Three Things We’re Hearing

- How higher rates affected marketing spend

- Epic Credit Card Mt. Rushmore – who’s next???

- Checking account marketing outpaces other products

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

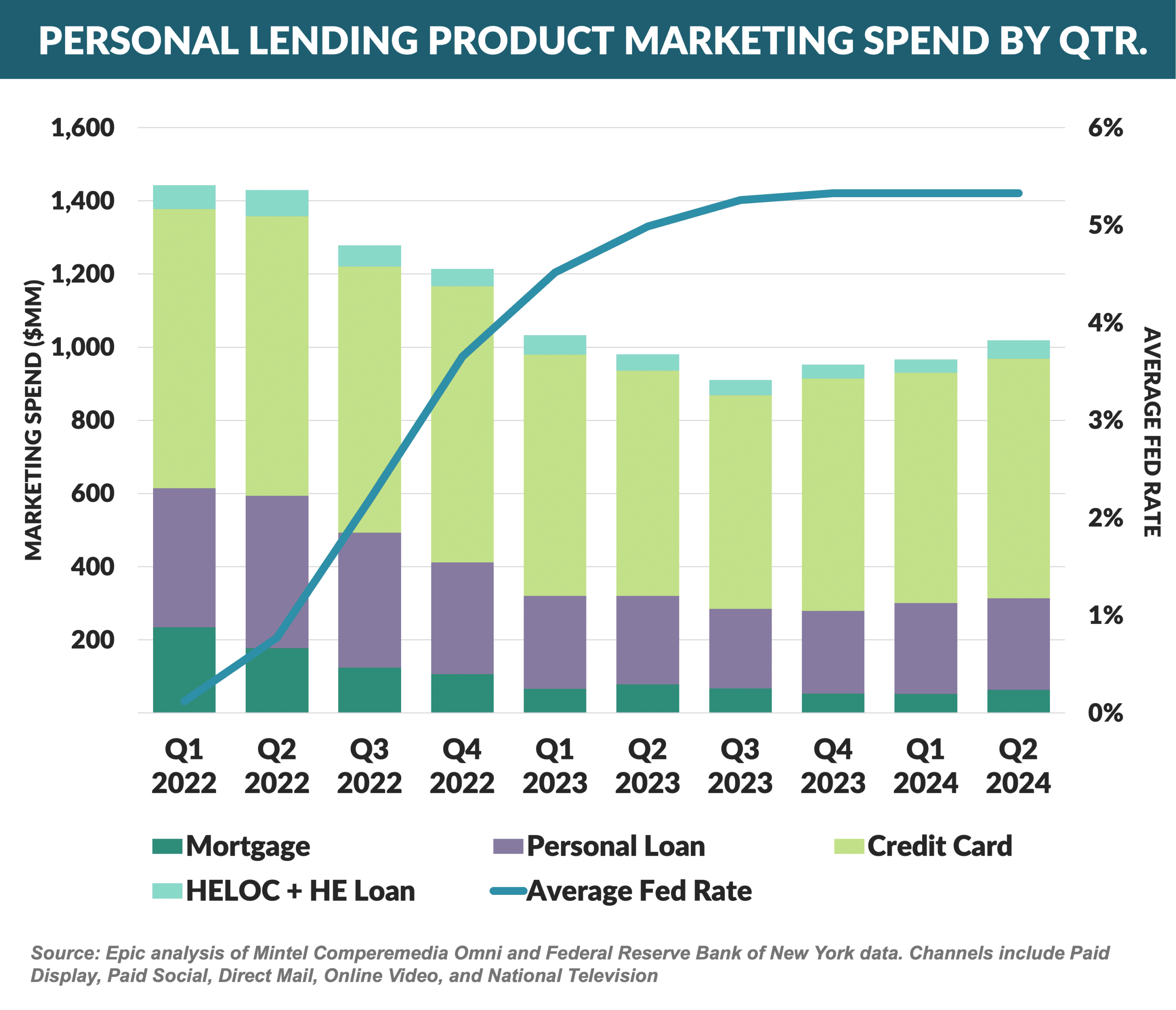

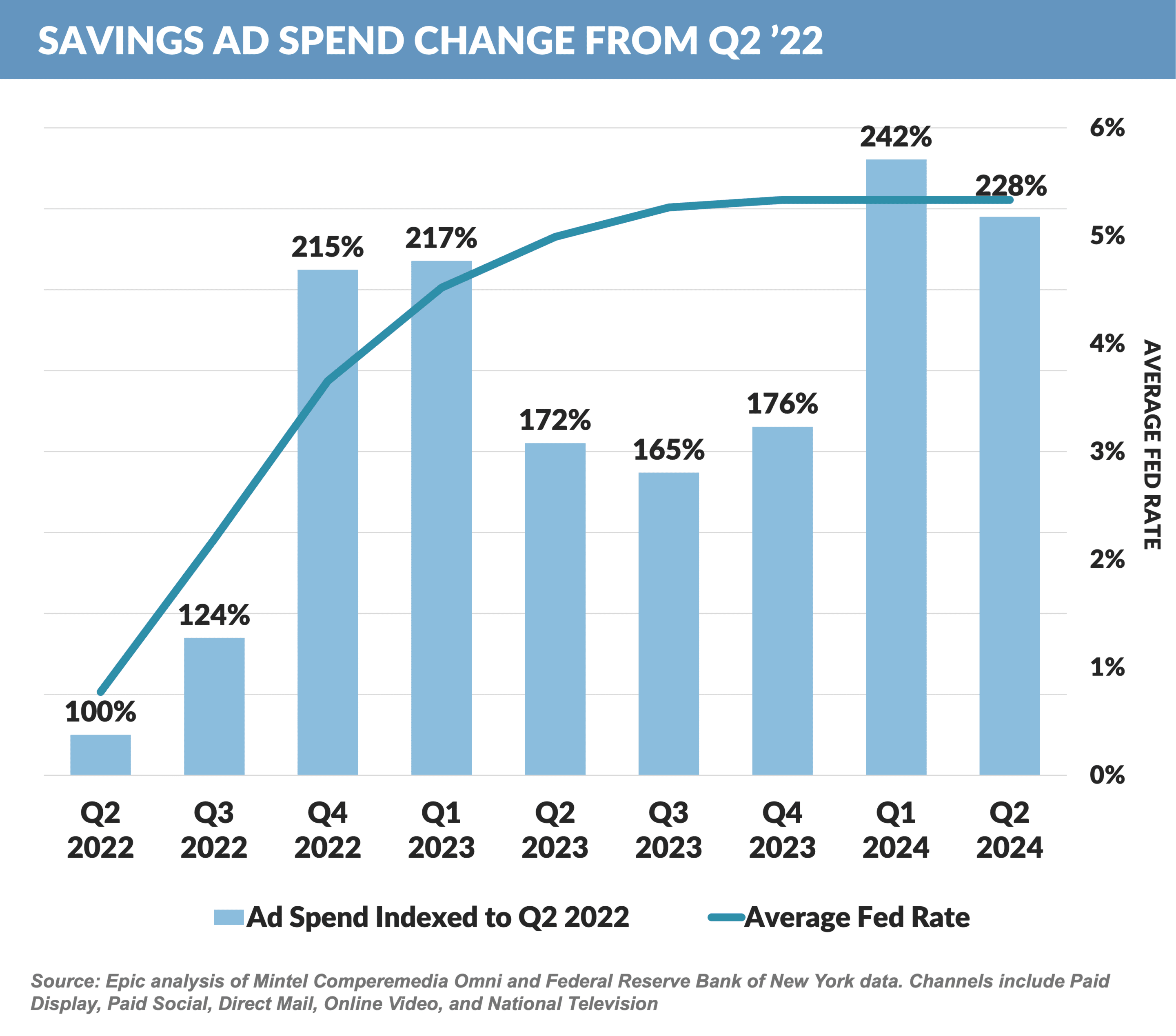

How Higher Rates Affected Marketing Spend

- The Fed has indicated that they will begin lowering rates, and we wanted to take a look at the impact of the recent series of rate increases on marketing spending

- Since rates began rising in Q2 2022, marketing spending on consumer financial lending products dropped for most loan products due to both declining response rates and credit tightening by lenders

