Three Things We’re Hearing

- Aggregators aggravate banks!

- Bankcard losses approach “normal” levels

- Citizens dominates regional bank marketing!

A four-minute read

If the Epic Report was forwarded to you, click here if you’d like to be added to our mailing list

Aggregators Aggravate Banks!

- Aggregators (aka “comparison sites”), such as Credit Karma, NerdWallet, and Bankrate have become a main source of new customers for banks and other lenders

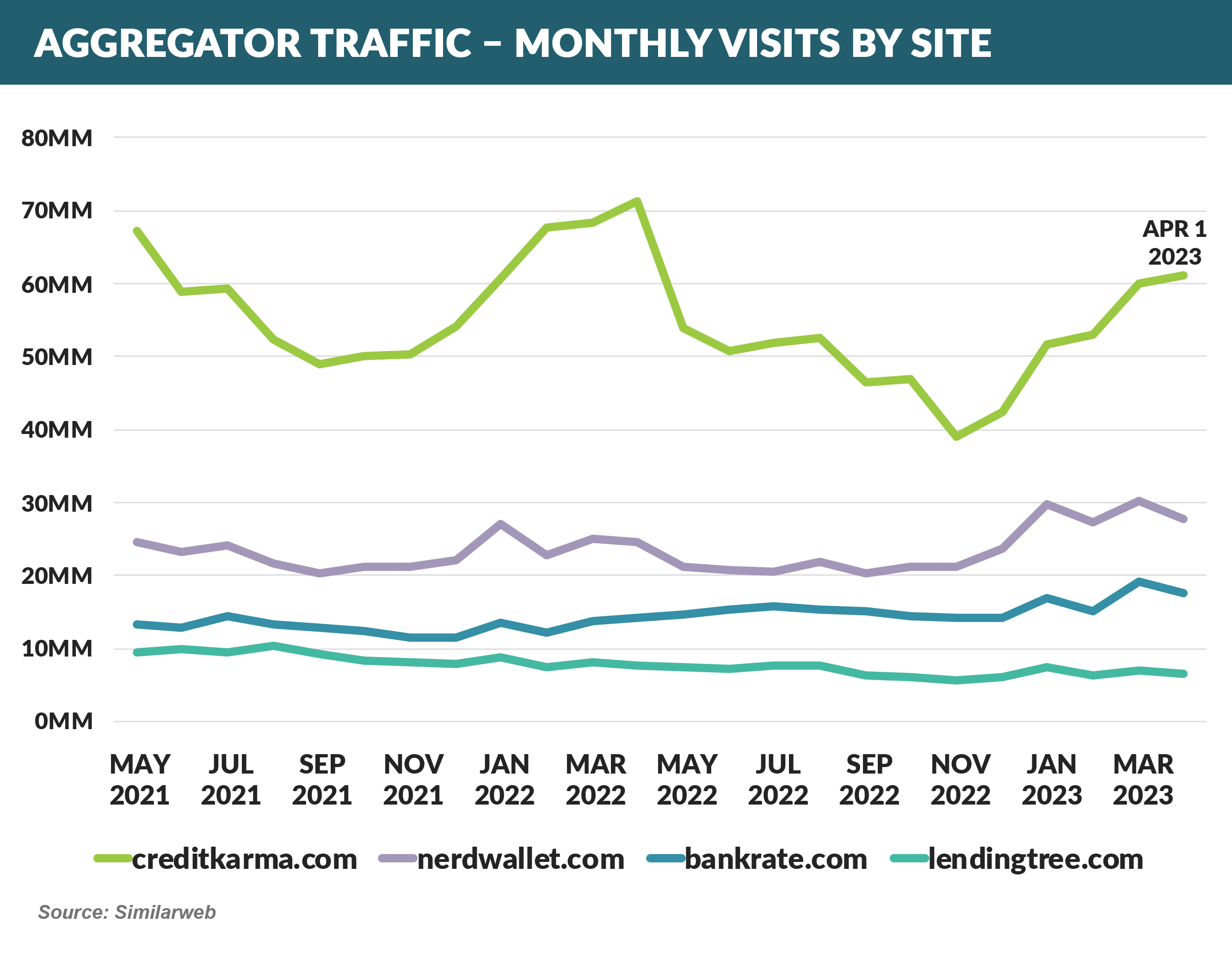

- Over the past two years, Credit Karma has been the dominant aggregator based on page visits, with twice the volume of number two NerdWallet and more than the next three competitors combined

- Despite the disparity in page visits, over the past two years, Credit Karma and NerdWallet each had ~25 million outgoing visits to credit and banking sites

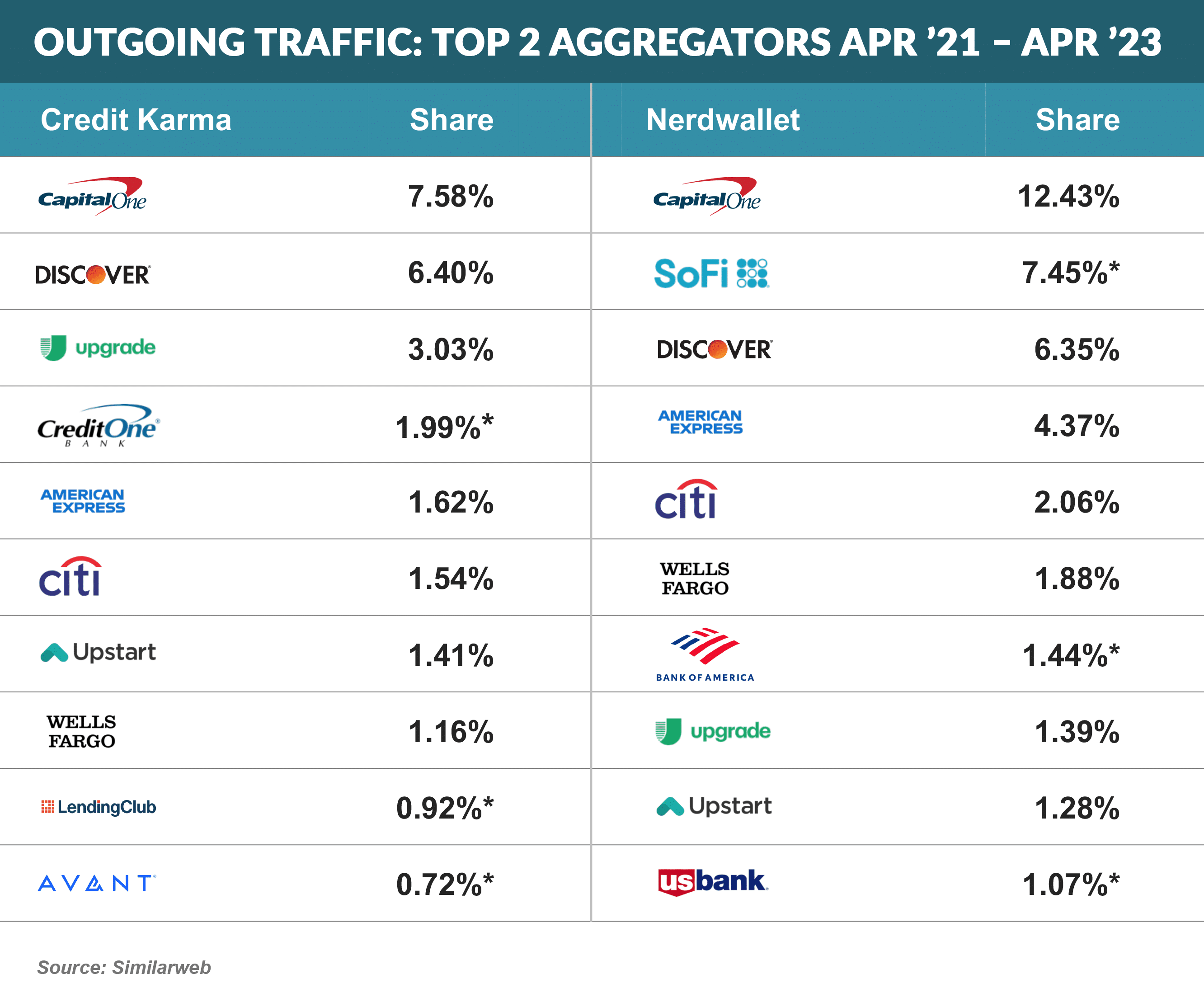

- Over the past two years, Capital One was the highest volume destination from the top two sites with some differences* as you go down the list

