Three Things We’re Hearing

- Personal loan marketing down, consumer benefit up!

- Digital response options grow

- Debt settlement marketing awakening?

A four-minute read

If you would like the Epic Report delivered right to your inbox, click here

Personal Loan Marketing Down, Consumer Benefit Up!

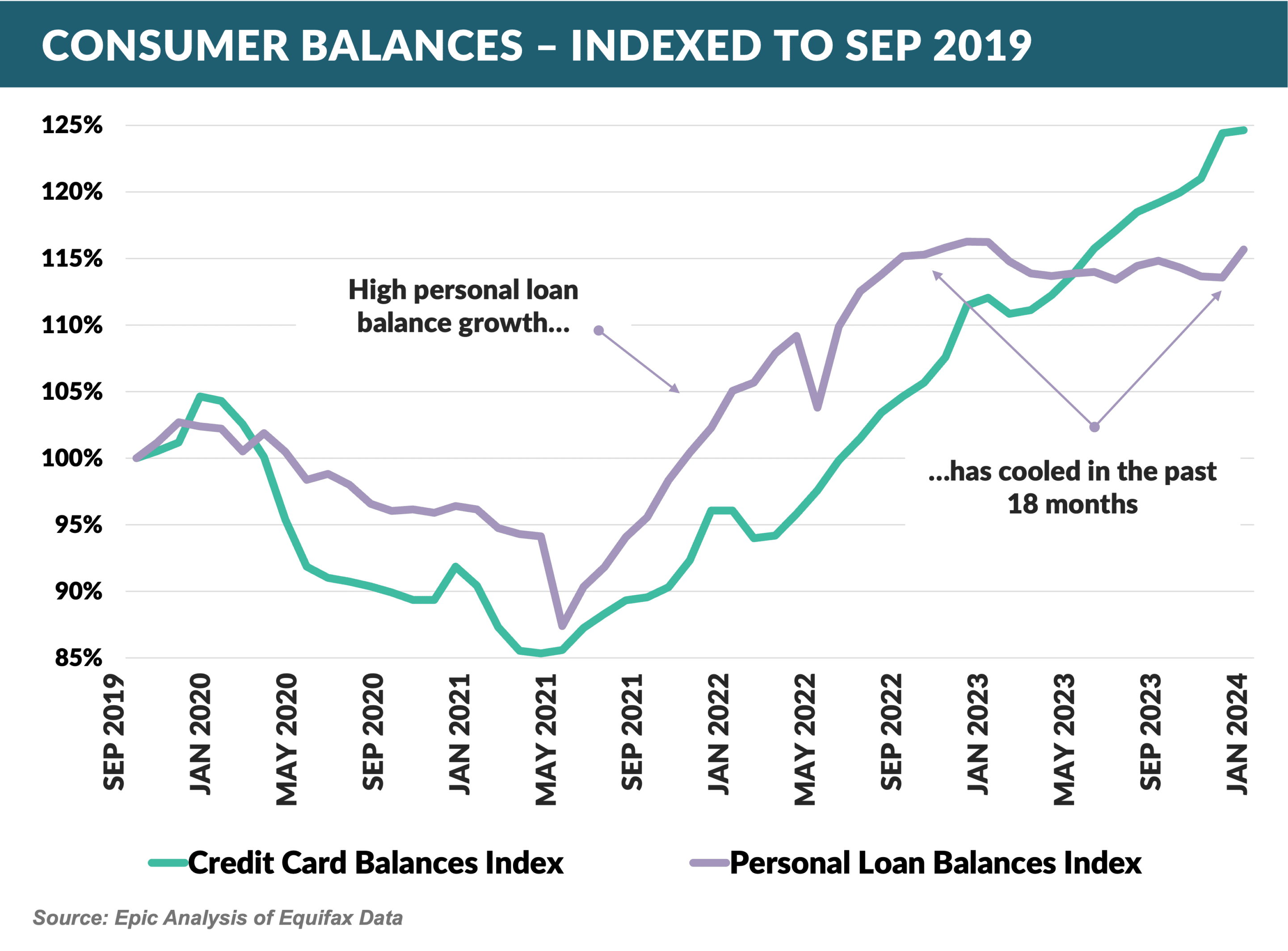

- Total personal loan balances grew faster than credit cards in the post-pandemic period of 2021-2022; however, rising rates and other market factors have cooled personal loan growth in the past 18 months

