Three Things We’re Hearing

- HELOC opportunity???

- It’s top card issuer season!!!

- Marketing trends

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

HELOC Opportunity???

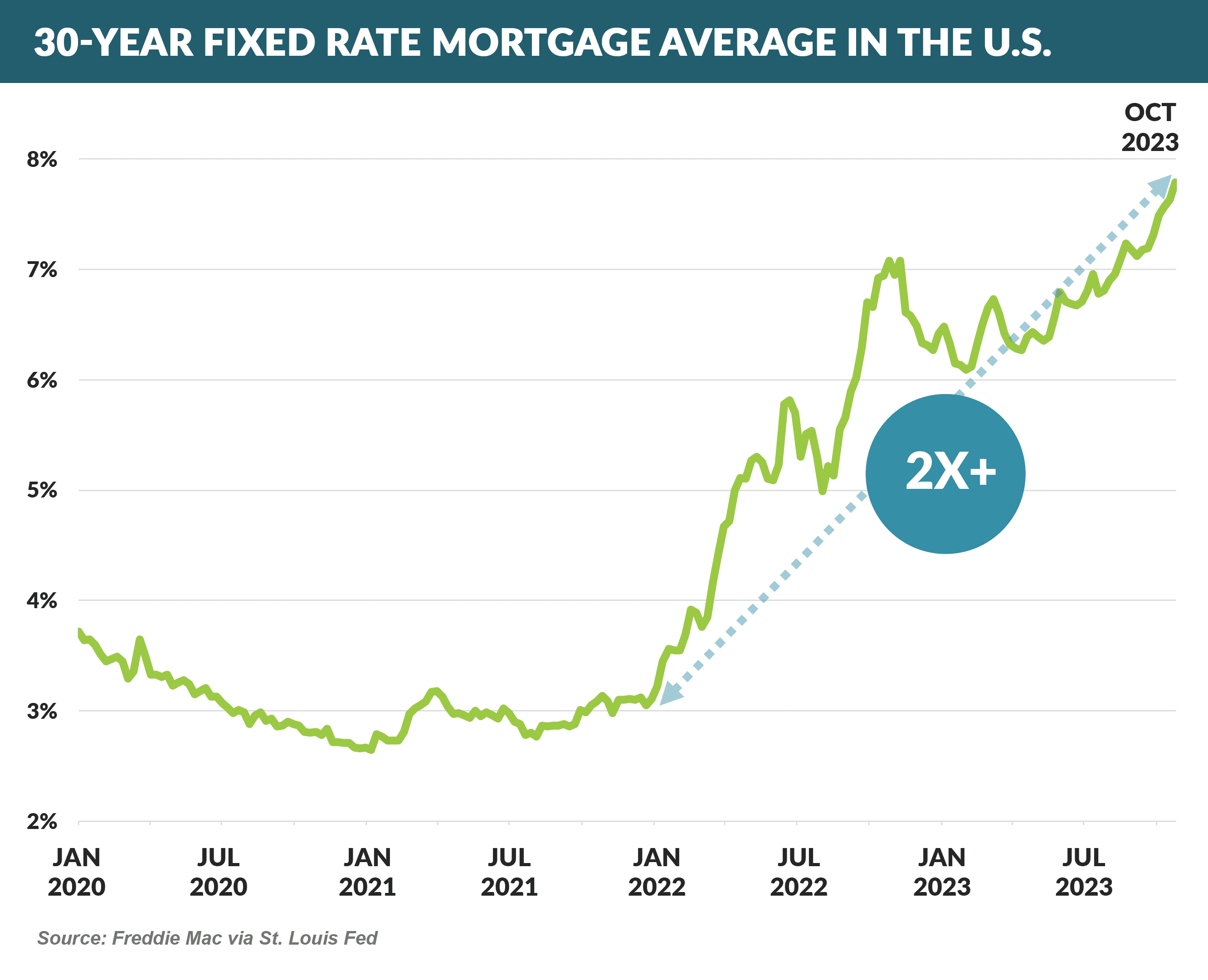

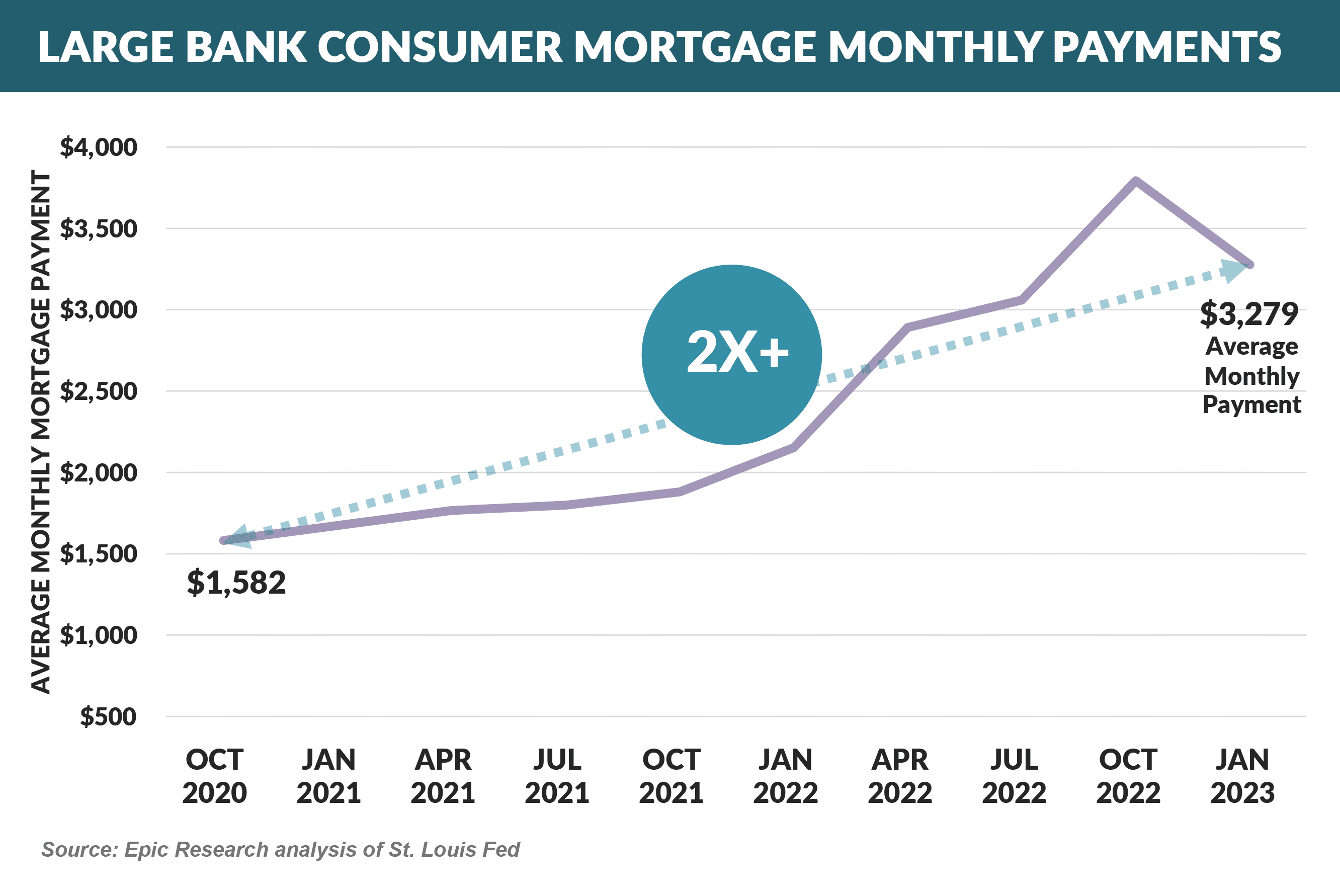

- Mortgage interest rates have more than doubled since January 2022

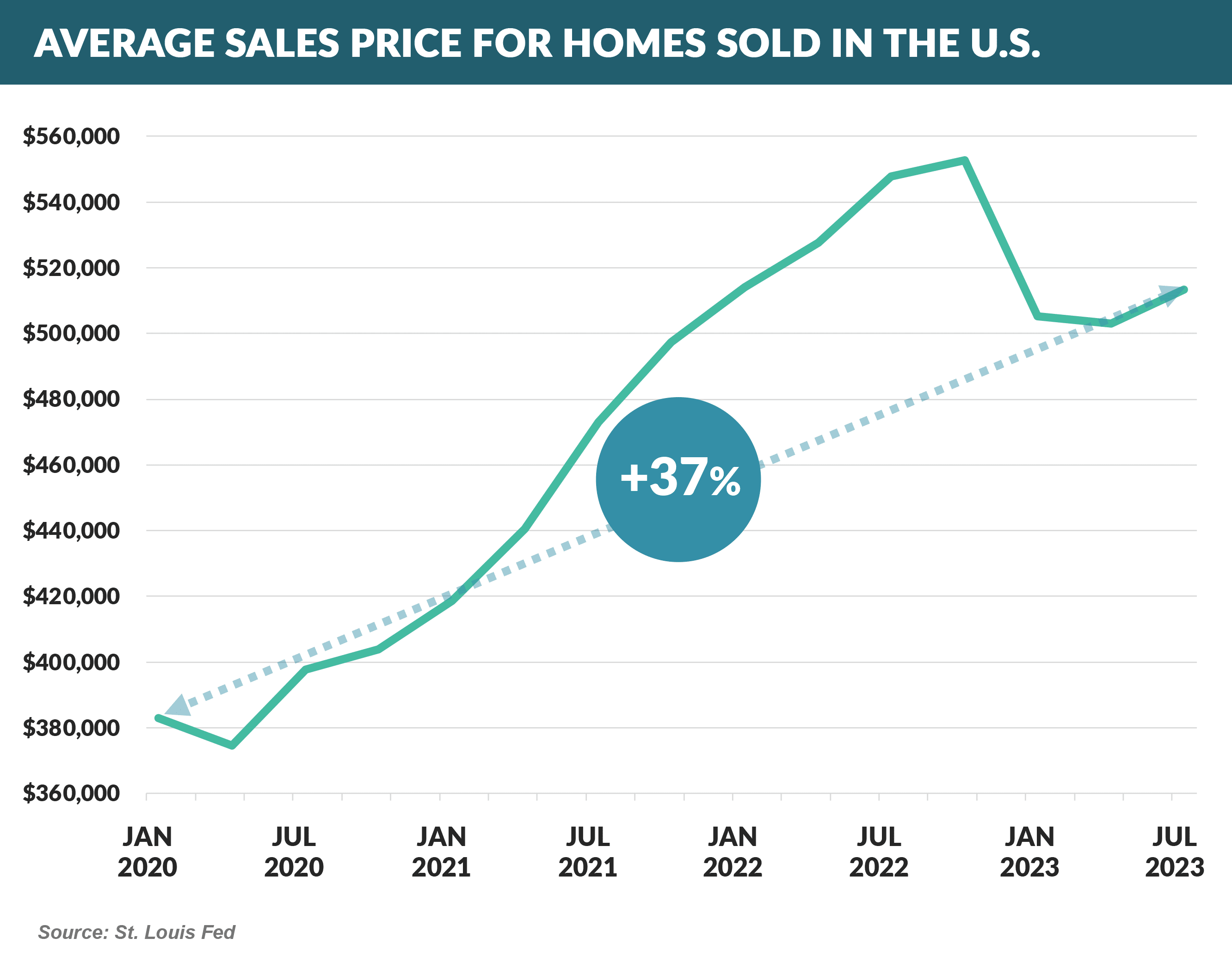

- And the average sales price for homes is up 37% since 2020

- Factors that have combined to more than double average monthly mortgage payments