- The companies shown above do not necessarily distinguish between products, however bankcard (Capital One, Discover, American Express) and personal loans (Upgrade, Upstart, Lending Club) appear to be most dominant

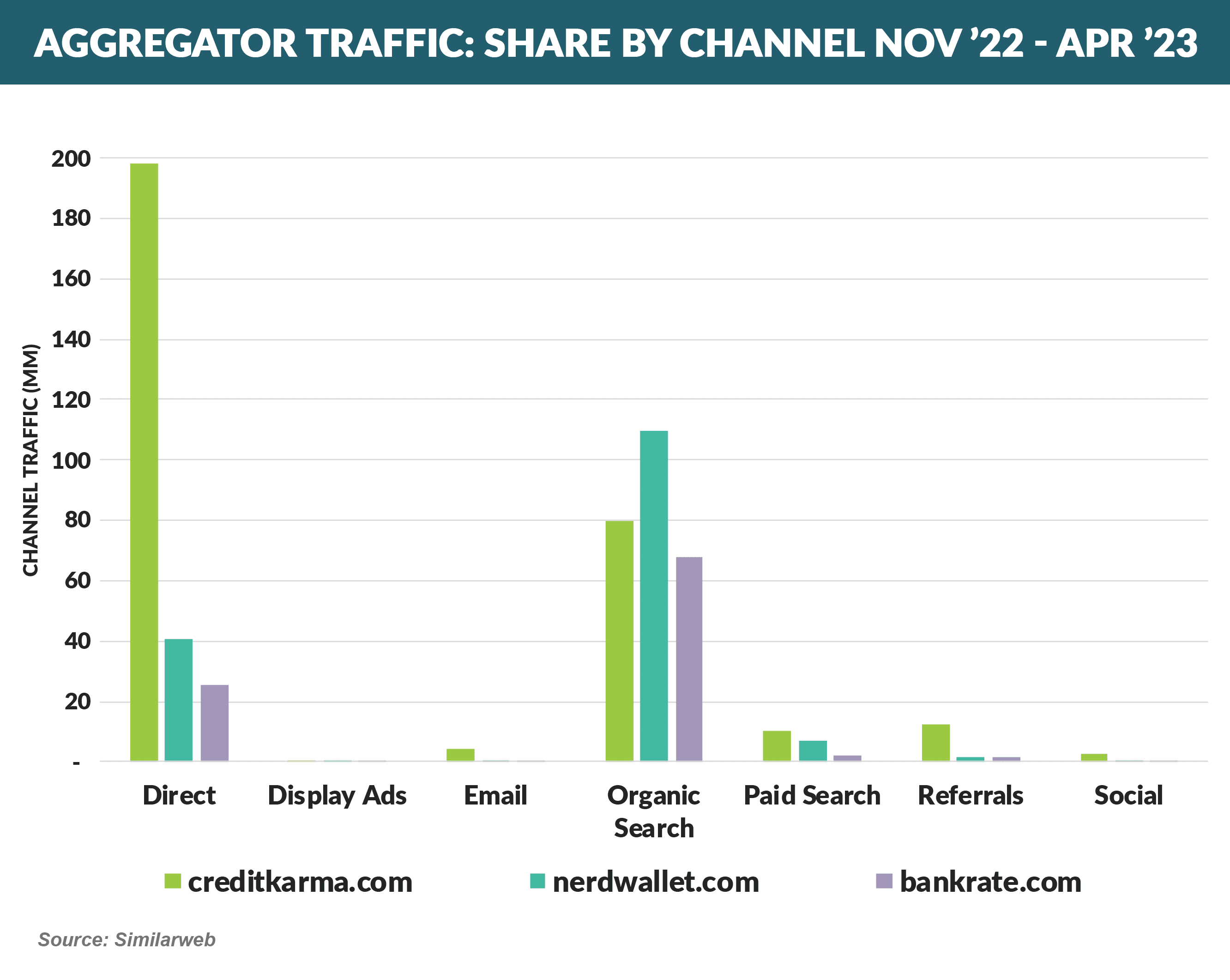

- Most aggregator traffic comes from direct and organic search, indicating a high degree of consumer awareness of aggregator brands

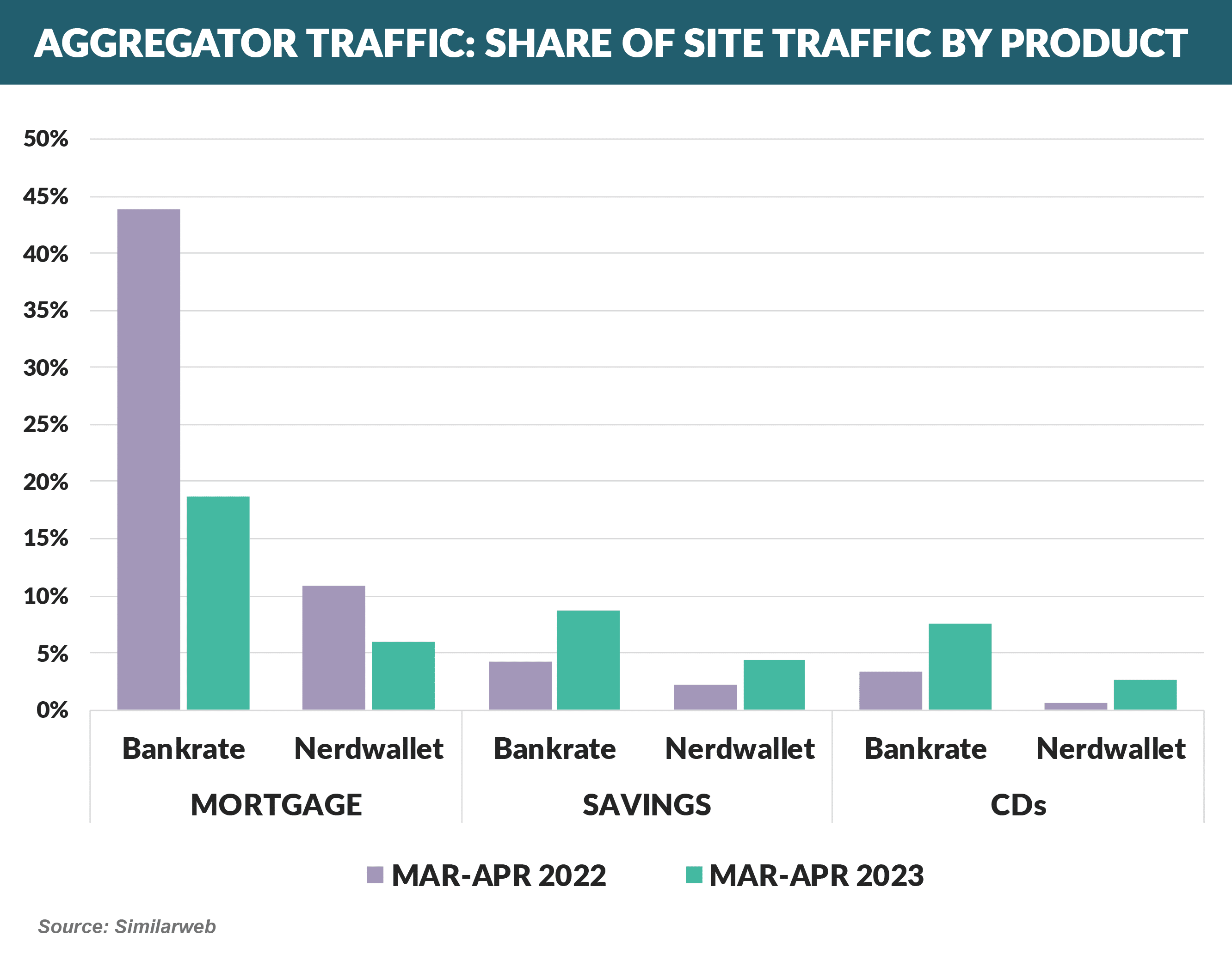

- Topics driving traffic to aggregators have shifted over the past year, reflecting consumer reaction to changes in interest rates with mortgage traffic trending downward steeply while savings and CD traffic is on the rise