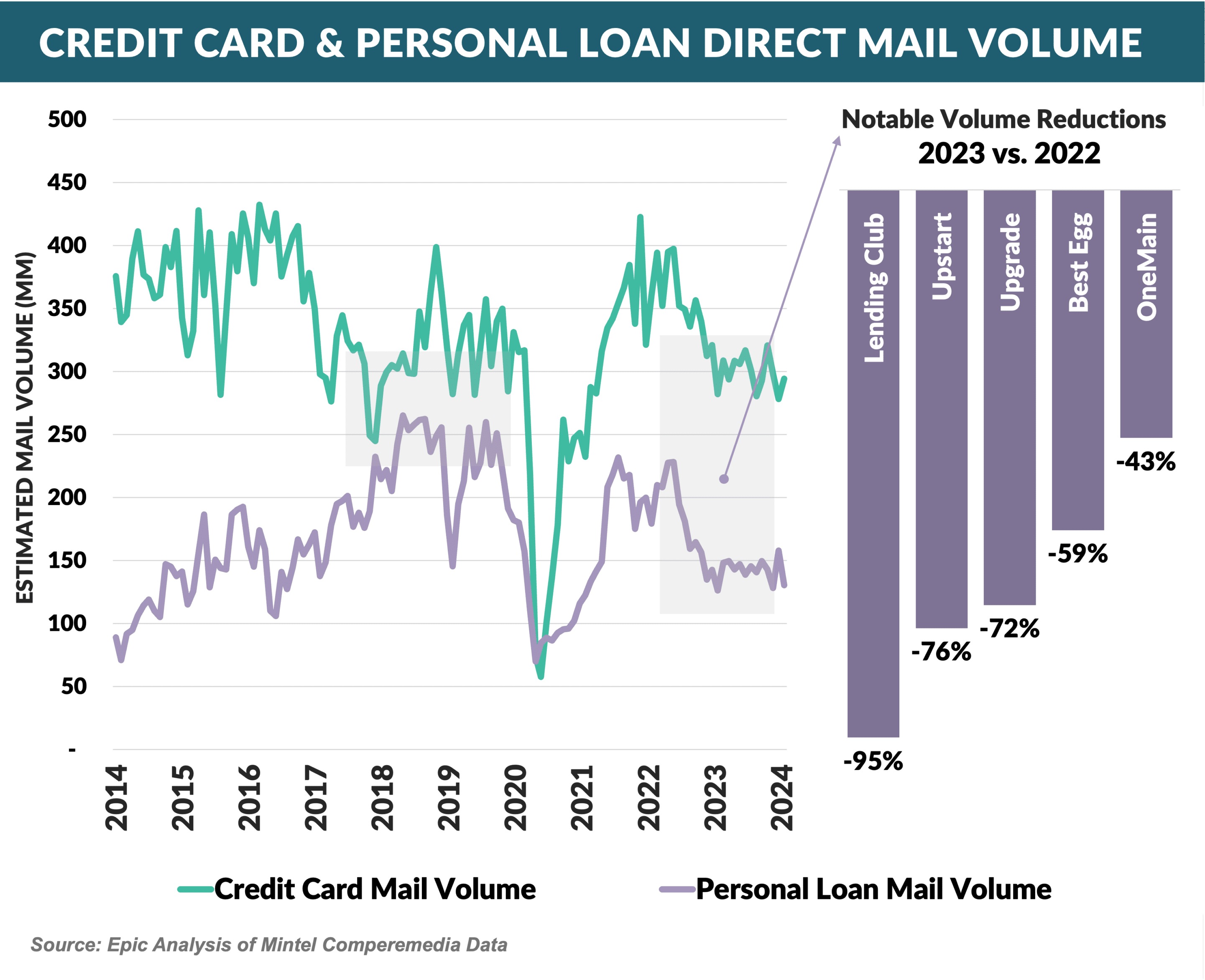

- Personal loan direct mail volume, long the predominant acquisition channel, approached that of credit cards five years ago

- However, the diminished institutional appetite to fund loans for fintechs, combined with the reluctance of commercial banks to participate in the market, has diminished personal loan mail volume to roughly half that of cards

