Three Things We’re Hearing

- Delinquency watch continues!

- High-yield savings opportunity

- Personal loan mail volume awakening?

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Delinquency Watch Continues

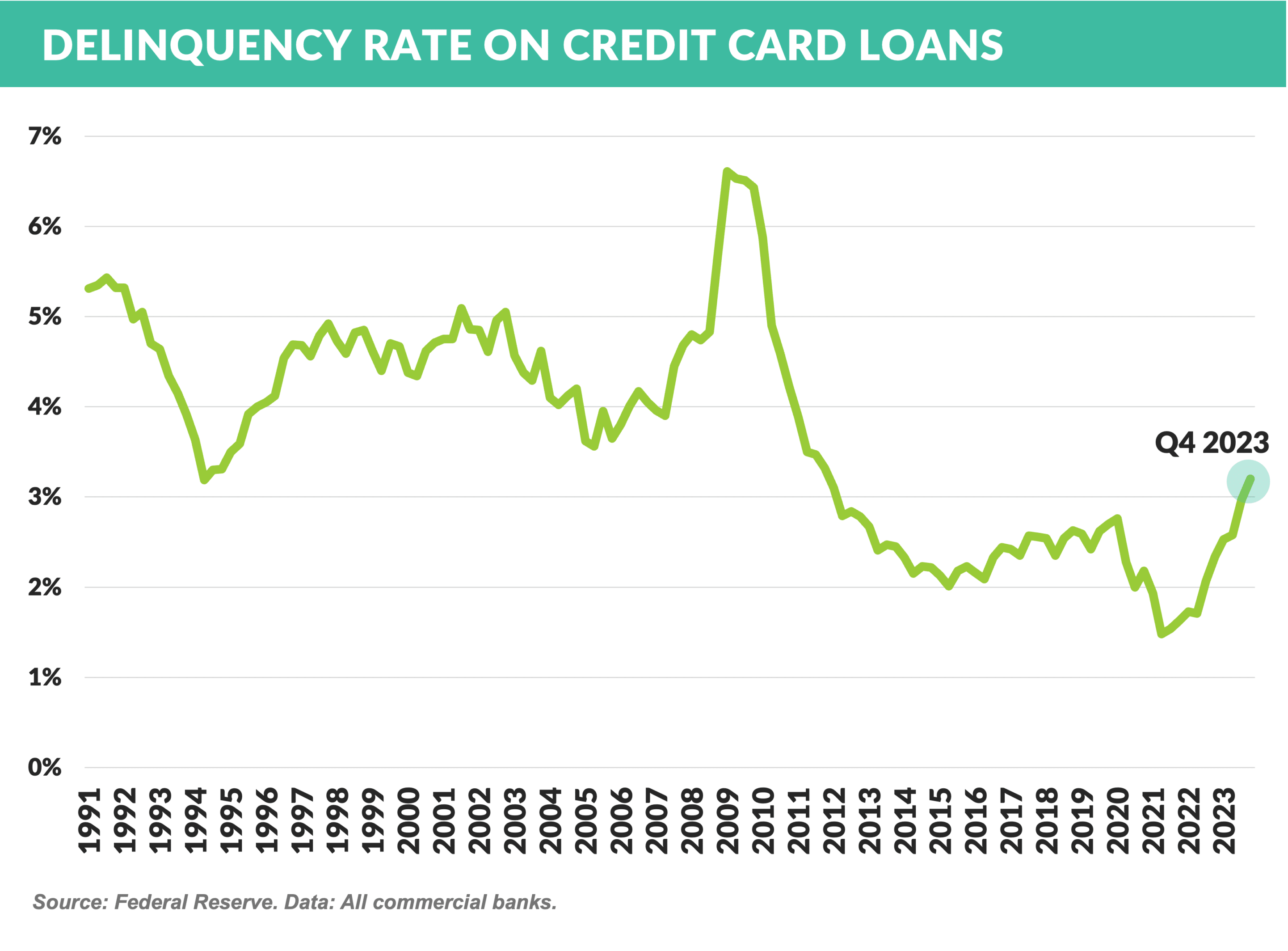

- After a long period of lower-than-average levels, delinquency rates for bankcards have risen to the highest levels since 2011 (although still below long-term industry levels)

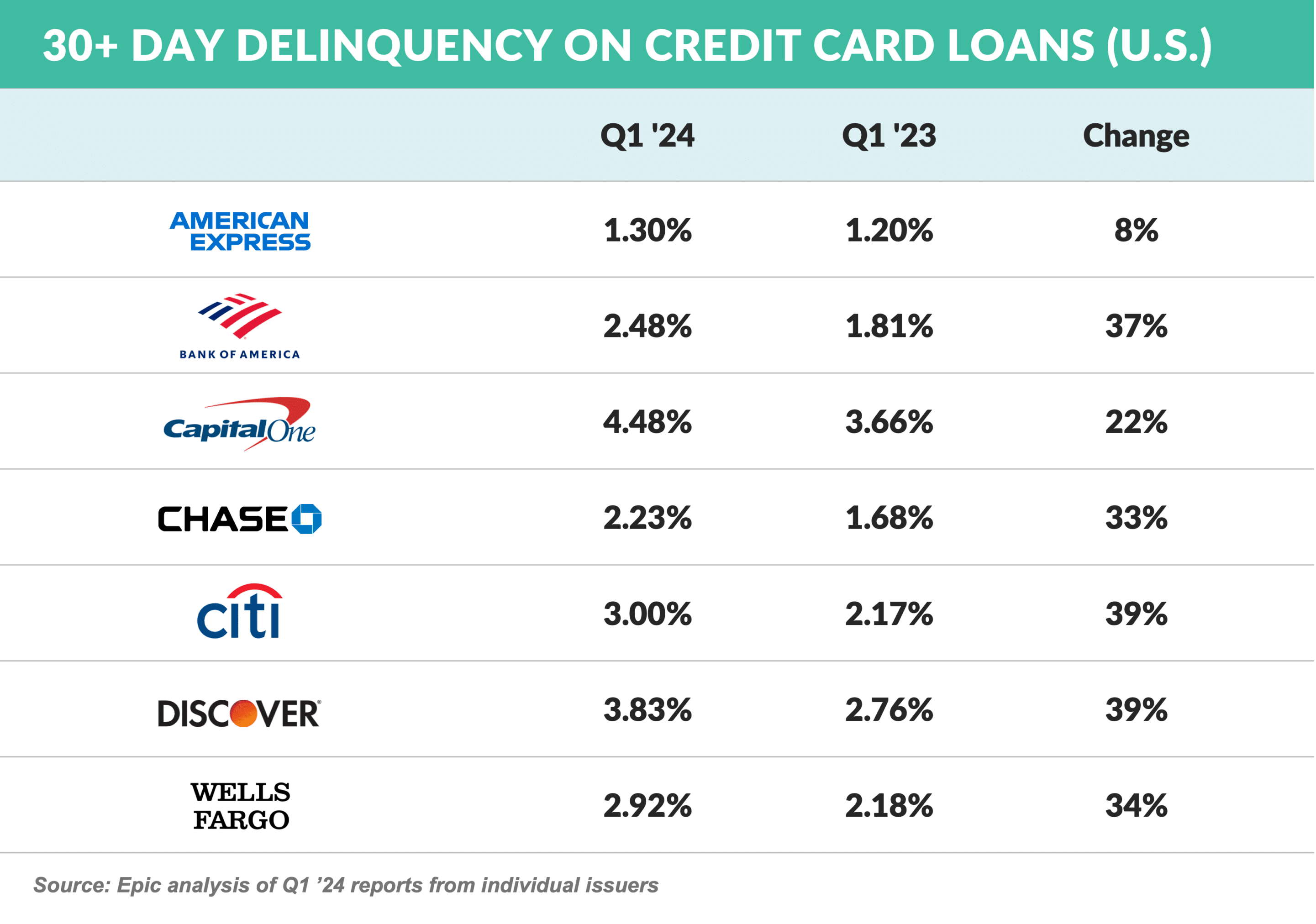

- Q1 ’24 reports from individual lenders show year-over-year increases of 8% - 39%