- The aggregators’ rise in significance is driving growing industry and regulatory concerns about the cost and loss of control of new customer acquisition

- Acquisition bounties paid by financial institutions range from under $100 to over $1,000, depending on the product

- For some institutions, these bounties now amount to hundreds of millions of dollars representing a large share of their annual marketing budget

- Issues regarding “who owns the customer” have caused conflict between financial institutions and aggregators, with aggregators sometimes cross-selling other products to customers they have previously referred to other institutions

- All of this is driving increased regulatory scrutiny of the aggregators’ responsibilities to consumers

Bankcard Losses Approach “Normal” Levels

- It seems like every day there is a new headline about rising consumer delinquency

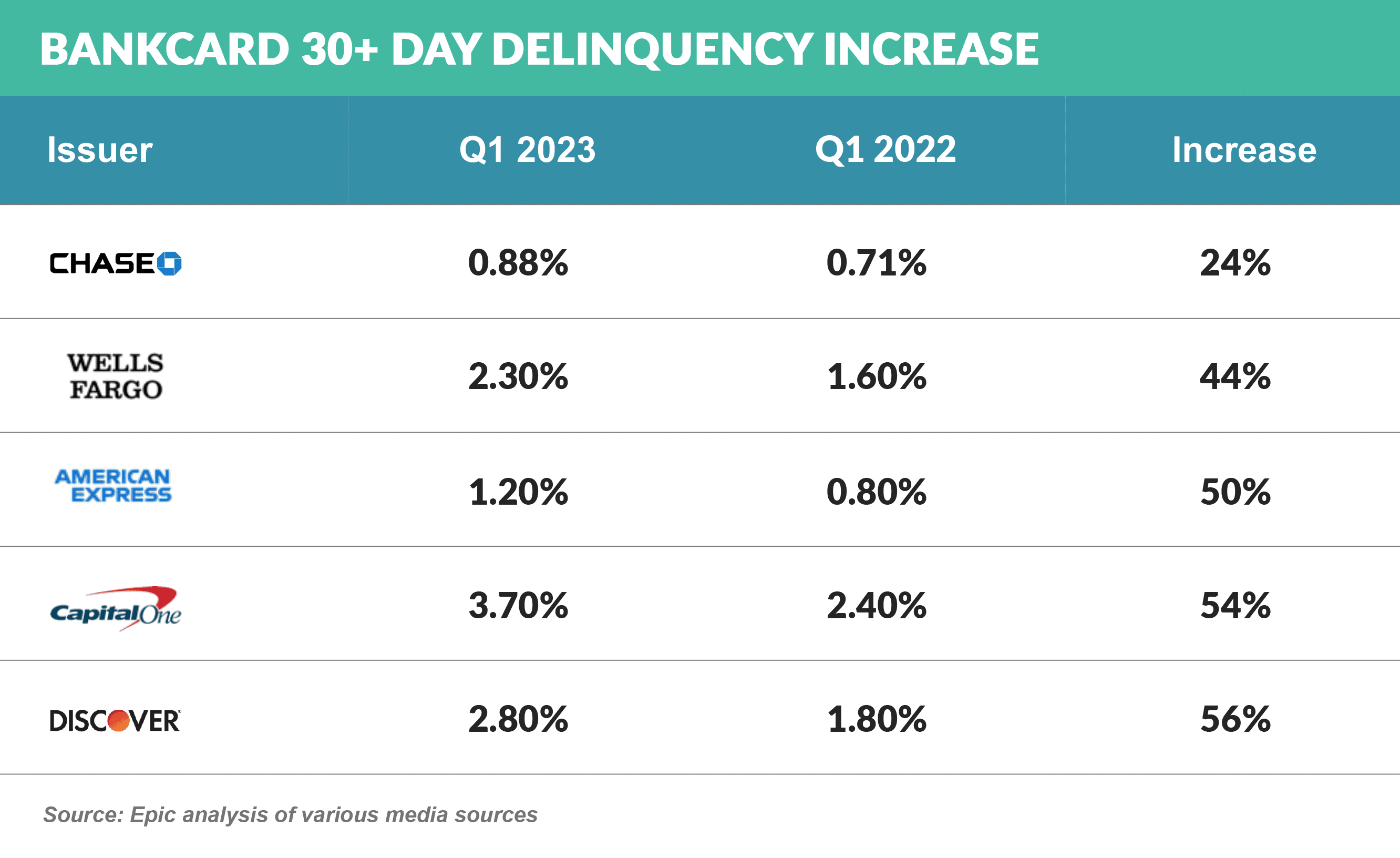

- Major issuers have recently reported 30+ day delinquency increases of 24% - 56% over the same period last year