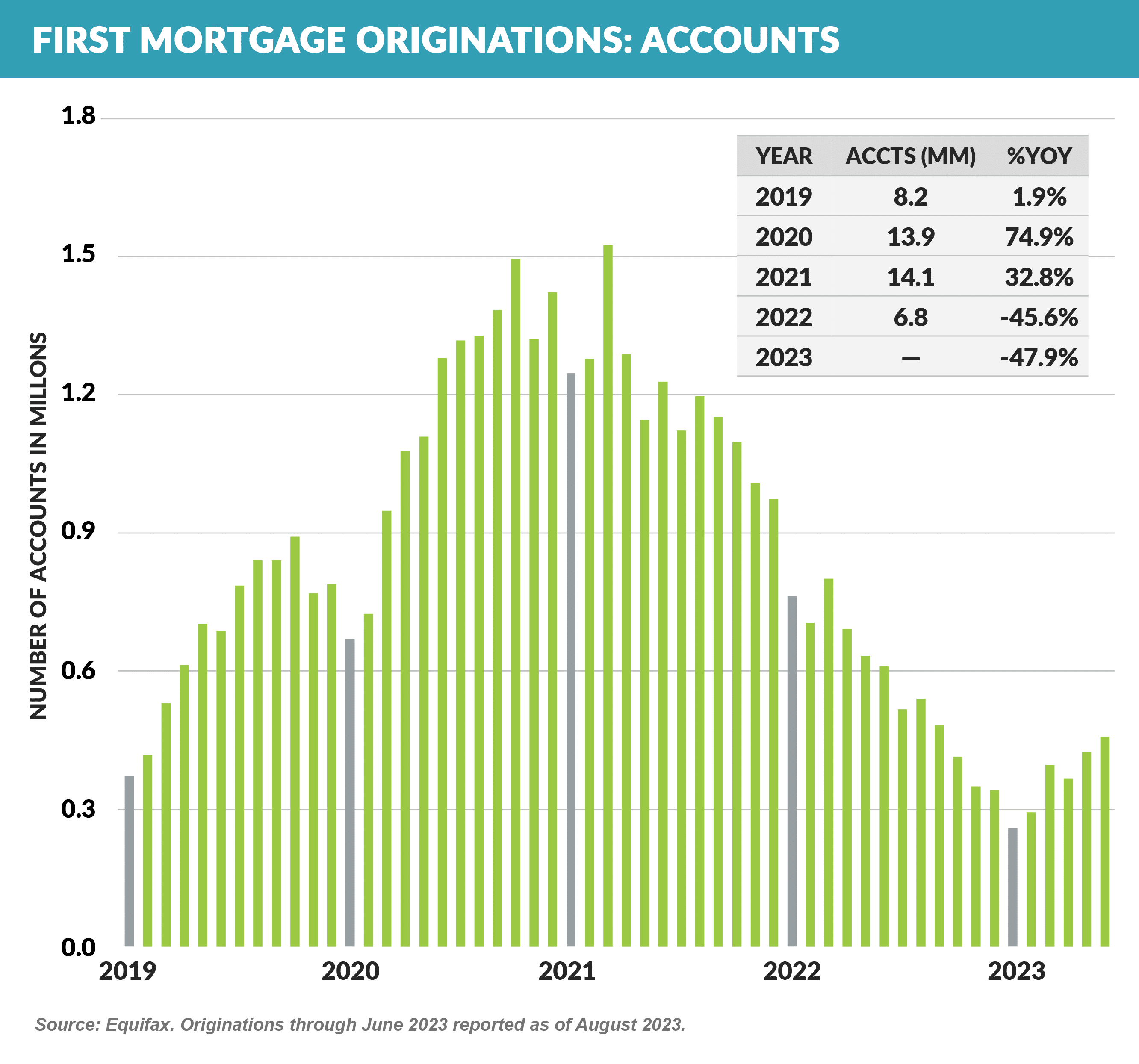

- Consequently, first mortgage originations have dropped 45% in 2022 and 47% YTD 2023

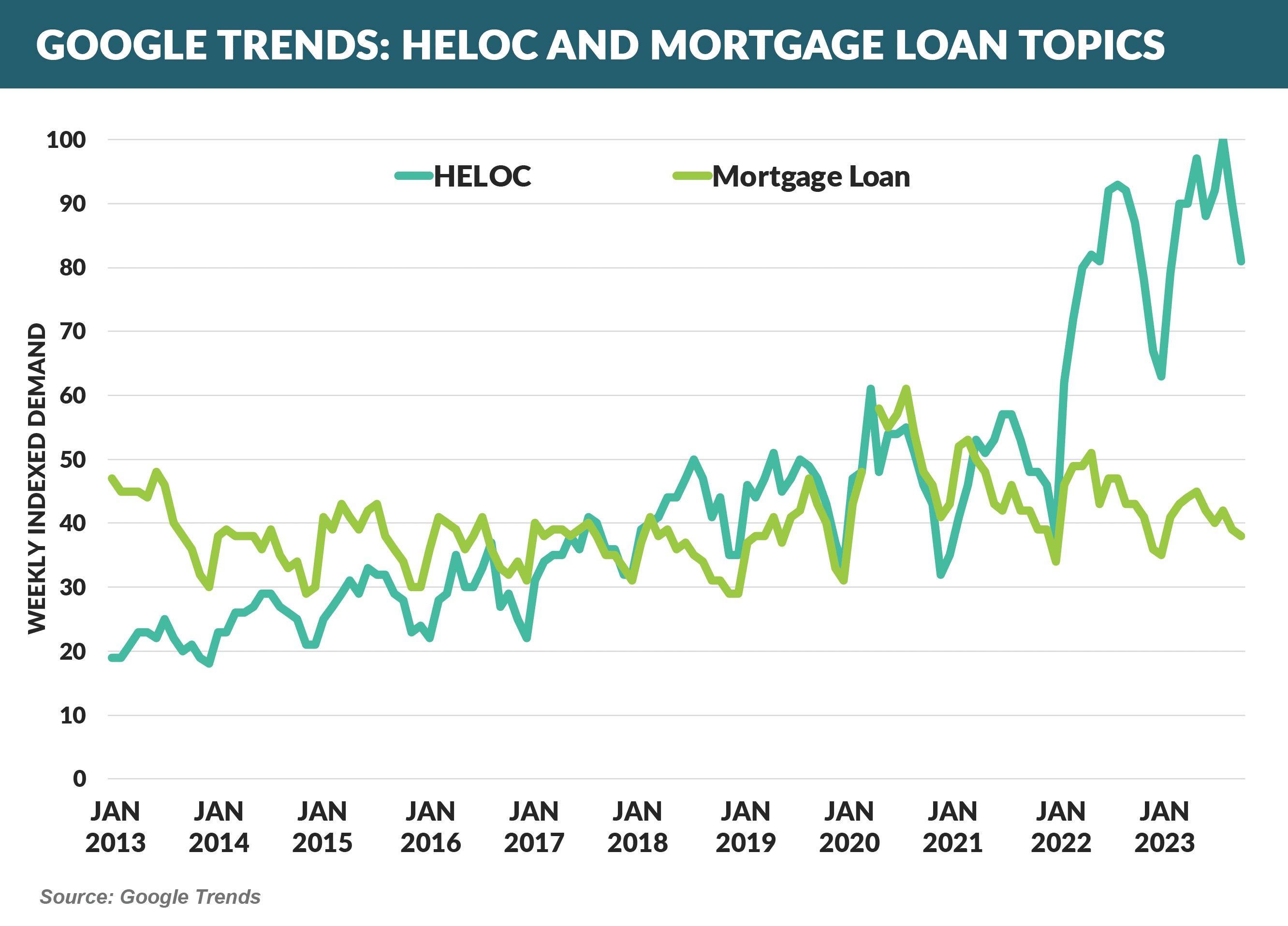

- However, as first mortgage originations have slowed, interest in Home Equity Lines of Credit has soared as consumers tap the increased equity in their homes generated by rising home values