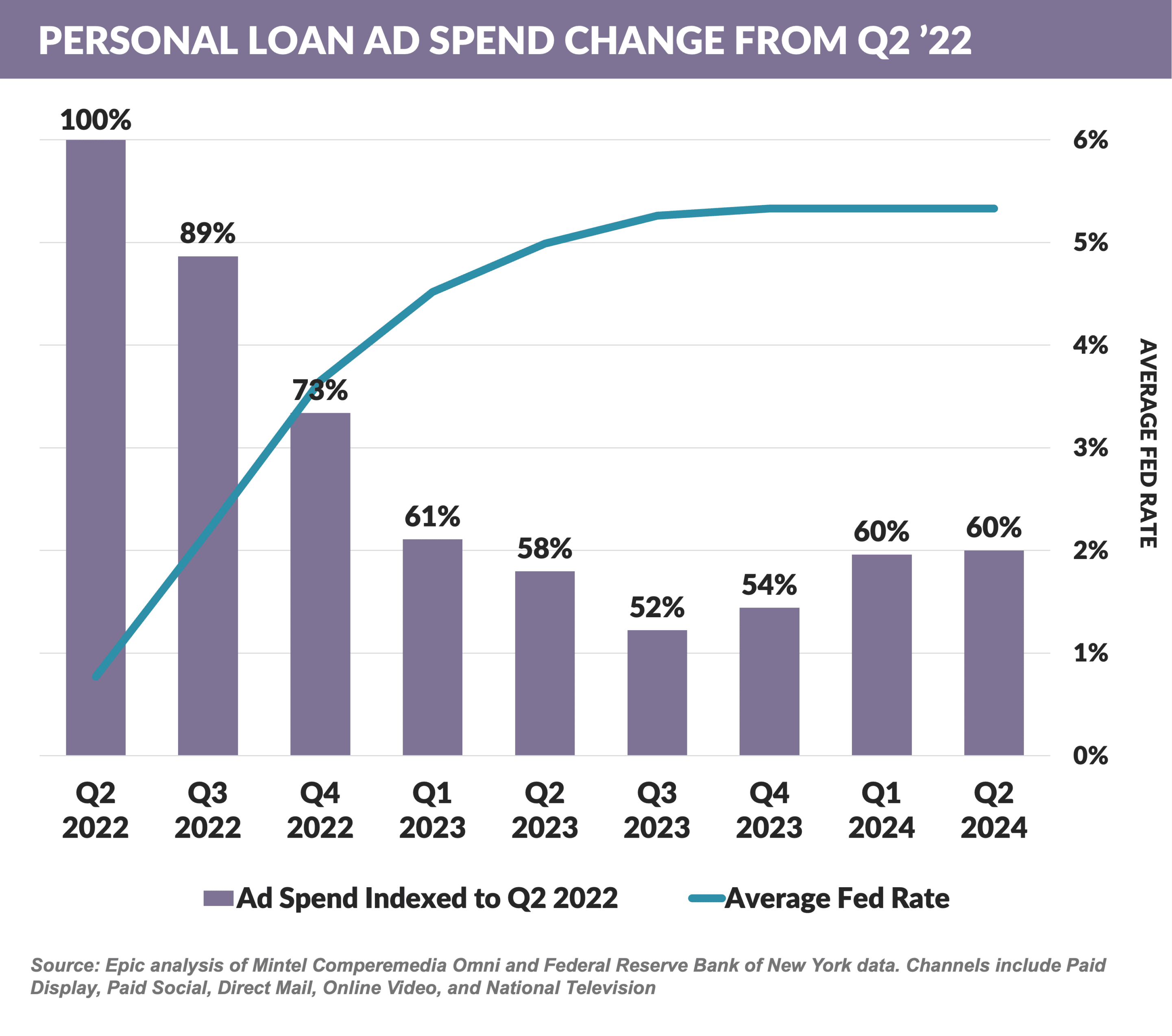

- Advertising spending for personal loan, one of the more interest rate sensitive products, dropped 40% - 50% in the months following the onset of rate increases

