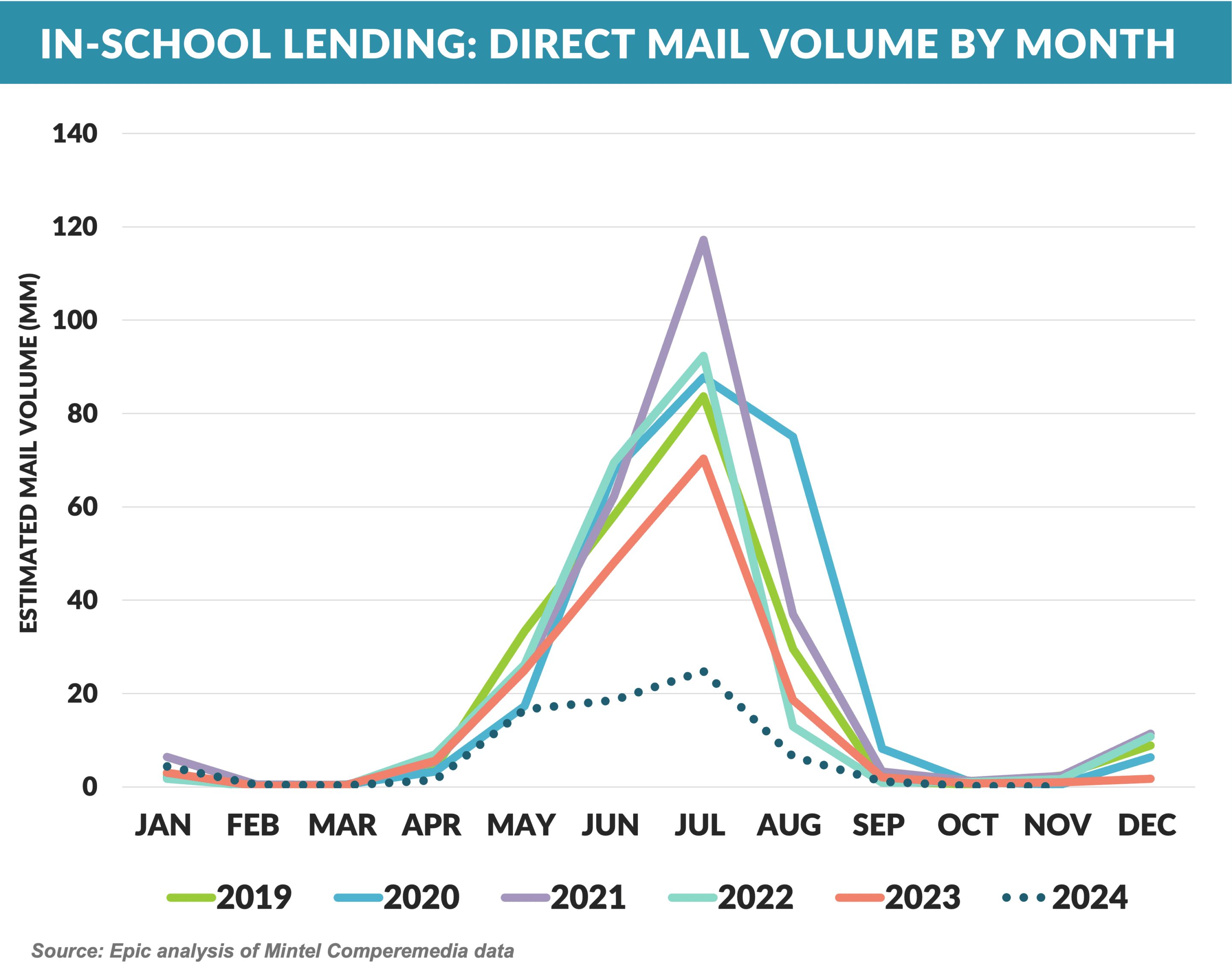

- The disappearance of Discover’s new student loan originations in 2024 further consolidated the “niche” private student loan business benefitting dominant players Sallie Mae, College Ave, Citizens, and SoFi

- Our last 2024 prediction reflected our continued skepticism of the BNPL industry, forecasting that “At least TWO BNPL providers will blow up in 2024!”

