Three Things We’re Hearing

- What’s important in travel rewards cards?

- Credit cards not interest rate sensitive???

- 2022 marketing year in review

A four-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

What’s Important in Travel Rewards Cards?

- Epic surveyed 1,254 consumers regarding their Travel Rewards Card preferences

- Among the most interesting findings are those asking about the relative value of airline miles vs. gift cards

Credit Cards Not Interest Rate Sensitive?

- As the Fed steadily increased interest rates since Spring, rates on credit cards have risen as well, with an average increase of 270 basis points over the last six months

- Despite these increases, credit card mail volume only decreased 8% in the second half of ’22, while personal loan mail volume was down 21%

- Interest rate sensitivity varies by loan type

- Credit cards have utility other than just as a lending vehicle – payment convenience, cash flow management, and rewards – and demand is less influenced by changes in interest rates

- Personal loan and HELOC demand is affected much more

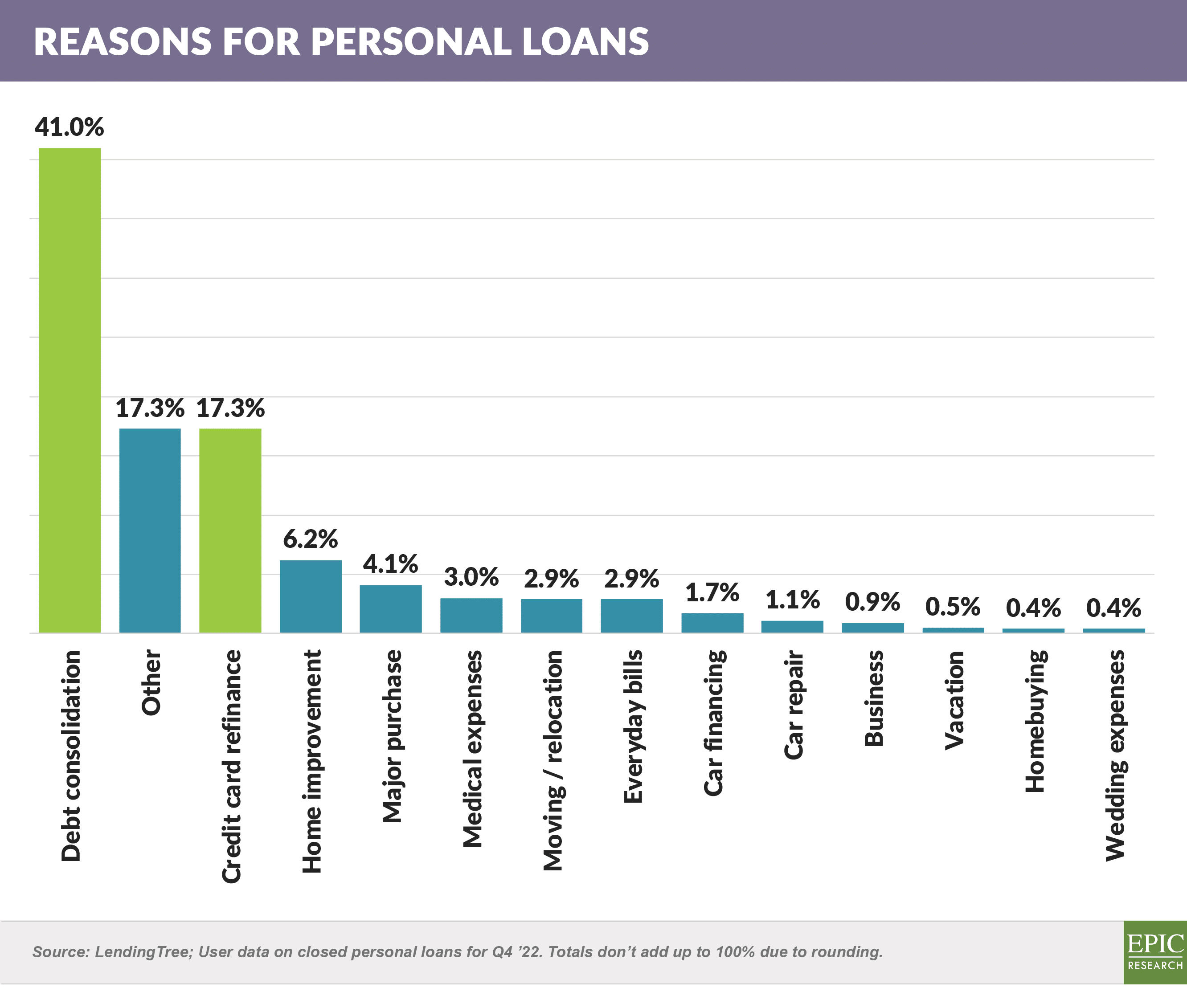

- The personal loan value proposition focuses heavily on paying off credit card debt with over half of those responding to this survey choosing debt consolidation or credit card refinance

