Four Things We’re Hearing

- Online savings accounts revive

- Card originations reach decade high

- Credit card portfolios are healthy

- Marketing spend at pre-pandemic levels

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Online Savings Accounts Revive

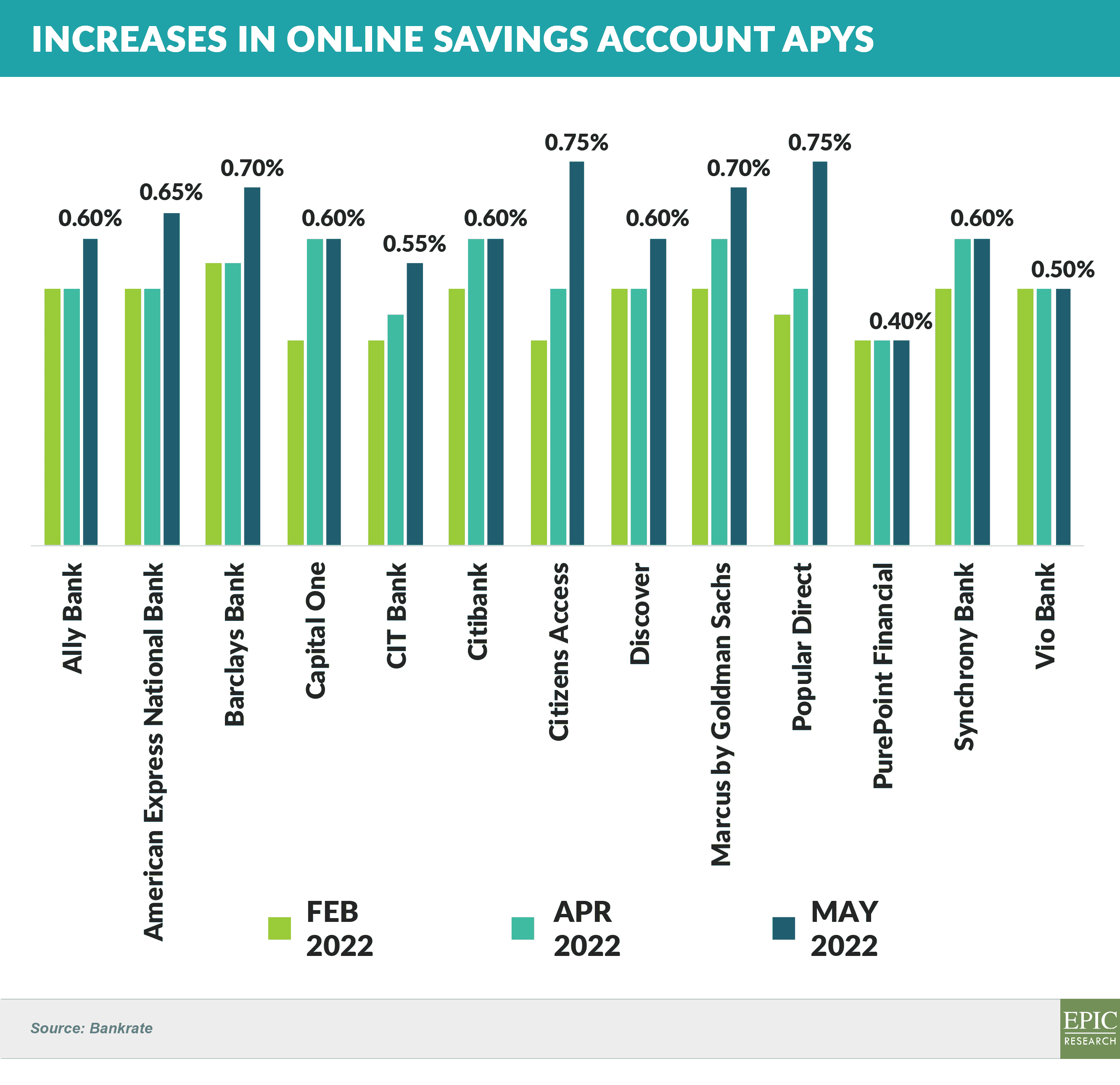

- After several years of declining savings account rates, APYs have reversed course, rising .20% - .25% in the past three months