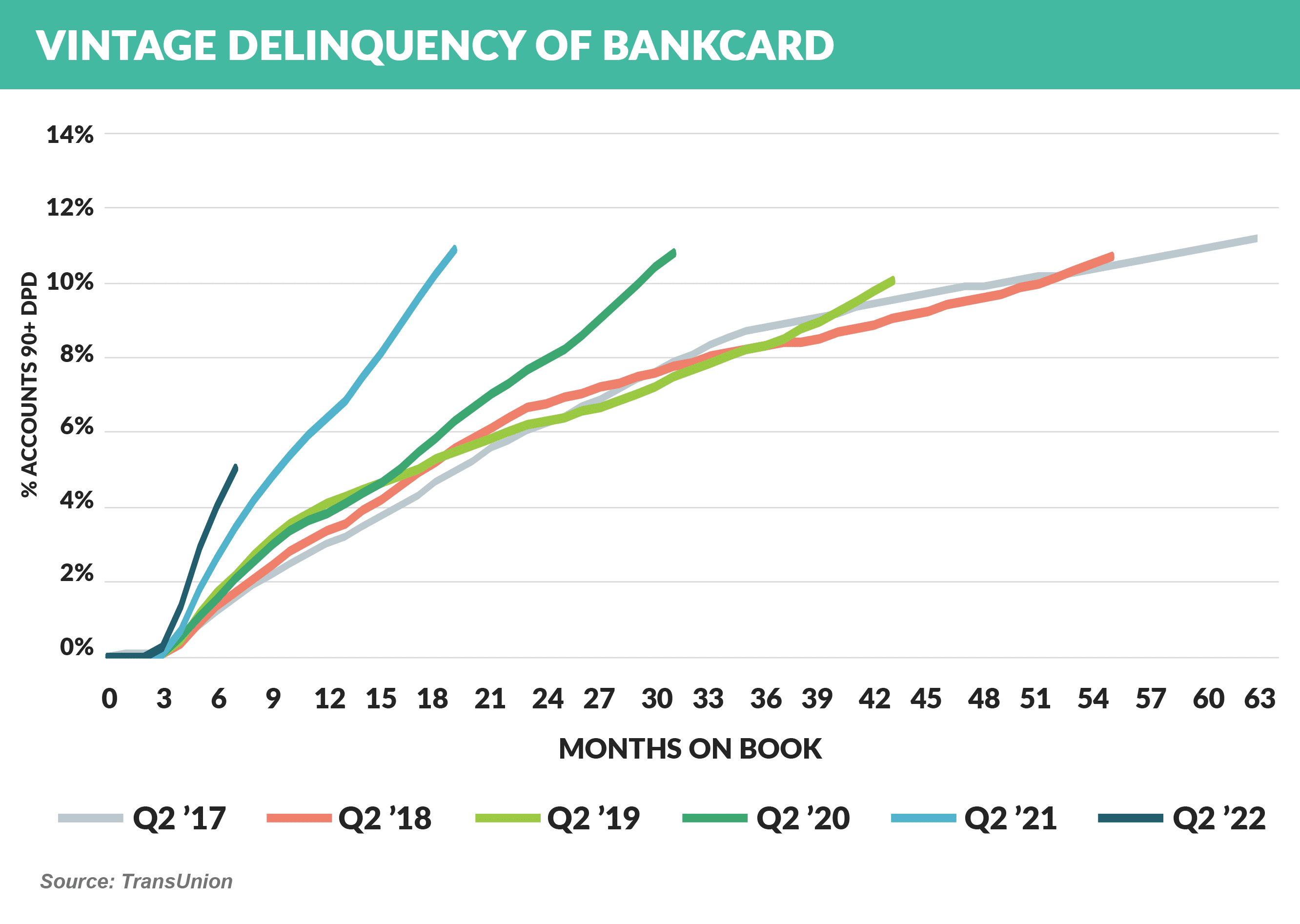

- Newer credit vintages are showing progressively higher delinquency rates

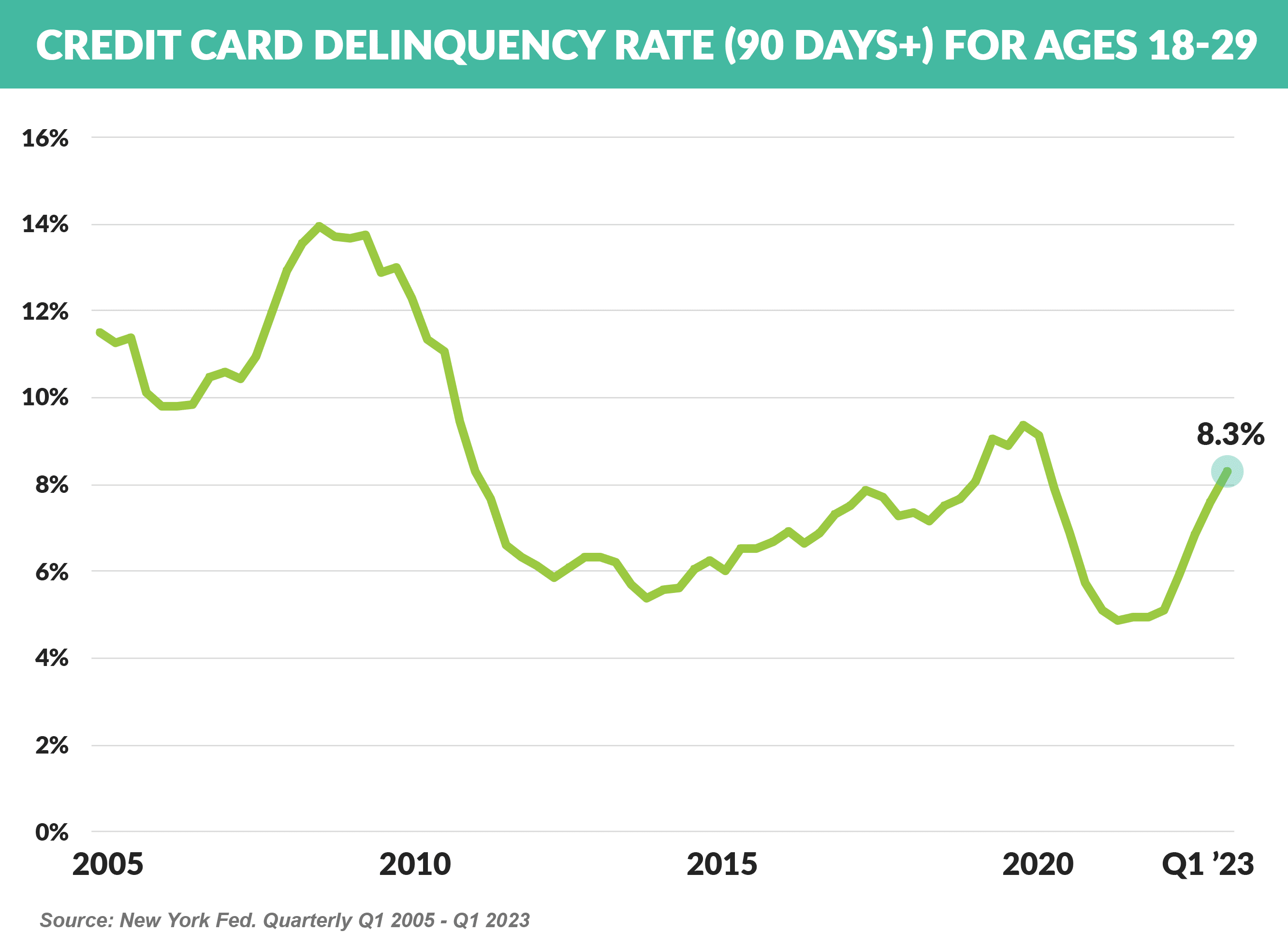

- And younger consumers’ past due payment rates have spiked

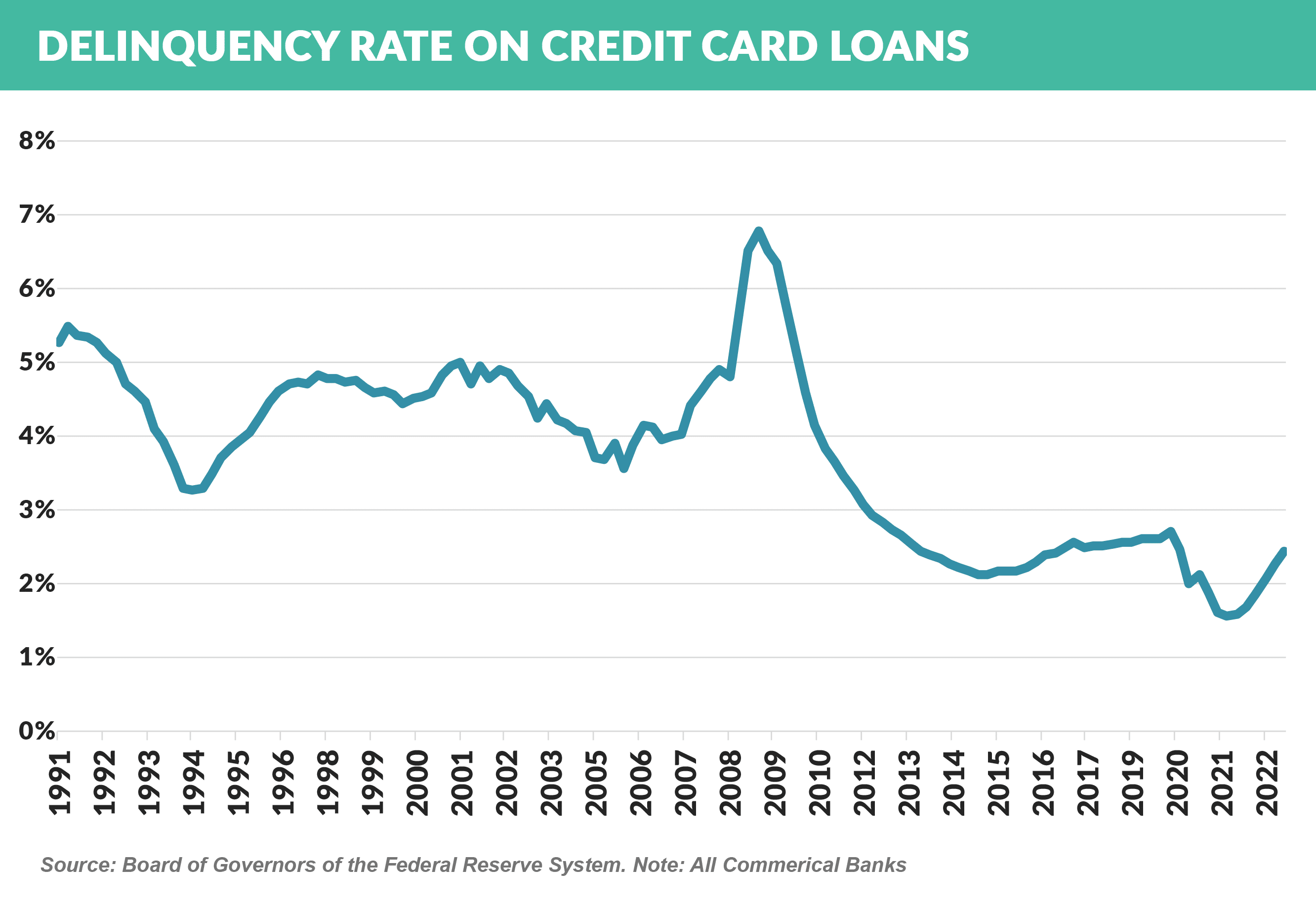

- While these headlines are accurate, it is important to remember that the past 15 years have had unusually low levels of consumer delinquency and losses

- The 2008-09 financial crisis had the effect of accelerating years of future losses with the following years reflecting that impact with lower than historical levels of losses

- COVID resulted in dramatic decreases in consumer spending, issuer forgiveness programs, and increased liquidity all of which resulted in higher payment rates and fewer past due payments

- In the 15 years prior to 2008, when the US bankcard industry had first matured, delinquency rates ranged between 3.5% and 5% - over twice those of recent years

- The threatened recession will exacerbate the rise in delinquency; however, the fundamentals of credit quality remain strong, with unemployment low and wages rising