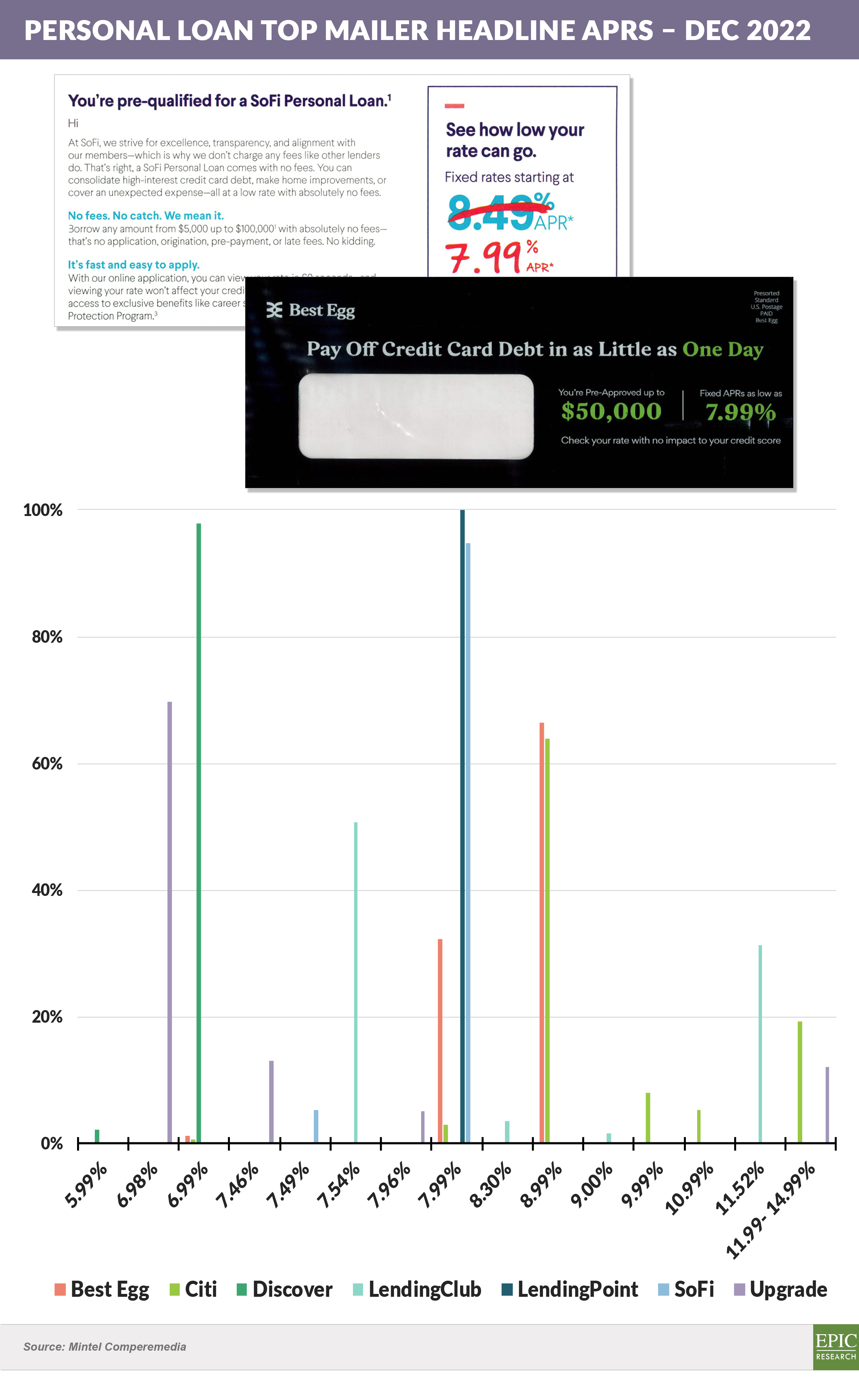

- Of key importance in personal loan solicitations is the “headline” rate, due to the recent rise in rates, leading mailers are now advertising 6.99%-7.99% in December