- Similarly, delinquency statistics for the bankcard industry (available through February) show a 34% increase – to 3.21% from 2.40% in February ’23

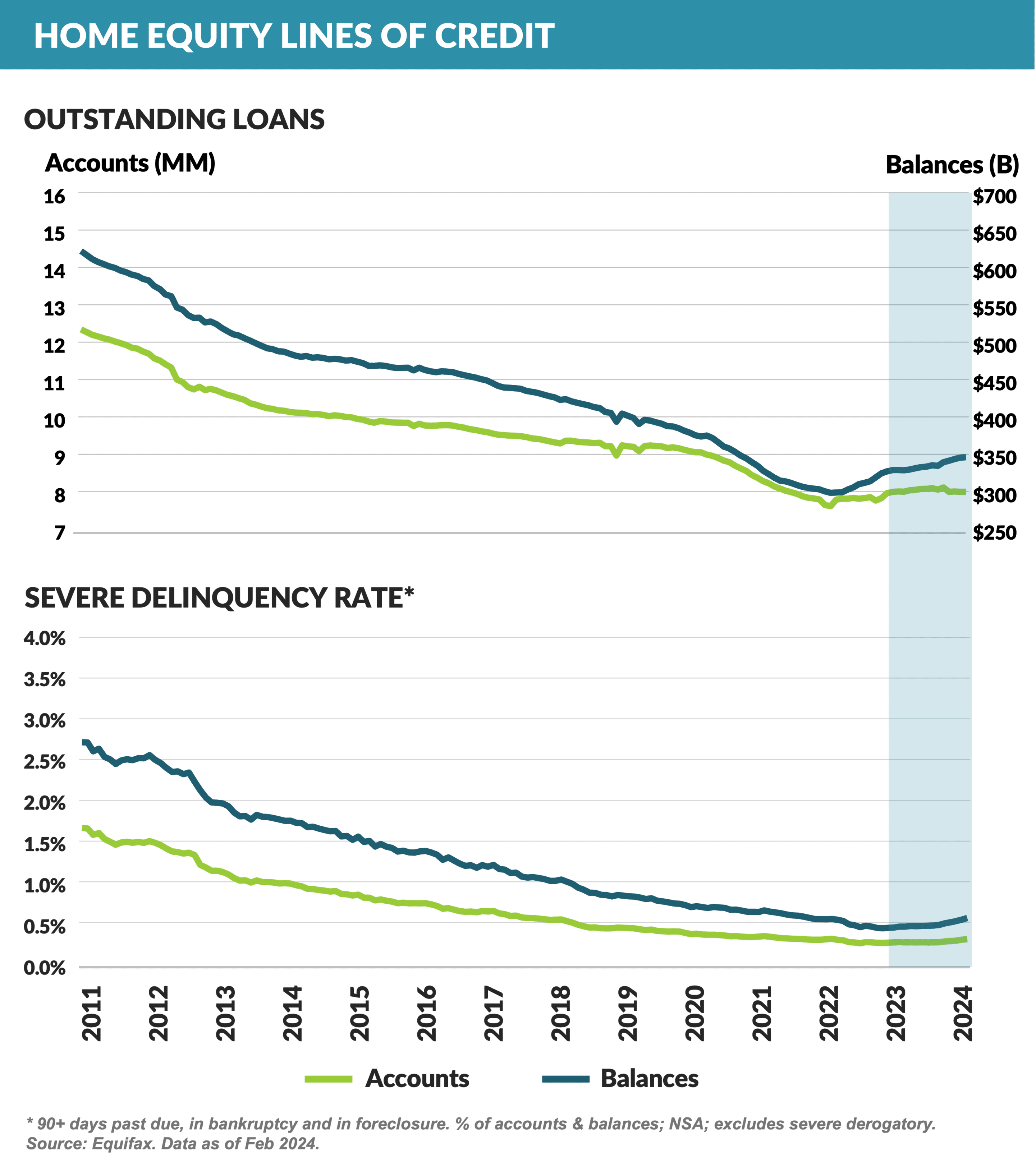

- HELOC loan growth has slowed, and delinquency has risen 24% from February ’23 yet still remains dramatically lower than earlier years

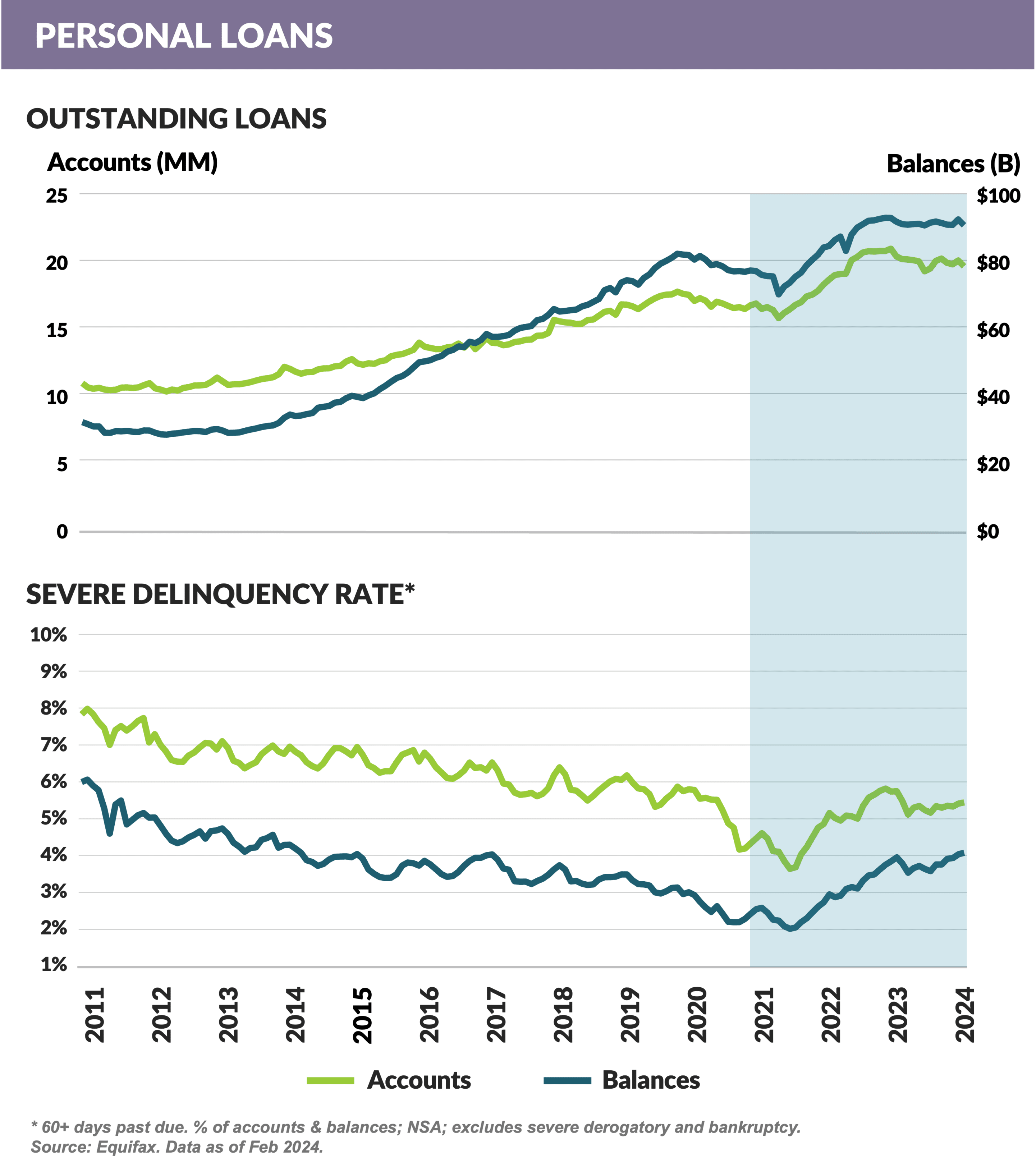

- Personal loan delinquencies doubled between 2021 and 2023, and the resulting cutbacks in new solicitations caused personal loan outstandings to flatten; despite the unchanged denominator and aging of older vintages, delinquencies have flattened