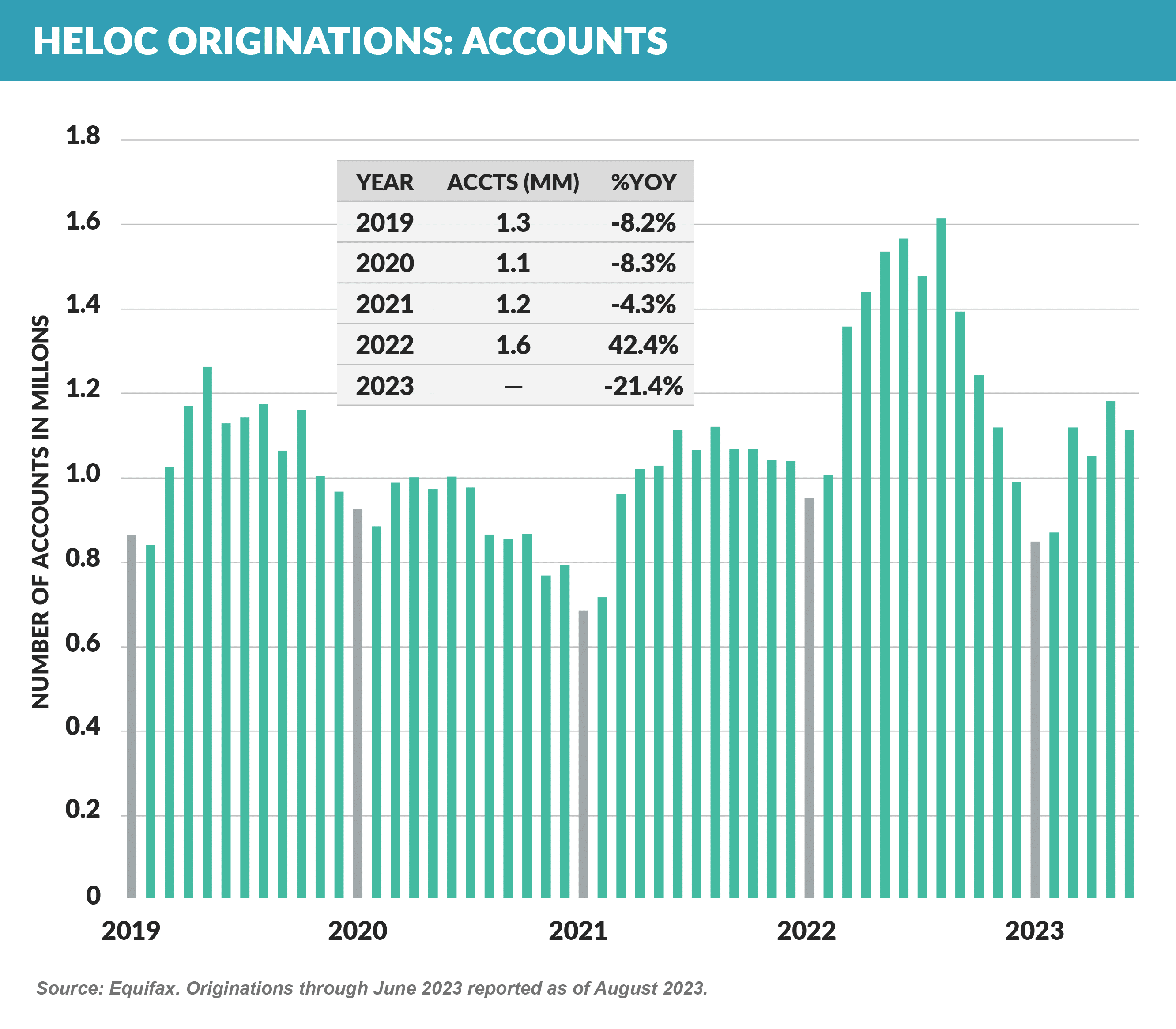

- HELOC originations were up 42% in 2022, and while year-over-year growth has slowed in 2023, new HELOC originations are still well above the pace of 2020 and 2021

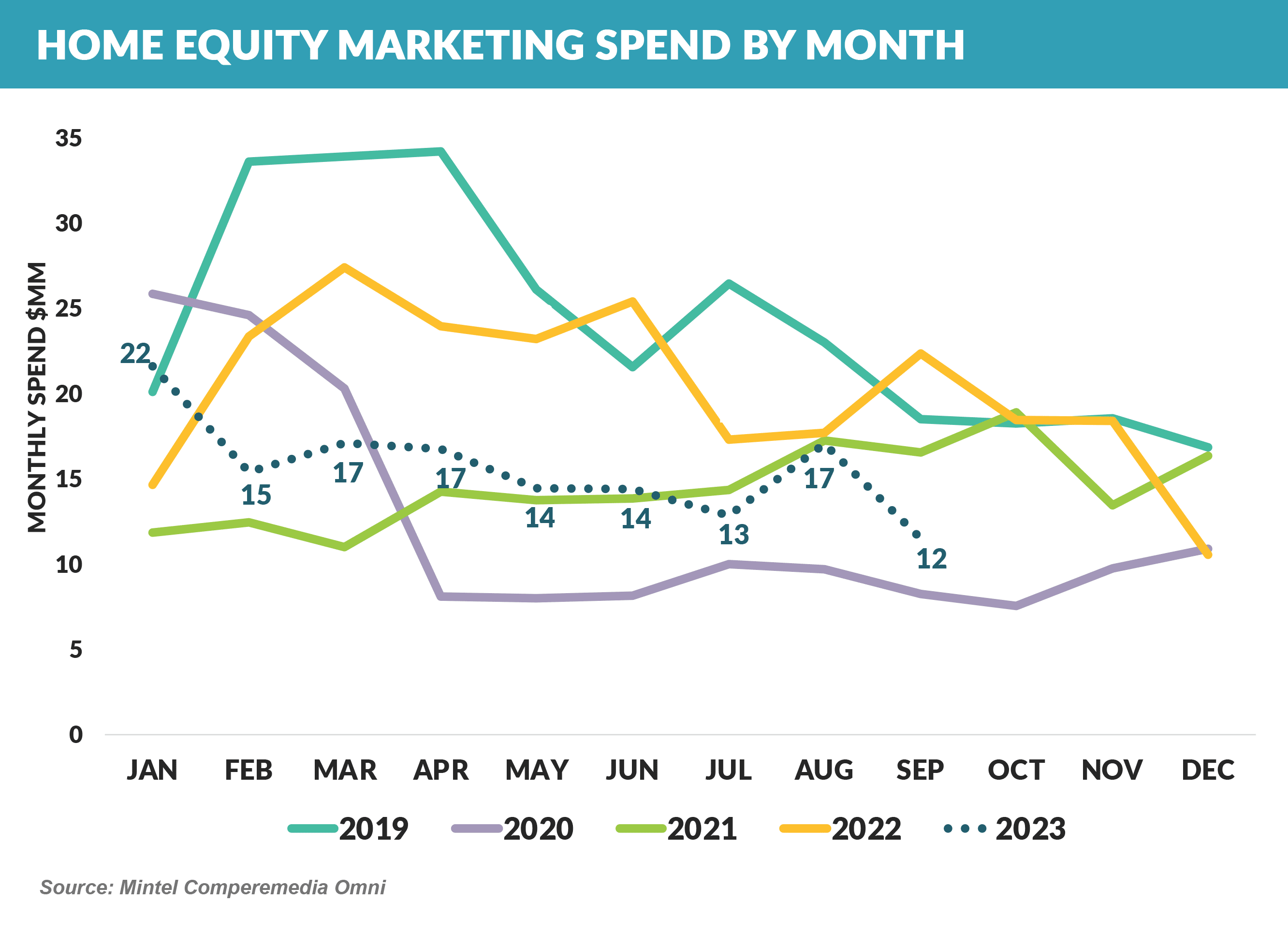

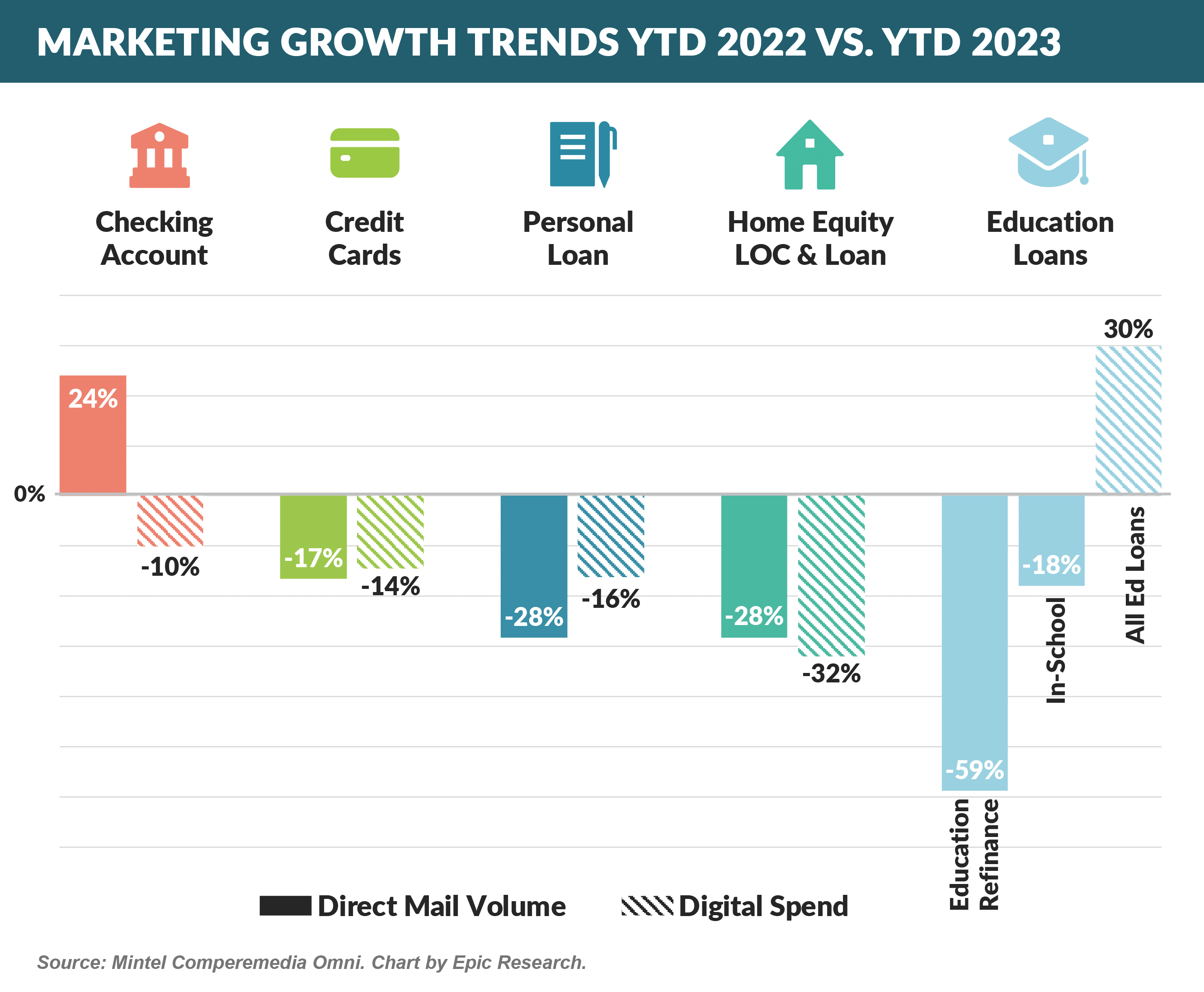

- HELOC advertising spend is down 28% YTD from 2022, and, considering the spike in consumer interest, there may be an opportunity for home equity lenders to lean in

It’s Top Card Issuer Season!!!