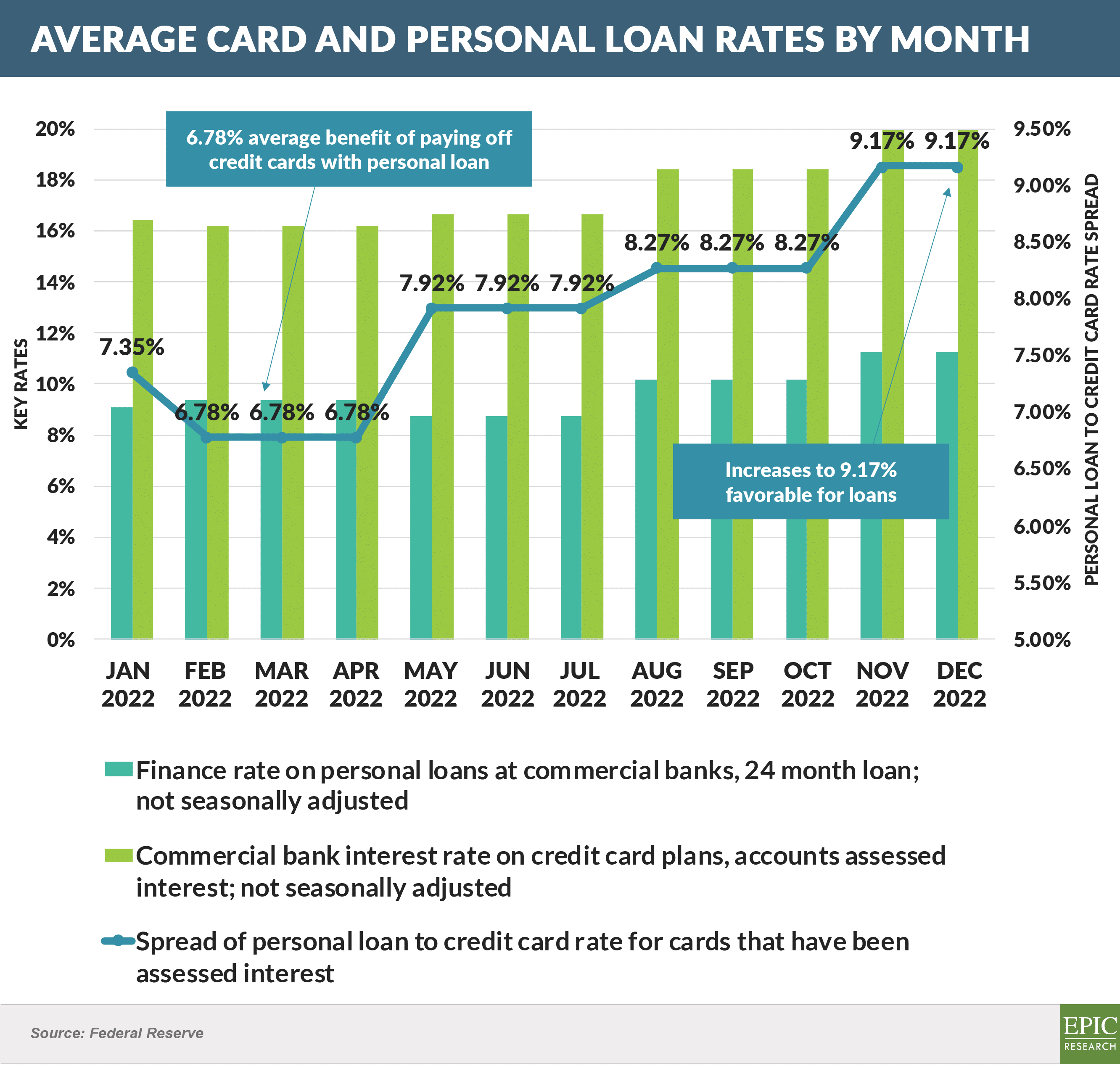

- Despite the recent increases in rates, the math for debt consolidation remains very favorable for personal loans, with the benefit of paying off credit cards with a personal loan actually improving since April

- Some of the retreat from personal loan mailing is due to credit tightening, however those issuers most experienced in underwriting through various phases of the credit cycle, such as Best Egg and Mercury, will benefit from the others’ retreat

