Three Things We’re Hearing

- Digital wallet opportunity!

- Student lending rebound?

- Checking and HELOC lead the pack

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Digital Wallet Opportunity!

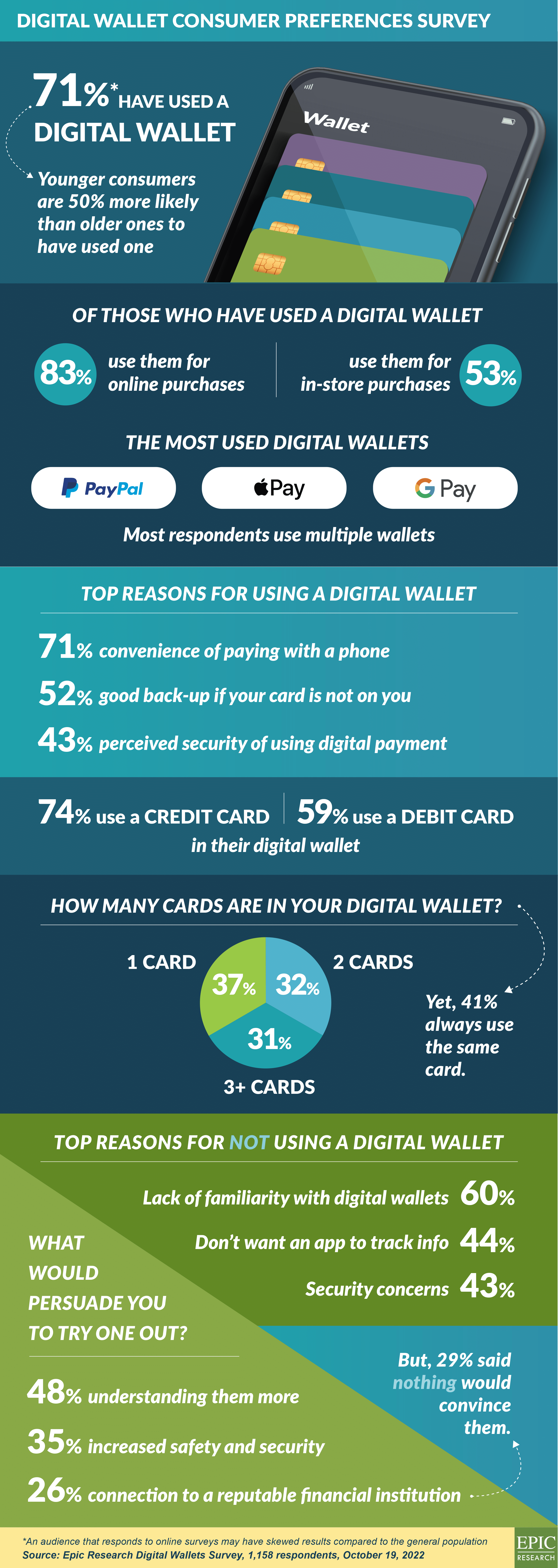

- Epic surveyed 1,158 consumers regarding their digital wallet usage and found the vast majority of respondents use digital wallets

- Although most consumers keep multiple cards in their digital wallets, 41% always use the same card for purchases, leaving an opportunity for greater penetration

Student Lending Rebound?