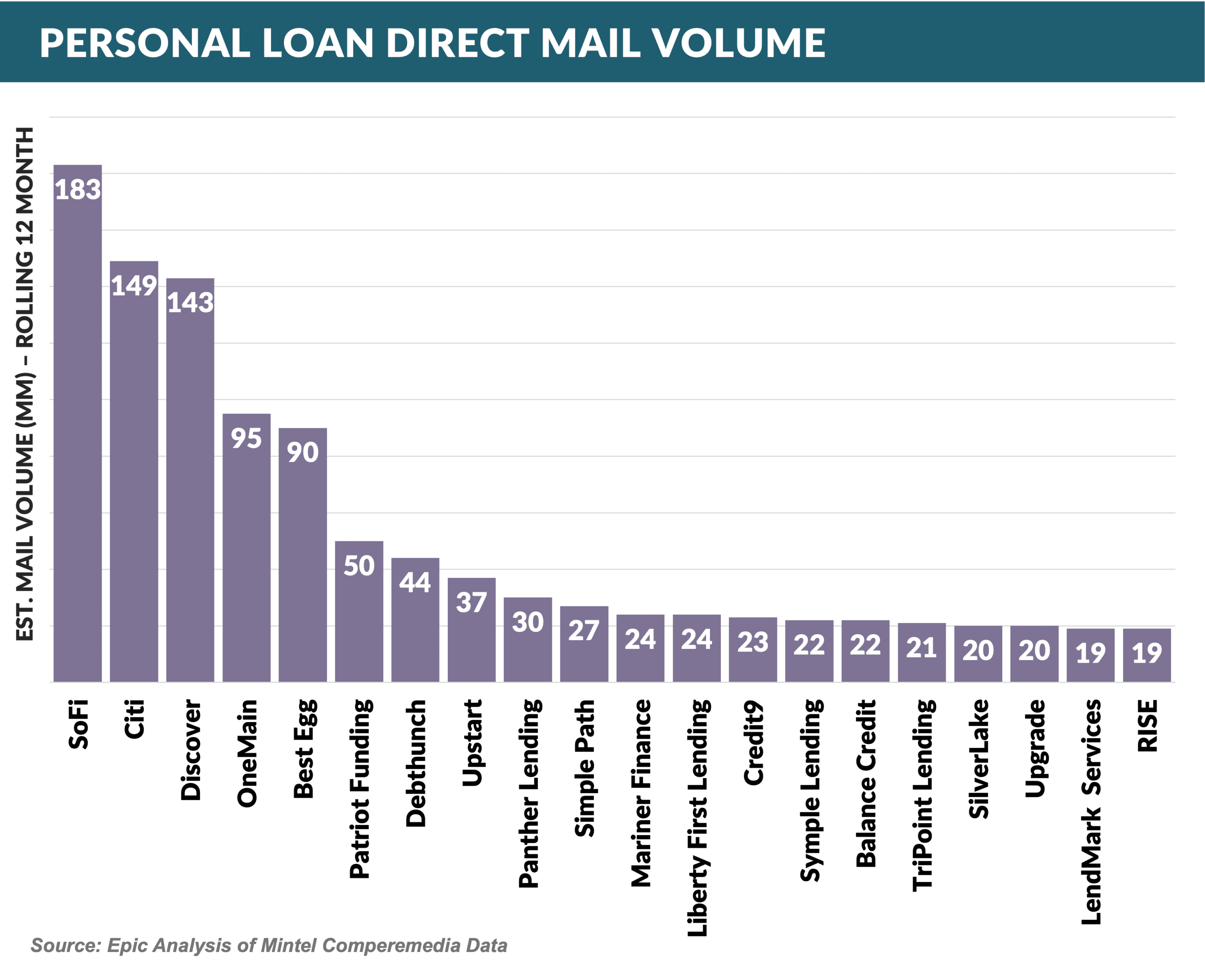

- In the recent, smaller market for personal loans, fintechs remain the dominant providers with Citi and Discover the only “traditional” institutions amongst the top mailers

- The slowdown in personal loan marketing has come at a time where the benefit of refinancing a credit card balance with a personal loan is at a recent high, with the average loan costing ~10 percentage points less than an average credit card loan – twice the benefit of that in 2019 when personal loan mail volume was at an all-time high

- Commercial banks would seem to have a distinct advantage in marketing personal loans, due to the stability and lower cost of deposit funding along with their superior brand equity. However, many commercial banks are spooked by the specialized credit expertise required to underwrite personal loans

- With $1 trillion+ of card balances, there is a massive opportunity for commercial banks to participate in the promising personal loan market