2022 Marketing Year in Review

- 2022 in Review

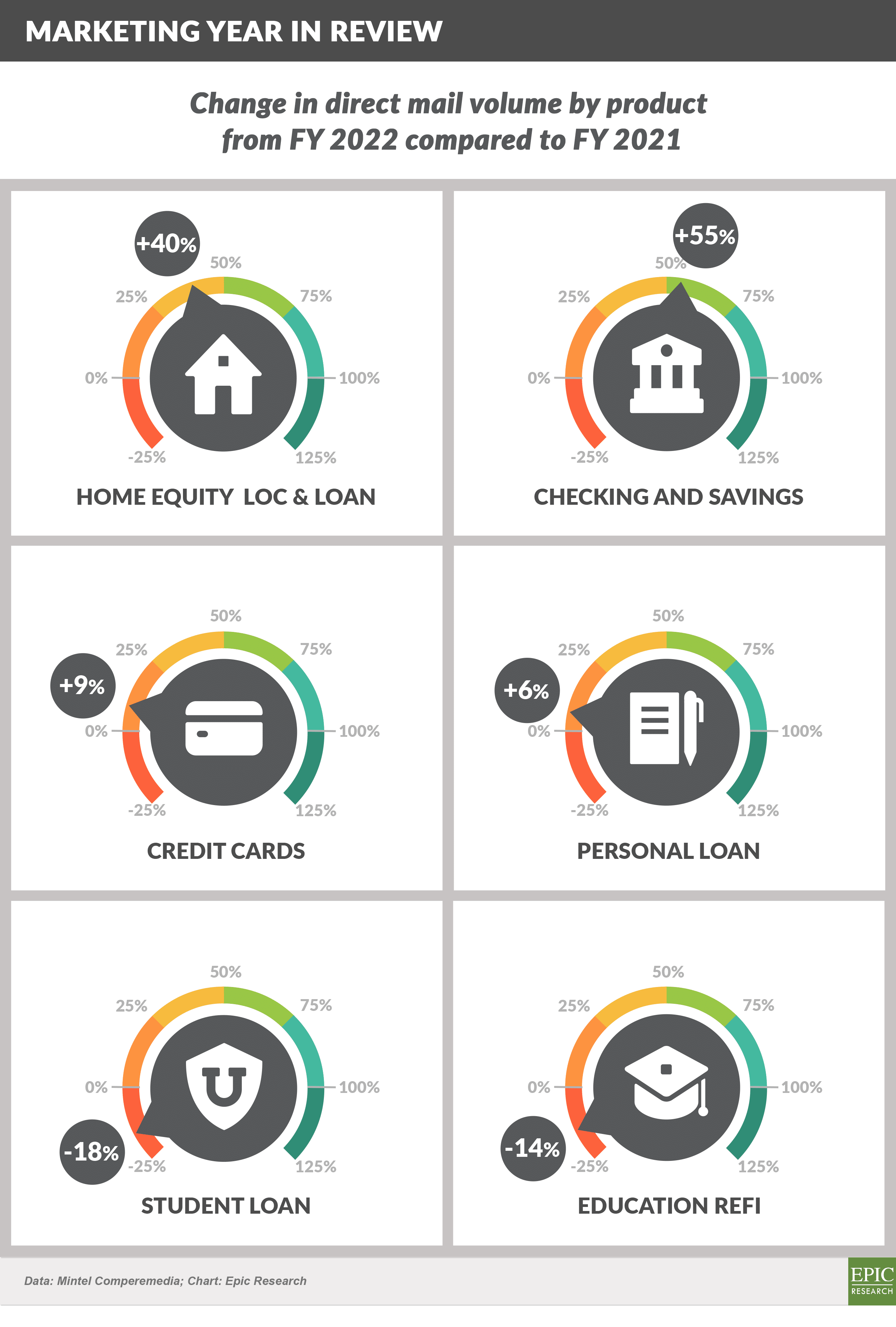

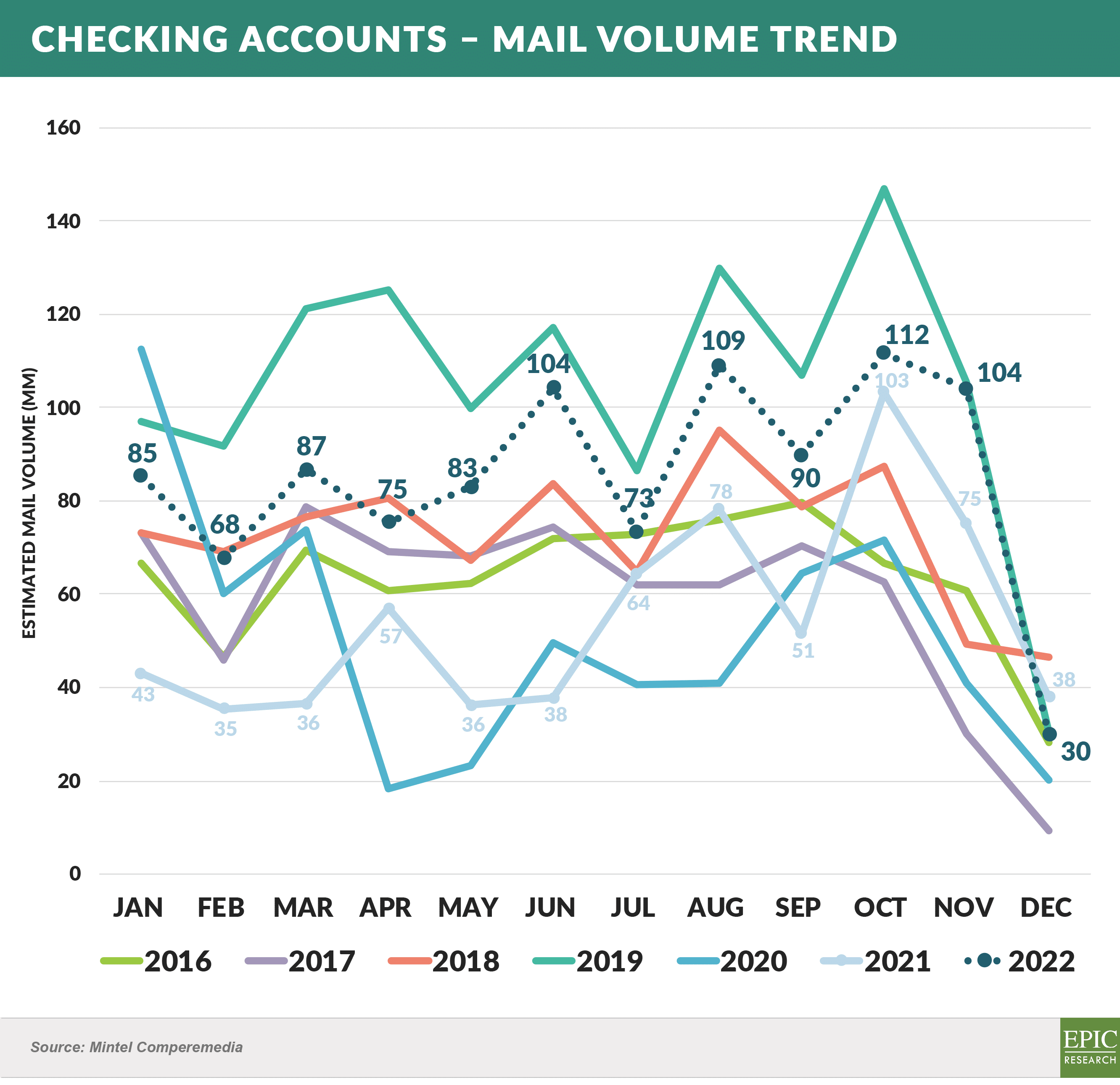

- Mail volume was higher for most products in 2022 versus 2021 and well above that of 2020

- Education refinance, impacted by the ongoing payment pause, and private student loans were the only products mailing less in ’22 than both ’20 and ’21