"The consumer is in great shape in terms of credit quality by any historical standards. Employment remains good, wages remain good, and we have not seen any cracks in that portfolio yet."

Bank of America Chief Financial Officer Alastair Borthwick

Source: Reuters

- One fact that remains a question mark is the absence of institutional memory – few executives in credit, marketing, finance, and general management have operated in an environment other than the benign one of the past 15 years

- Credit underwriting standards from recent years as well as management’s response to increased losses (“Cut the marketing budget!” or “Hire more collectors!”) will soon be under increased scrutiny

Citizens Dominates Regional Bank Marketing!

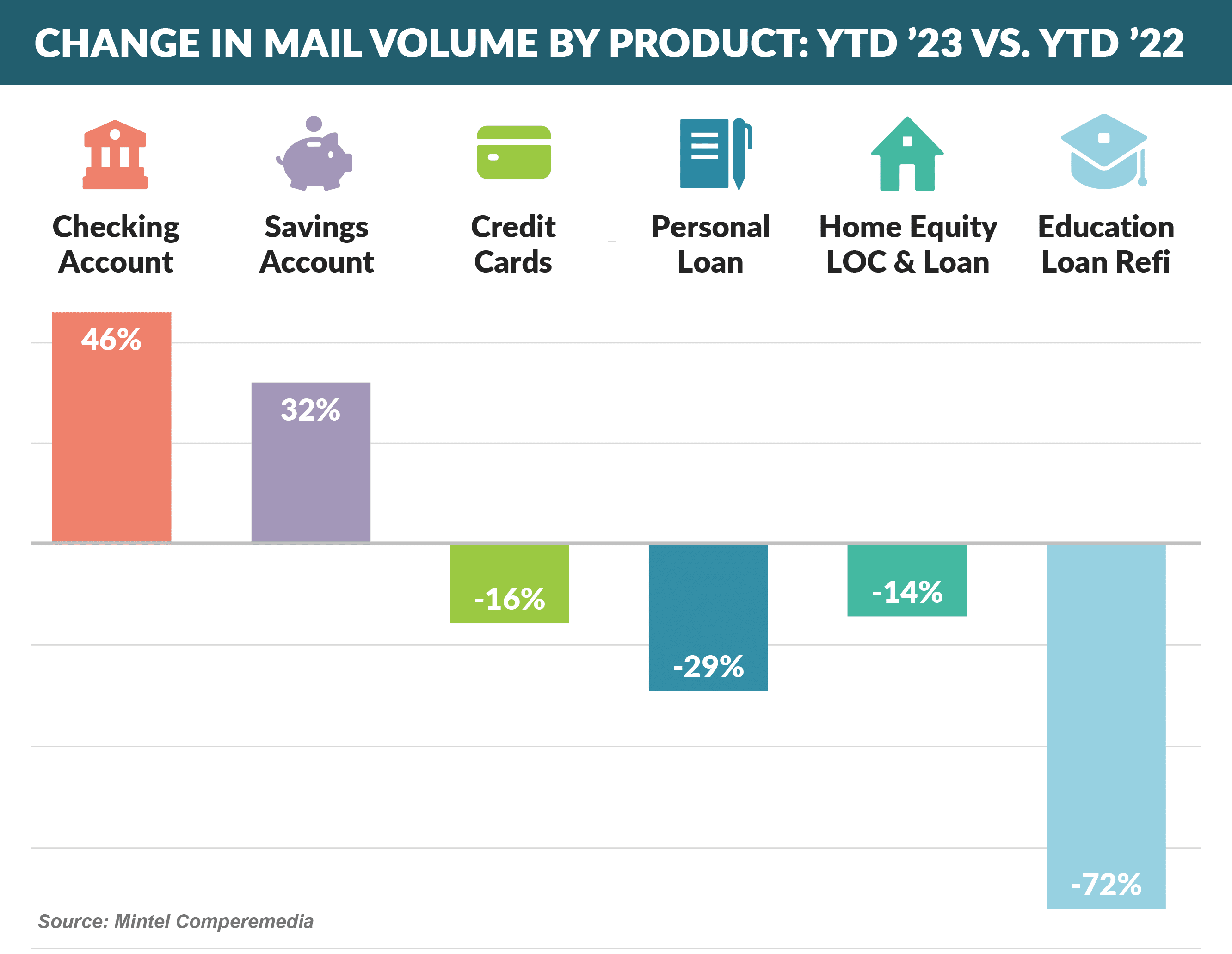

- April mail volume trends were mostly flat from March

- Credit card, personal loan, and HELOC have all had stable volume since January

- Deposit products have vacillated month to month, but at levels much higher than prior years

- Lending products have lower volume than the same period last year and deposit products higher