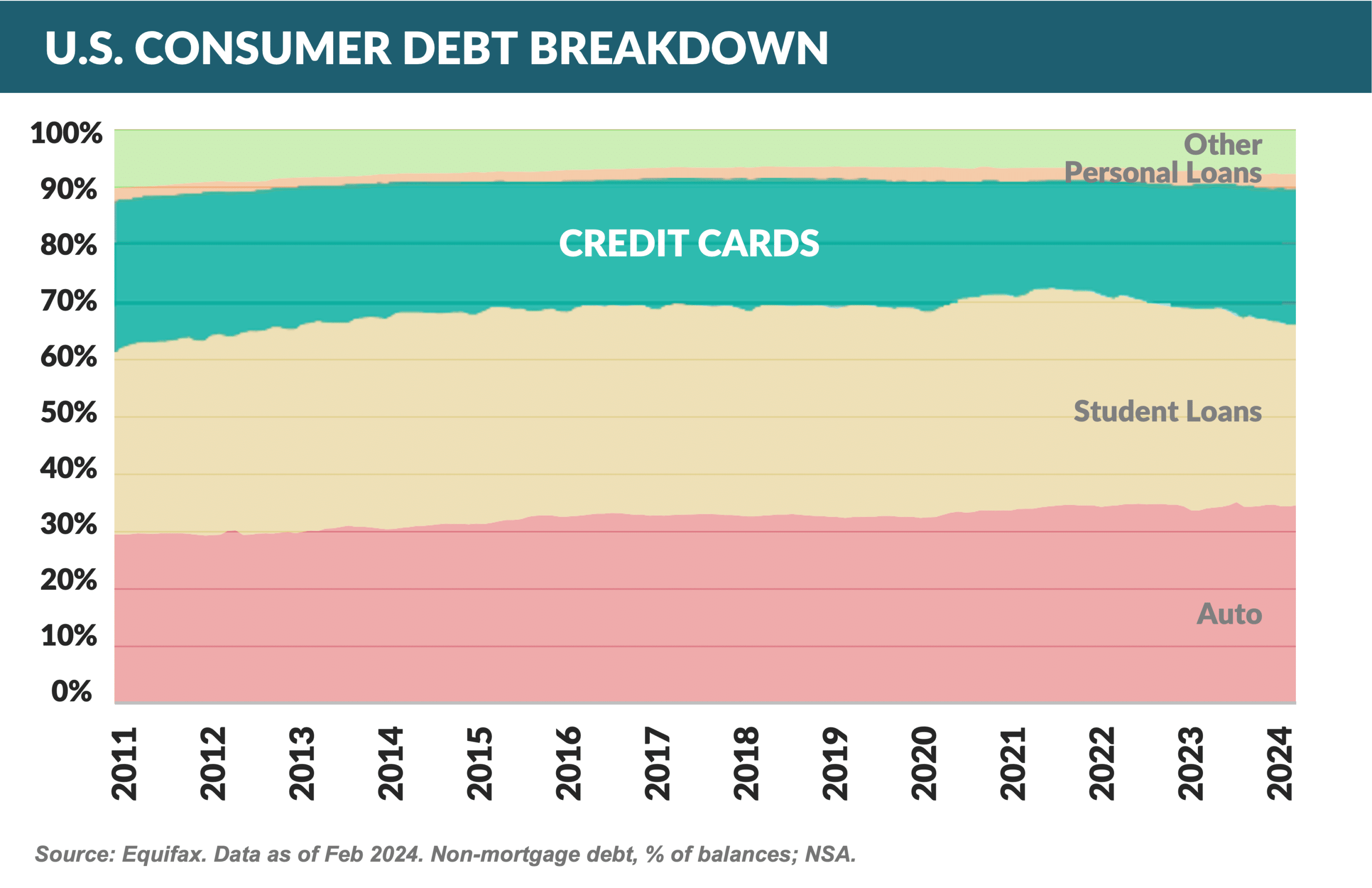

- Recent headlines have trumpeted the fact that card balances are now greater than $1 trillion – however card balances now account for 22% of all non-mortgage consumer debt, down from 26% in 2011

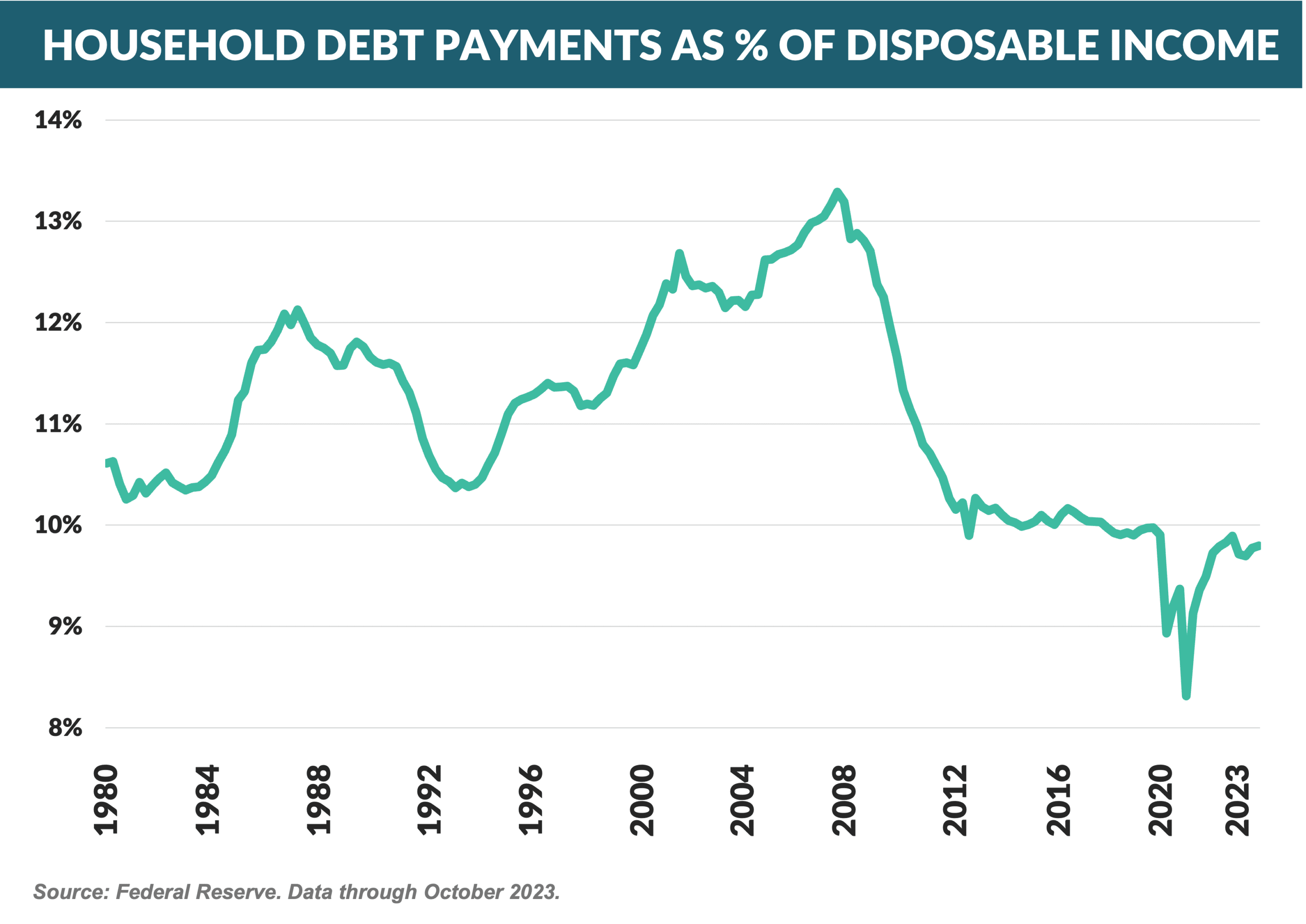

- Household debt service as a percent of income remains near historic lows

- Our view is that continued record low unemployment and healthy GDP growth should offset other factors and that consumer delinquencies will remain within historic norms