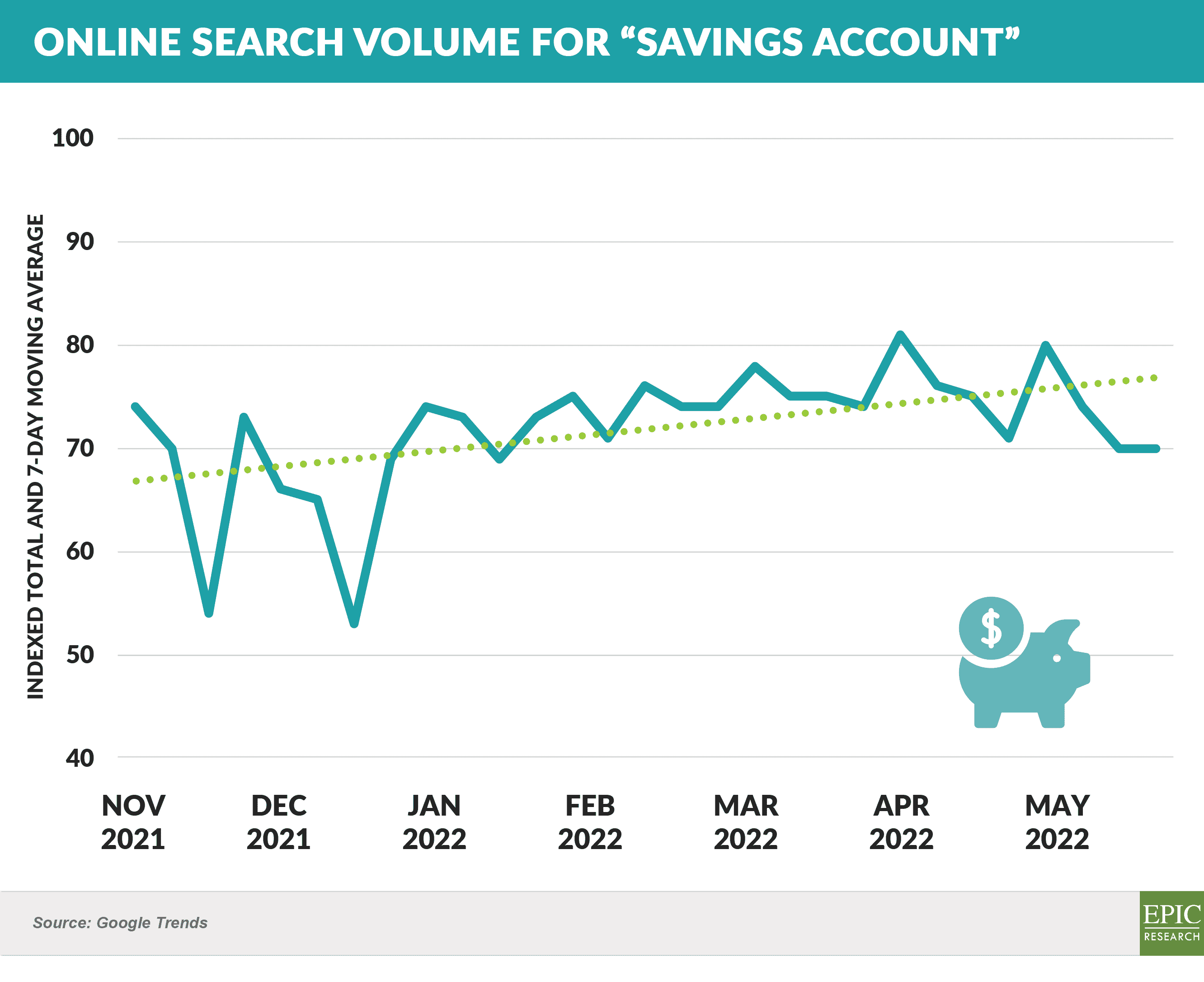

- Consumer interest has correspondingly increased with online search volume for "savings account" rising in the past six months

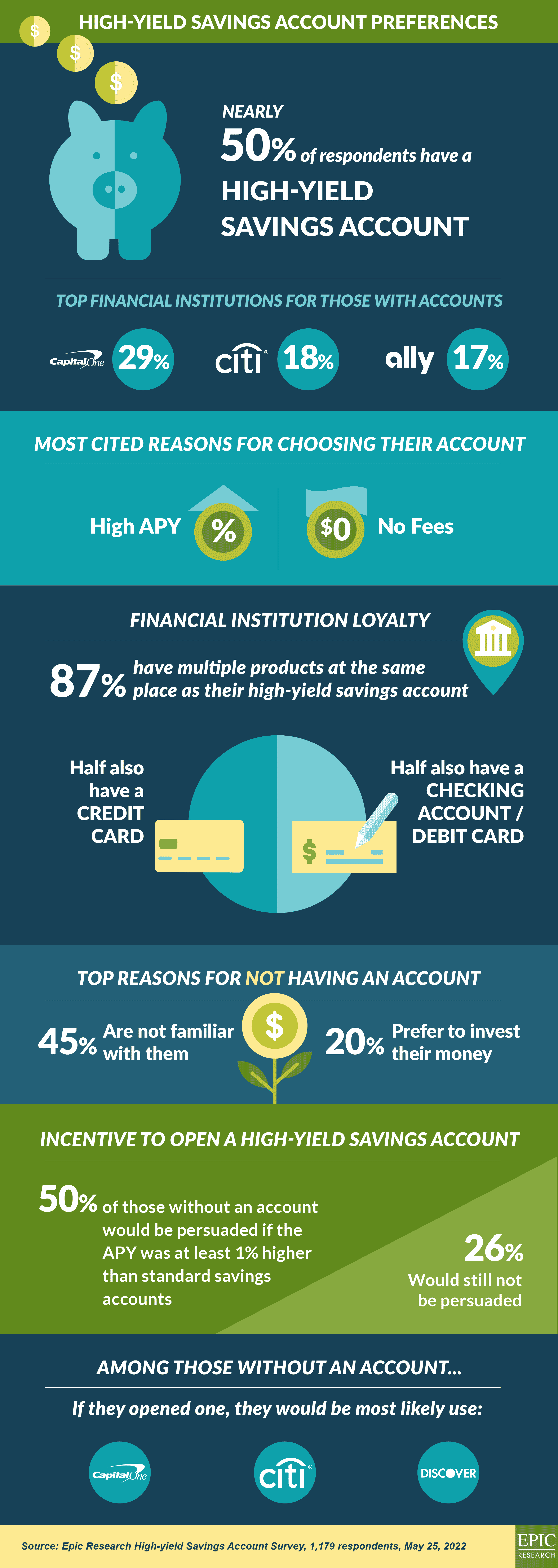

- Epic recently surveyed 1,179 consumers to assess their attitudes regarding high-yield savings accounts