- If you are like us, you eagerly anticipate the Nilson Report’s “Top Credit Card Issuer” list that is published at both mid-year and year-end

- We have segmented the mid-2023 list of Visa and Mastercard issuers into four categories:

- National

- Specialty

- Regional

- Near- and Sub-Prime

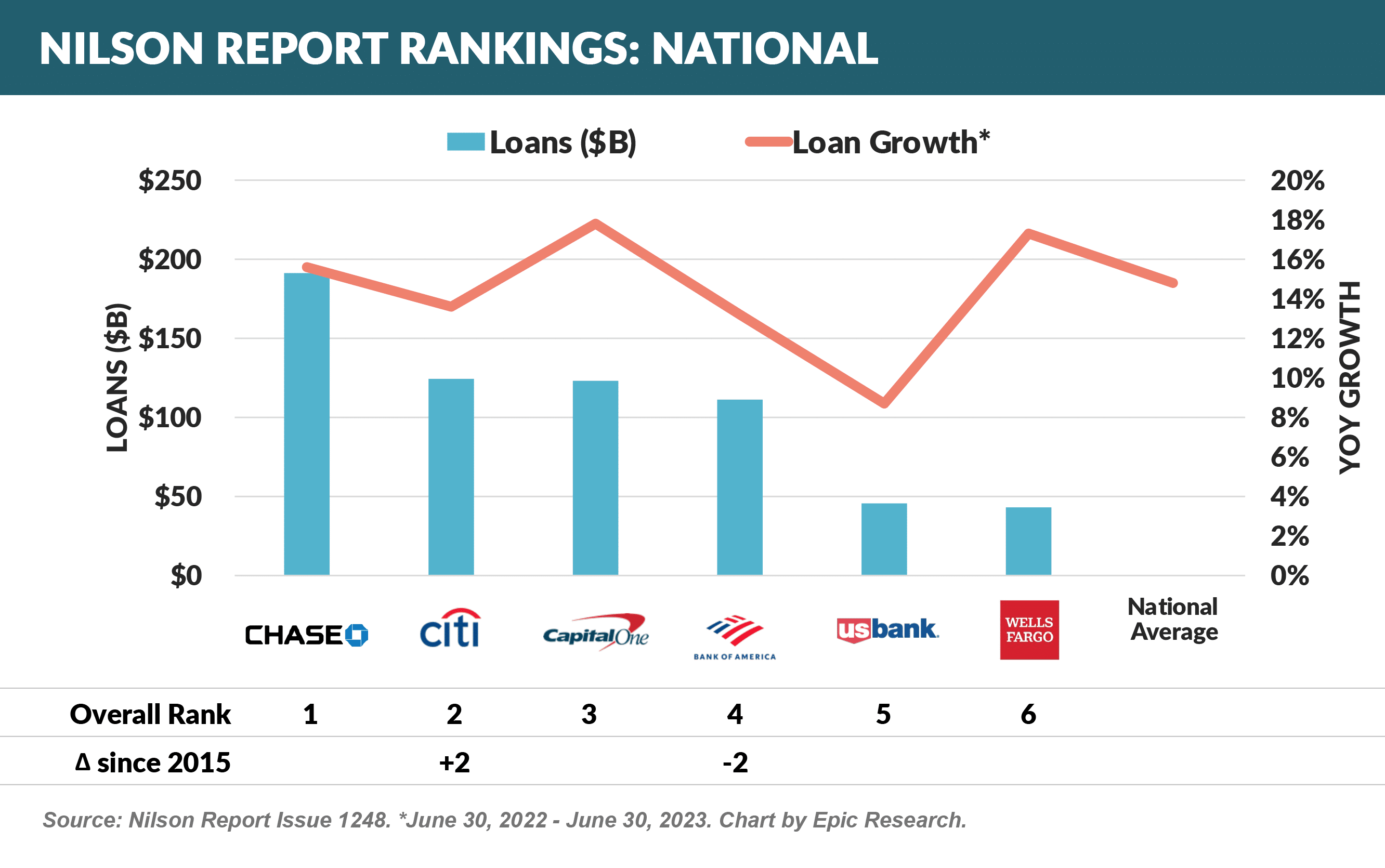

- Amongst the top National issuers, there has been little change in the rankings since 2015, with only Bank of America and Citi switching places in the top 5

- 12-month growth was consistently in the mid-teens, other than US Bank

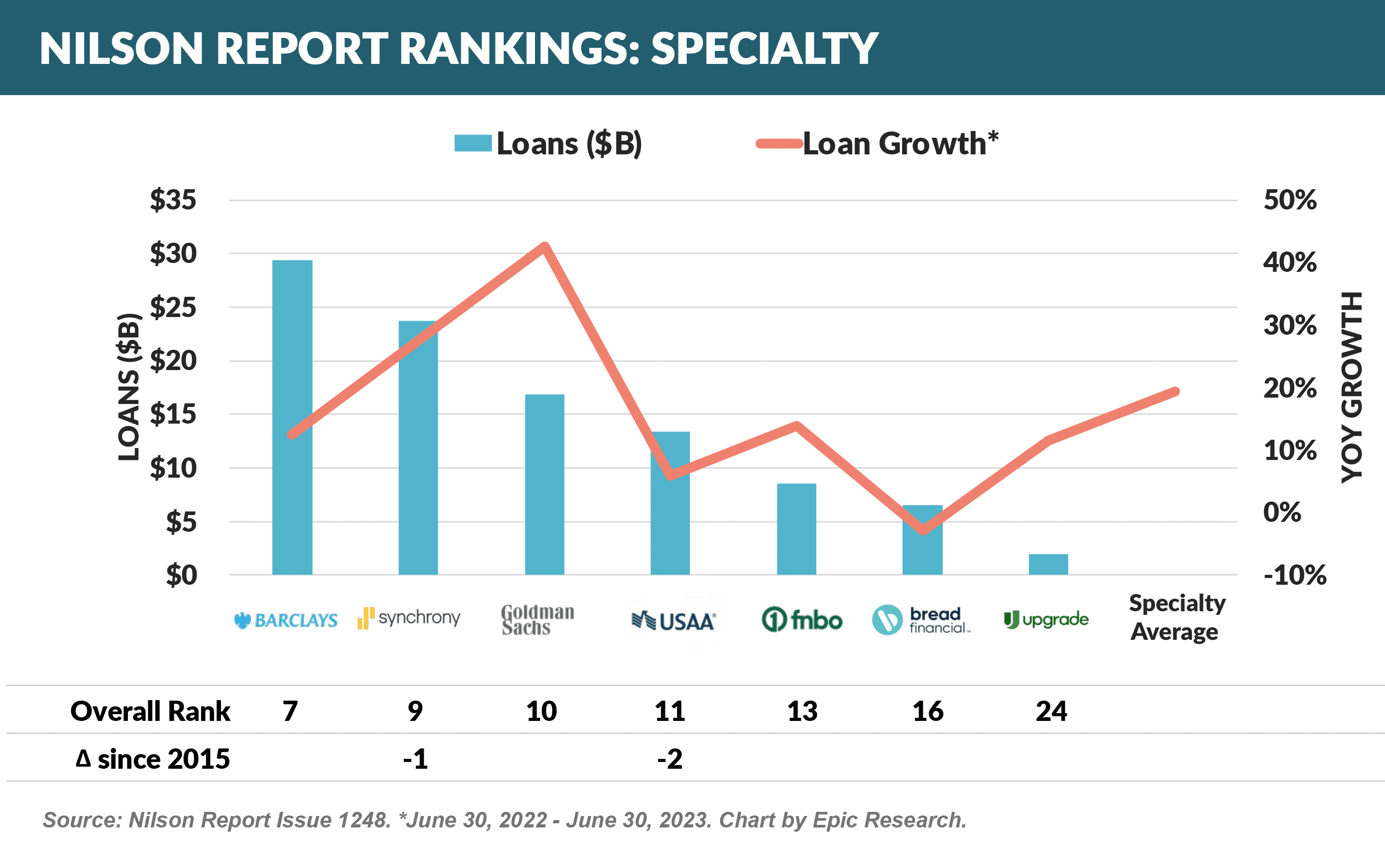

- “Specialty” issuers – generally those without large branch networks – showed more varied growth rates

- Goldman Sachs (GM portfolio acquisition) and Synchrony grew fastest, while Bread and USAA were below market growth

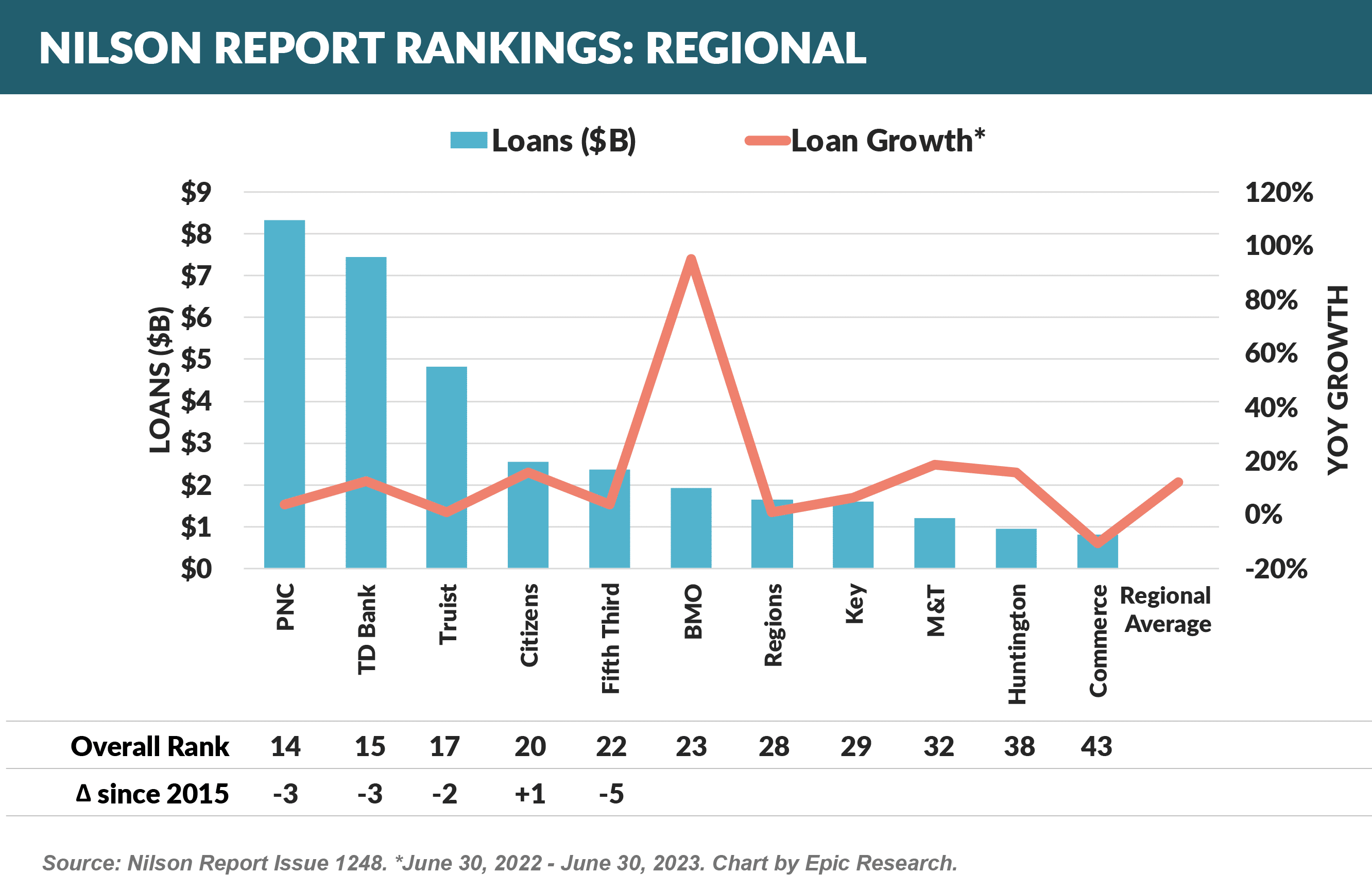

- Regional banks were the slowest growing segment

- BMO benefitted from the Bank of the West acquisition, and only TD Bank, Citizens, M&T, and Huntington matched the growth rate of National issuers