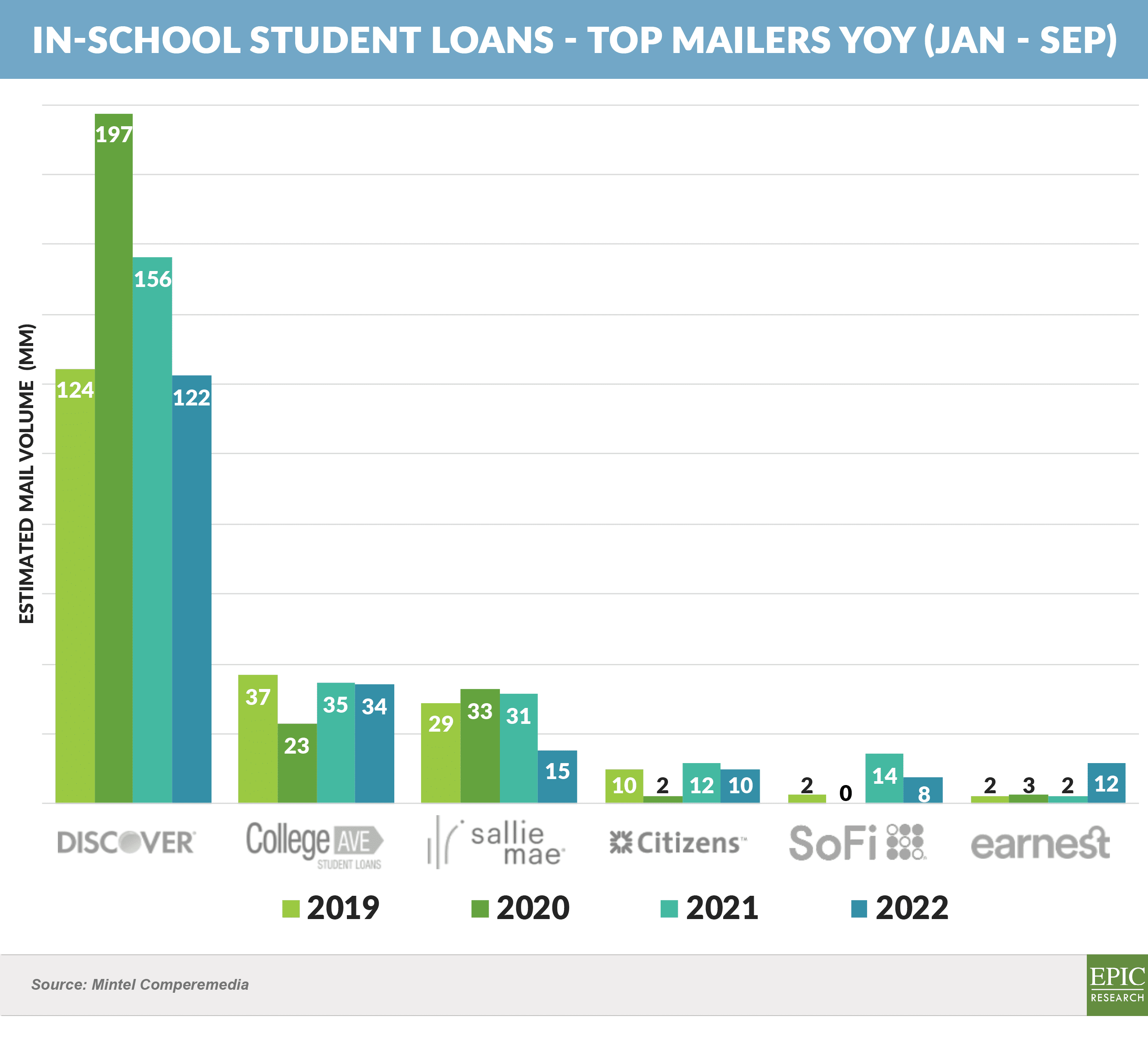

- Many lenders have abandoned issuing new private student loans (PSLs) over the past 15 years, and they have now become a niche product with four major players – Sallie Mae, College Ave, Discover, and Citizens