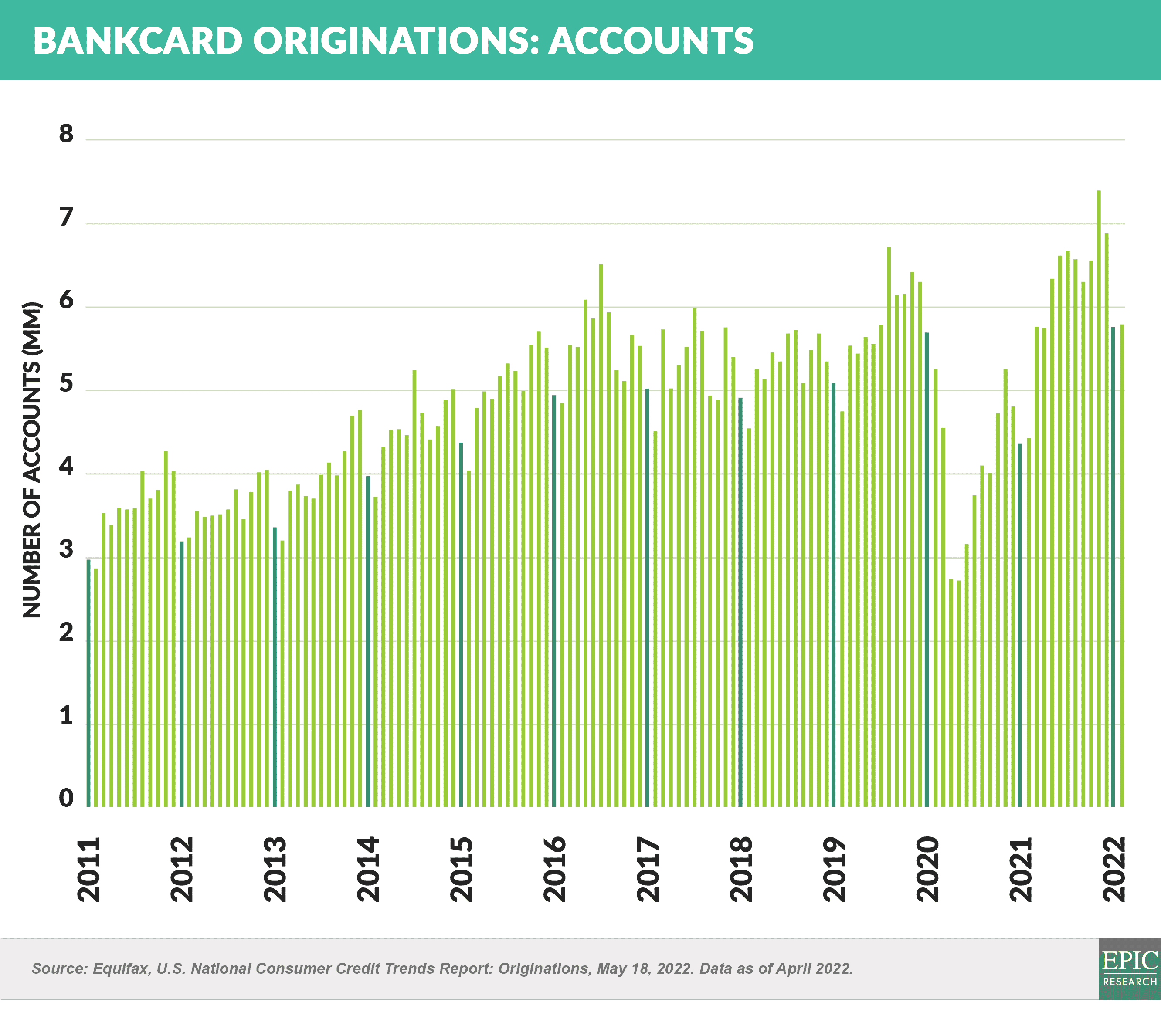

Card Originations Reach Decade High

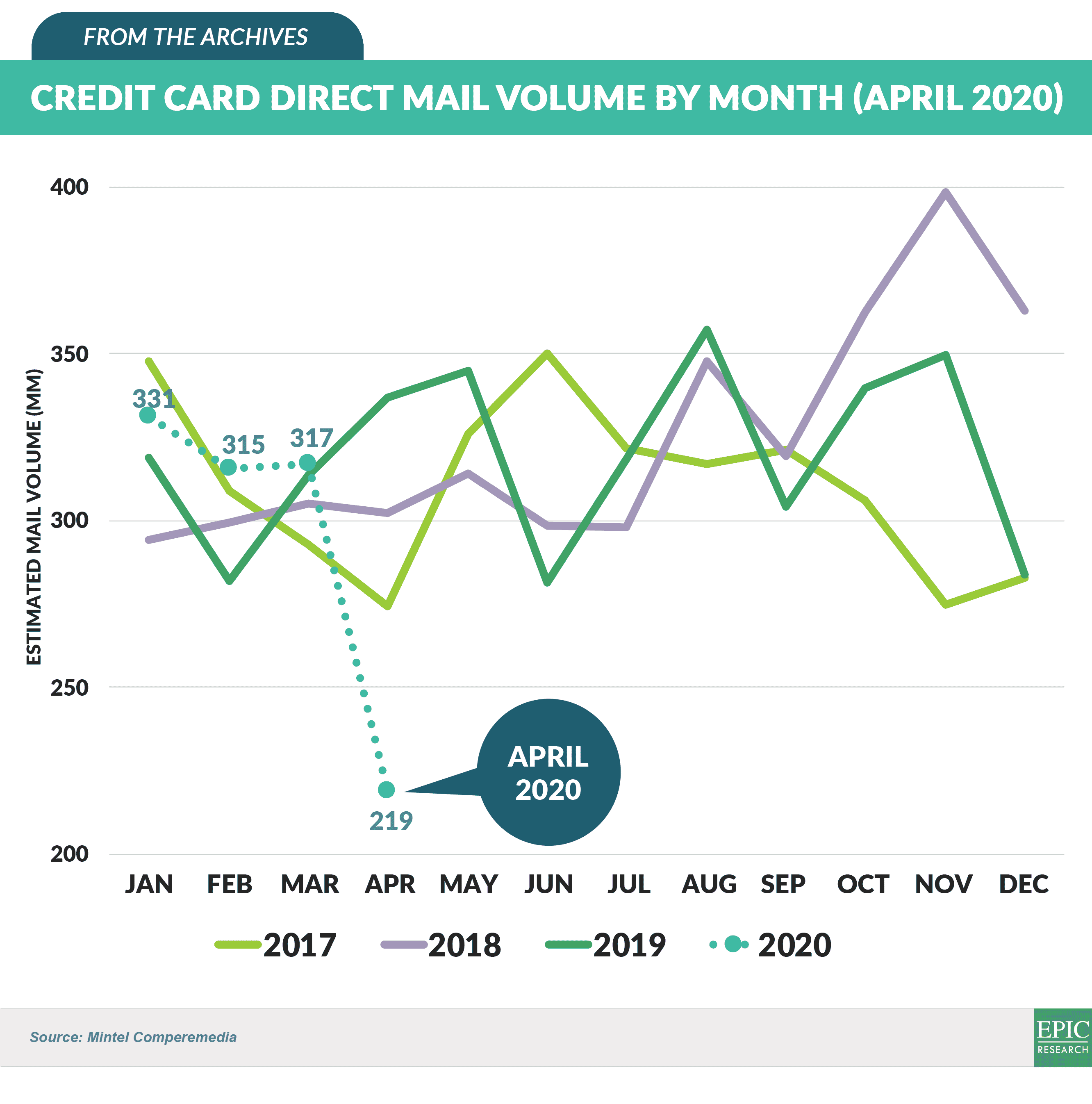

- The May 30, 2020 Epic Report highlighted the dramatic effect of the pandemic on credit card direct mail volume

- New card acquisition has since fully recovered, and 229 million credit card accounts were opened in Q1 2022, higher than pre-pandemic levels