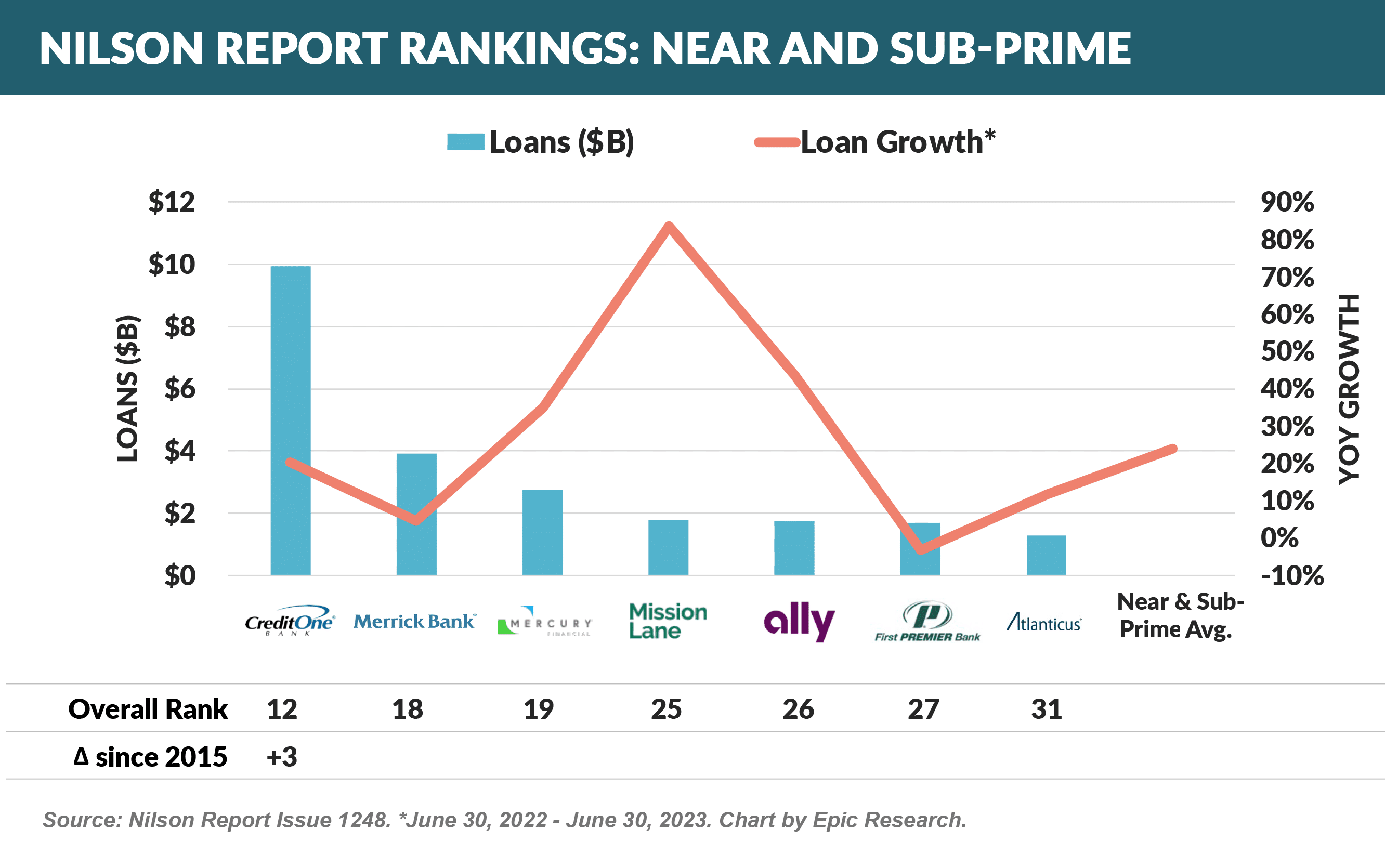

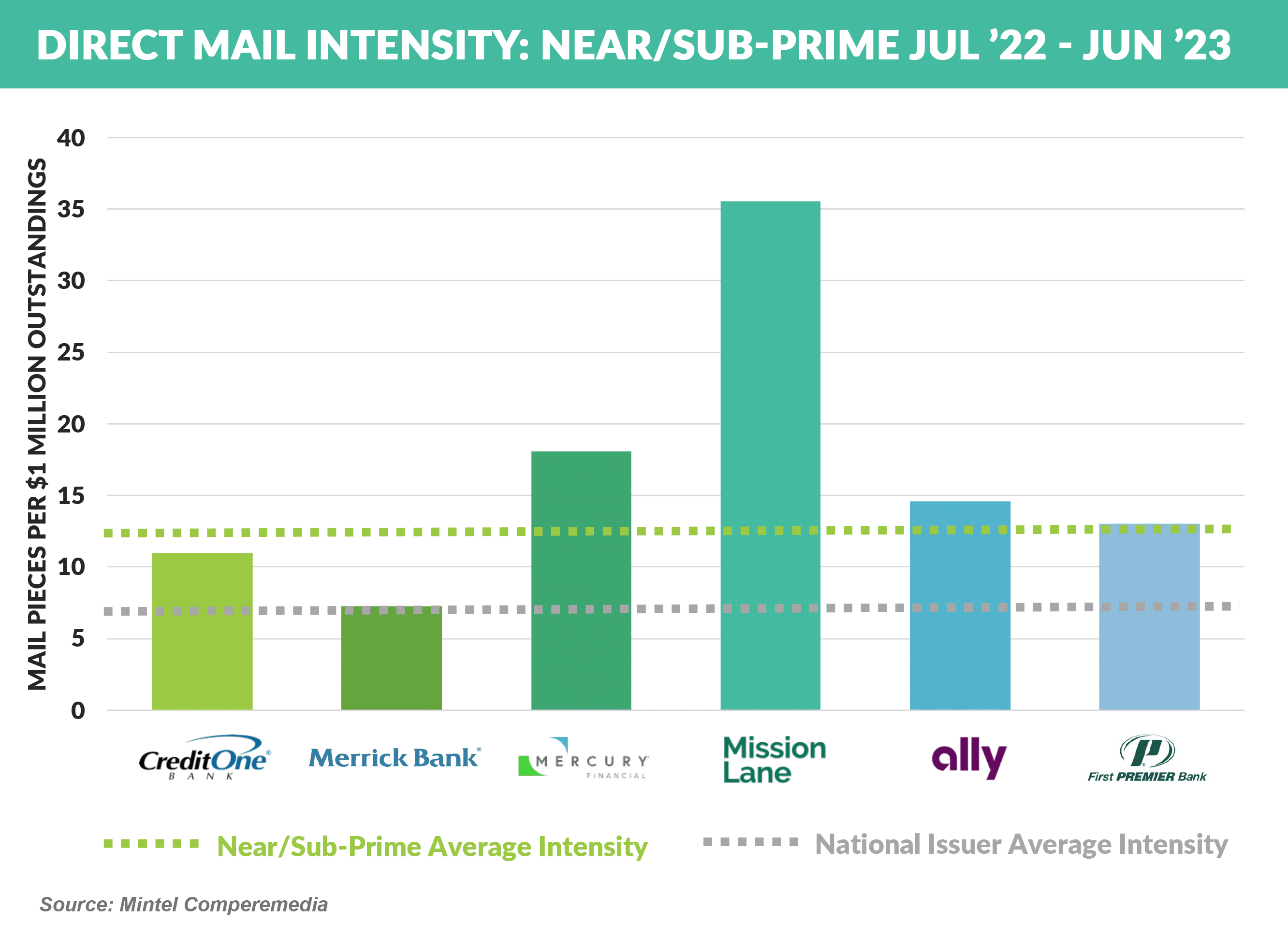

- The Near and Sub-Prime segment showed the highest growth, with Mercury, Mission Lane, and Ally (FairSquare portfolio acquisition) leading the pack

- As issuers grow larger, growth becomes more challenging and the largest have mammoth growth engines. For example:

- Chase’s net growth in this period was 15.6%, or $28.5 billion – the equivalent of roughly the size of number seven issuer Barclays

- Allowing for an estimated “natural” attrition rate of ~15%, that adds another $25 billion of growth needed for Chase – just to keep outstandings flat

- When added to the $28.5 billion in net growth, Chase added $53 billion of total new outstandings in 12 months!