High-Yield Savings Opportunity

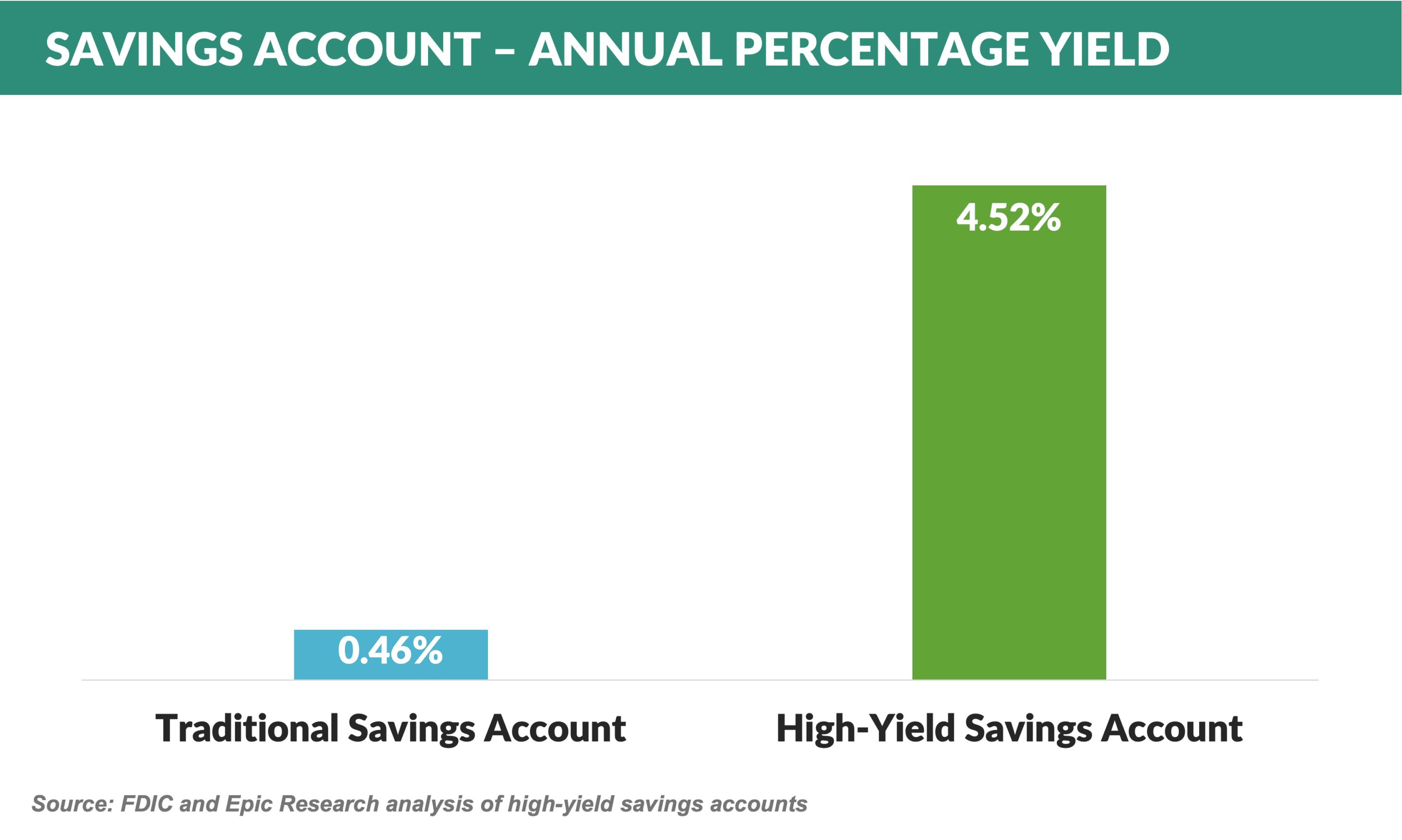

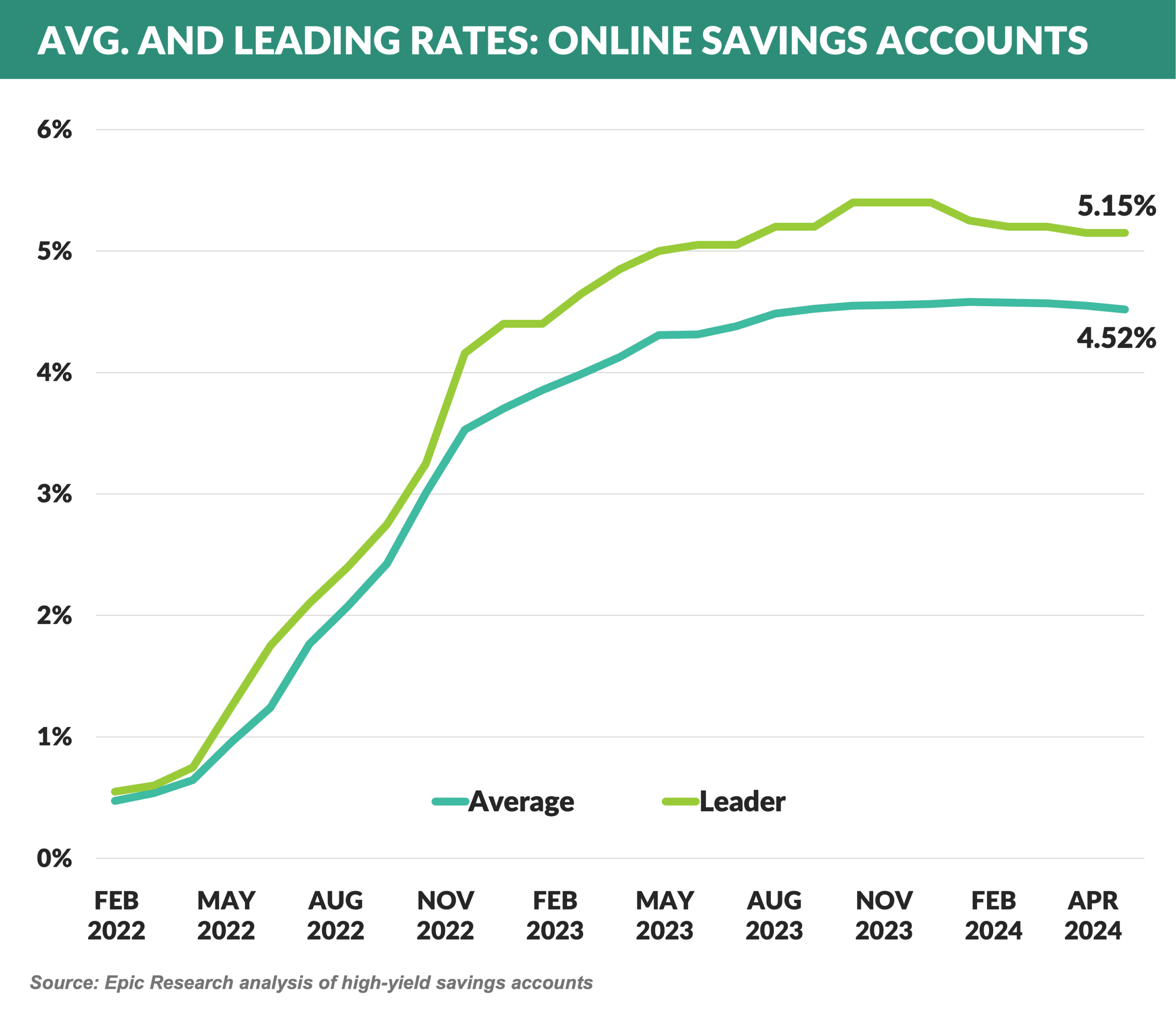

- Previous Epic Reports have noted the growing disparity between interest rates for “traditional” savings accounts compared to “High-Yield” savings accounts