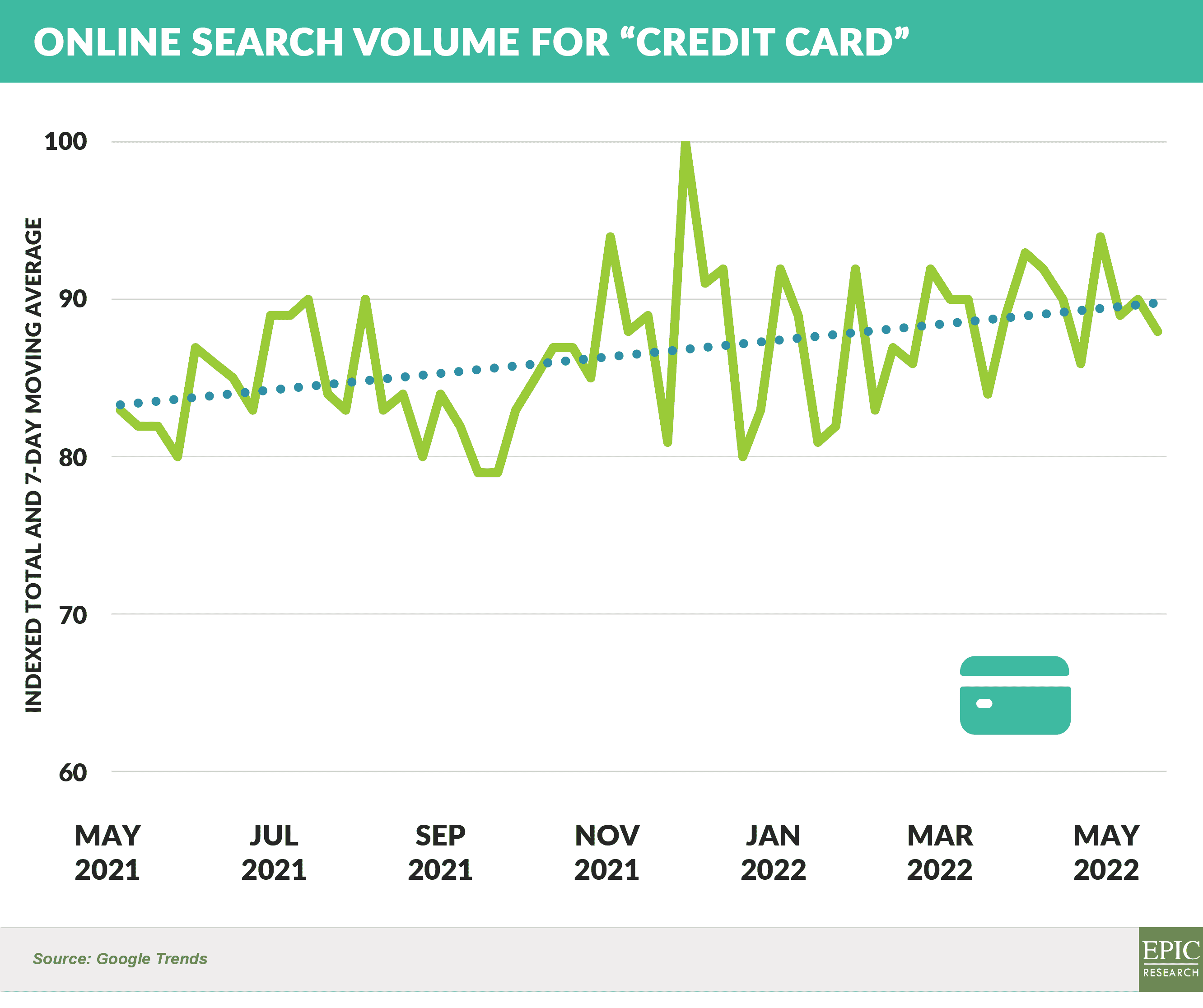

- Online search activity for the keyword “credit card” has also trended upwards since Q4 2021