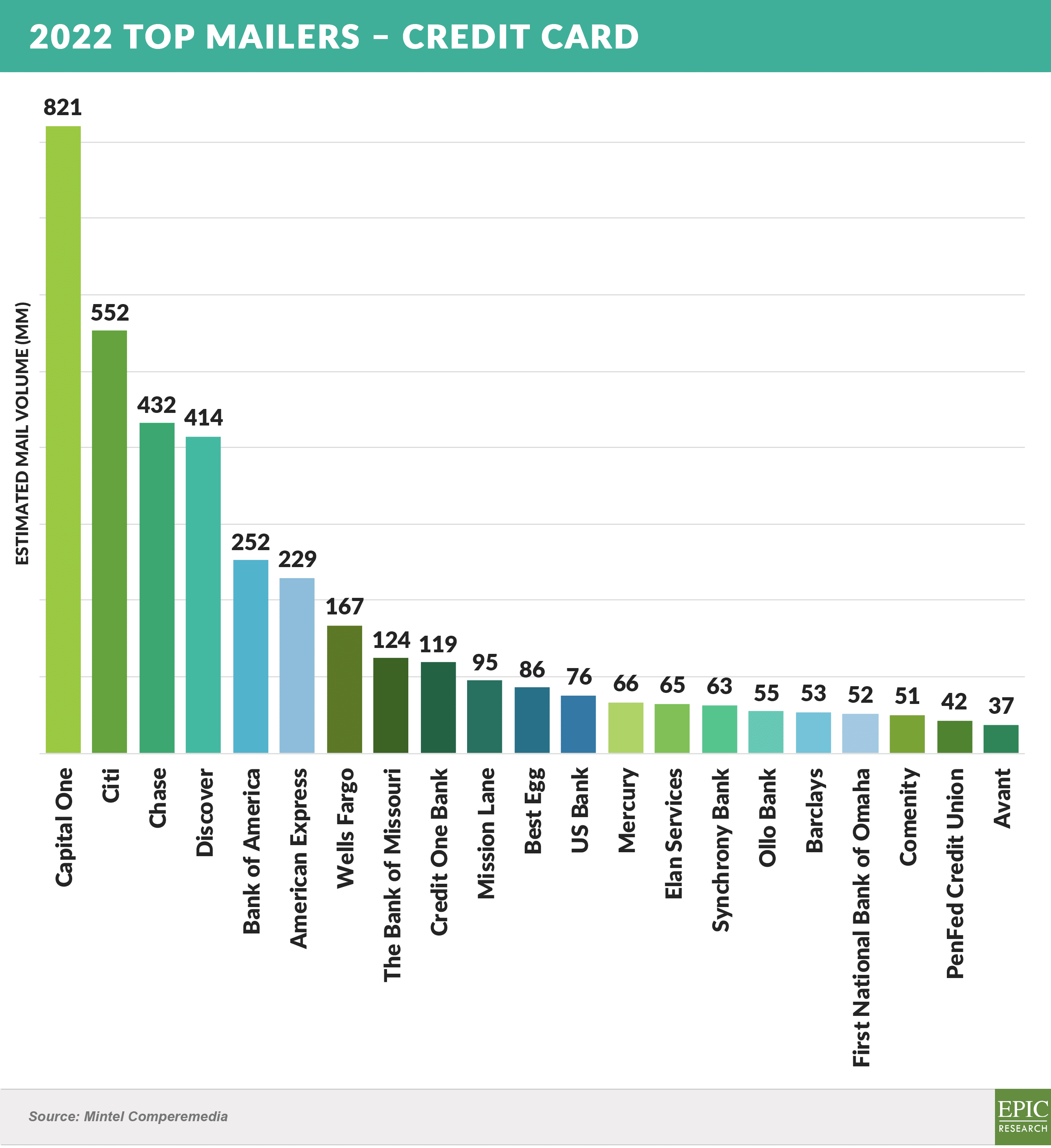

- Credit Card mail volume once again led all consumer finance categories in 2022 growing 9% over 2021 to 4.3 billion mail pieces

- Capital One was the top card mailer for the year, followed by Citi, Chase, and Discover