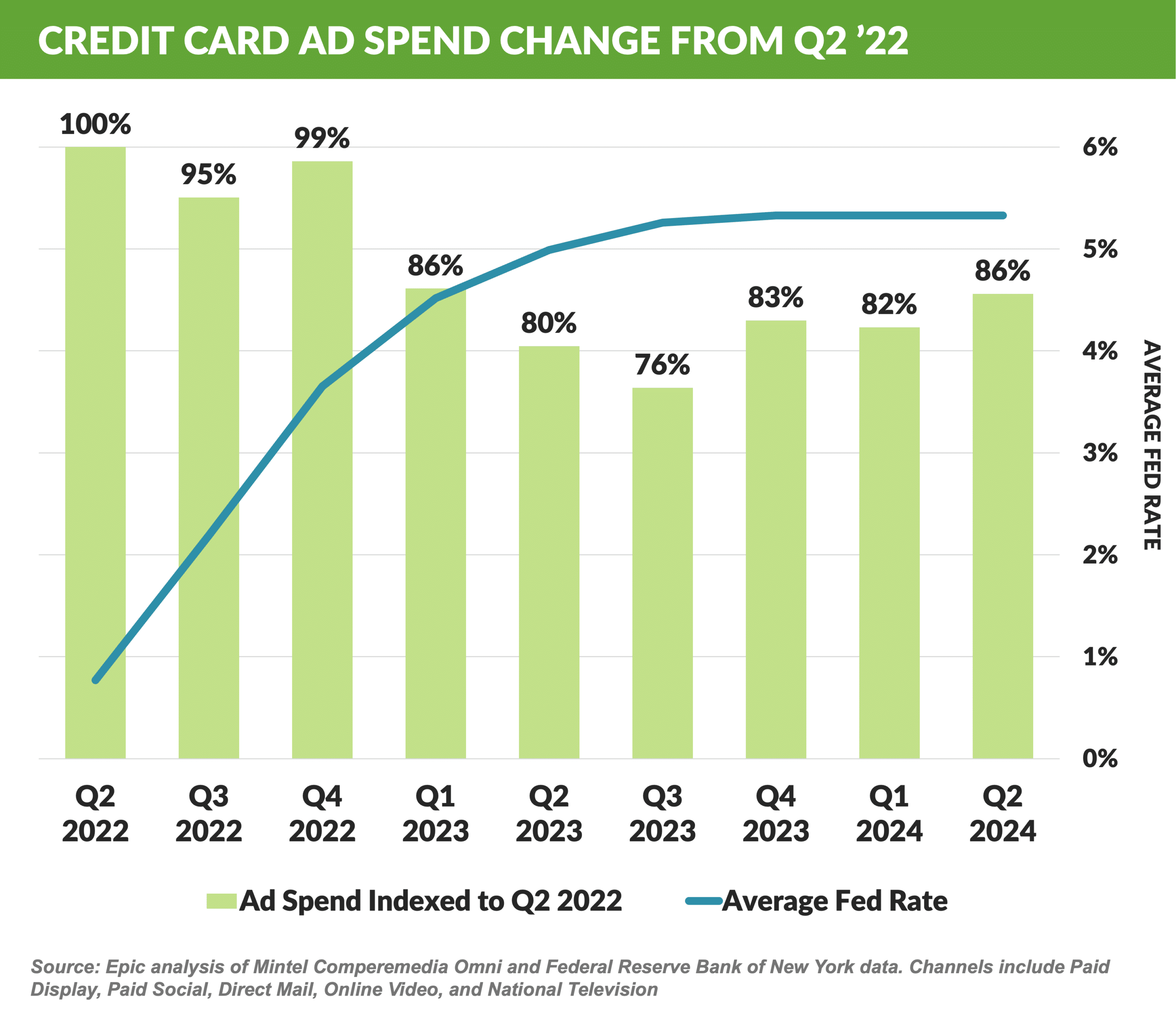

- Credit card, which has traditionally been less interest rate sensitive due to its payment and rewards features, saw spending drop only 24%