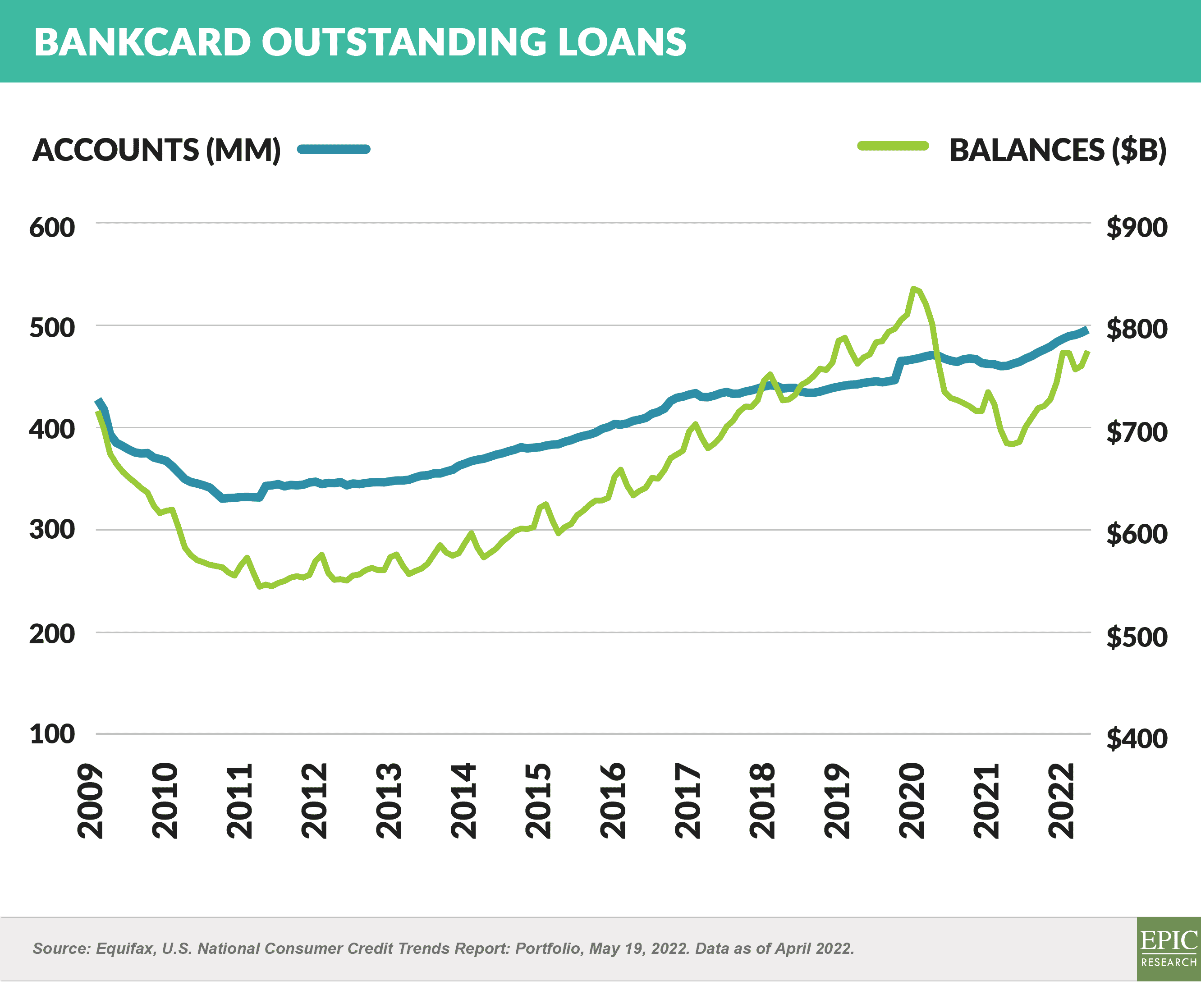

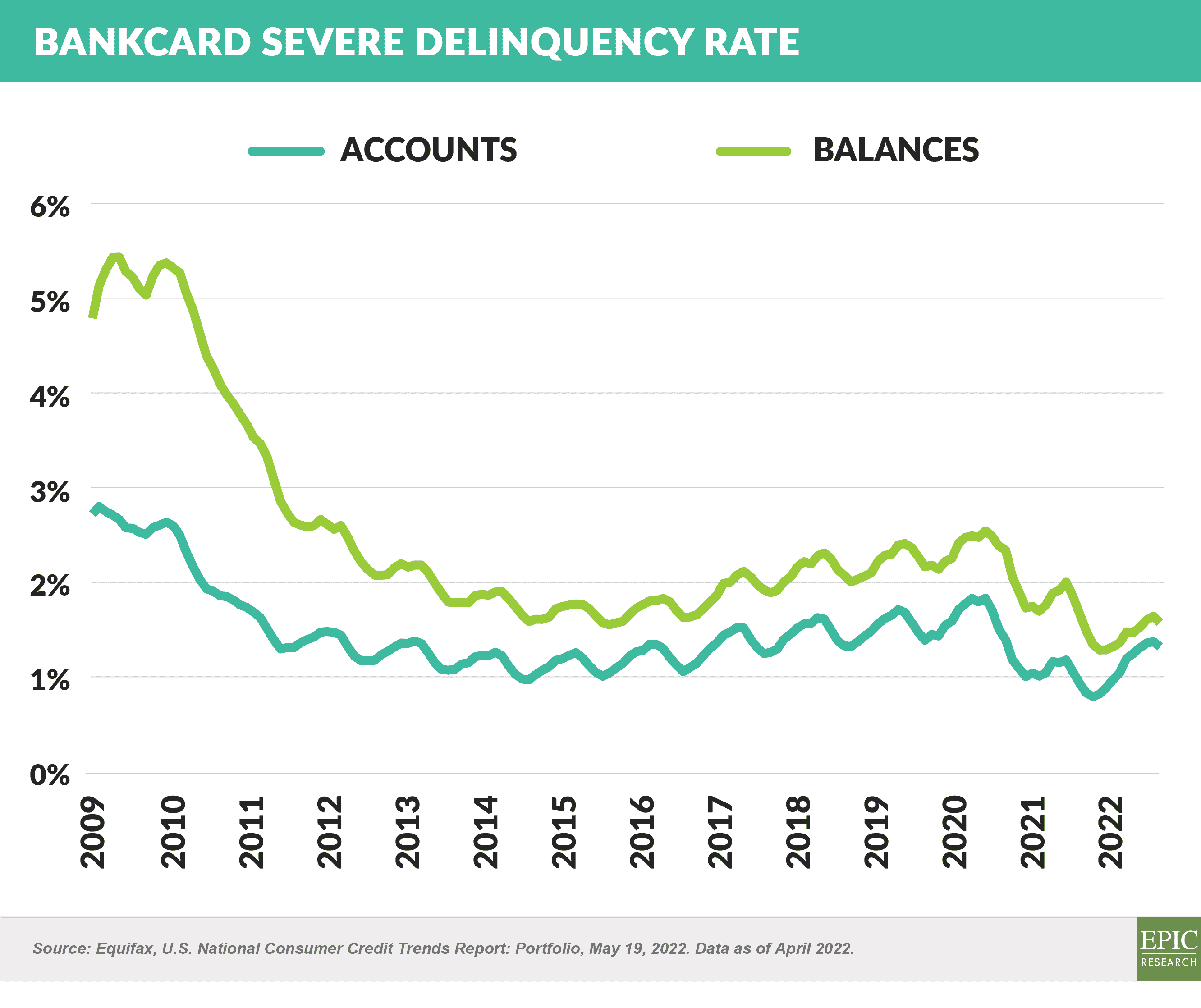

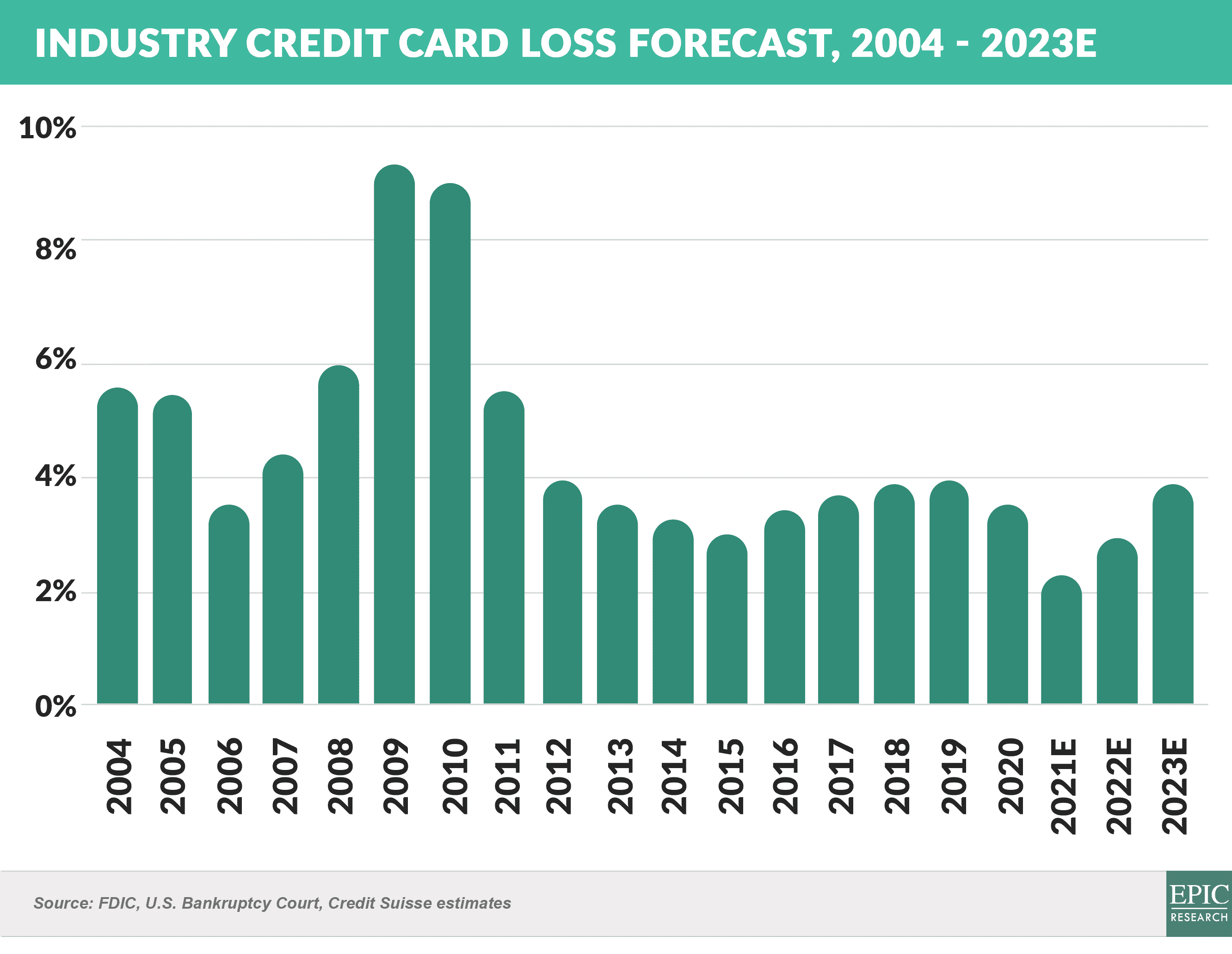

Credit Card Portfolios are Healthy

- The decline in card balances has reversed due to a combination of lower consumer paydown rates and increased spending

- April's bankcard delinquency rate of 1.58% is lower than the April 2021 level of 1.67%