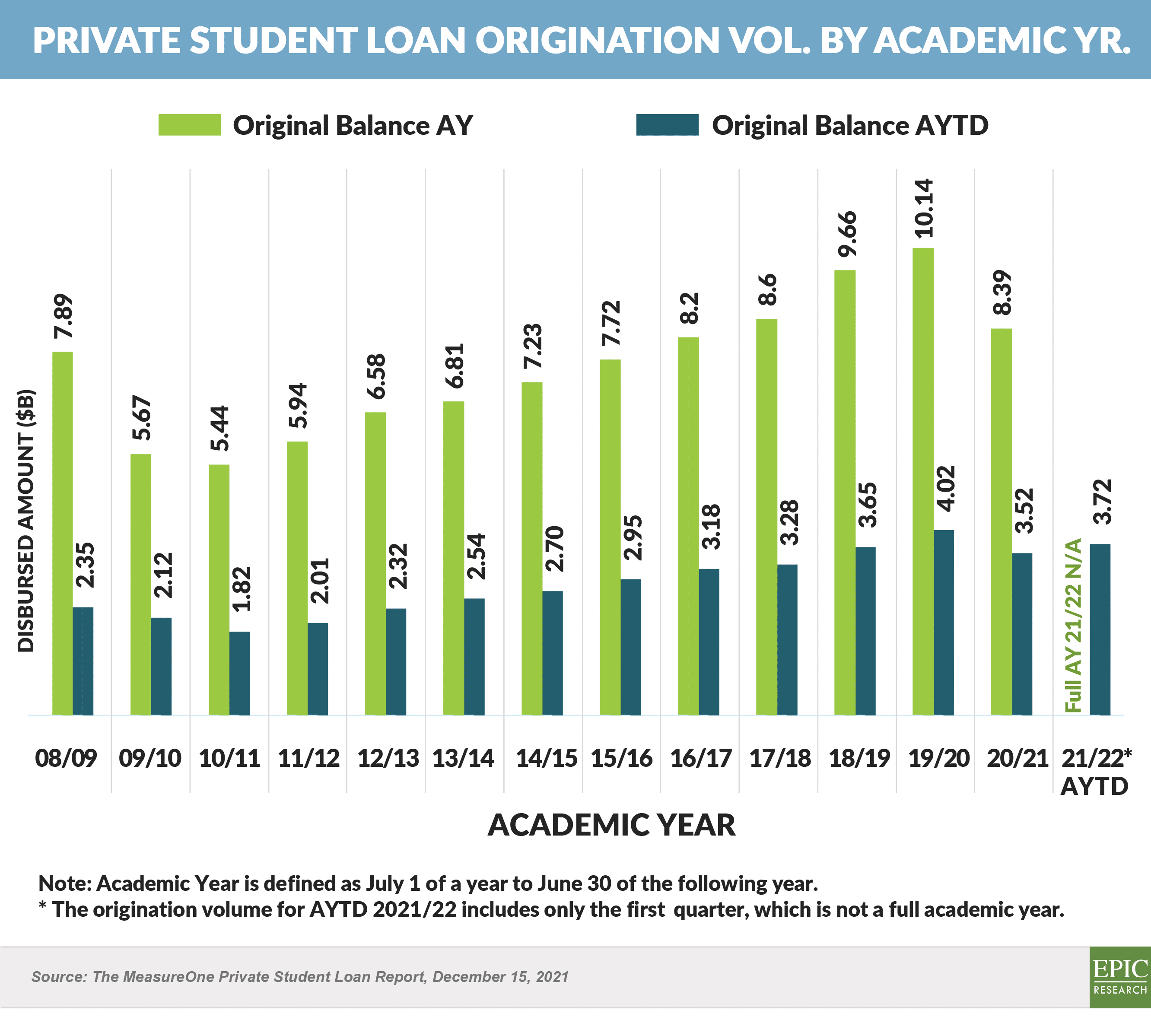

- New loan originations increased each year since 2010/11 until falling in the pandemic-affected 2020/21 academic year (the last full year available), with new loans down 17% from the prior year

- College enrollment has declined for three straight years, likely driving a portion of the decline

- However, early data for 2021/22 shows a slight increase in loan volume over the same period in the prior year

- Sallie Mae, the lone publicly traded student lending monoline, reported YTD 2022 loan originations of $5.2 billion, up 10% from the same period last year

- The other major PSL players – Discover, Citizens, and College Ave – do not publicly announce their PSL loan origination volumes

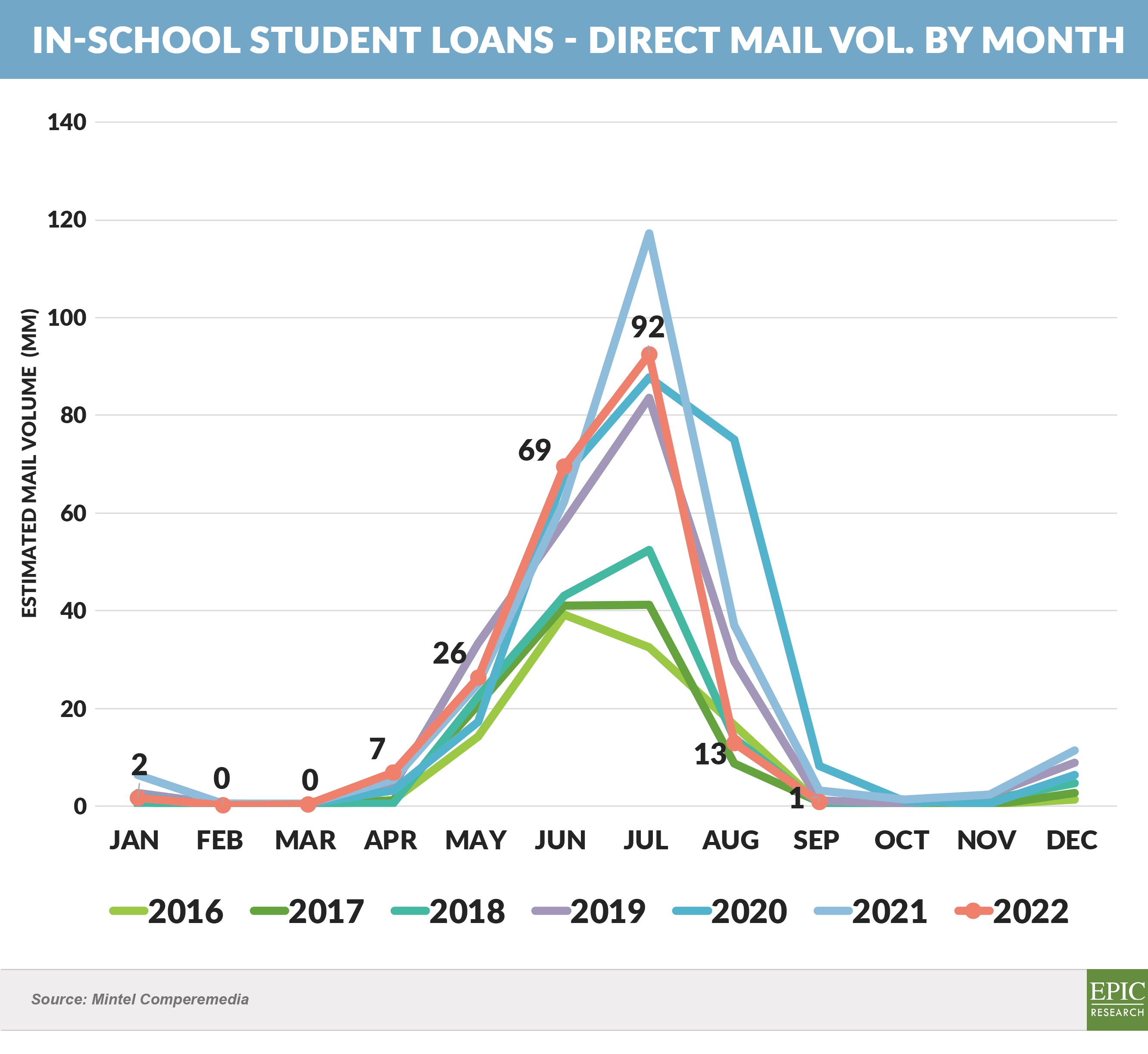

- Direct mail is not the primary driver of new loan volume for PSLs, unlike for other consumer financial products, with direct college relationships, digital channels, and serial borrowing by existing customers driving most new loans