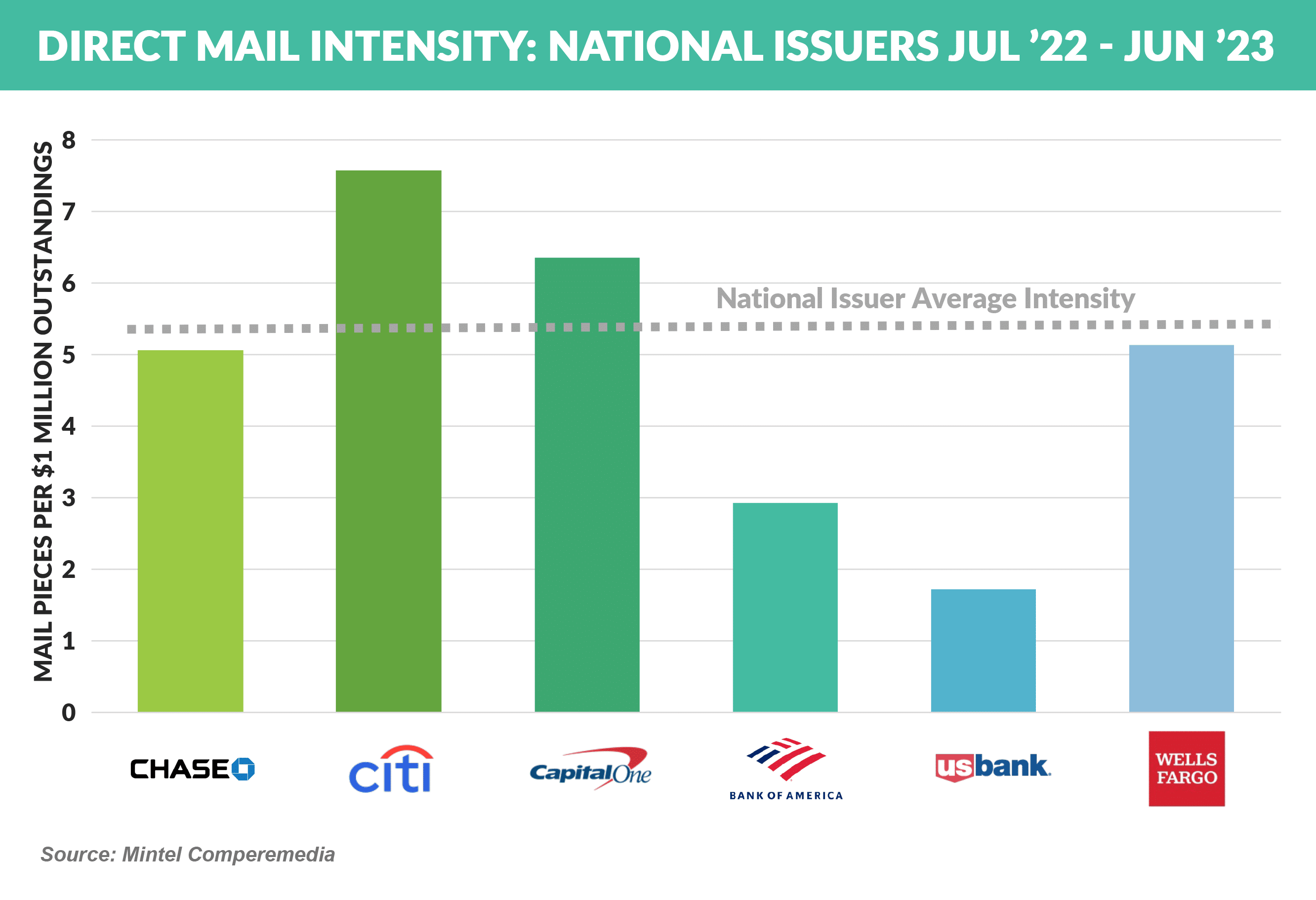

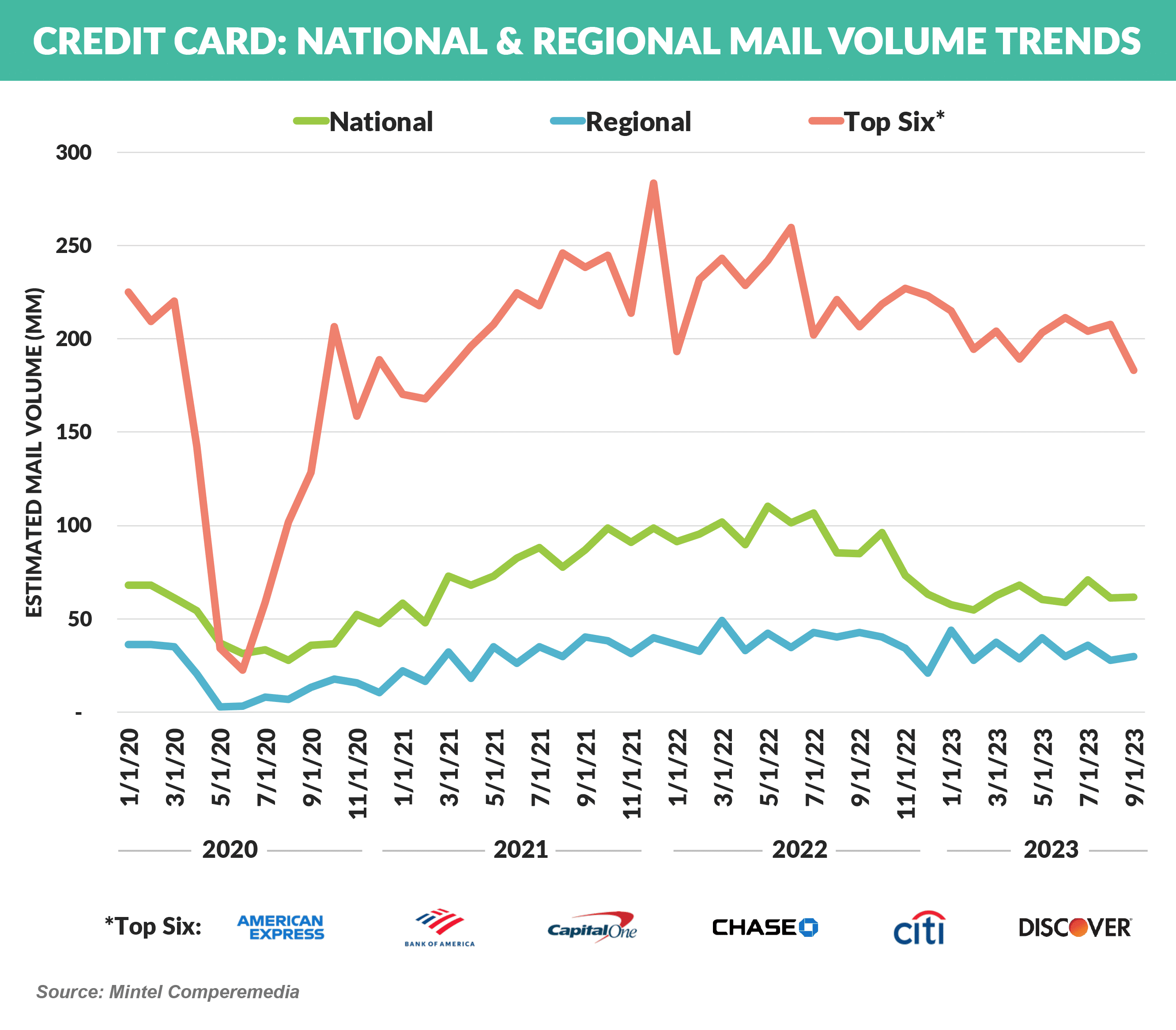

- Direct mail has consistently accounted for 60%+ of new credit card accounts, and National Issuers Chase, Citi, Capital One, and Wells Fargo mail at similar levels relative to their size, with Bank of America and US Bank mailing less

- Near- and Sub-Prime issuers – smaller and less dependent on co-brand partners – have over twice the mail intensity of the National issuers

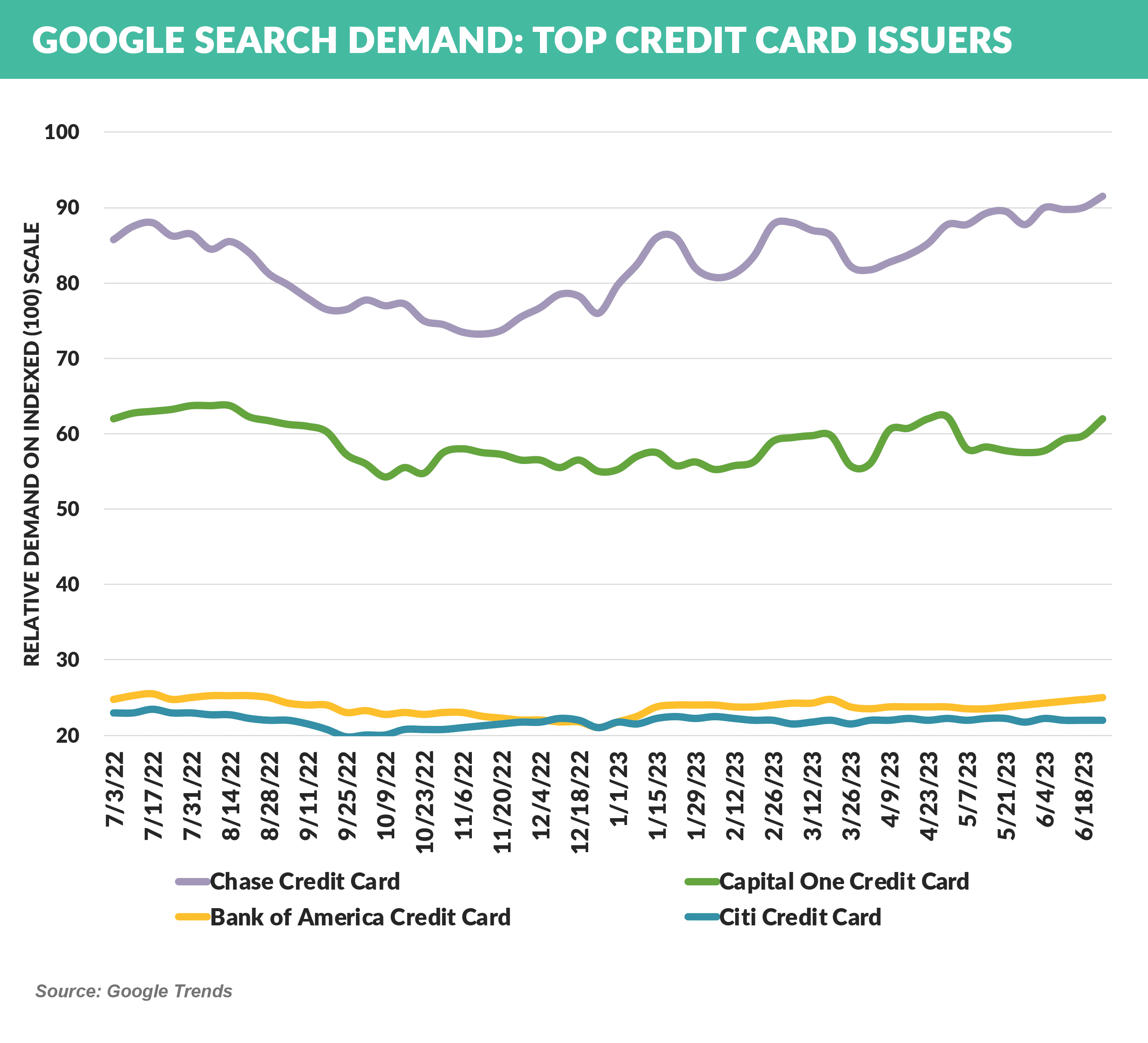

- Brand strength and national advertising also result in strong organic search volumes for the national issuers, with Chase and Capital One well above the others