- Following the relatively benign card asset quality environment of the past two years, Credit Suisse predicts a return to pre-pandemic credit loss rate levels by 2023

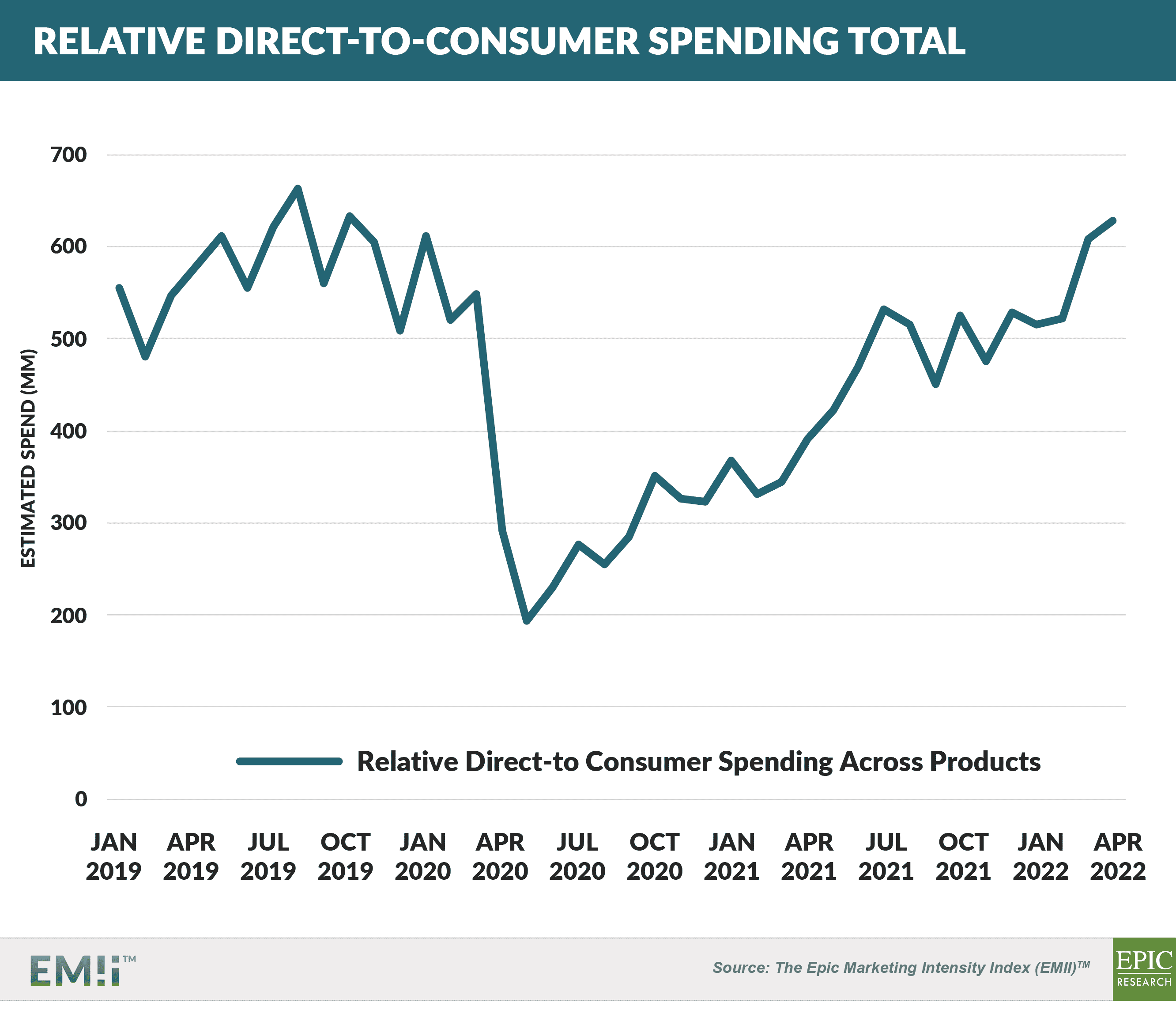

Marketing Spend at Pre-Pandemic Levels

- The Epic Marketing Intensity Index (“EMII”), which measures financial services acquisition spending in the direct mail and online channels, shows that total spending has finally reached 2019 levels