- We’ve been “early” on this one before (although BNPL provider Openpay liquidated in 2023), predicting a major BNPL blow up for three years, and were so committed to this prediction last year, that we doubled down in 2024

- Alas, the presence of high growth, high interest rates, rocky capital markets, rising delinquencies, and hundreds of competitors (and now increased regulatory scrutiny) has yet to phase the BNPL industry with the likes of Affirm and Klarna posting continued high growth with Klarna reaching profitability

- We noted last year that “In the unlikely event we’re wrong on this one (again), we’ll publish nothing but glowing articles about the BNPL industry for a year” (*see below)

- We will share our bold predictions for 2025 in the February Epic Report!

Education Lending Sluggish

- Direct mail spend YTD is flat for all products except education loans that has 59% less mail spend than 2023

- “Other” spending – paid social, national TV, display, and online video – is up in all categories other than education

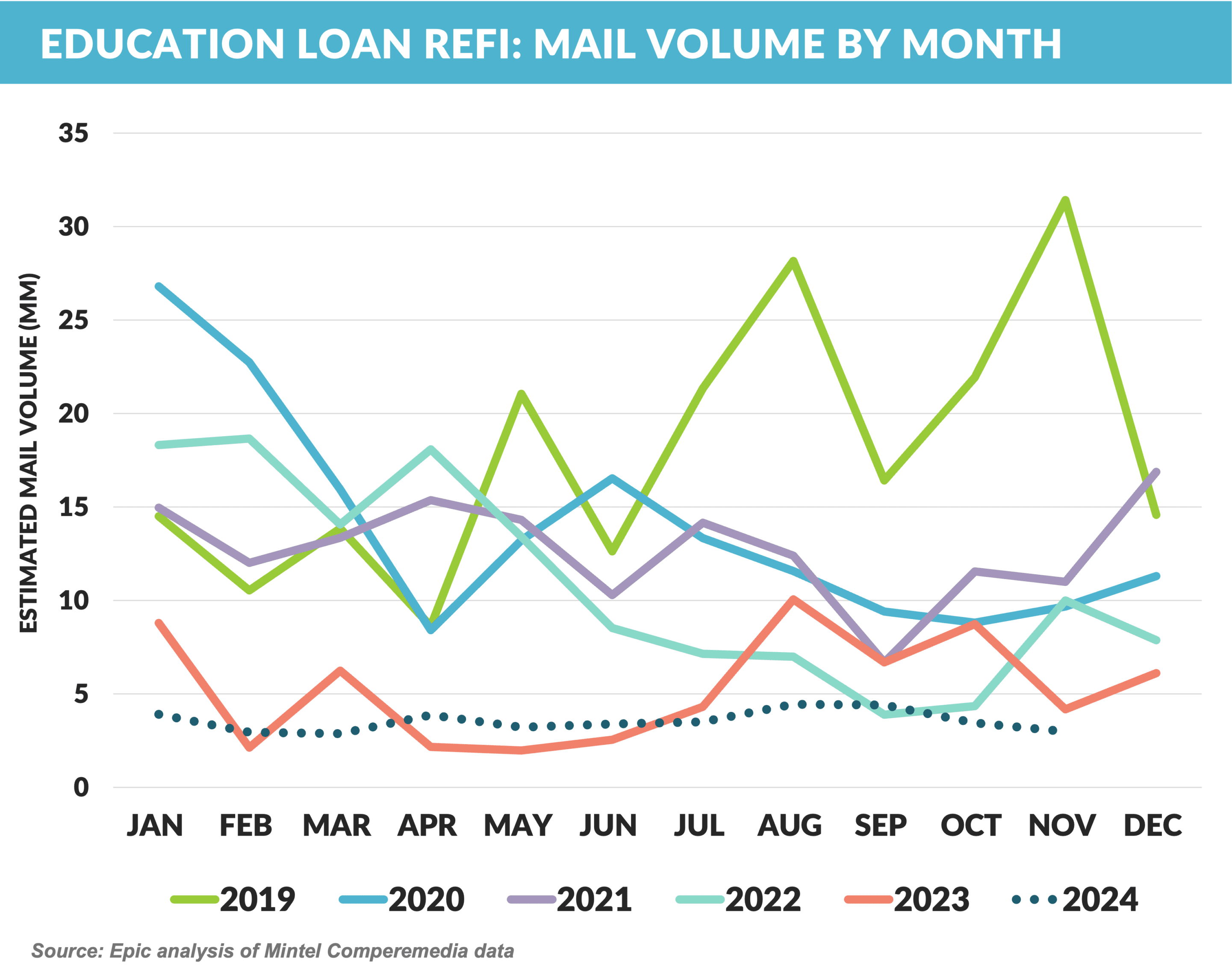

- Both in-school and education refinance lending segments had the lowest mail volume in years