Digital Response Options Grow

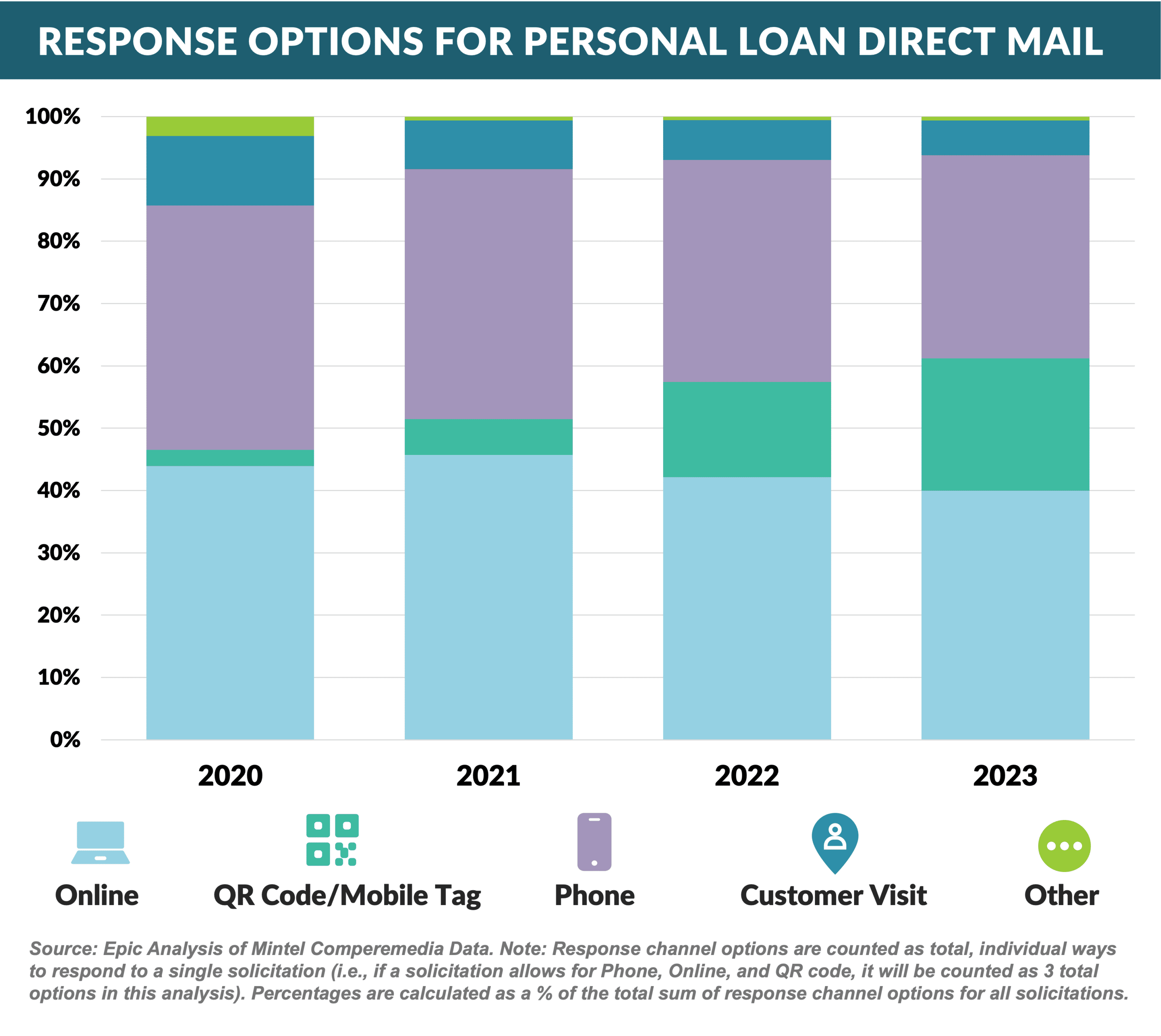

- Response options for credit card and loan mail solicitations were once dominated by paper applications and inbound phone, and, while phone is still offered as a popular channel, paper applications have all but disappeared and been replaced by digital options

- Diving into Personal Loan direct mail, we see that QR Code presence increased 7X from 3% in 2020 to 21% in 2023, as consumers have finally become increasingly comfortable with this 30-year-old technology

- Digital (URL and QR codes) has grown to 61% of all response options for personal loan in 2023, up sharply from 47% in 2020

- Phone and branch choices on personal loan mail have dropped from a combined 50% in 2020 to just 39% in 2023