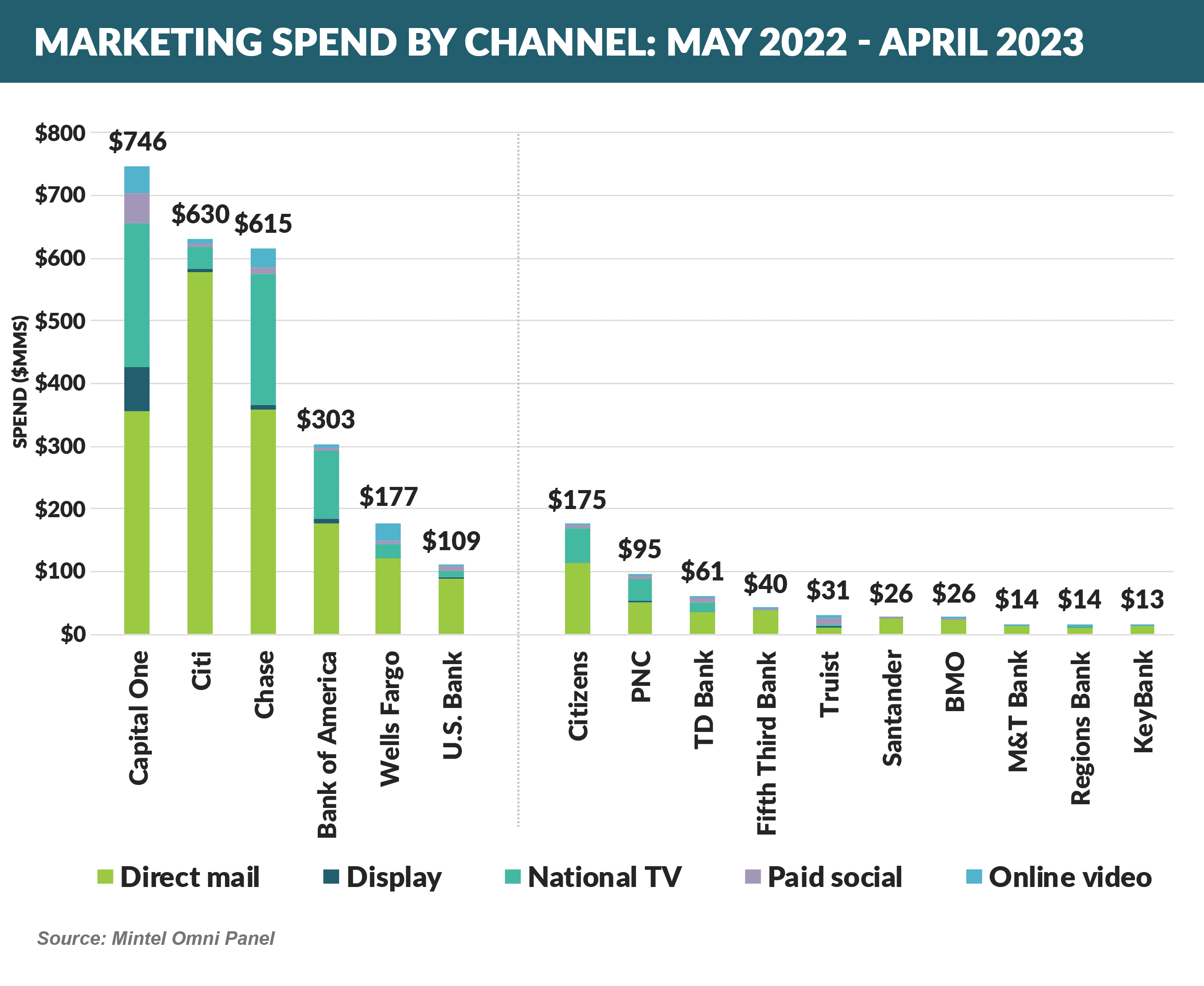

- Consumer financial services marketing spending is dominated by large national credit card issuers; however, some regional banks have seized the organic growth opportunity in cards and other products