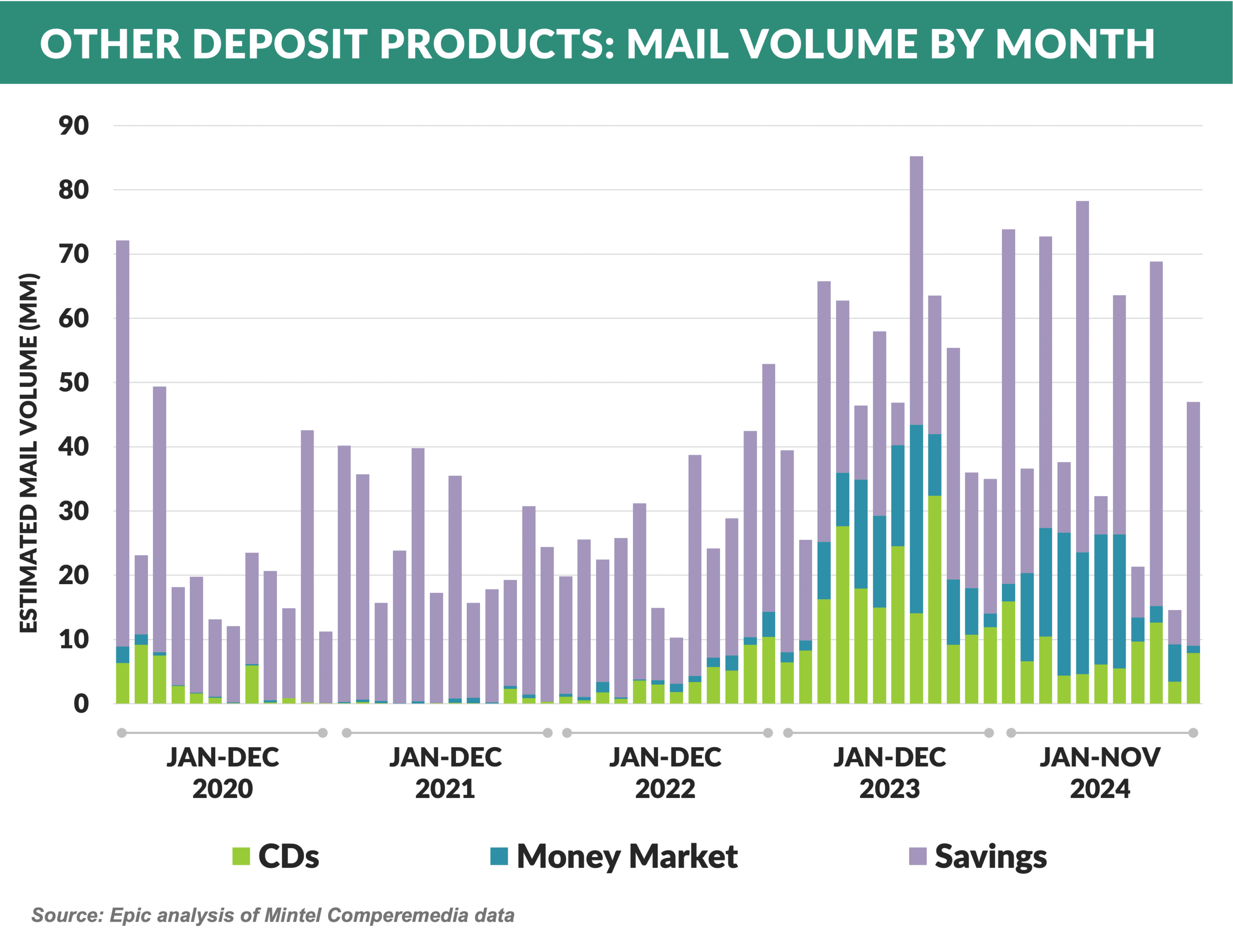

- Other than checking, high yield savings products have dominated the deposit product category in past years with CDs and money markets showing significant mail volume in some months