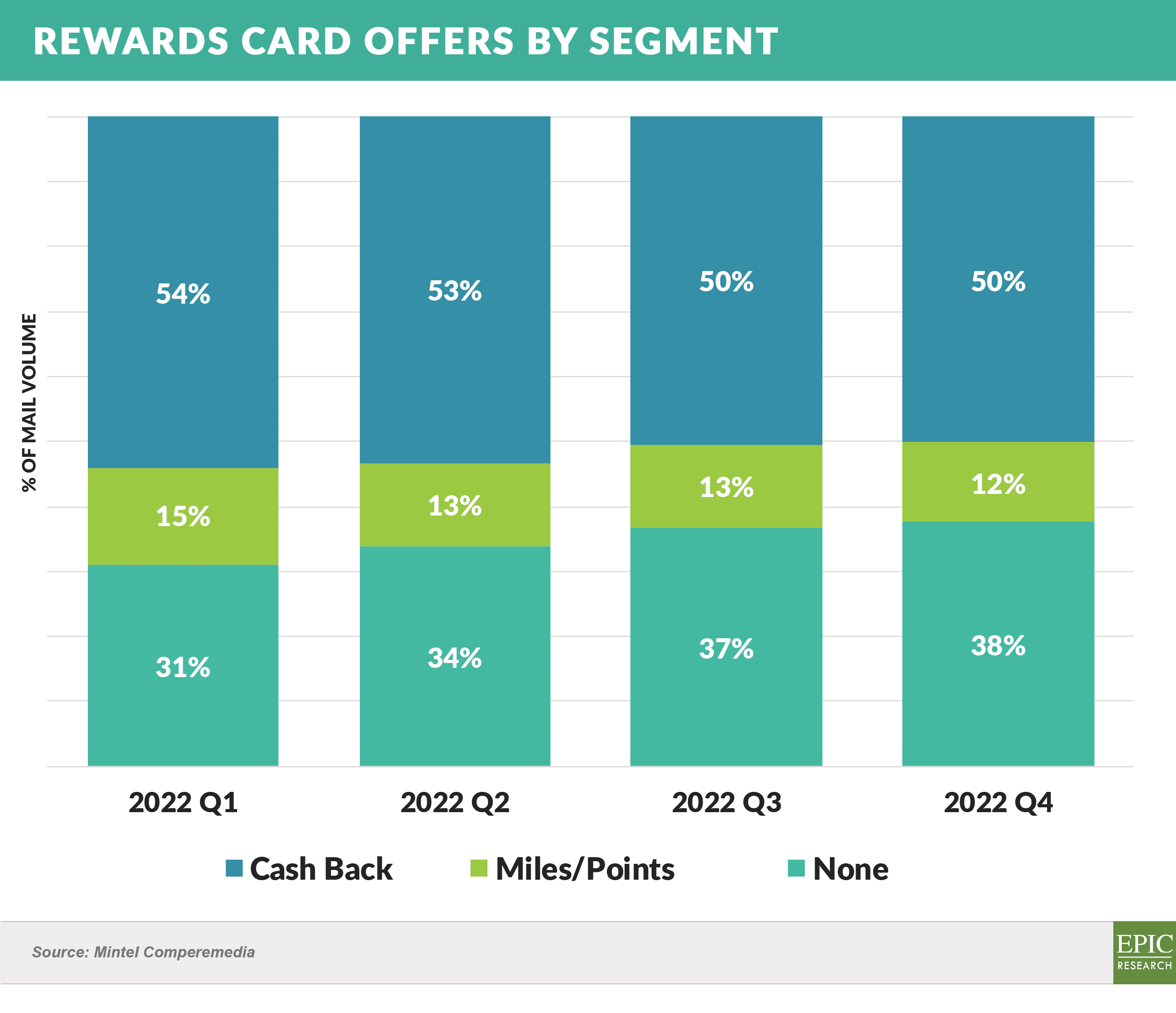

- Cash back, which consistently ranks as the most popular rewards option in our surveys, has accounted for around half of all rewards card offers

- The 2022 growth champion was checking, which increased 55% year-over-year to just over 1 billion pieces