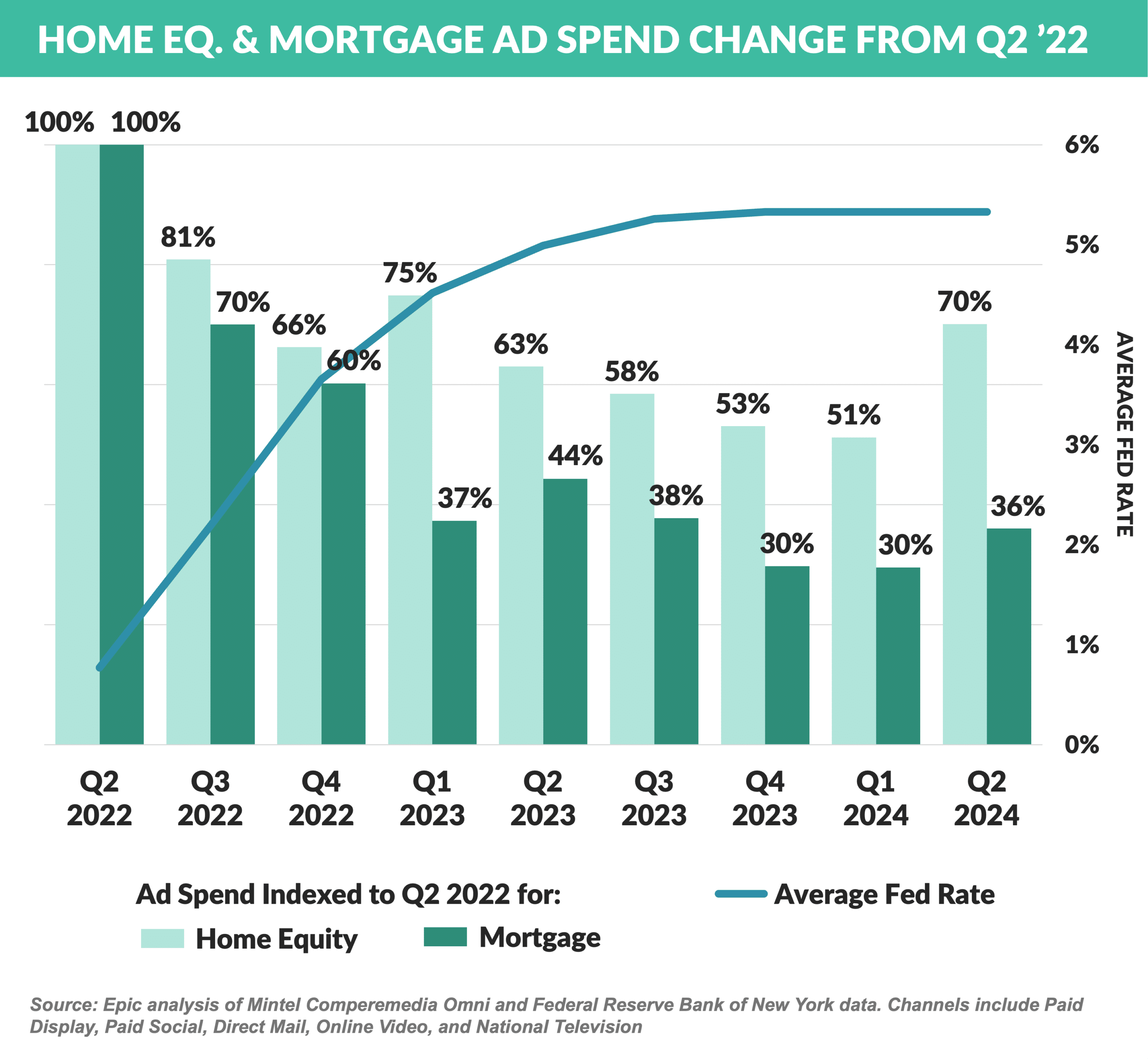

- Mortgage product ad spending dropped by as much as 70%, while home equity products dropped only 50%, possibly taking some share from mortgage

- In contrast to lending products, savings product advertising increased 24% - 142%

- While the overall economy also affects marketing spend, lower rates should result in a rebound in advertising for loan products

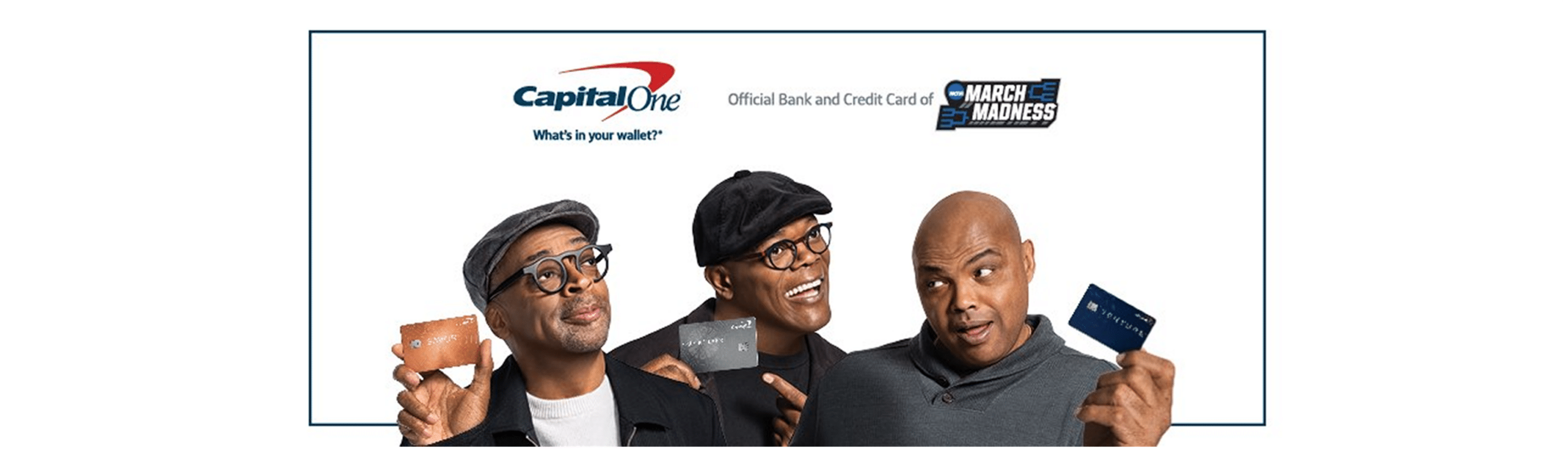

Epic Credit Card Mt. Rushmore – Who’s Next???

- In previous months, our series about the most influential issuers in the modern credit card industry has added Citi and MBNA to the Epic Credit Card Mt. Rushmore

- This month we add Capital One to the honored list

- Capital One was originally founded in 1988 as Signet Financial, the credit card subsidiary of Richmond-based Signet Bank

- Founded by Rich Fairbank and Nigel Morris, who began their relationship with Signet as consultants, Signet Financial was a pioneer in using data to determine different card offers for individuals

- In 1994, Signet spun off the card subsidiary, initially naming it Oakstone Financial before changing it to Capital One just months after the IPO, joining First USA and MBNA as “monoline” card issuers

- Beginning in the late ’80s and extending into the ’90s, the credit card industry, once dominated by large commercial banks such as Citi, Chase, and Bank of America, changed significantly