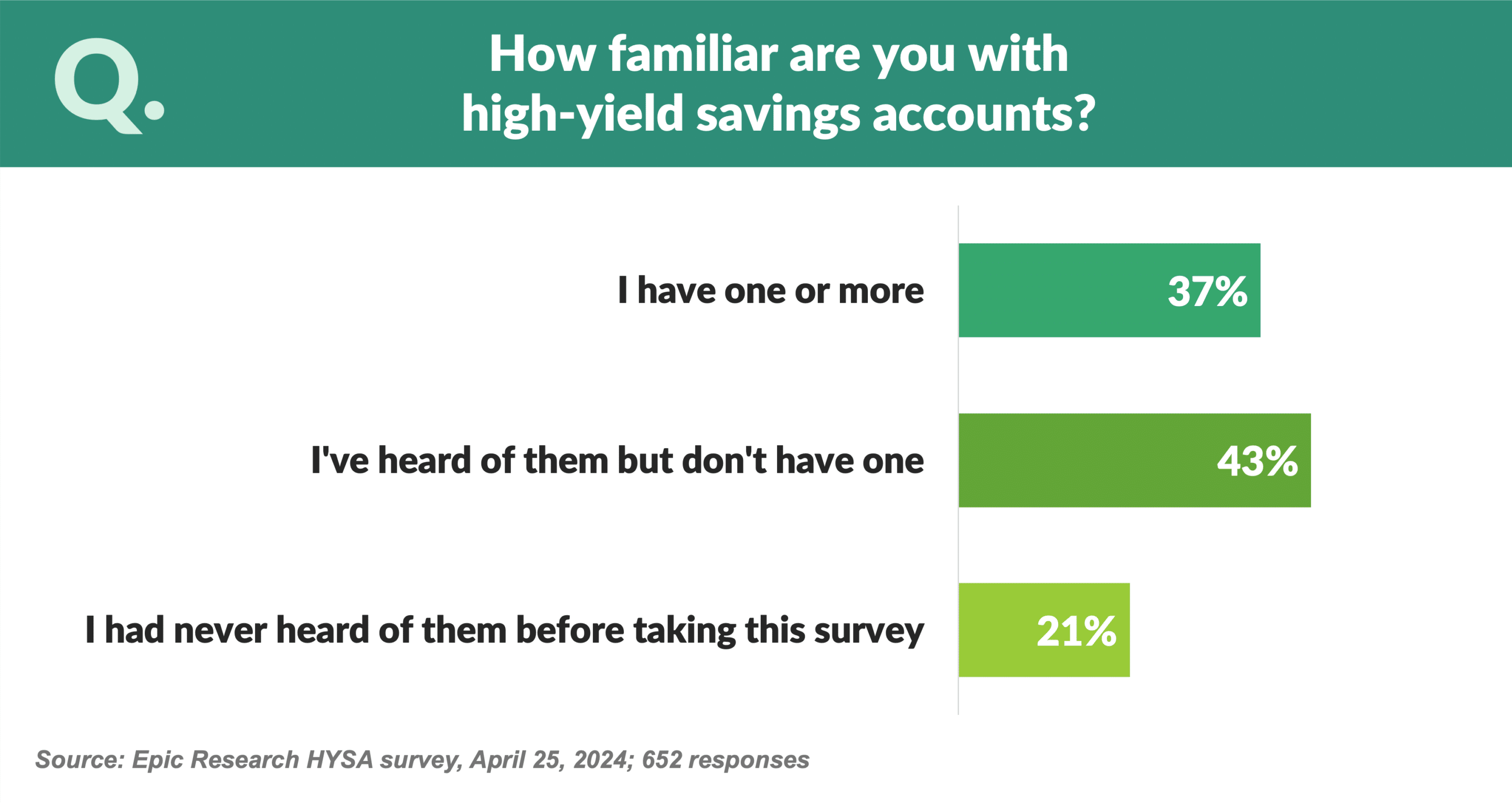

- Despite some consumers moving savings to higher-yield accounts, many remain unaware and hesitant to open one

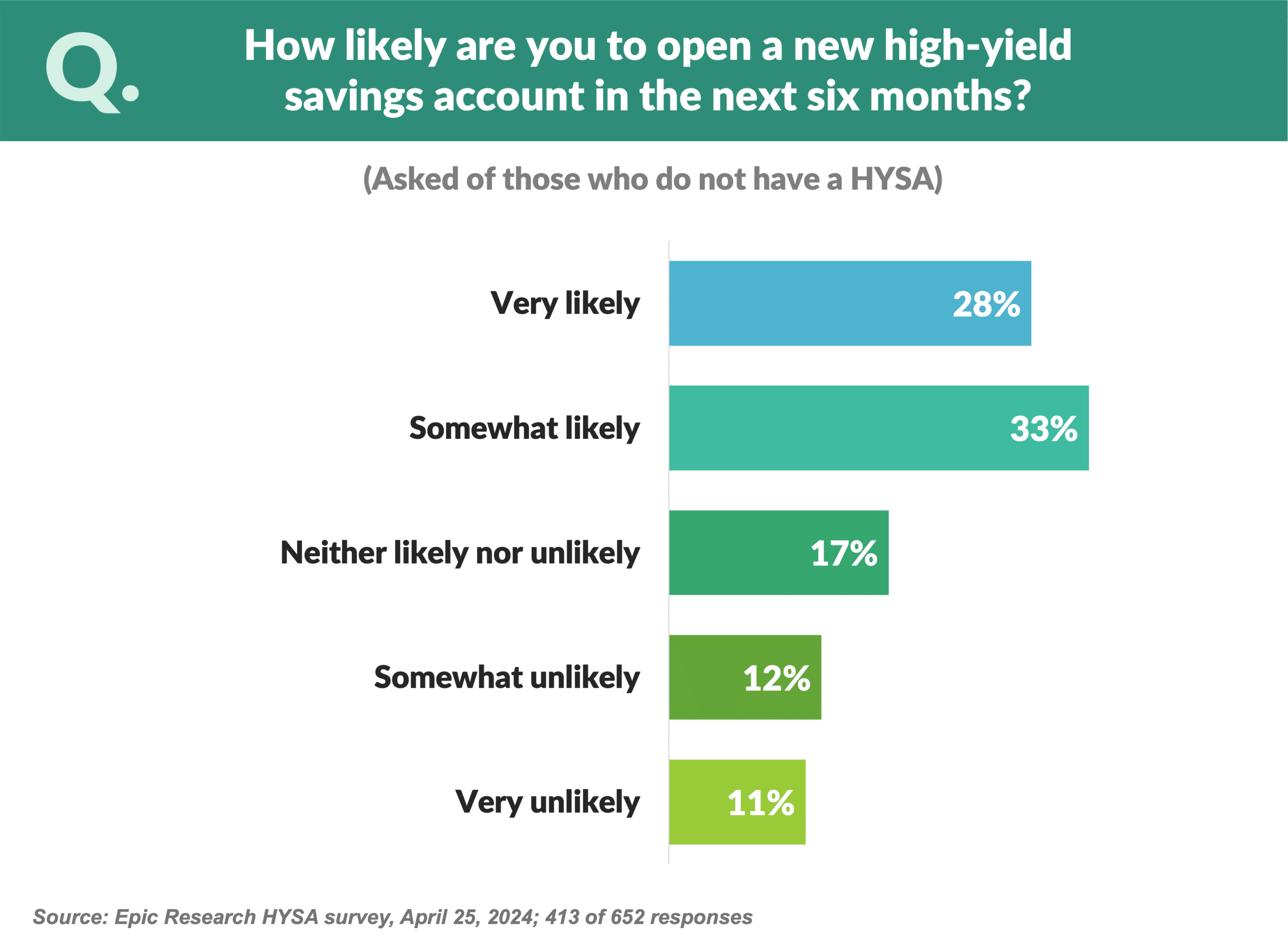

- Of those not currently having a high-yield account, nearly 60% said they were “Very” or “Somewhat” likely to open one within the next six months