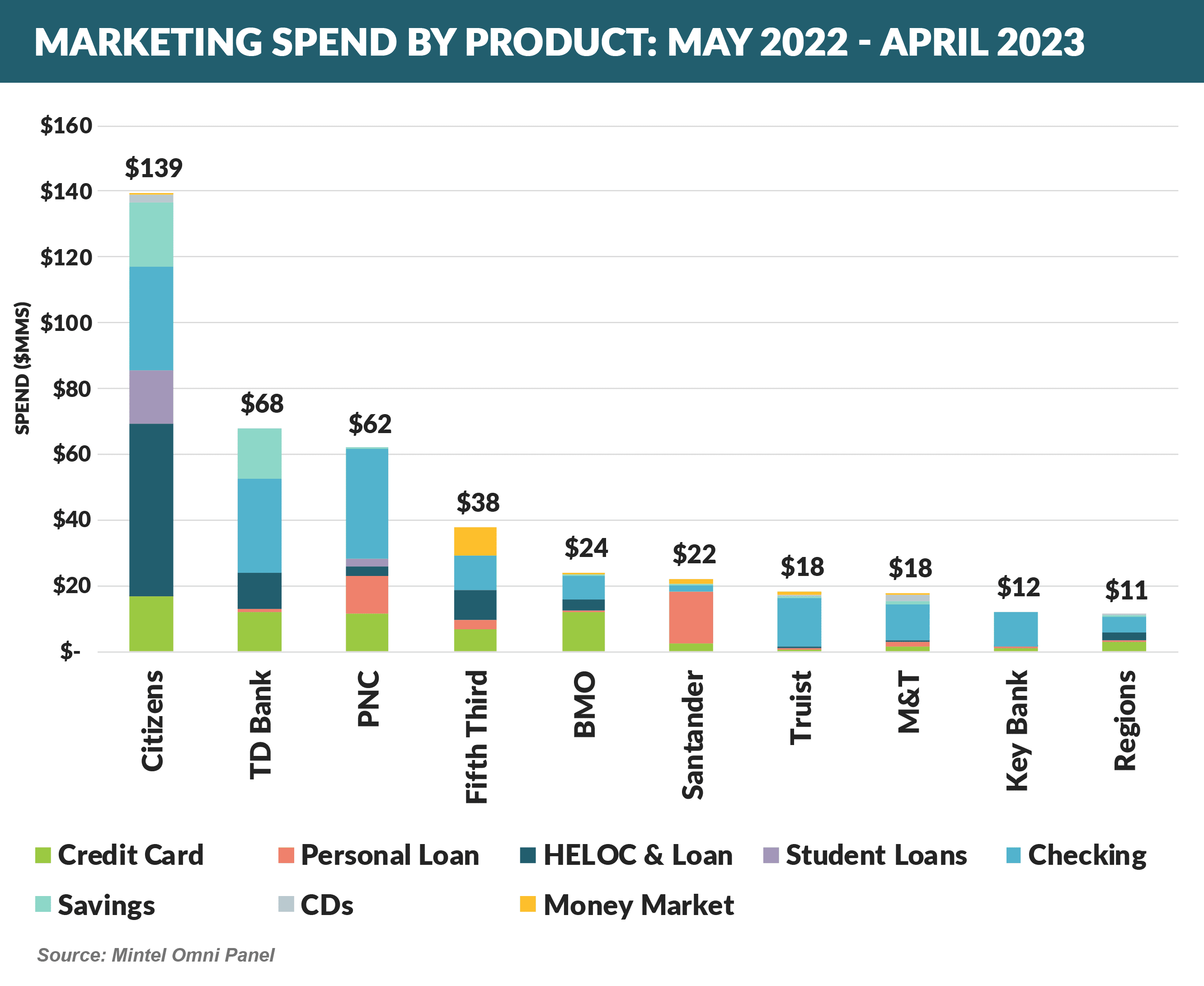

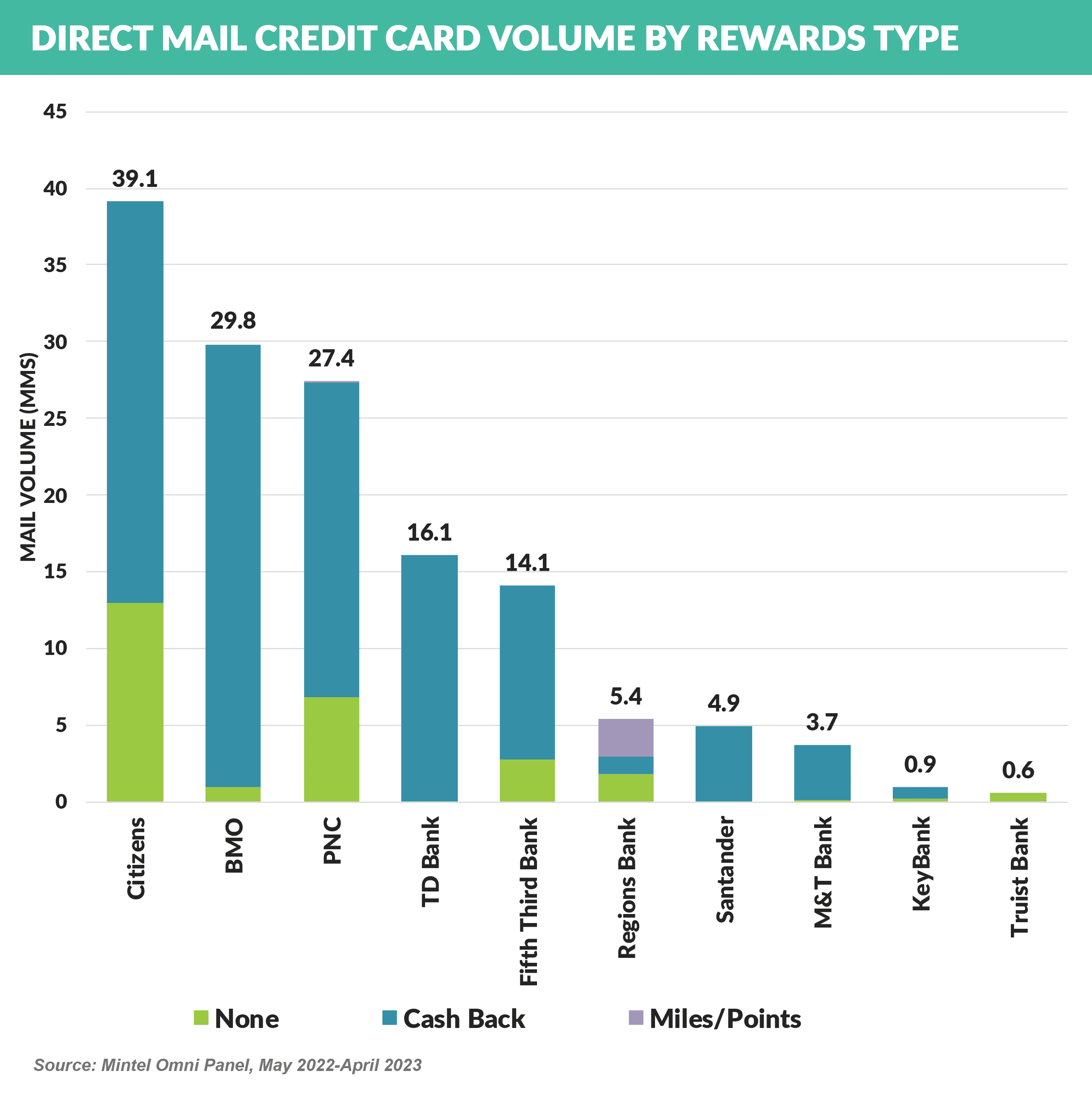

- In particular, Citizens has aggressively grown their card, HELOC, and education loan portfolios – they were the fastest growing regional bankcard portfolio in ’22 and the number one regional marketer in HELOC (by far!), savings, and student lending

- Epic’s surveys over the past few years have shown a strong consumer preference for cash back cards and for doing business with their local bank and many regionals have focused on cash back offers

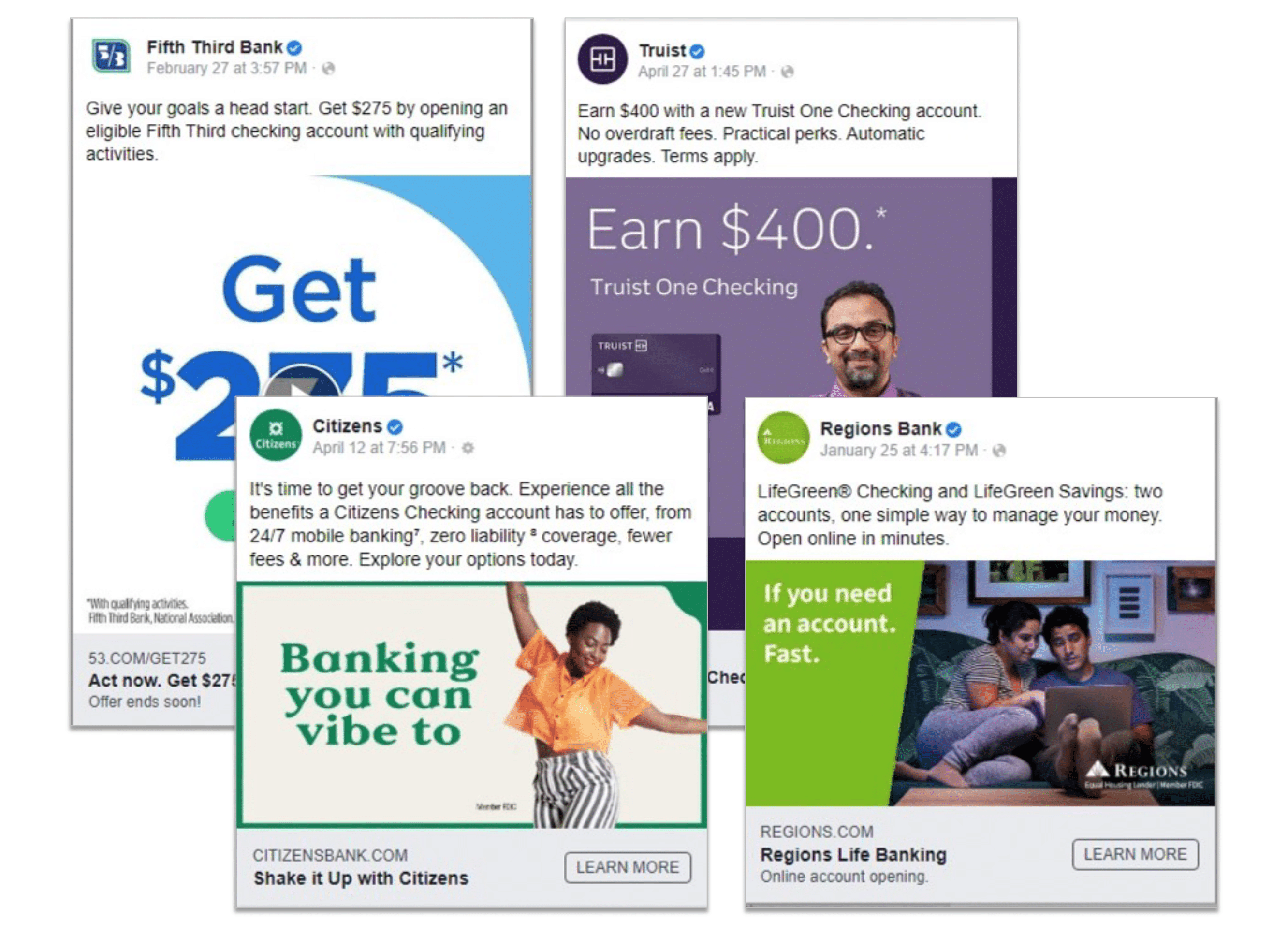

- Given the geo-targeting capabilities in social media, an increasing amount of regional bank DDA advertising is coming through paid social channels

- Apple launched its high yield savings account, which reportedly drew $400 million in deposits on the first day and a total of $990 million in the first four days!