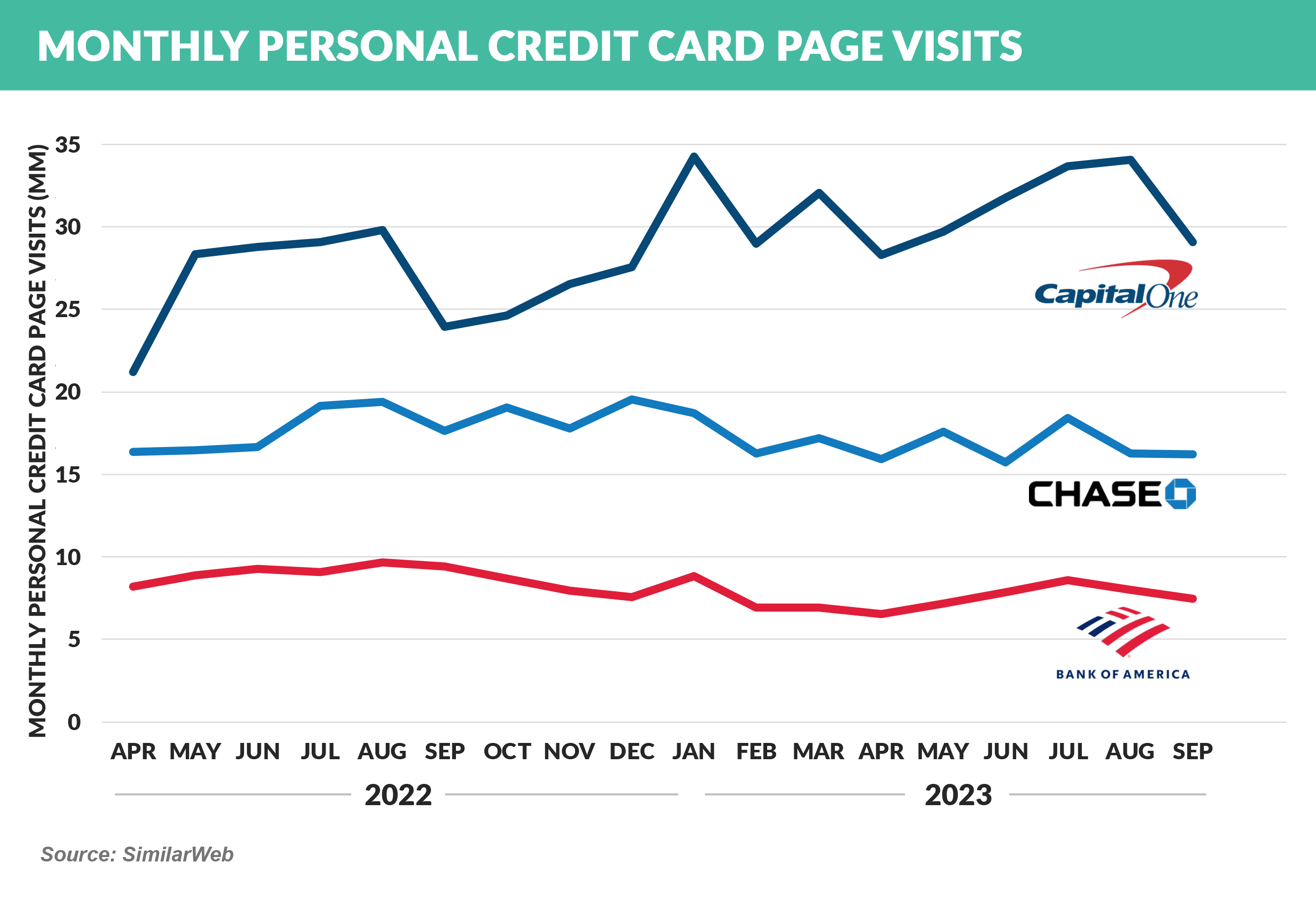

- Capital One is dominant in online activity

- However, mail volume and organic search do not tell the entire story, as portfolio acquisitions, partner channel volumes, and aggregator generated accounts – metrics that do not appear in most industry tracking services – can add substantially to growth

Marketing Trends

- Consistent with earlier in 2023, YTD mail volume is down across all products, again except for Checking which is up 24% vs. 2022

- Spending in social, display, TV, and online is similarly down across all products, apart from Student Lending, which is up 30% vs. 2022