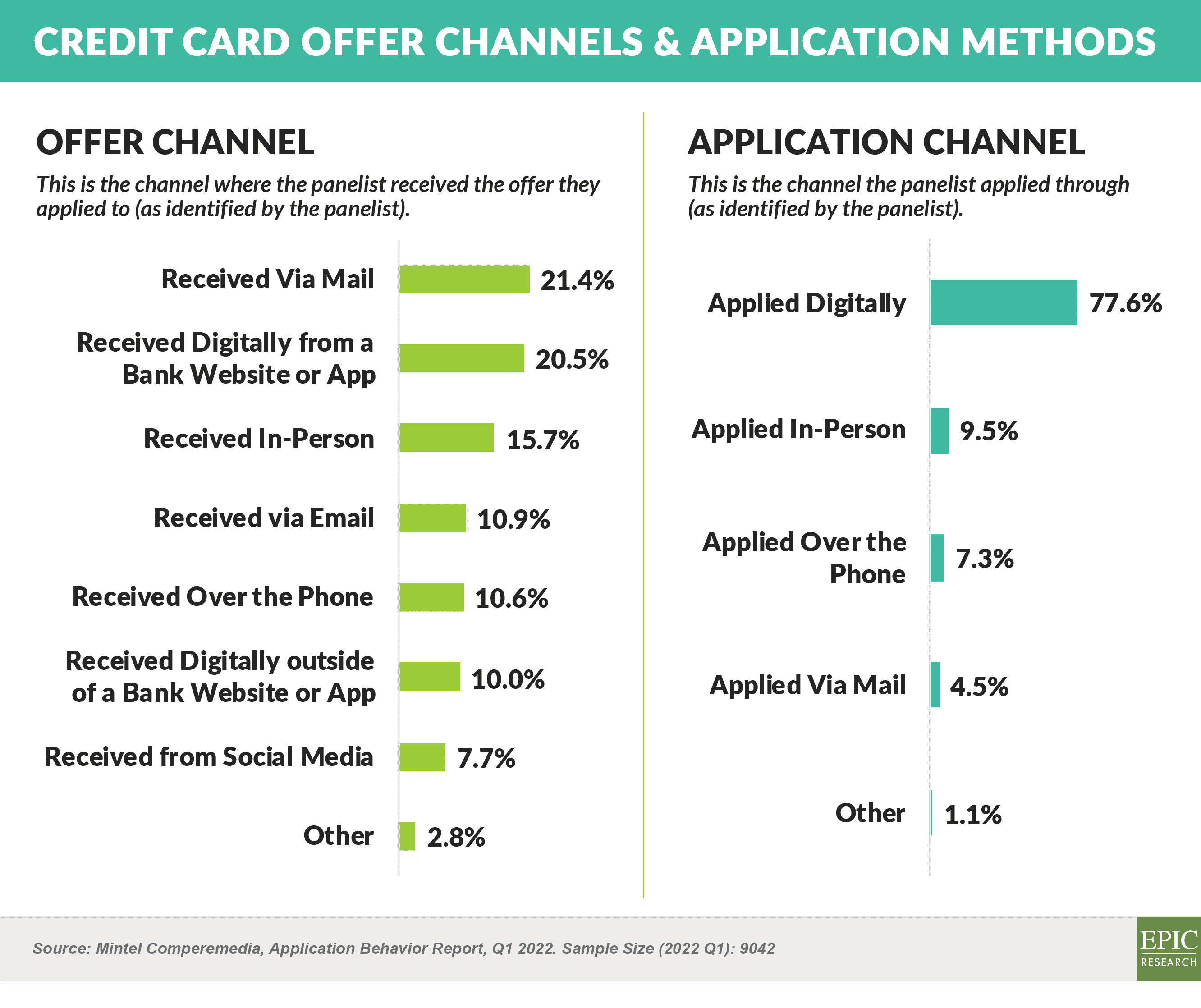

- Recent data from Comperemedia shows direct mail returning as the most prevalent channel for receiving new credit card offers, with the digital channel dominating applications

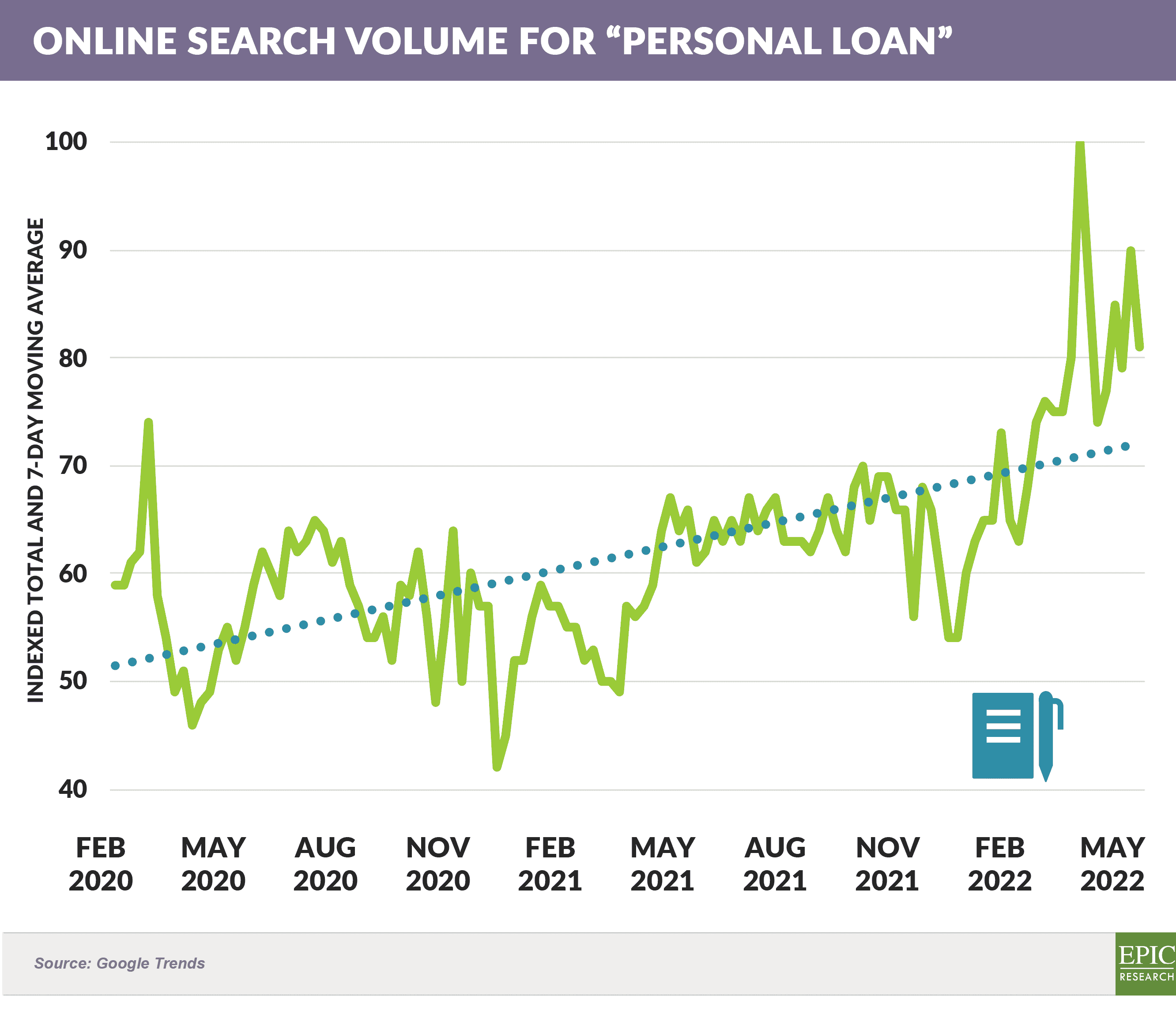

- Consumer interest in personal loans for receiving new credit card offers, was rather sluggish during the pandemic, however recent months have seen a spike in online search activity