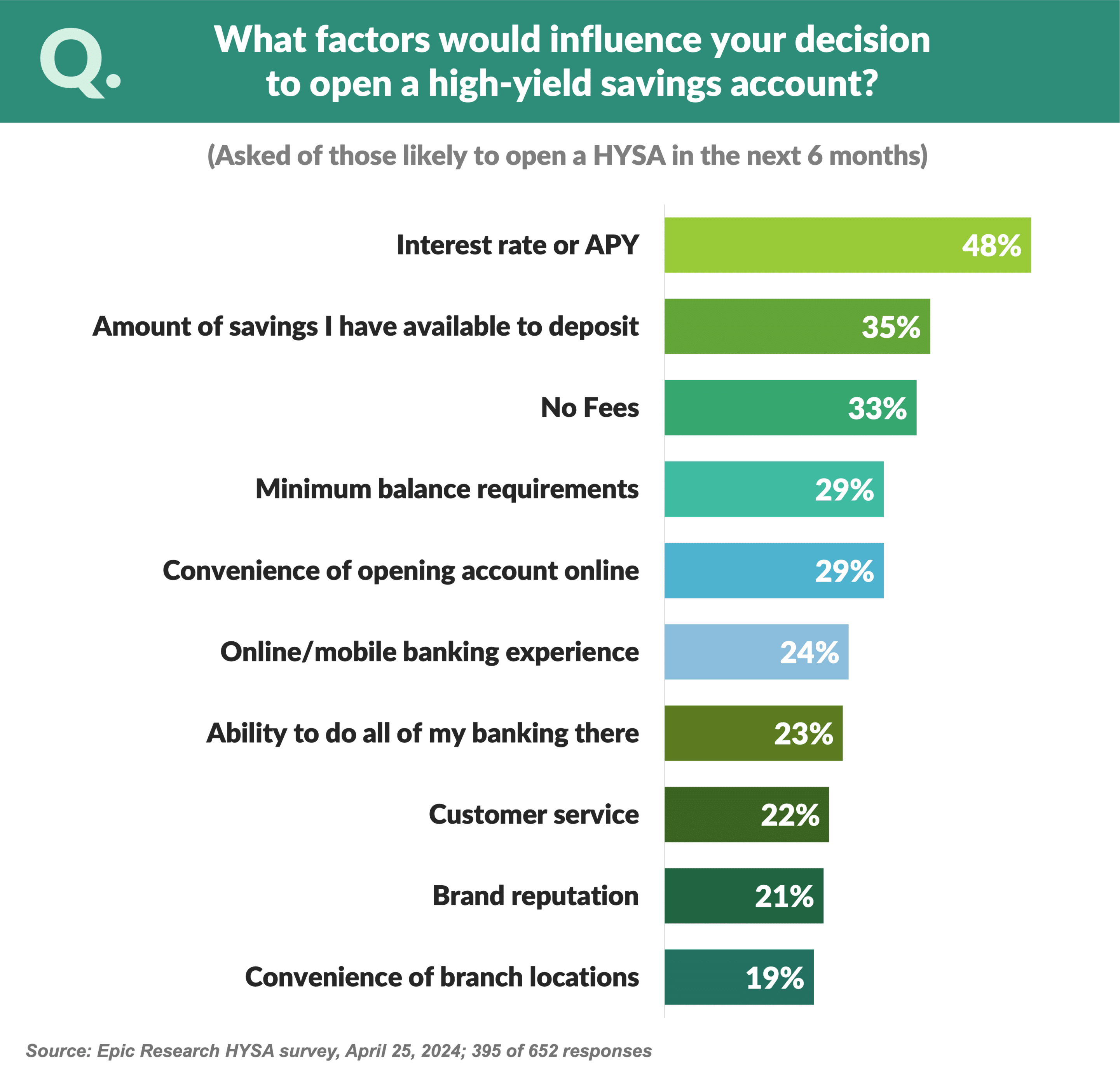

- If considering opening an account, “interest rate” is the most important factor, and “no fees” and “amount of savings I have available to invest” were next with “brand reputation” ranking only ninth

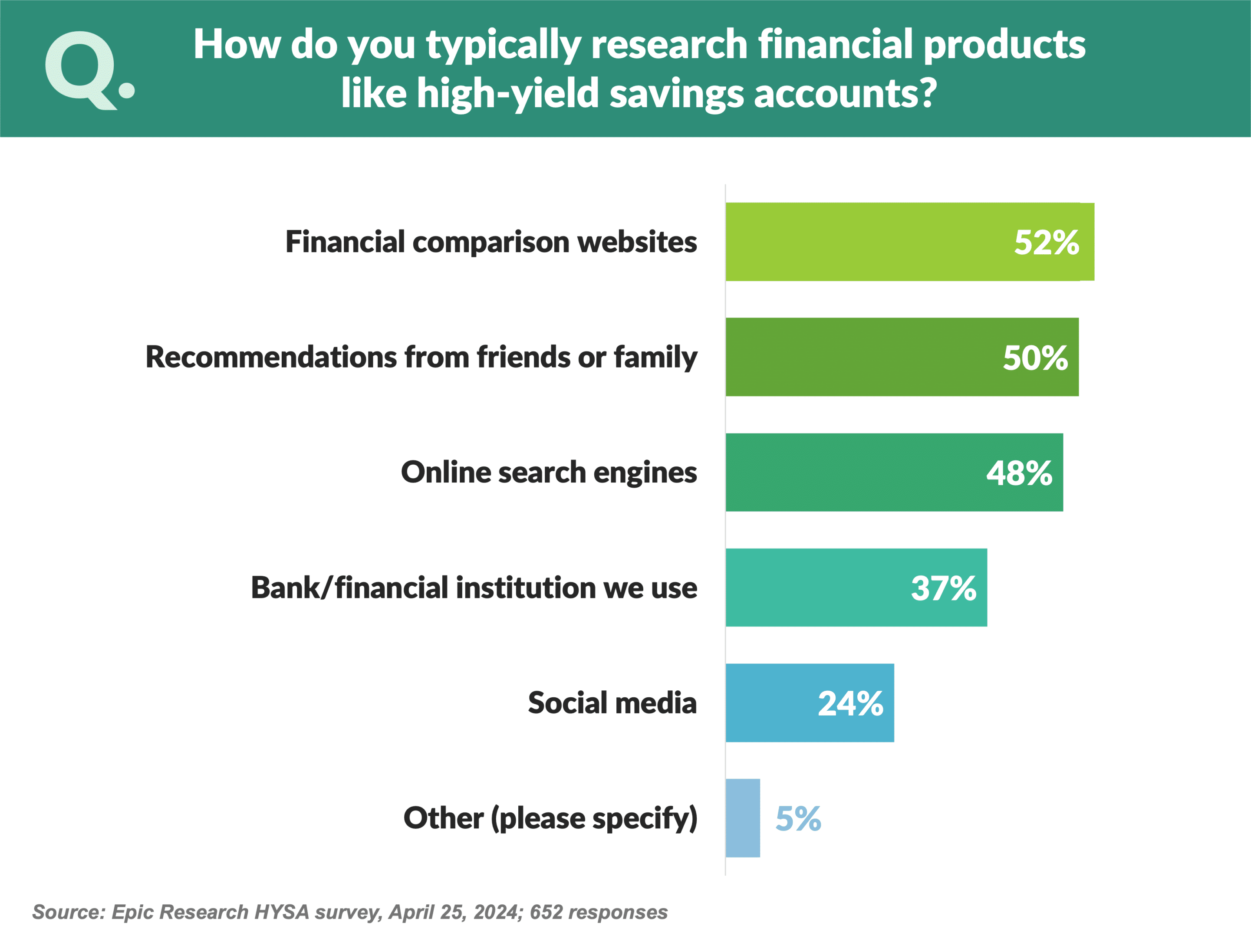

- When researching financial products, comparison websites, recommendations from friends or family, and online search engines were the most popular sources

- The results indicate a significant opportunity for banks to attract depositors with competitive rates rather than brand reputation

Personal Loan Mail Volume Awakening?