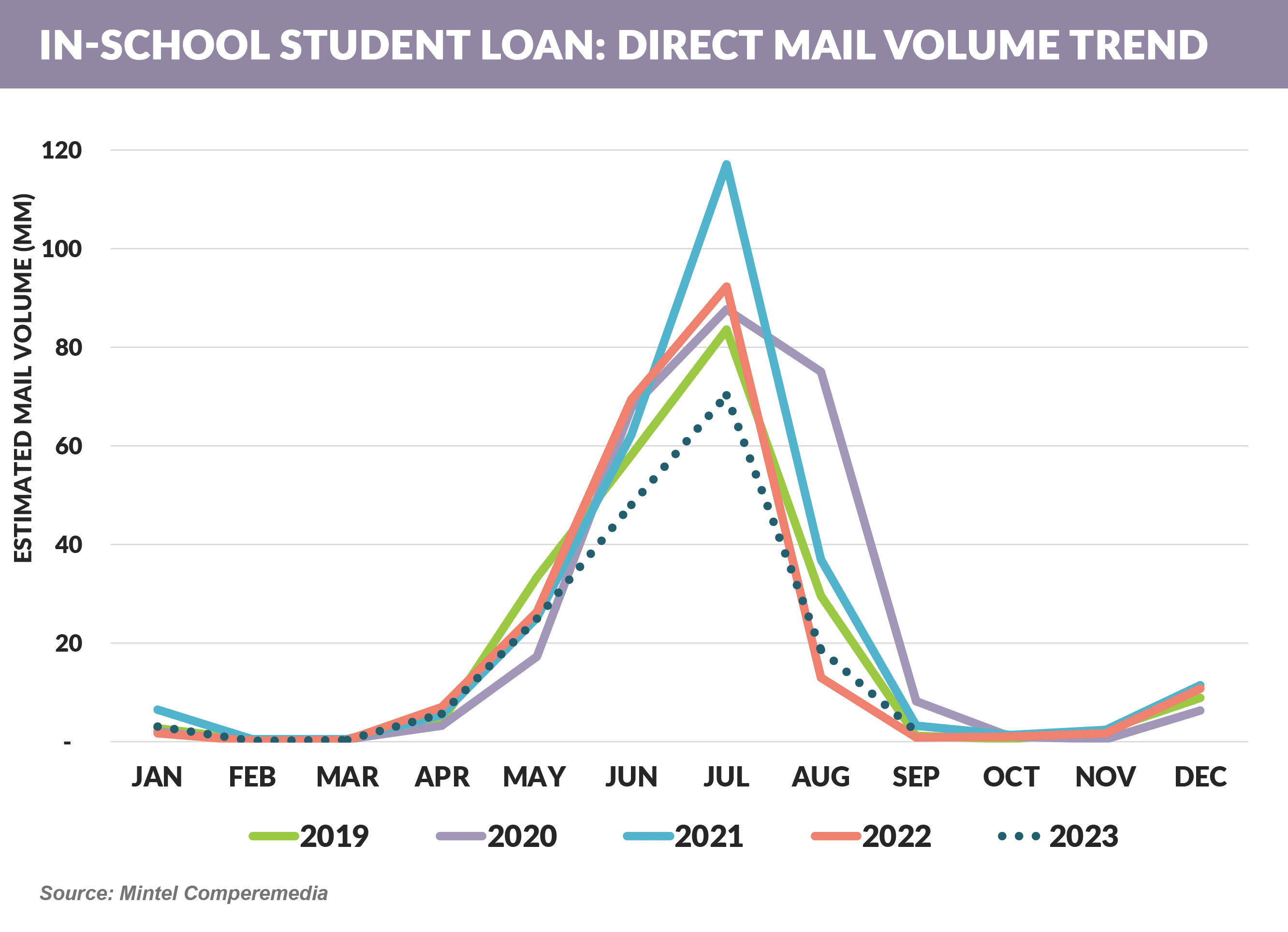

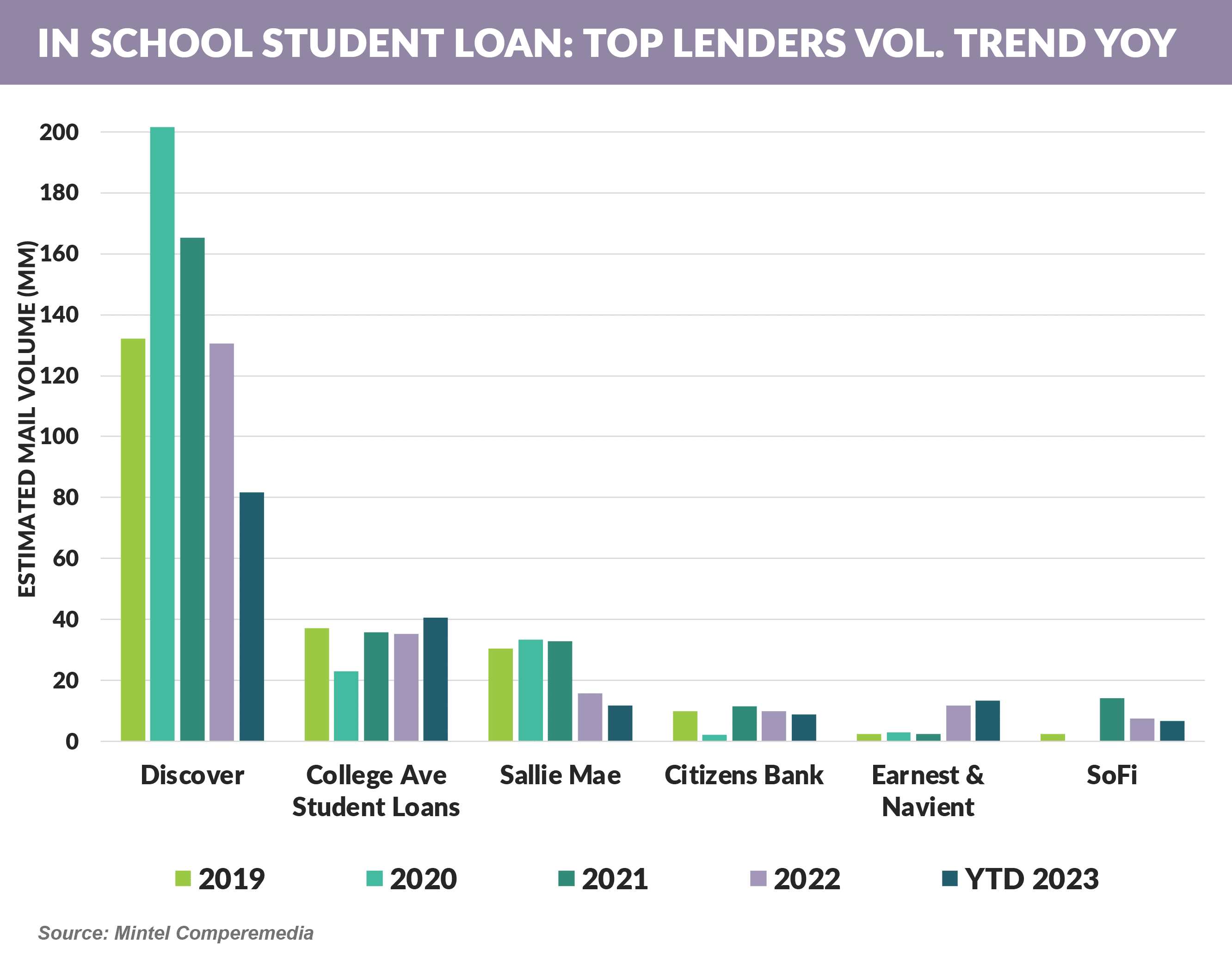

- The Private Student Loan “peak season” lasts about 90 days over the summer and this year wrapped up with mail volume down 18% from 2022

- The drop is driven primarily by dominant mailer Discover, who has reduced student loan mail volume for each of the past three years

- The top six card mailers have consistently accounted for two-thirds of monthly mail volume over the past two years

- Experian has launched the Experian Smart Money Debit Card

- The card is targeted at the credit builder segment and includes Experian’s “Boost” service

- We’ve always envied the credit bureaus’ business model

- Banks pay the bureaus to collect banks’ data

- Banks pay the bureaus to use their (own) data

- Now Experian is using their customers’ data to compete against them!

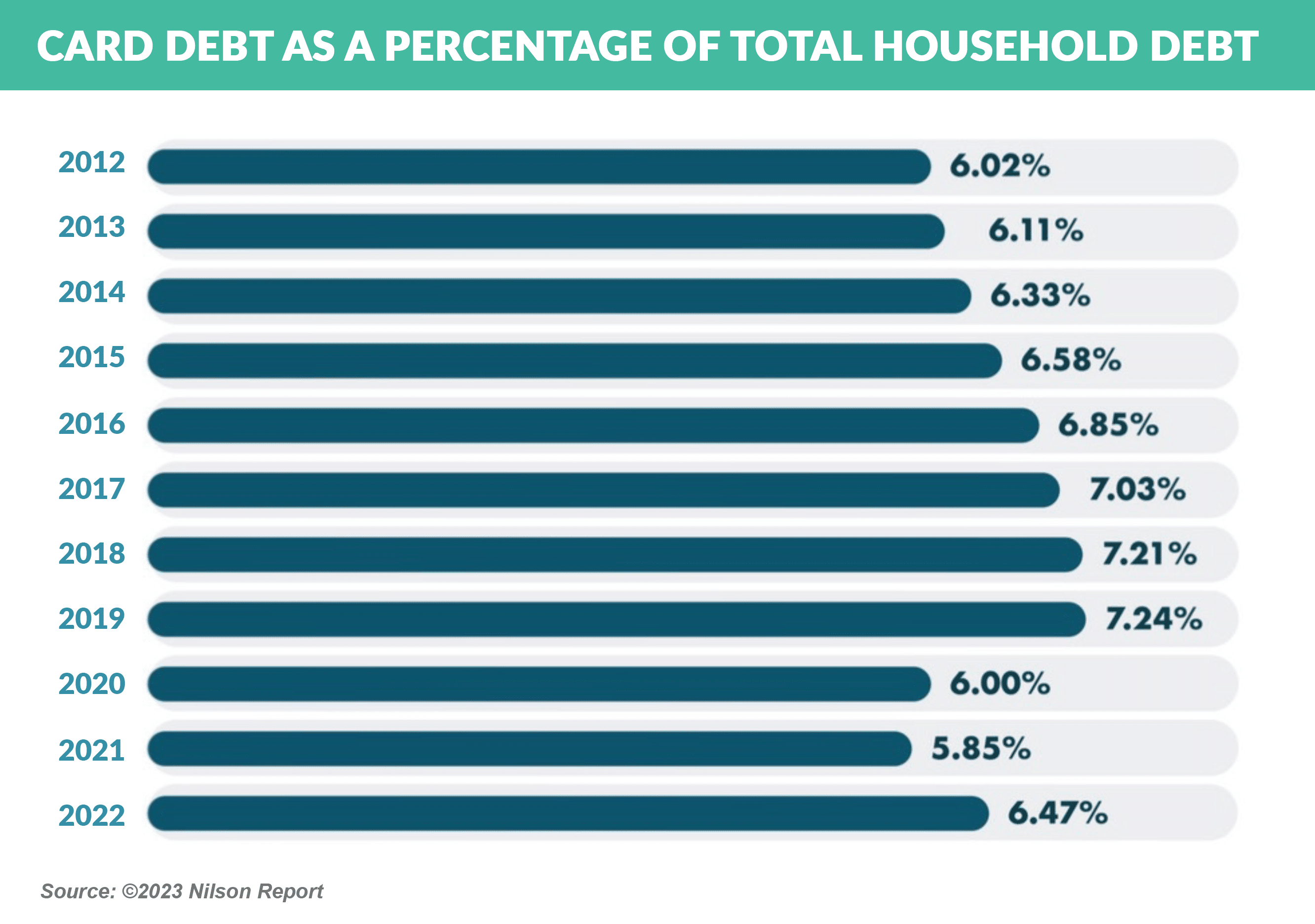

- Speaking of credit cards, the recent hysteria surrounding credit card balances exceeding $1 trillion failed to mention that credit card debt as a percentage of overall household debt is lower that it was in 2015

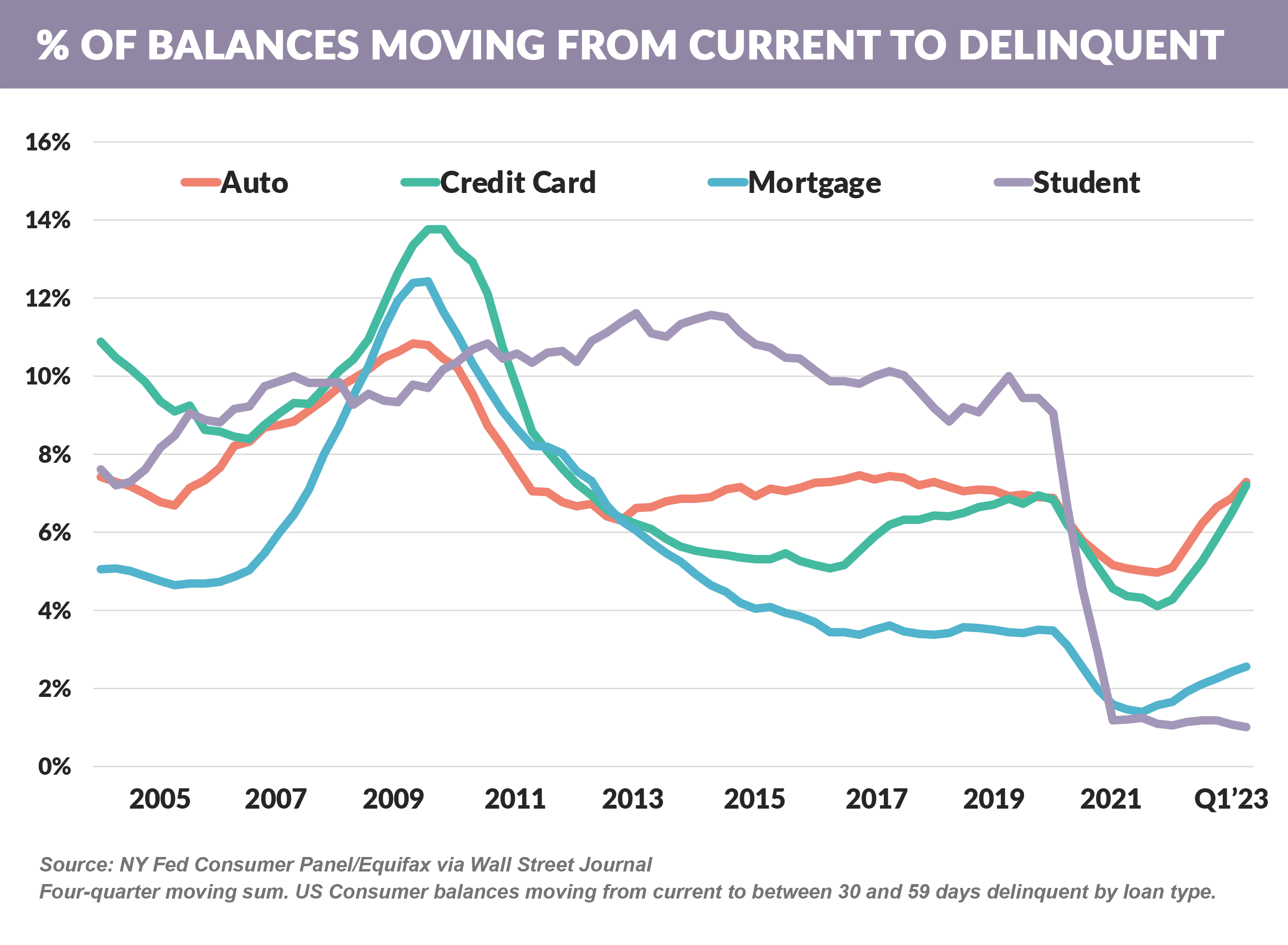

- Except for student loans (near zero delinquency due to the pandemic-era payment pause), all types of consumer loans show delinquency rising to “normal” pre-Covid levels

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on December 9th.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.