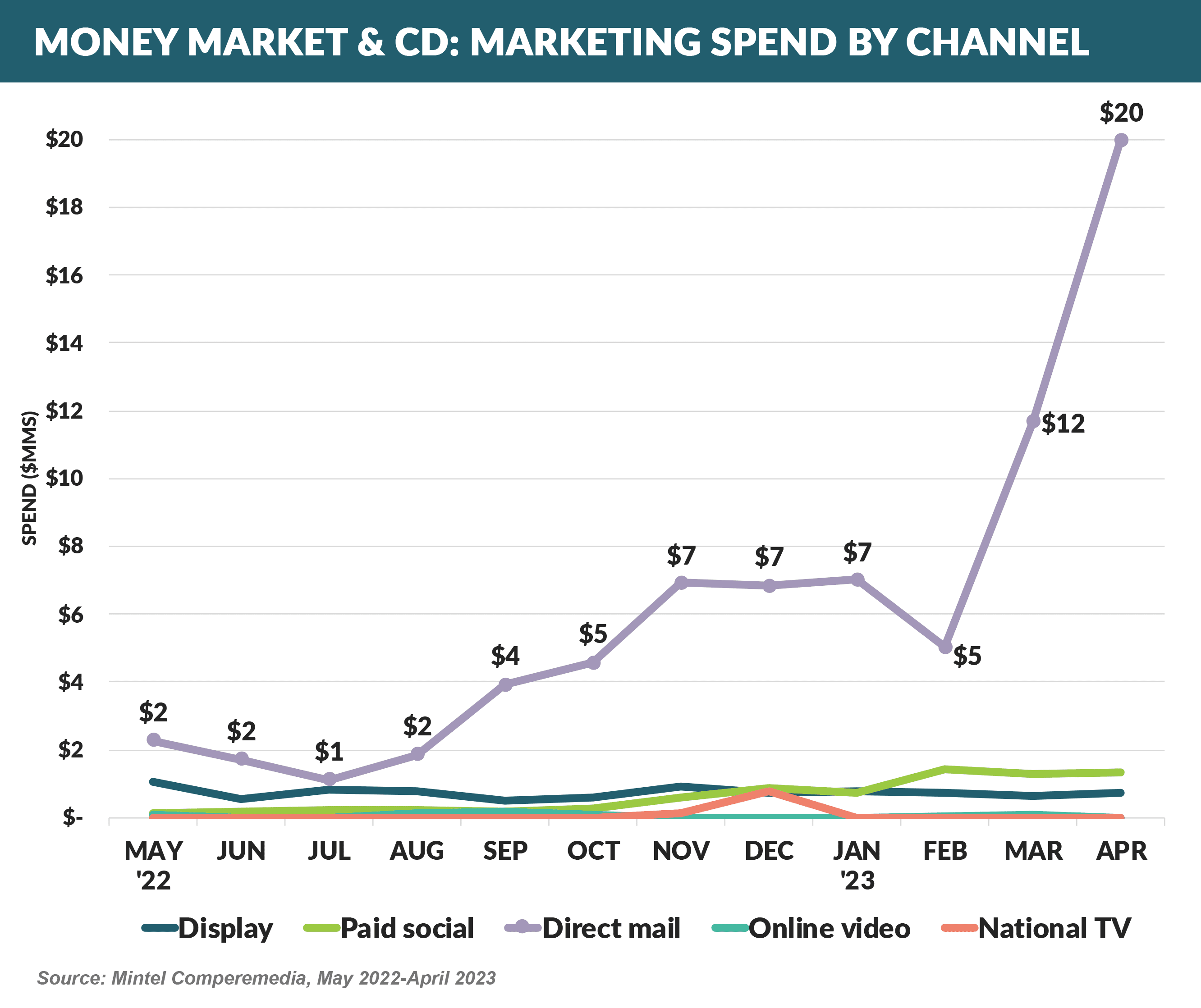

- Spending on money market and CD acquisition tripled in April from levels seen in Q4 ’22, with over 90% of total spending in the direct mail channel

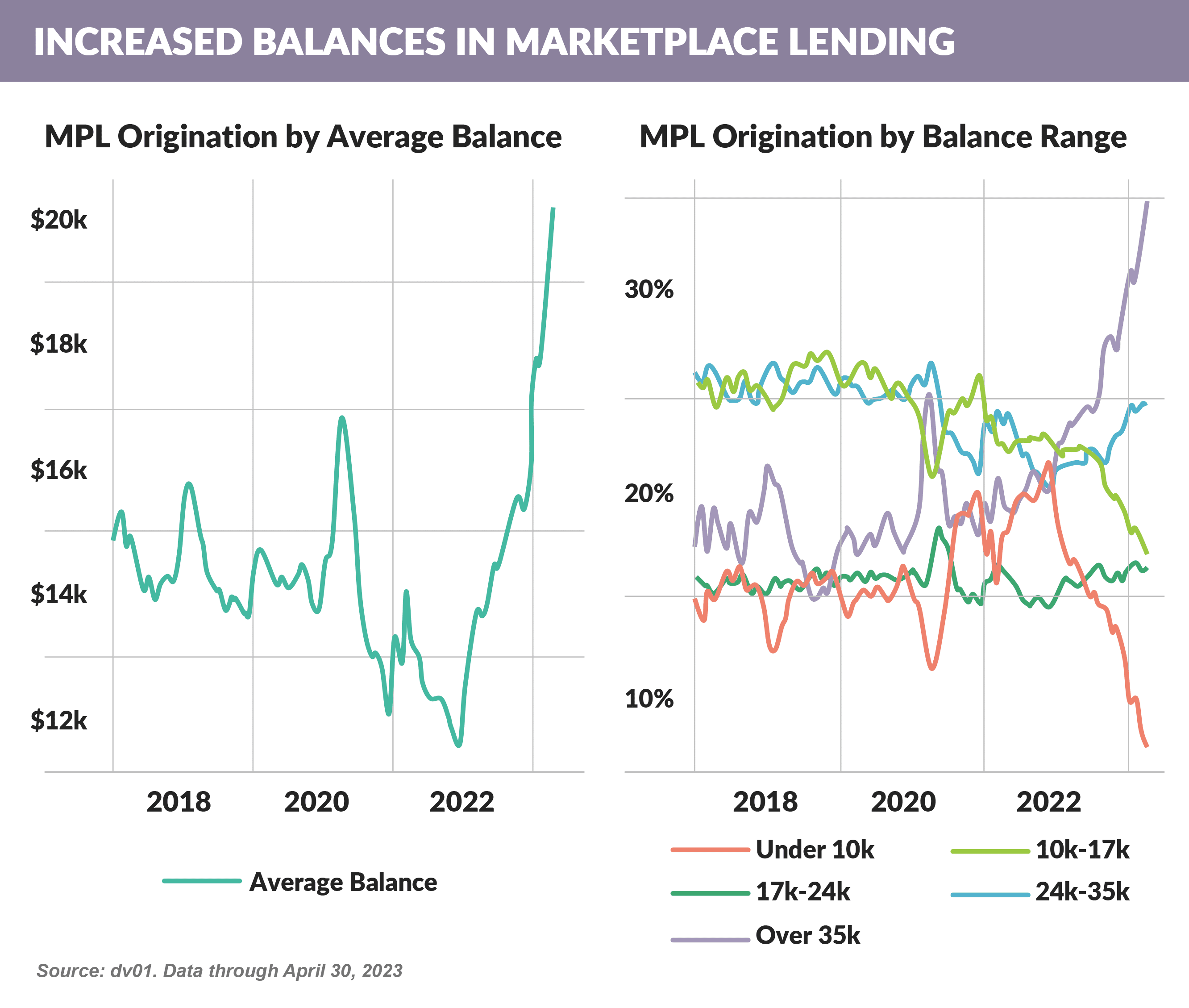

- As underwriting standards tighten, the average personal loan amount has risen dramatically

Thank you for reading.

Jim Stewart

www.epicresearch.net

The Epic Report is published monthly, with the next issue on July 1st.

Please email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.