- Total PSL mail volume through September was down 18% from 2021

- Among the largest PSL mailers:

- Discover continued to dominate direct mail volume in the segment, however it had the largest year-over-year decline, down 34 million mail pieces or 22%

- College Ave’s volume was flat to last year

- Sallie Mae’s mail volume was down 50% from ’21, however on a much lower volume of 15 million pieces

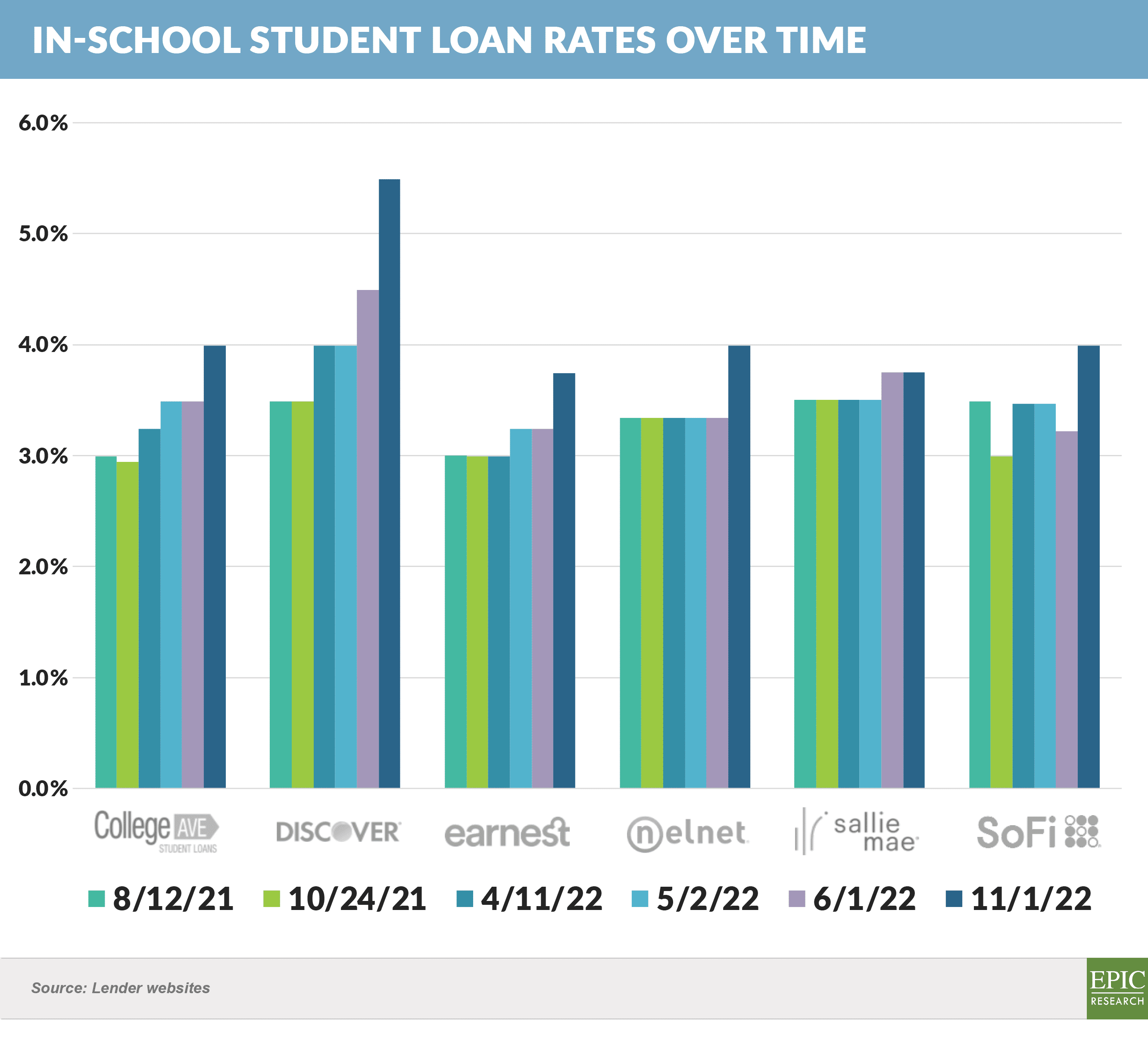

- Interest rates remained mostly steady over the past year, until starting to tick up in mid-2022

- While major PSL players Discover and Citizens already offer a variety of other products, pure play lenders in the segment have indicated a desire to expand their product and service offerings within the student demographic

- Navient acquired financial aid platform Going Merry and has launched the Earnest Mastercard

- Sallie Mae acquired student loan comparison website Nitro

- College Ave noted “new expansion opportunities” following its major investment from Thrivent