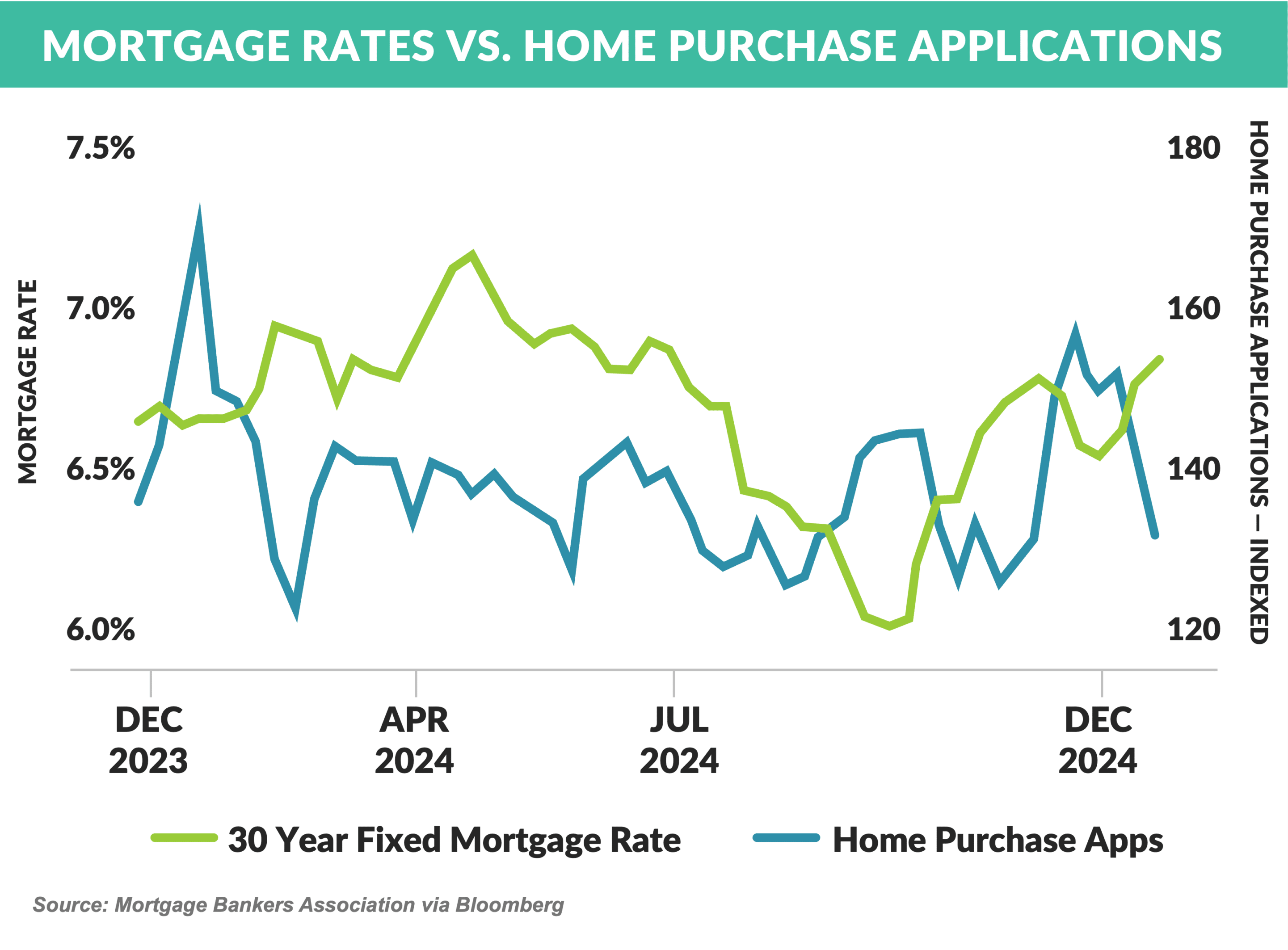

- Mortgage rates neared 7% – their highest level since July – while home purchases declined