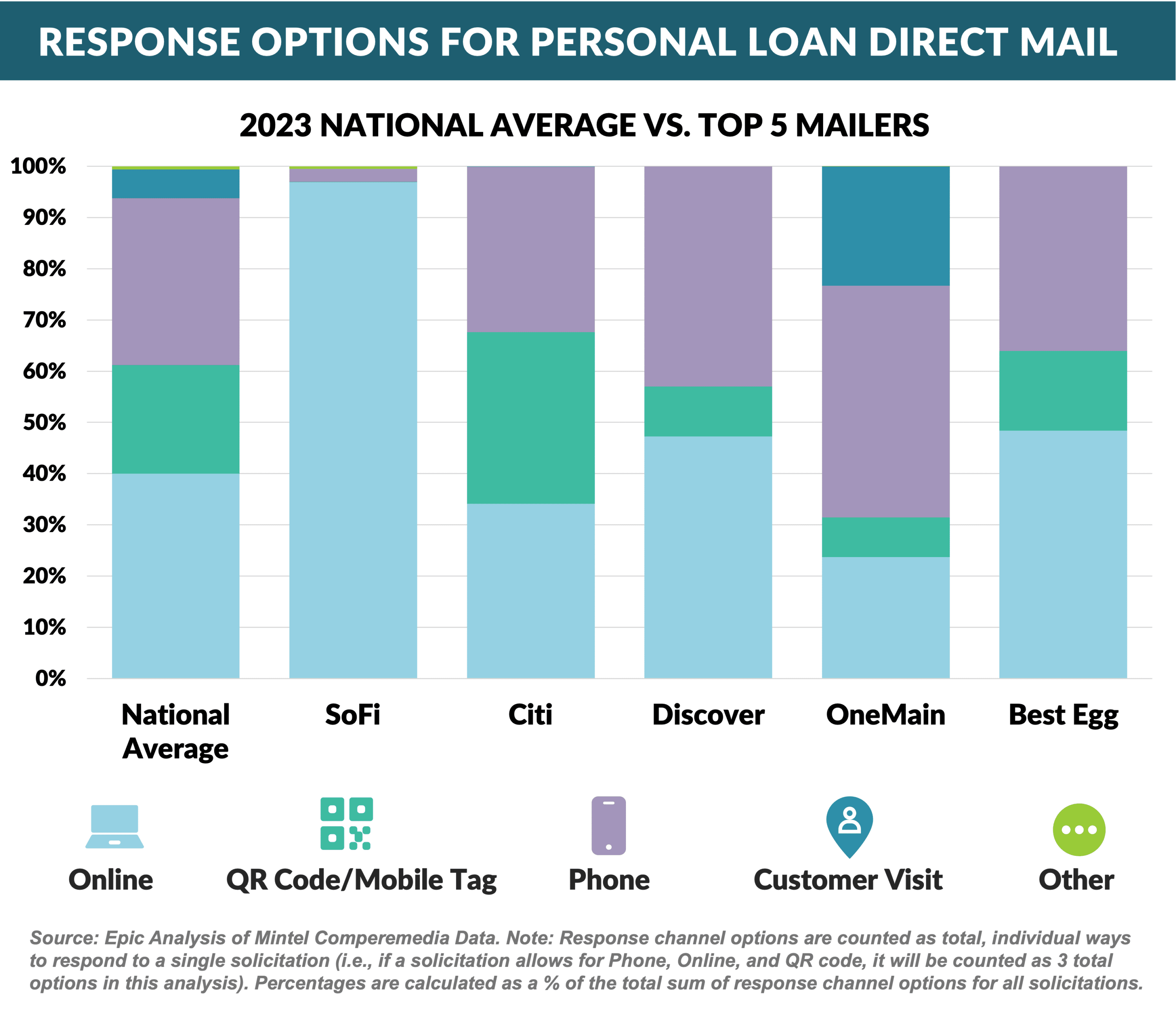

- Individual lender response options vary greatly, as an analysis of 2023’s top five personal loan mailers shows

- SoFi almost never includes a QR code, surprisingly still relying mostly on traditional URLs

- With strong URL and QR code presence, Citi leans more digital than the national average (67% vs. 61%) but shies from promoting their nearly 700 branches as a response option, even in targeted areas

- Discover and OneMain both have a lower share of digital and a higher share of phone options presented compared to the national average

- Given their network of ~1,400 branches, it makes sense OneMain also steers consumers to the branch channel (23% of response options presented)

- Best Egg most closely mirrors the national average, with a little extra weight in digital and phone given their lack of a branch network

- Overall, lenders continue to march toward their digital goals even while leveraging the offline mail channel to drive acquisitions

Debt Settlement Marketing Awakening?