Checking and HELOC Lead the Pack

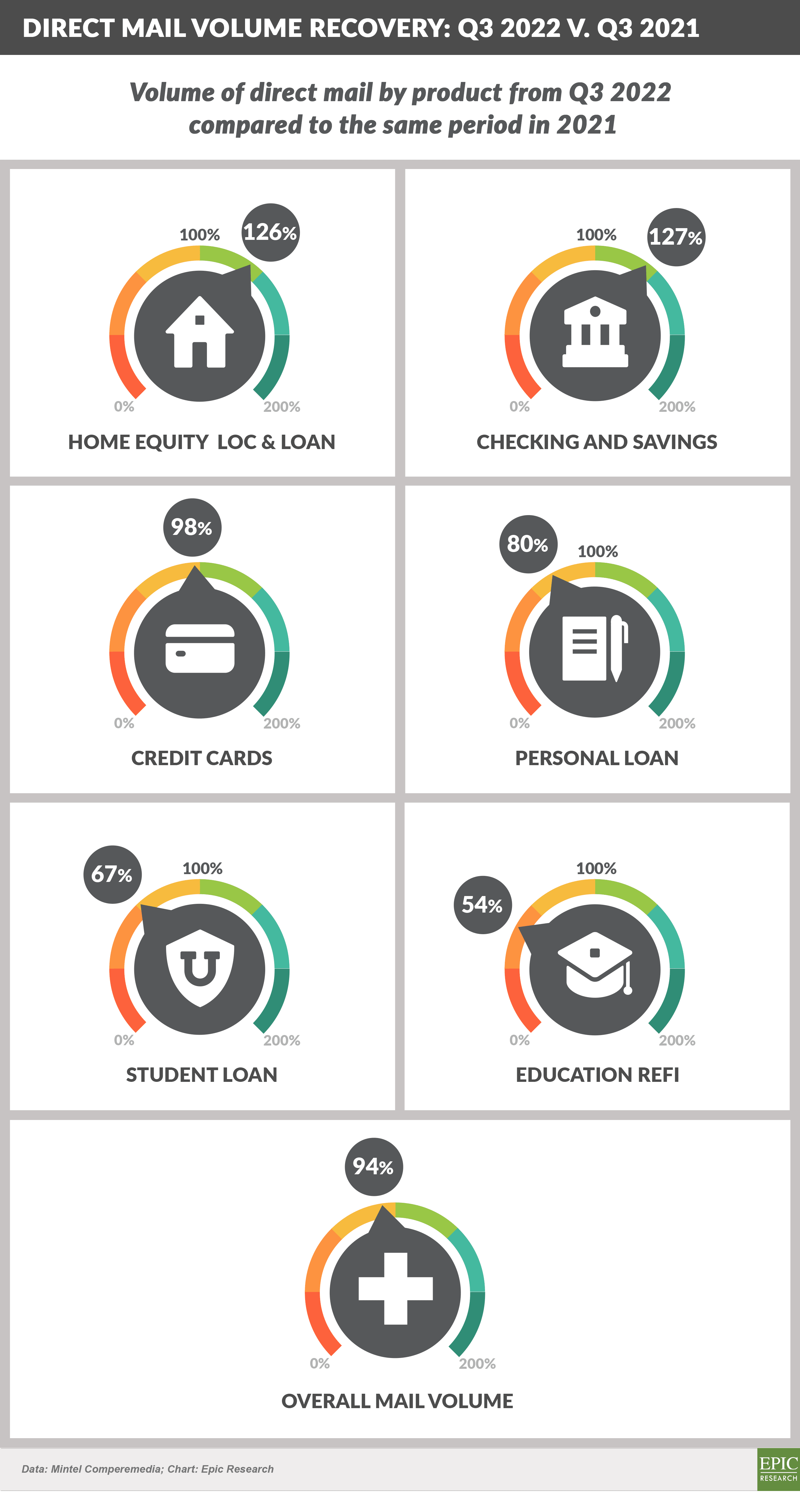

- September data shows checking (+76%) and HELOC (+52%) with the largest year-over-year increases in mail volume