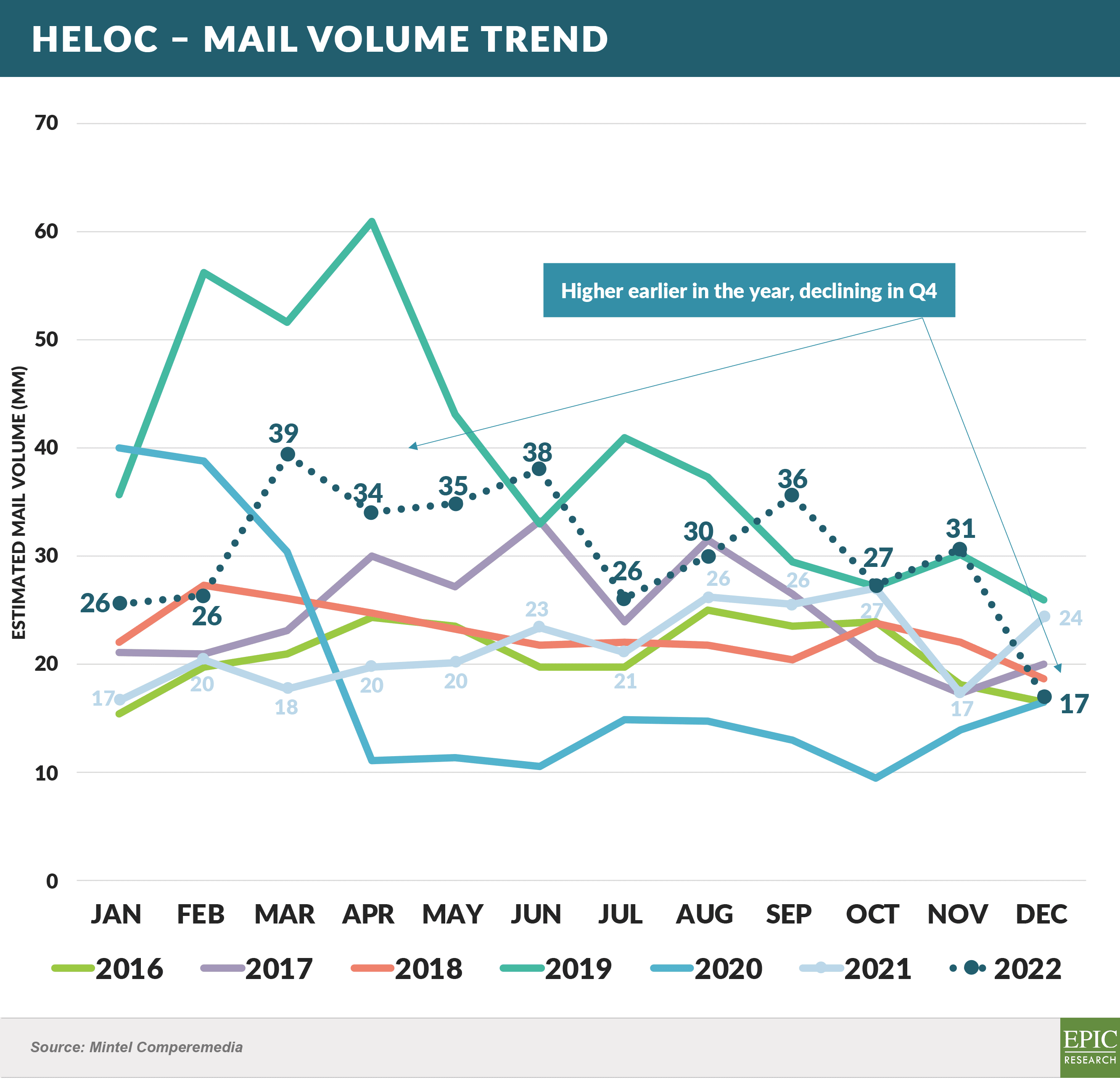

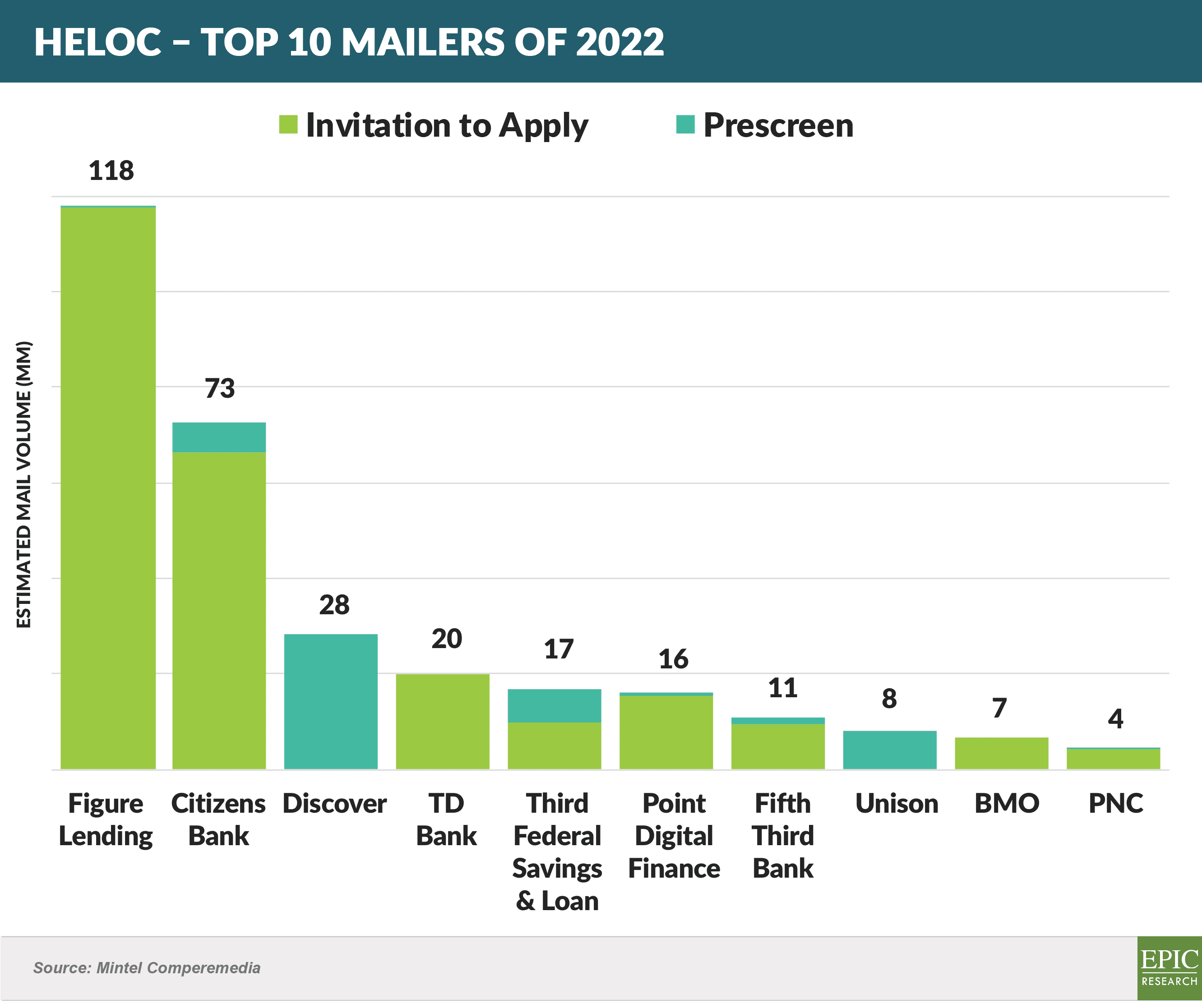

- HELOC had a moment in the sun with 40% annual growth, however recent months have seen a drop from the levels of early 2022

- As it was in 2021, Figure remained the largest mailer, followed by the largest retail bank mailer Citizens