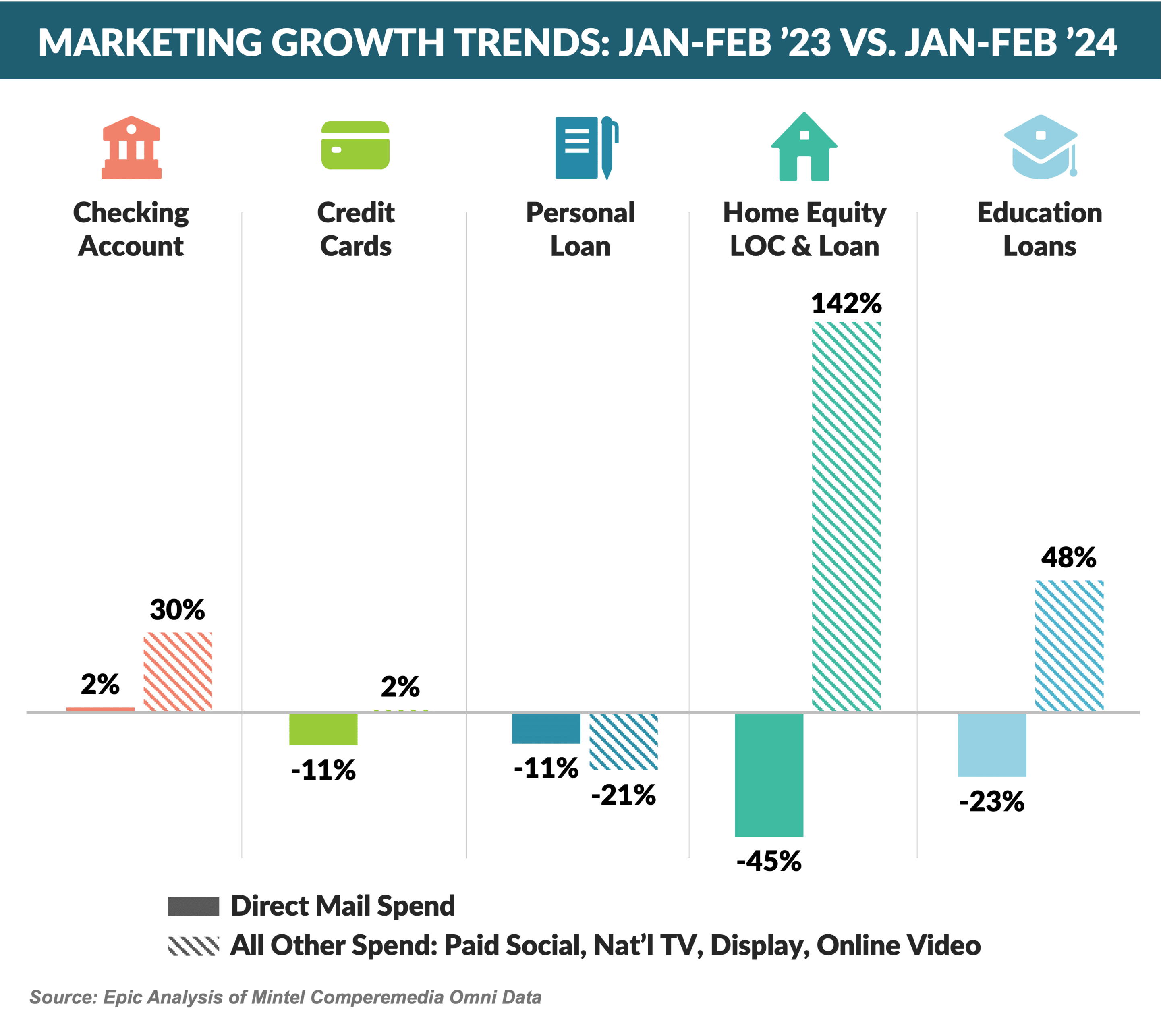

- Lending products – cards, personal loans, HELOC, and education loans – show lower mail spend YTD as compared to 2023 due primarily to credit tightening and higher interest rates