- Customer pricing was predominantly the same – APRs of 19.8% and annual fees of $20 for a “classic” card, $35 for a “gold” card – and there was little differentiation in features other than the name of the bank

- Monoline issuers began differentiating with lower APRs and no annual fees, along with affinity and cobrand relationships

- Capital One’s investments in data and analytical personnel allowed them to better match offers to individuals, thereby optimizing investment decisioning and returns

- Rather than focusing heavily on partner programs, Capital One began large-scale television advertising and sports sponsorships to further build their brand

- Capital One broke the monoline mold when they bought Hibernia National Bank in 2005 and North Fork Bank in 2006 – moves that expanded their access to stable, low-cost deposit funding – and following subsequent mergers, Capital One is now one of the ten largest commercial banks in the US

- In February 2024, Capital One and Discover announced plans to merge, which, if completed, will make Capital One the largest US credit card issuer with over $300 billion in loans – more than double that of current number two American Express

- Capital One becomes the third issuer added to the Epic Credit Card Mt. Rushmore

Checking Account Marketing Outpaces Other Products

- For the consumer banking products we track with substantial spend, checking accounts are the only product we see with increases in both direct mail and other channel spend

- Advertising spend for checking accounts shows the most year-over-year growth among major consumer banking products with total spend for mail, paid social, national TV, and online video up 9% YTD 2024 vs. the same period last year

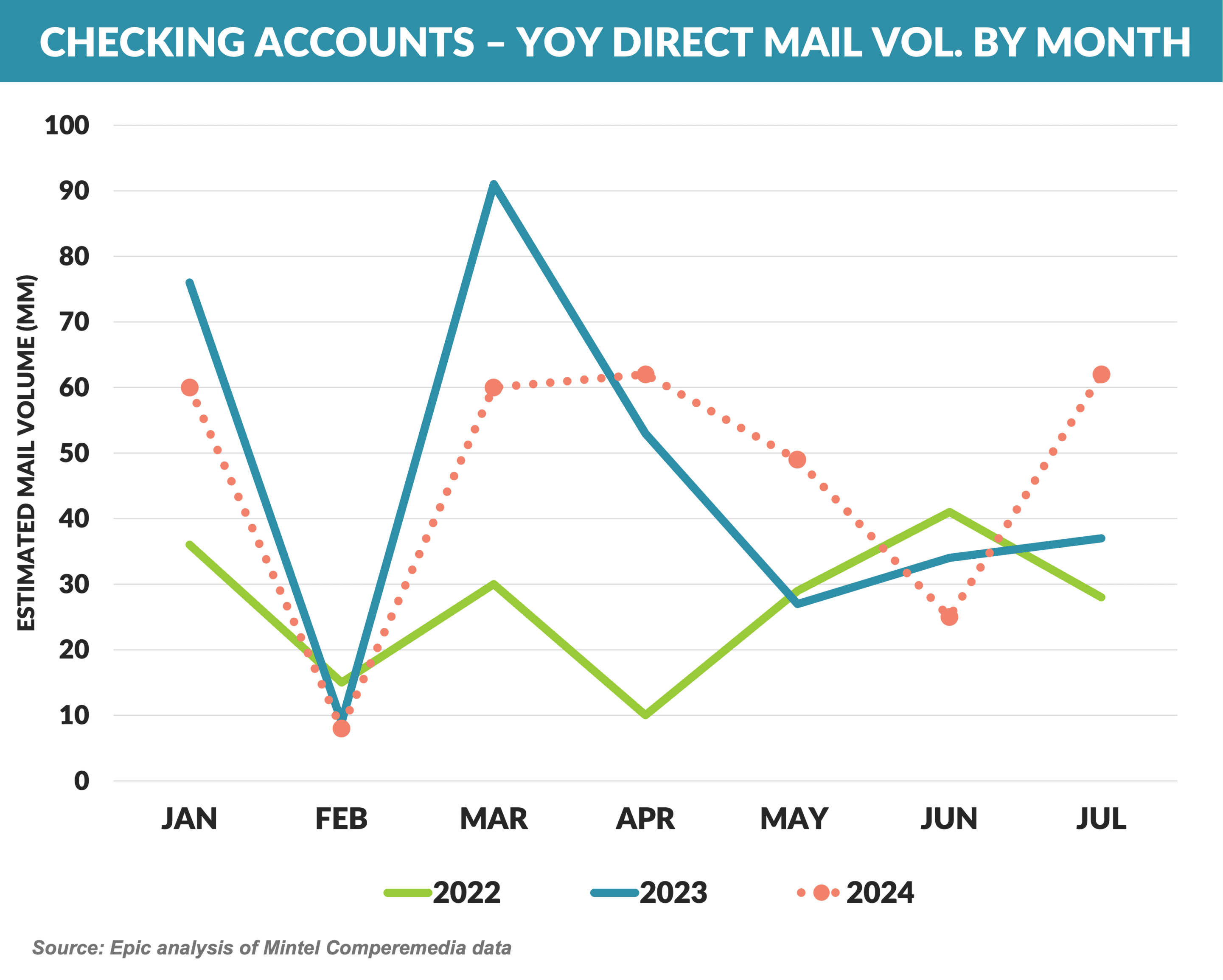

- Checking Account mail volume for July was 62 million mail pieces vs. 25 million in June, and 37 million last July