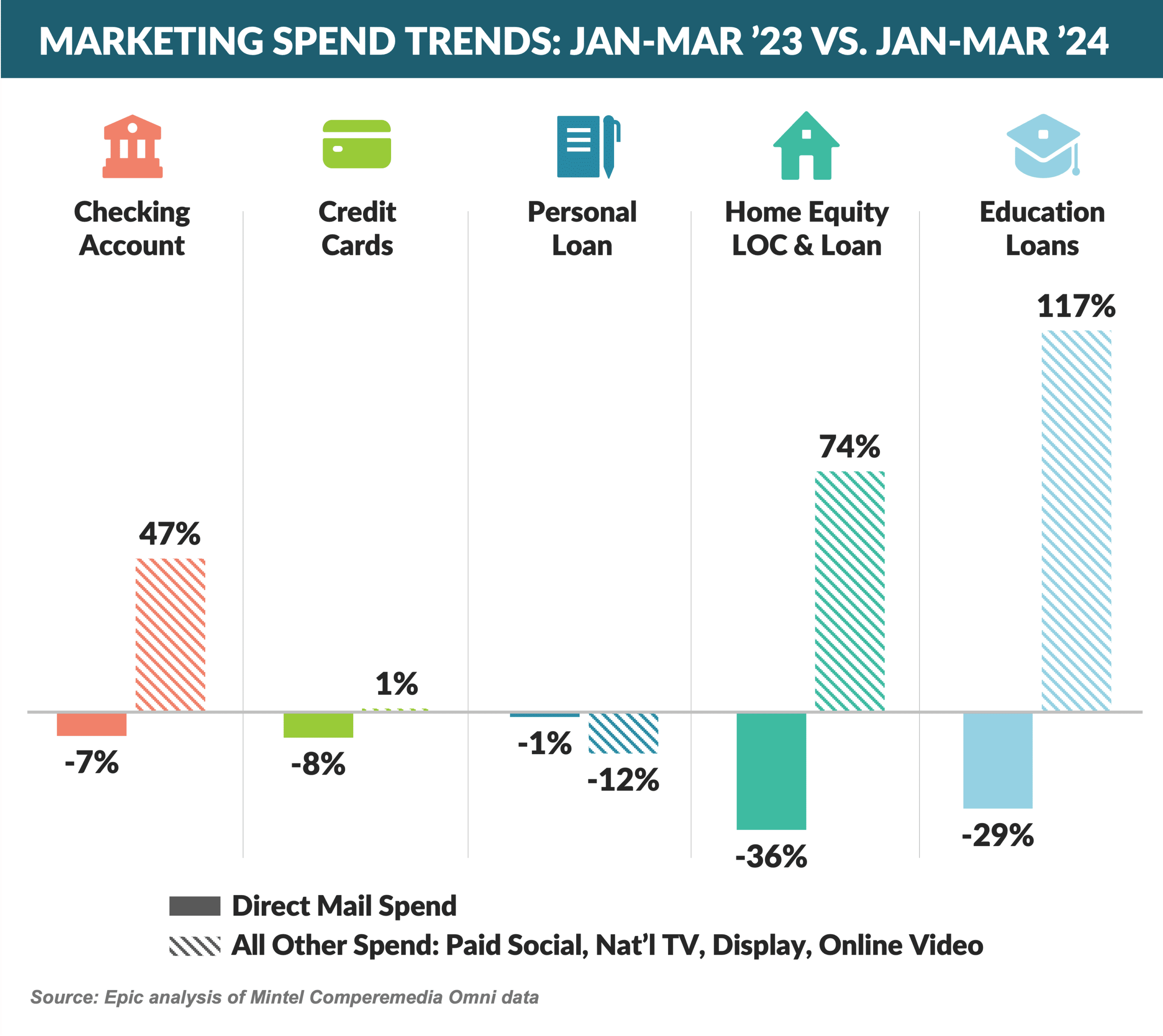

- YTD spending on channels other than mail is up for checking, home equity, and education

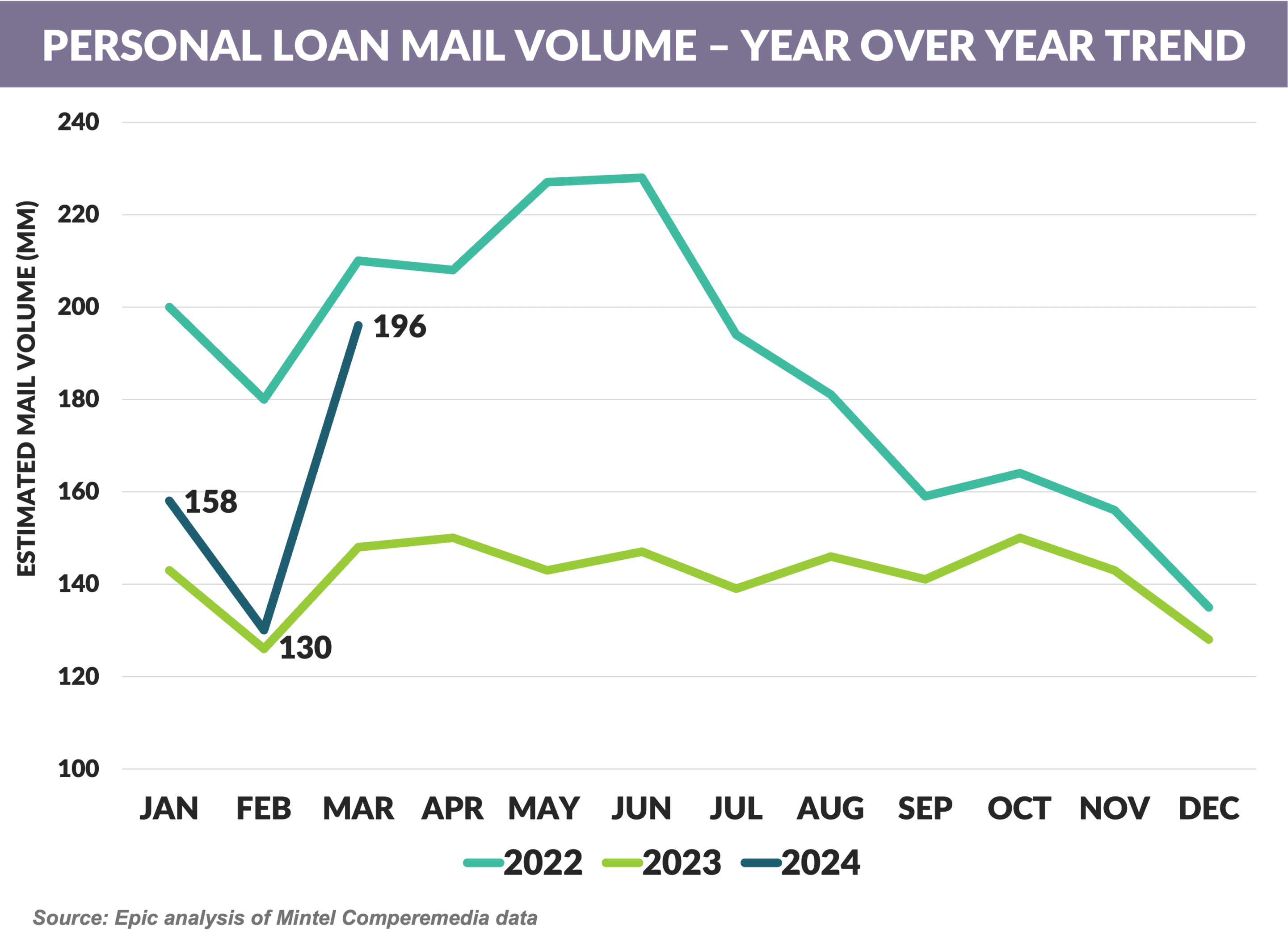

- After declining for most of the past two years, personal loan direct mail volume spiked up 66 million pieces (+50%) in March vs. February ’24 and up 34% from March ’23