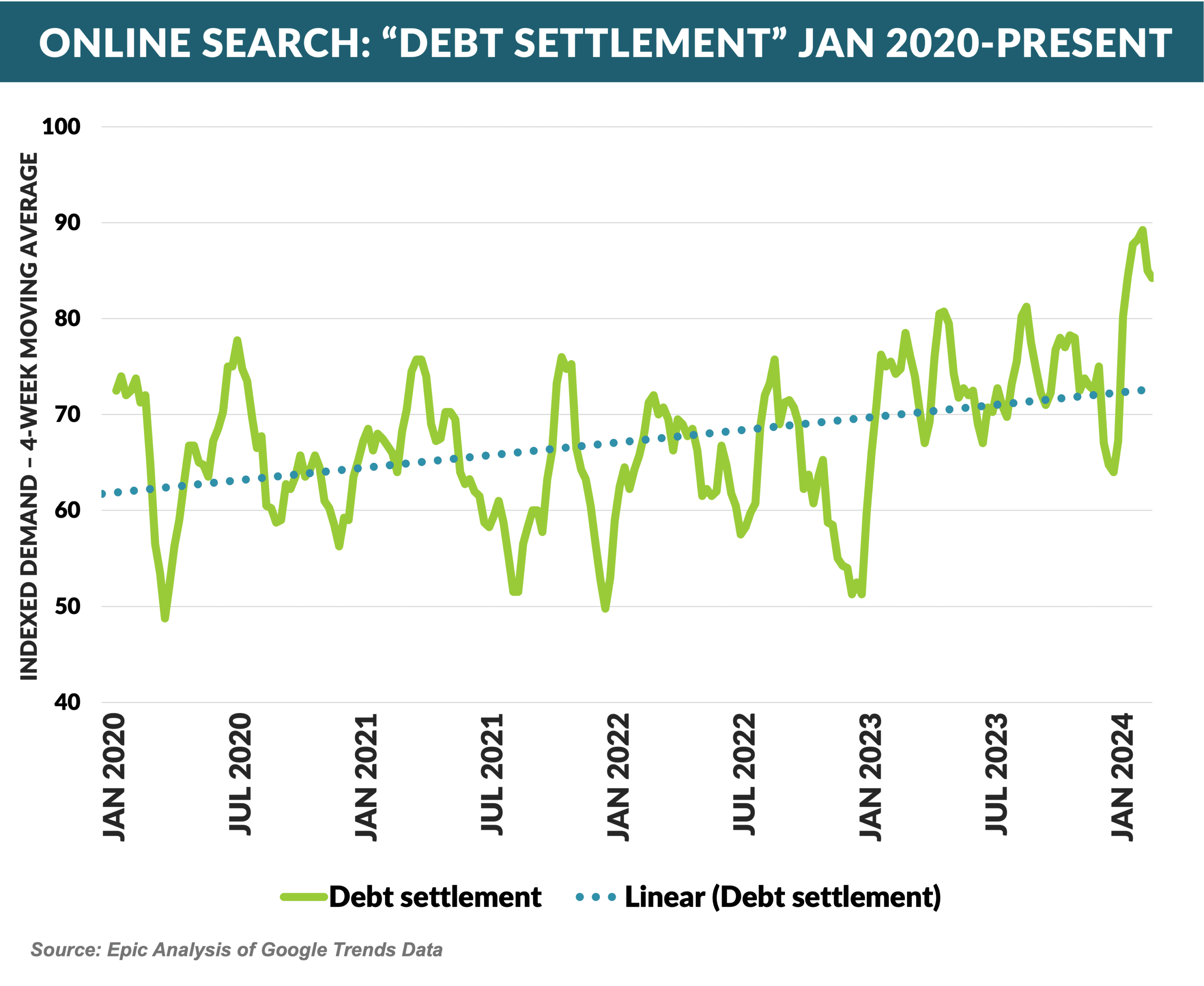

- We don’t typically track marketing activity for debt settlement; however, this once popular product has had a recent uptick in online search activity, likely reacting to higher consumer loan delinquencies

- However, the recent rise in search volume barely registers when compared to the 2008 – 2010 peak in activity

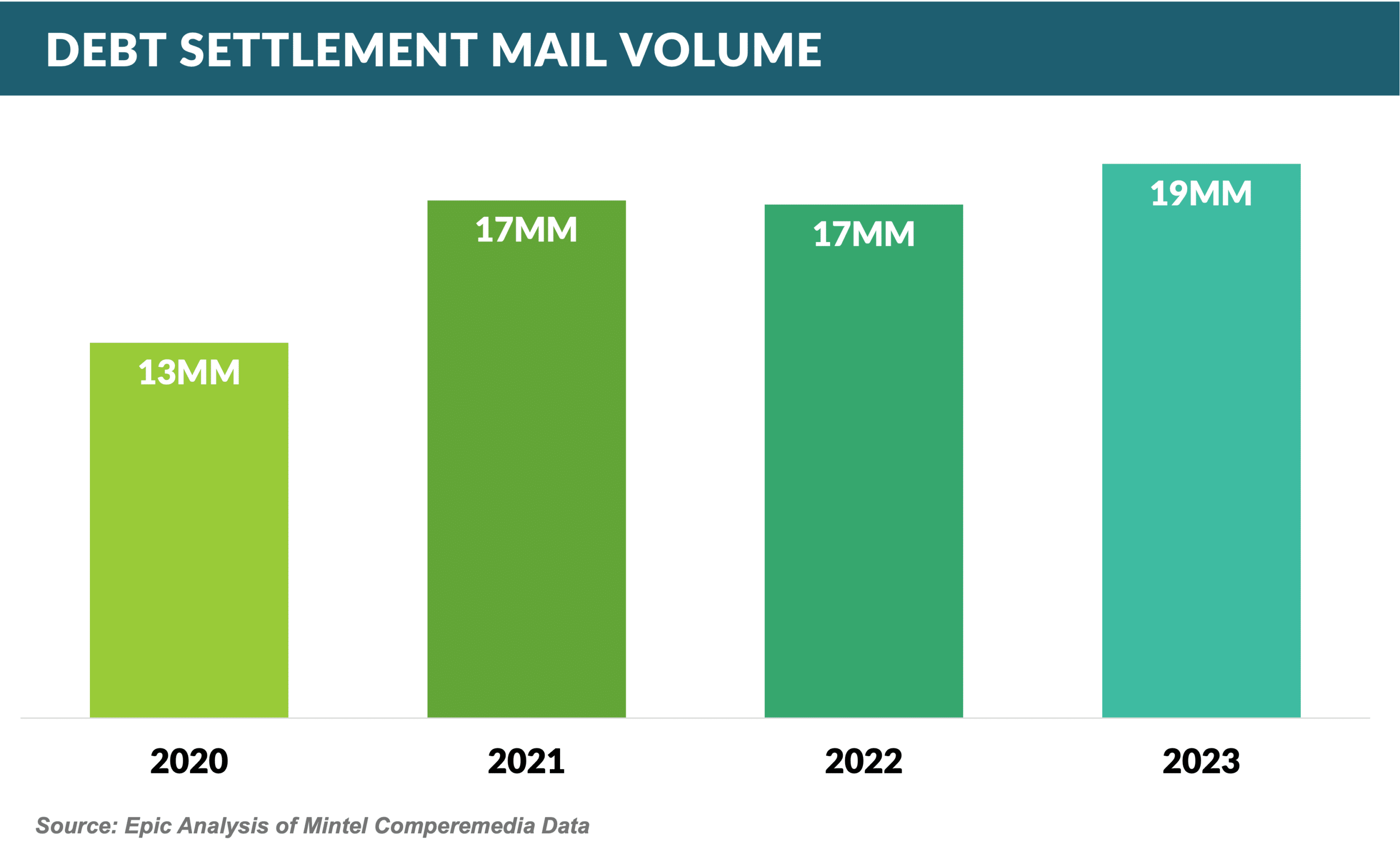

- Debt settlement mail volume rose slightly in 2023, but remains less than 1% of the volume of card and loan products