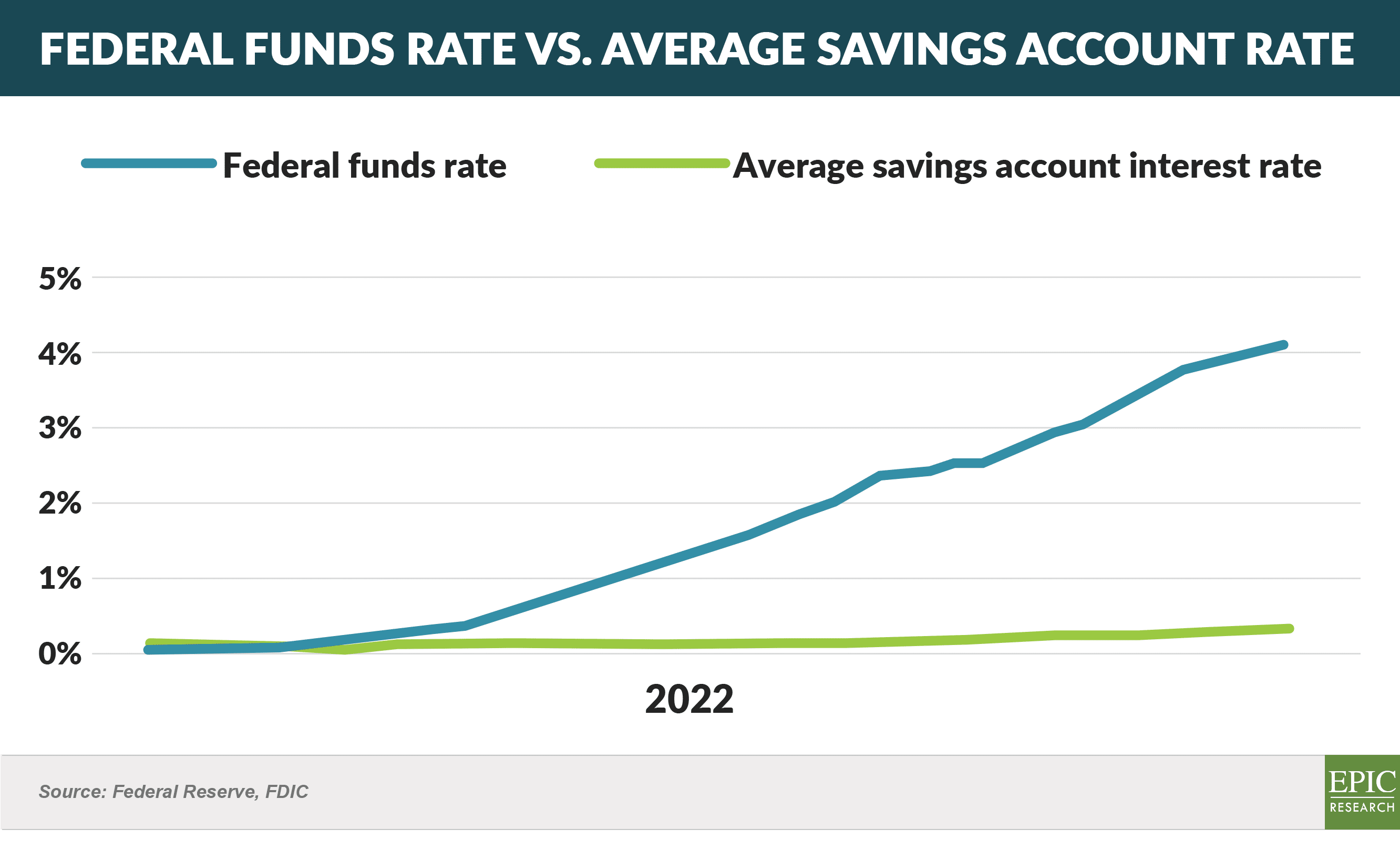

- Banks’ regular savings account interest rates have not kept up with the rise in money market funds and other savings vehicles

- Despite treasury bills, CDs, and other savings vehicles paying rates between 4% and 5%, the typical bank savings account still pays just 0.33% according to the FDIC

- Affluent customers are moving their funds to the higher yielding vehicles at a much higher pace than average bank customers

- Bank of America reported that their wealth management customers balances decreased 17% in 2022 while regular savings balances were down only 0.6%

- JPMorgan, Bank of America, Wells Fargo and several other large institutions announced the launch of a digital wallet later in 2023

- The wallet will initially accept Visa and Mastercard products and be operated by Early Warning Services, which is owned by many of the banks involved in the wallet and which also operates Zelle

- The move is seen to be a counter to Apple Pay, Google Pay and other forms of digital payment

- The CFPB has proposed changes to the Card Act that would further limit the maximum allowed late fees on credit cards

- The proposal cuts the first and second late fees from $30/$41 to $8 and would ban late fees that are higher than 25% of the required payment

- Late fees currently account for $12 billion a year in credit card revenue and the CFPB projects the new rules could reduce this total to $3 billion

- Some question why the federal government has decided to dictate pricing in such an ultra-competitive industry

- Wells Fargo announced a retreat from first mortgage originations, opting to concentrate on loans to bank clients and minority buyers

- Wells is the third largest mortgage lender in the US and will also shrink its existing mortgage servicing portfolio via asset sales

- The move comes amid an overall decline in mortgage loan originations, with Wells reporting a 32% drop in originations and JPMorgan’s falling 45%

- While we found the results of our Travel Rewards Card survey of interest, it is important to remember that survey results are not necessarily indicative of consumer behavior

- If you have ever attended a focus group, you undoubtedly know first-hand that what consumers say may be very different than what they do

- We’re reminded of the group of cardmembers we selected because we knew they had consistently revolved a balance

- When asked by the moderator who had ever paid less than the total amount due, only one of the 12 participants, who all qualified as “yes,” (reluctantly) raised their hand

- Another group evaluating the relative desirability of various card features voted a card with “no fees” as their choice – the resulting “no fees” product was rolled out and failed miserably due to the accompanying 3.9% intro rate that was dictated by product economics

- Financial services direct marketing is fortunate that in-market testing can quickly reveal winners and losers based upon consumers’ actual behavior (i.e., responding to the offer)

- So, when consumers say they prefer a $250 gift card over 50,000 airline miles (miles that likely cost the issuer ~$500), issuers would be wise to test it in the market first!

The Epic Report is published monthly, with the next issue releasing on March 4th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.