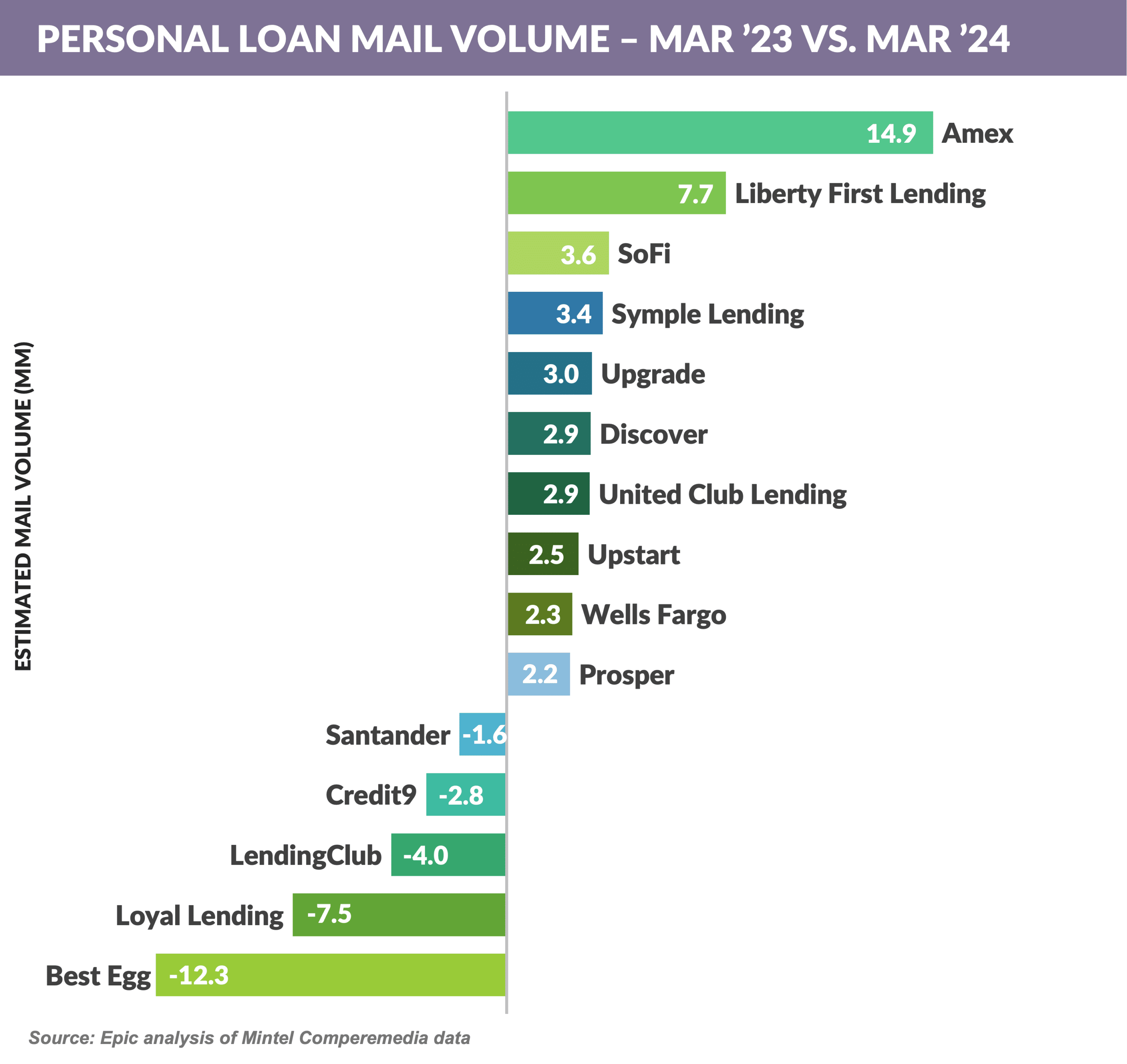

- Volume increases were led by two lenders who did not mail in March ’23 – American Express mailed 14.8 million pieces and new entrant (founded in 2023) Liberty Lending with 7.7 million pieces

- Several lenders were down significantly from ’23, including Best Egg (down 12.3 million), Loyal Lending (no mail in March, down 7.5 million), and Lending Club (no mail in March, down 4 million)

- In our spare time, we’ve been thinking about the most influential people in the development of the “modern day” (e.g., since 1990) credit card industry – those who have most effectively combined innovation with execution to transform the business (we do not go so far back as to include the “inventors” of Visa, Mastercard, Discover, or Amex)

- From those discussions, we’ve identified several individuals who we think belong on the Credit Card Mt. Rushmore

- We would like to know your thoughts! Click here to send your Mt. Rushmore nominations. We will unveil our version in the June Epic Report!

- The Wall Street Journal reports that Barclays is in discussions with Goldman Sachs to take over the GM cobrand program

- US Bank and Bread Financial were also reportedly in the mix, however Barclays is listed as the current front runner

- The ~$2 billion GM portfolio is one of the last pieces of Goldman’s consumer financial services venture yet to be sold

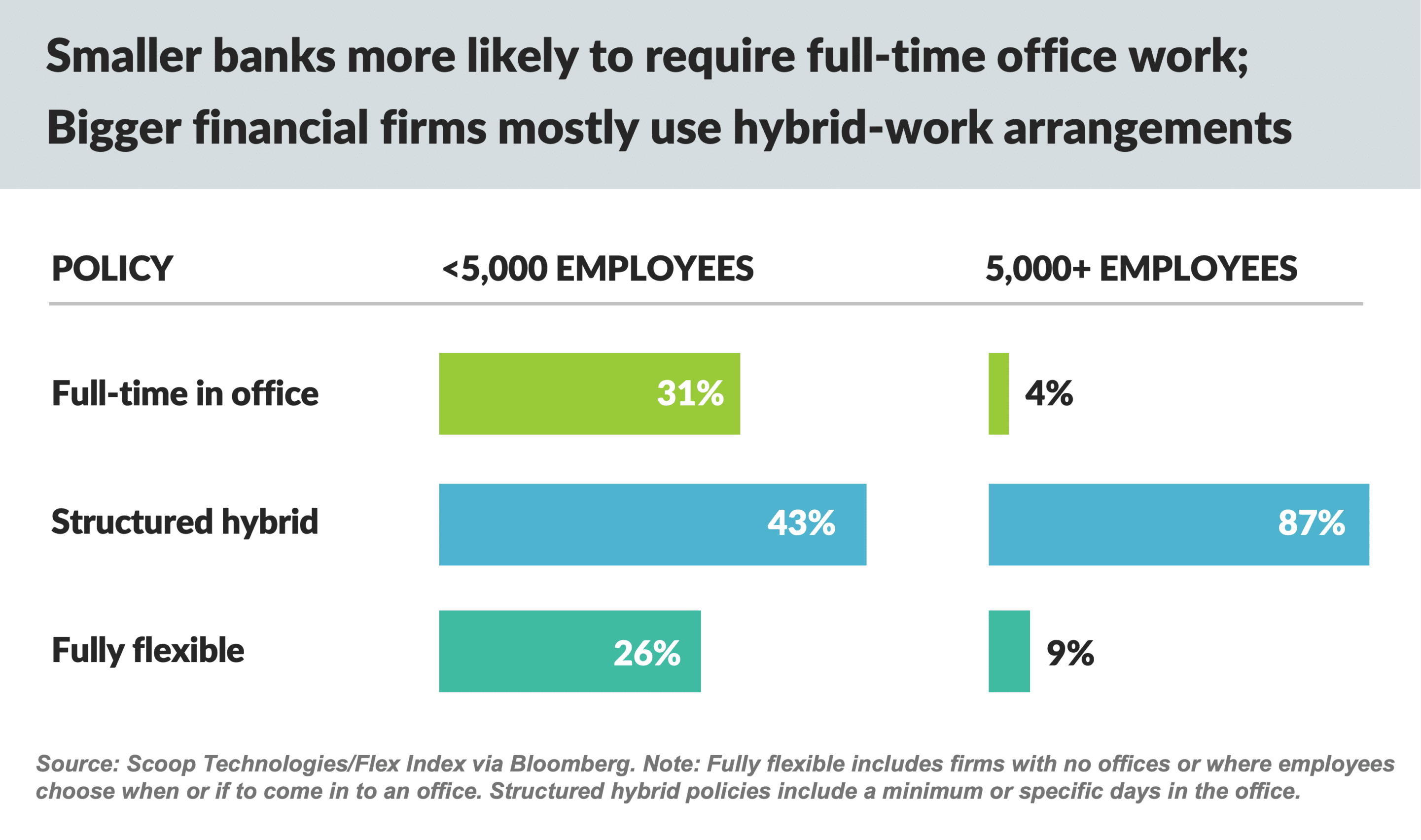

- Smaller banks are more likely to require workers to be in the office full-time than larger banks, with bigger institutions primarily “structured hybrid”

- Rates on high-yield savings accounts continue to soften

- Ally’s top rate went from 4.25% to 4.20%

- Amex from 4.35% to 4.25%

- Capital One from 4.35% to 4.25%

- Marcus from 4.50% to 4.40%

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on June 8th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.