- Robinhood announced a new credit card offering an uncapped 3% cash back on all spending

- The card is available to Robinhood Gold members, which requires a $50 annual fee

- The company says it will profit from revolving activity as well as “product cross sales” - all cash back will be paid through a Robinhood brokerage account which should offset some of the negative transactor income

- Please submit your pro-forma P&Ls here if you can figure out how this product will ever be profitable

- Wells Fargo announced the launch of the Autograph Journey Visa

- The card has a $95 annual fee and is targeted at travelers

- Travel partners include Choice Privileges, Air France-KLM Flying Blue, Avianca LifeMiles, British Airways Executive Club, AerClub, and Iberia Plus

- The Autograph Journey card generally competes in the same space as the Chase Sapphire and Capital One Venture Rewards cards

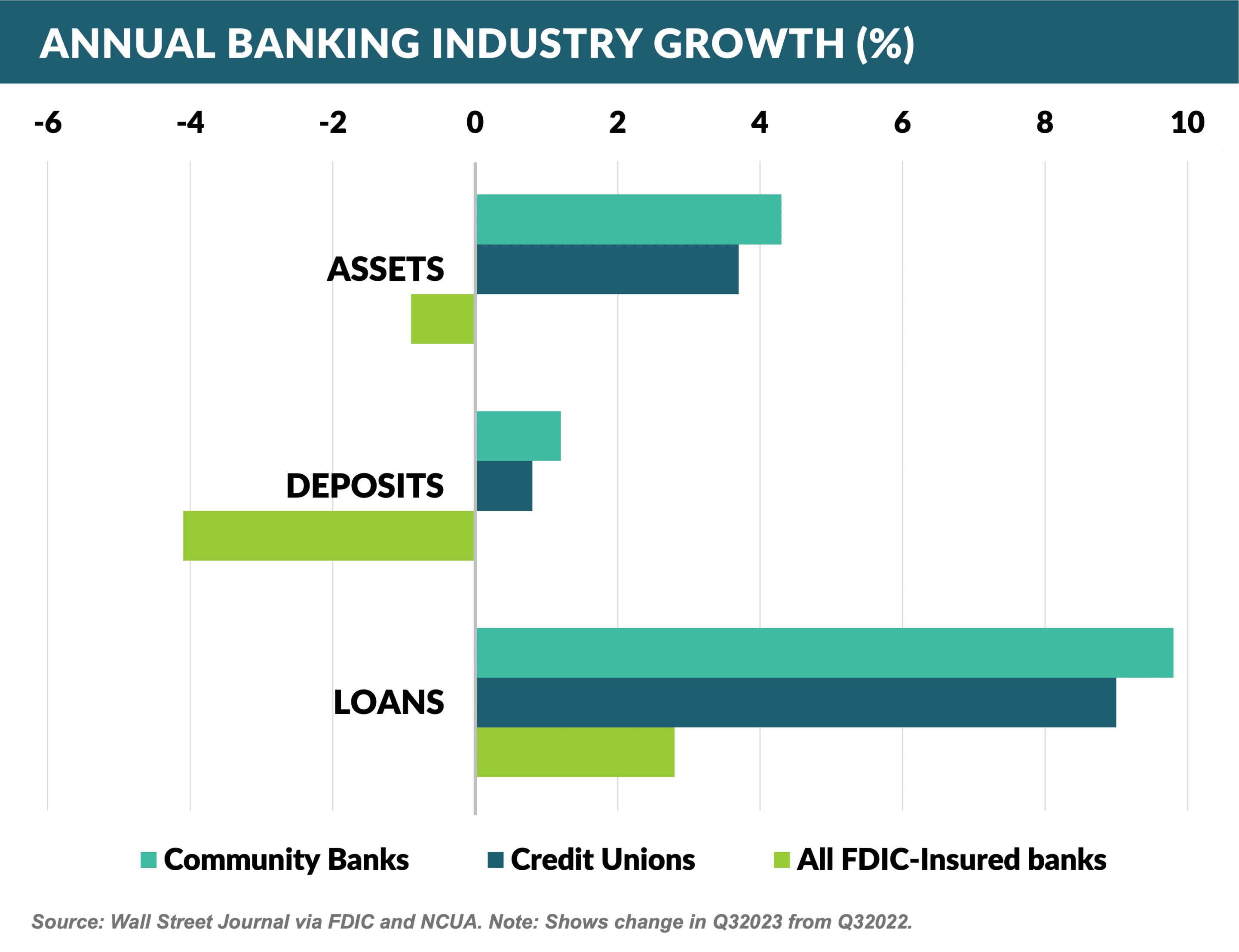

- Community banks and credit unions have shown more asset and deposit growth in the past year than the banking sector as a whole, with the Wall Street Journal speculating that it is a reaction to industry consolidation

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on May 4th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.