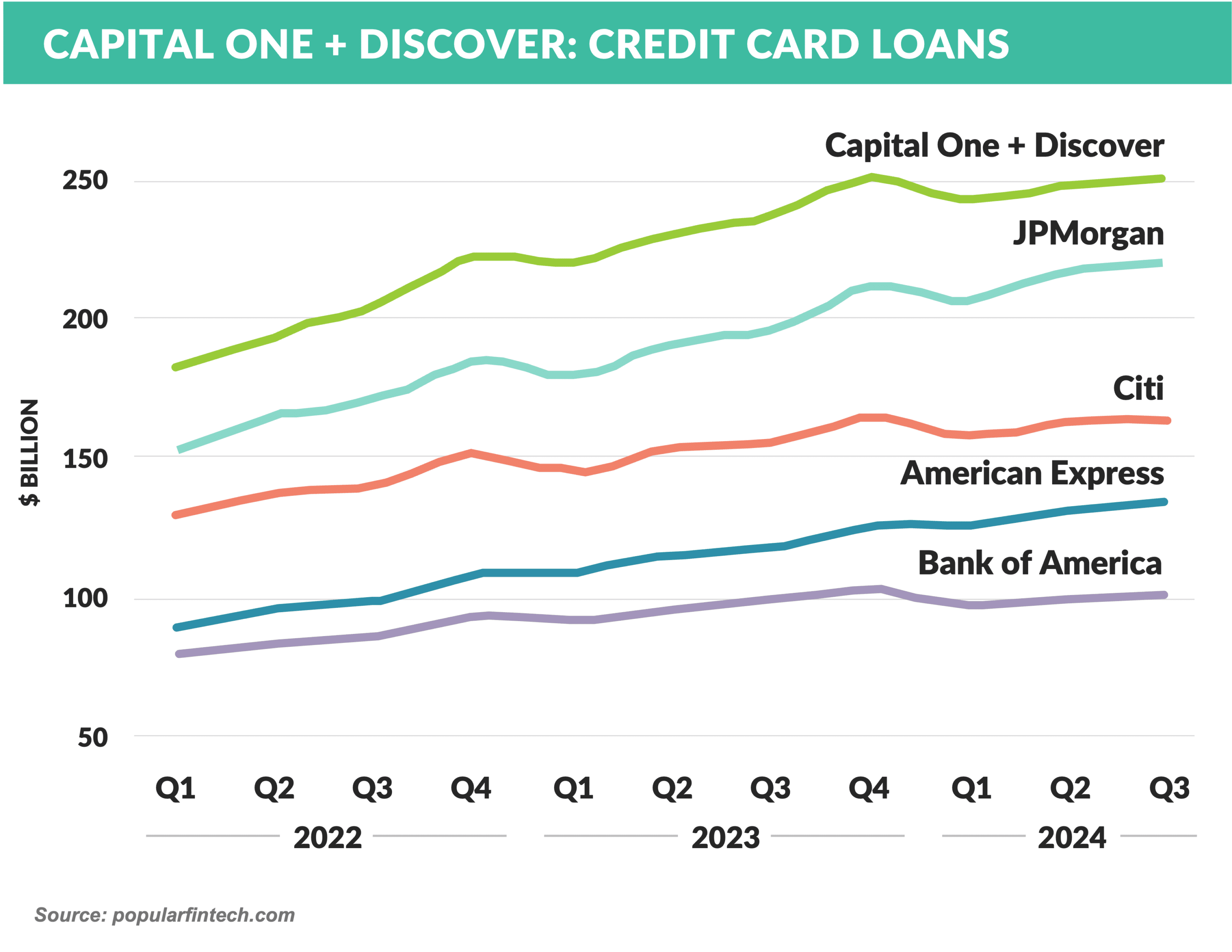

- Capital One anticipates closing the deal to acquire Discover in Q1 2025, following the approval by the Delaware State Banking Commissioner

- The deal still needs the approval of the OCC, Board of Governors of the Federal Reserve, and in a February vote by stockholders of each company

- Once finalized, Capital One will surpass JPMorgan Chase to become the largest US credit card issuer and sixth largest US bank in terms of deposits

- *BNPL provider Affirm has secured an agreement with investment firm Sixth Street to invest up to $4 billion to acquire Affirm’s loans as part of a three year forward flow agreement

- The company says it has grown its funding capacity over 50% over the past two years

- Affirm generated $28 billion in gross merchandise volume in the year ending September 2024 and reports serving over 19 million active users since its 2012 founding

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in February.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Find out how we can help you.