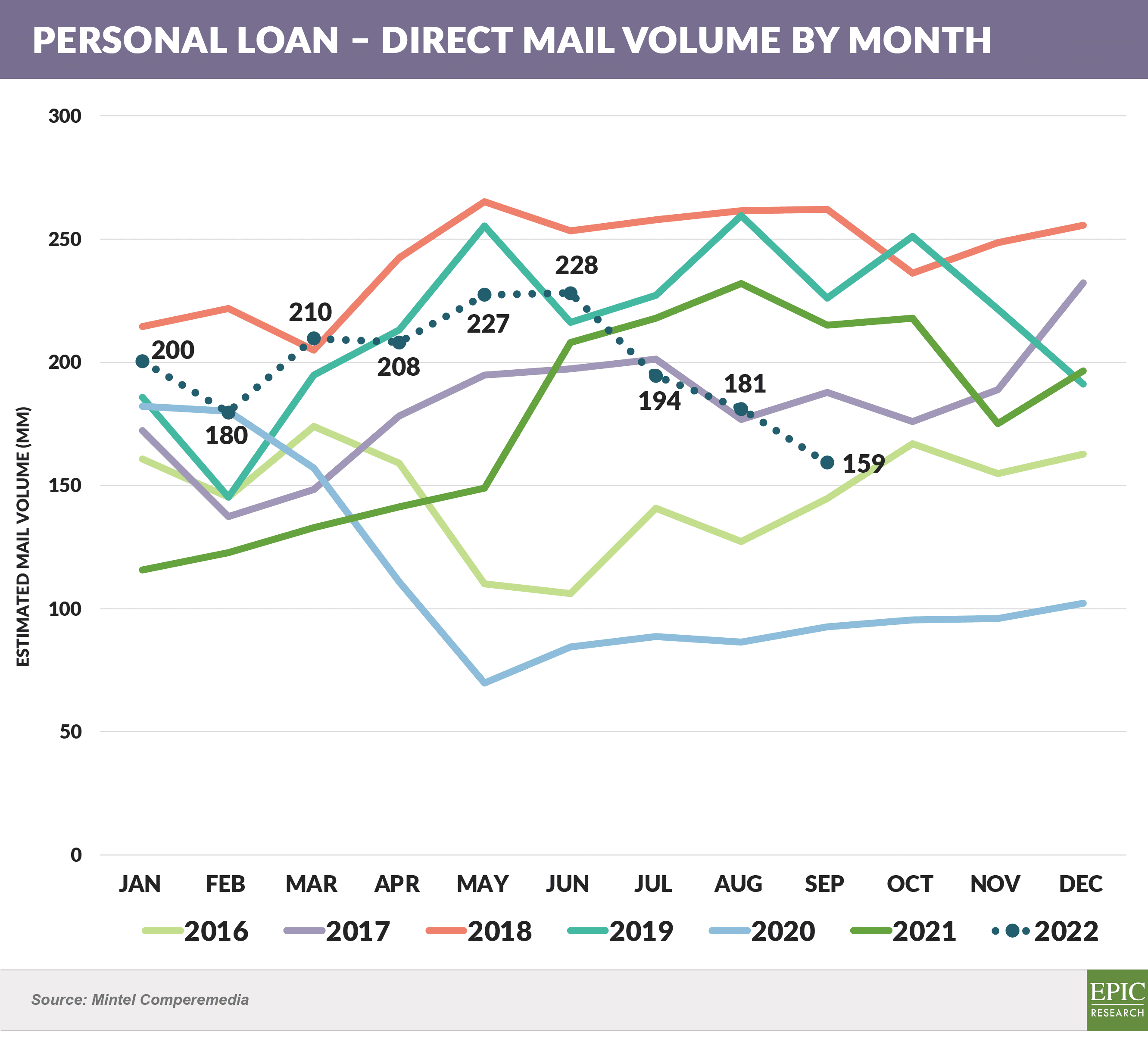

- Although personal loan mail volume is up 16% year-to-date, the past three months have shown a sharp decline as rates have increased