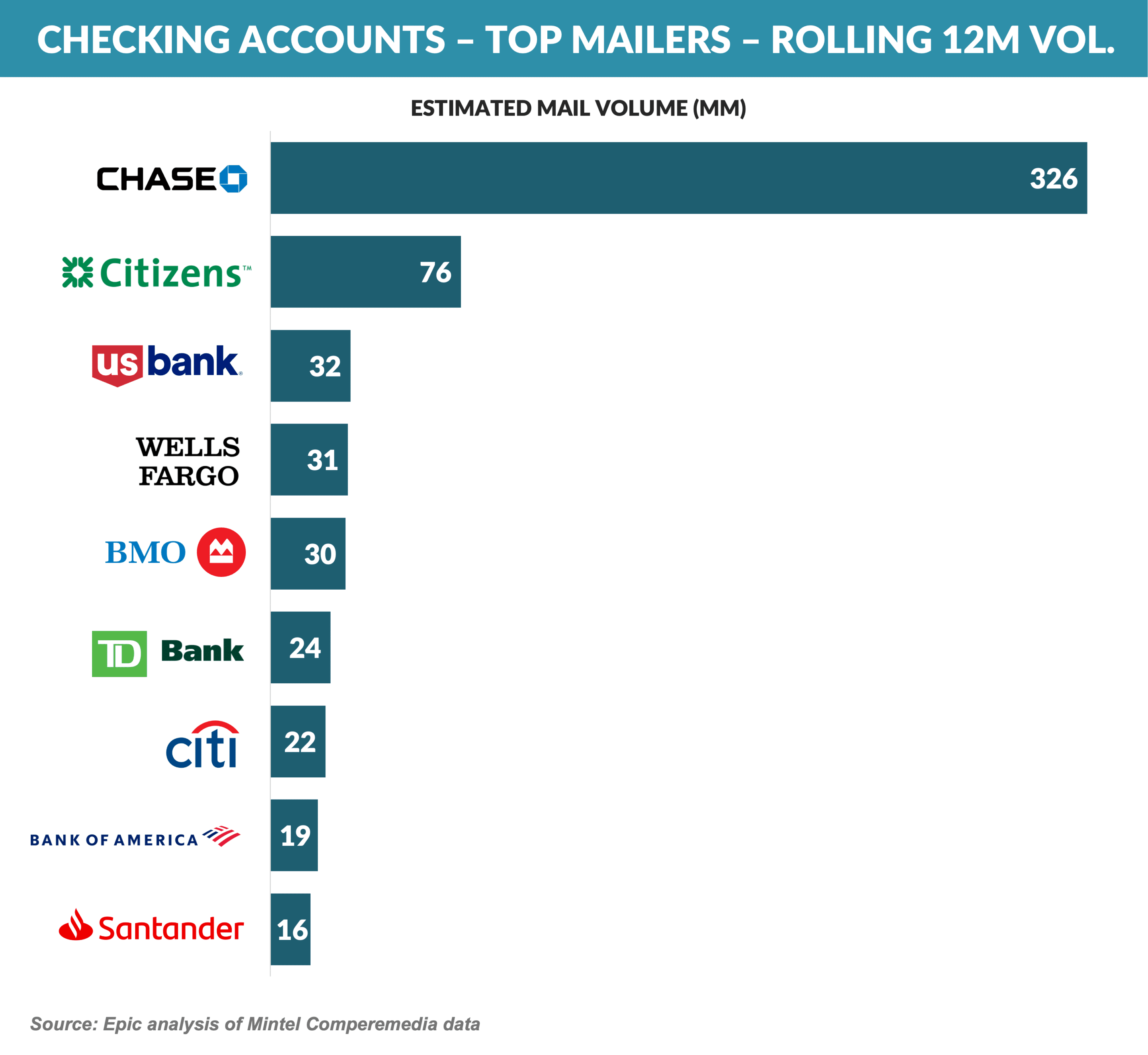

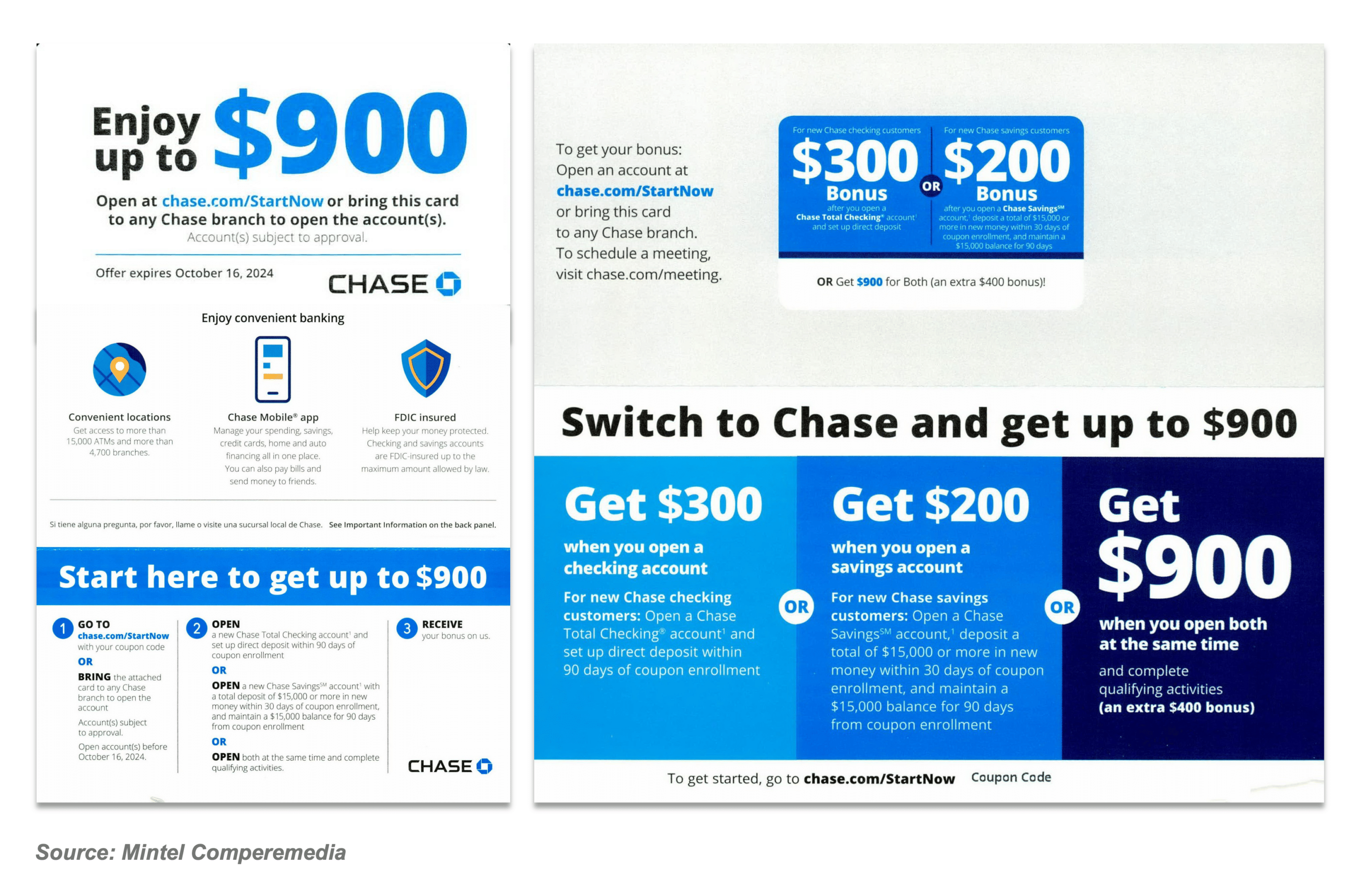

- Chase is consistently the top mailer, far separated from other FIs. Their recent campaigns contain large cash incentives with a savings account cross-sell

- Klarna reported that their revenues were up 27% for the first half of 2024 vs. the same period in 2023

- The Sweden-based company is distinct in the BNPL space in that it owns a bank and uses deposits, which are cheaper and more stable than wholesale funding sources, to fund much of their loans

- Klarna also appears to have made progress with expense ratios with revenue growth outpacing expense growth – they have reduced headcount from 5,000 to 3,800 in the past year and have plans to use AI to further reduce staff to 2,000 employees

- Klarna is targeting an IPO in 2025 with a valuation in the $20 billion range, below the $46 billion 2021 valuation, but higher than the 2022 number of $6.7 billion

- Rent rewards startup Bilt completed a $150 million fundraise, raising their valuation to $3.25 billion

- Bilt has a cobrand credit card with Wells Fargo, which earlier this year was reported to be suffering growing pains

- Ken Chenault, former Chairman and CEO of American Express, will join Bilt’s Board of Directors along with NFL Commissioner Roger Goodell

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue in October.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth – find out how we can help you.

Read our previous newsletters.