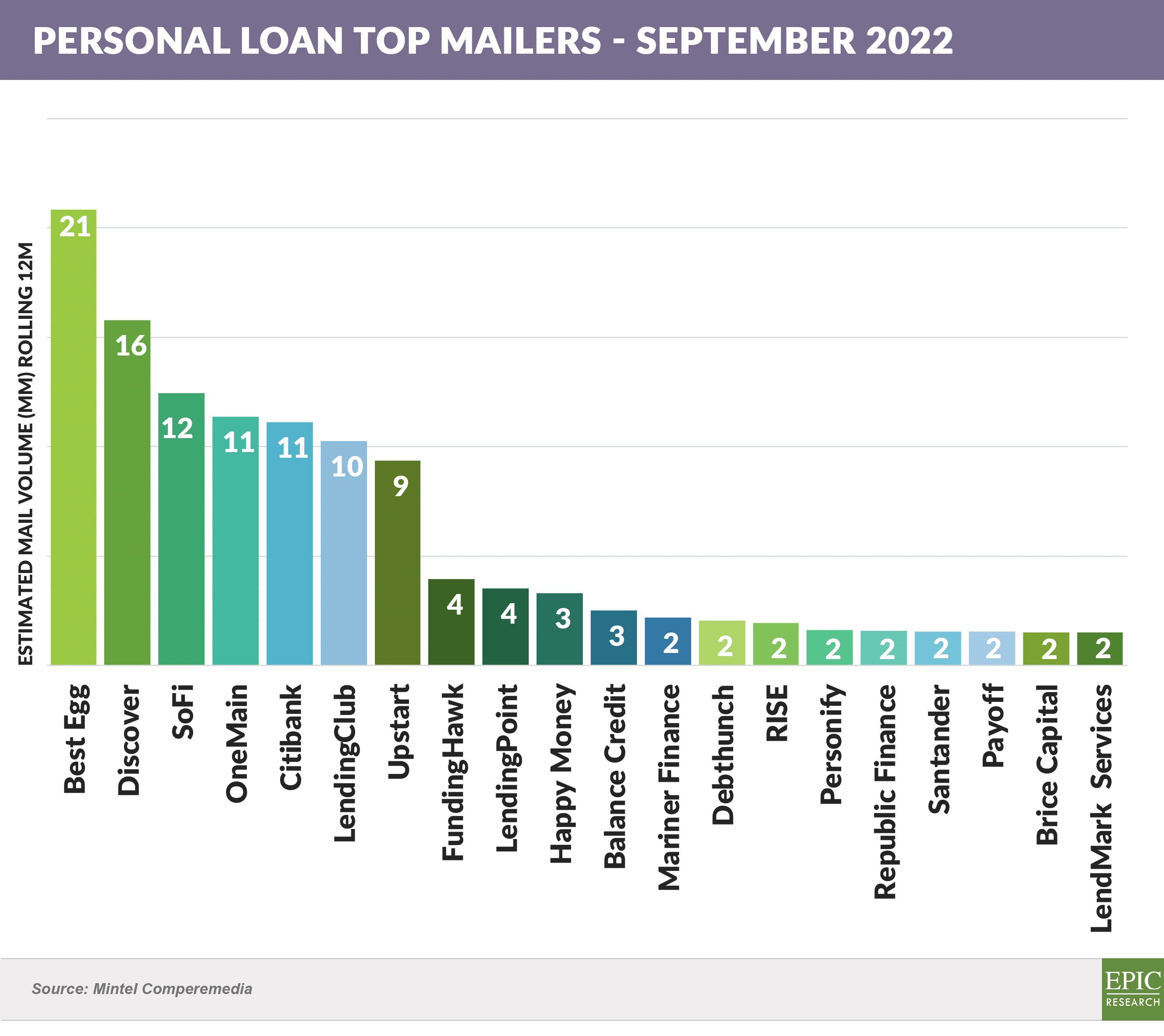

- Best Egg continues as the largest personal loan mailer – OneMain, LendingClub, and Upstart remain among the top mailers, but all have cut recent months’ volume by ~50% from earlier in the year

- Goldman Sachs, a top personal loan mailer in past years, abruptly disappeared from mailboxes in August of 2022

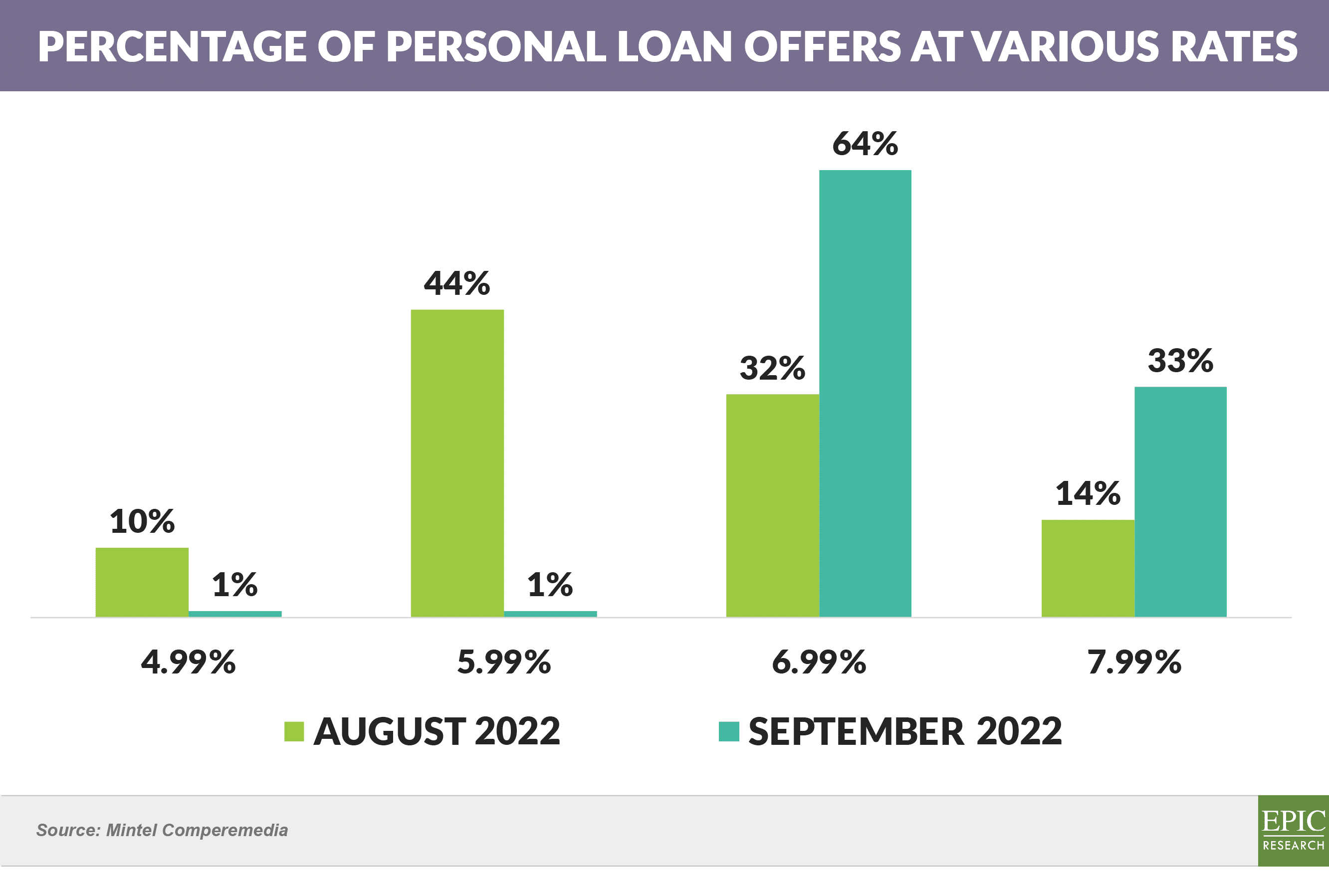

- Personal loan APRs have risen substantially in the past month, demonstrated by the proportion of mail by leading headline rate:

Quick Takes

- Goldman Sachs announced a broad restructuring, which includes dividing the consumer lending business between two different divisions

- Partner deals with Apple and General Motors will now be managed by the transaction banking unit and other consumer lending business will report into wealth management

- The move is widely seen as a move away from the broad consumer strategy that was previously in effect

- With interest rates, delinquency, and competition rising, many have predicted pain for BNPL providers

- The CFPB recently issued a report detailing each of these risks

- As a publicly traded company, Affirm is one of the few BNPL providers that offer visibility into their numbers, recently reporting that delinquencies had doubled in the past year, and its stock currently trades 90% lower than the peak of one year ago

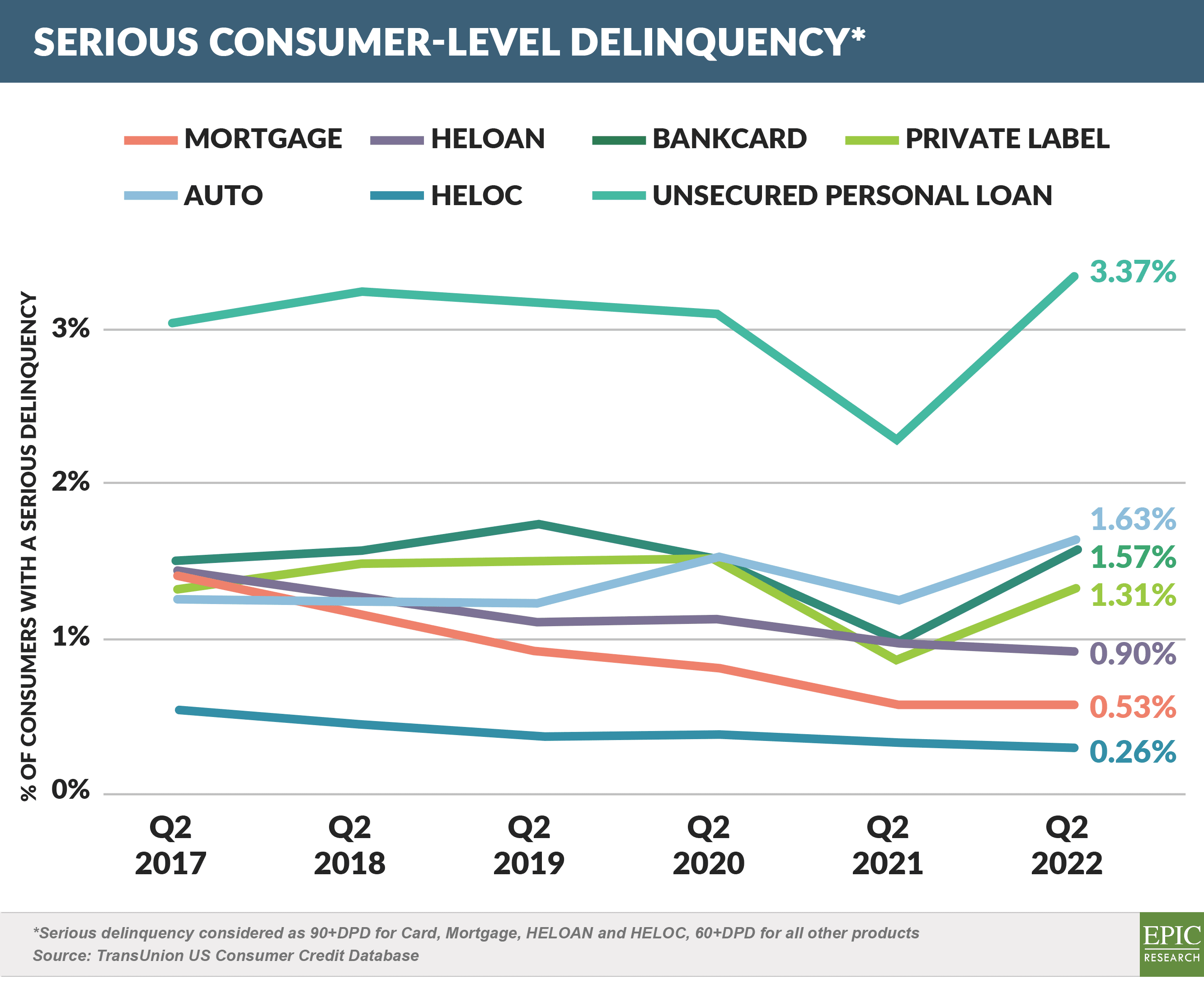

- Meanwhile, consumer delinquencies are trending upward for most non-mortgage portfolios

- With consumer delinquencies in a cyclical uptrend, be on the lookout for two guaranteed reactions:

- Lenders will underestimate the pace and magnitude of increased losses (on the other end of the cycle, they also underestimate how fast losses will decrease)

- Credit card portfolio executives will inevitably get the mandate from above to “Hire more collectors!!!” – even though it typically is an inefficient way (i.e., a waste of money) to control losses

The Epic Report is published monthly, with the next issue releasing on December 3rd.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.