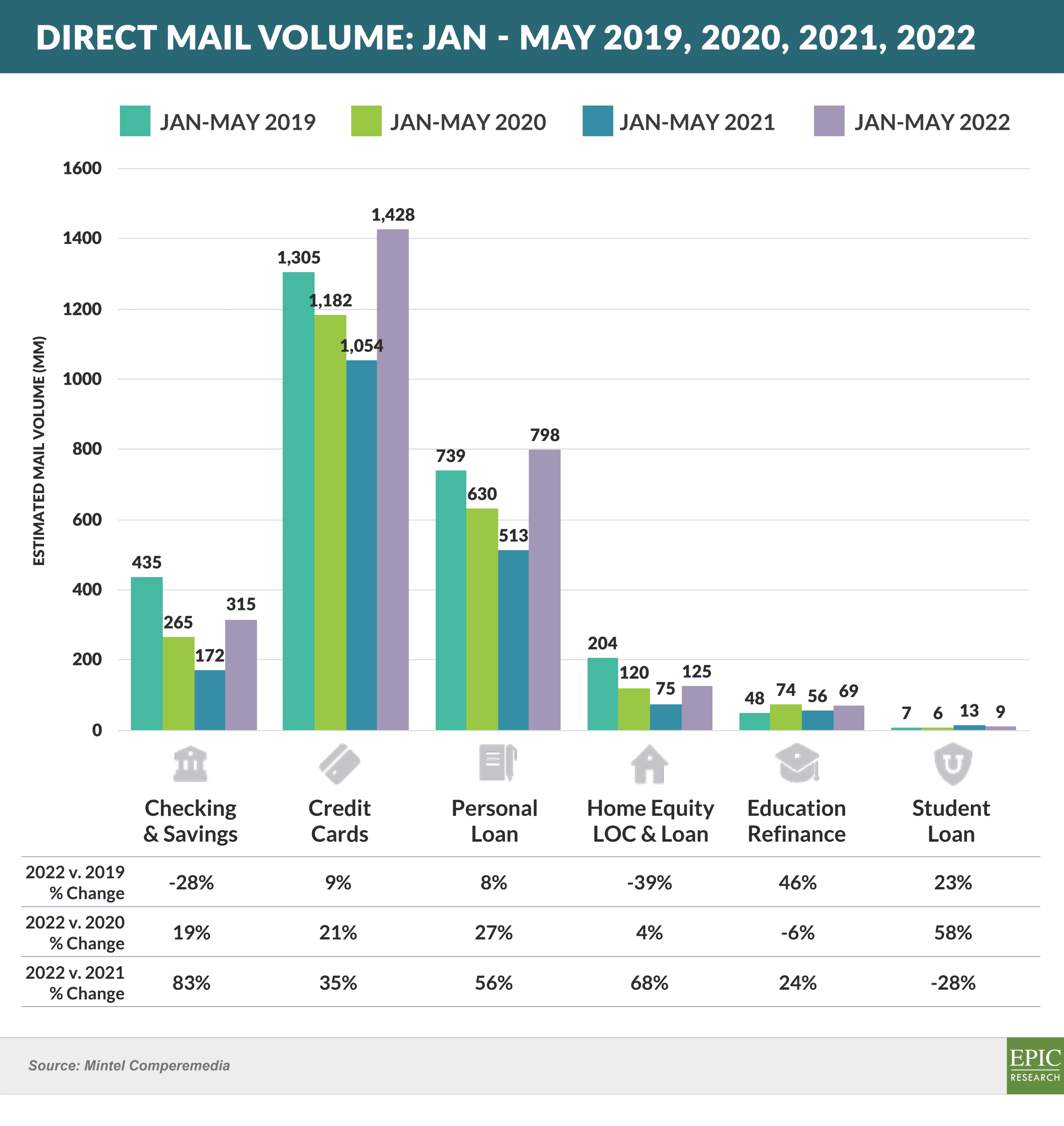

- Although personal loan direct mail volume also recovered at a slower pace than credit cards, it too has recently increased with Q1 2022 up 56% from Q1 2021

Quick Takes

- As noted in previous newsletters, paper shortages will impact mail volumes to some degree throughout 2022 – did you know that part of the issue was a union strike in Finland that closed paper mills and especially affected envelope production? The good news is that the strike is over!

- BNPL News

- Klarna

- Klarna, the Swedish BNPL company, and Europe's most valuable startup with a recent $46 billion valuation, is raising up to $1B in new funding at a valuation in the "low $30-billion-range" – one third lower than the prior valuation

- Klarna also announced it will lay off 10% of its staff

- Affirm

- Debit+, a new Visa debit card from Affirm, allows consumers 24 hours to split eligible purchases into an interest-free loan repayable within four installments due every two weeks

- Early results show the card fares best with Walmart shoppers buying groceries

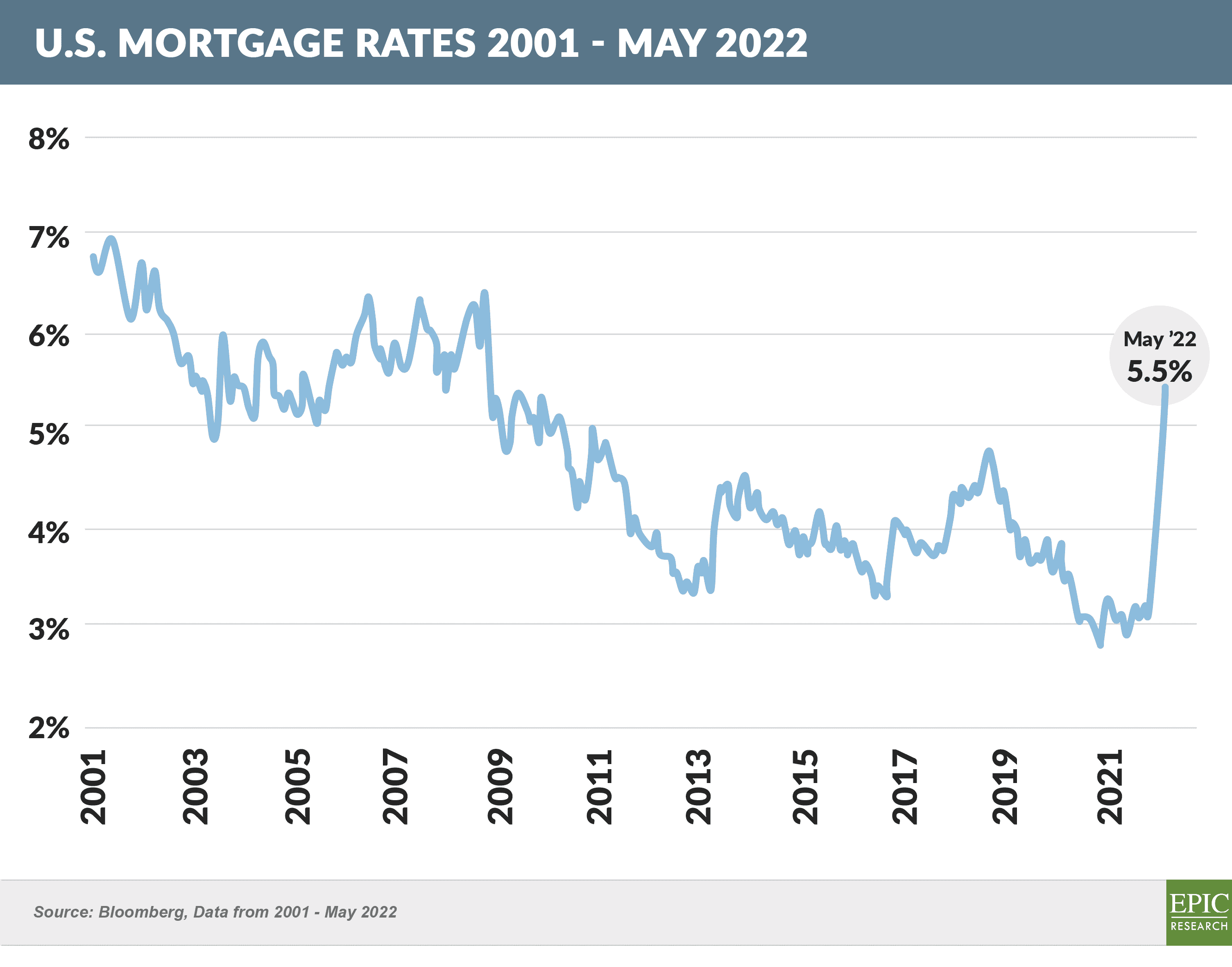

- First mortgage interest rates have recently jumped to levels in excess of 5% from the previous 3% range

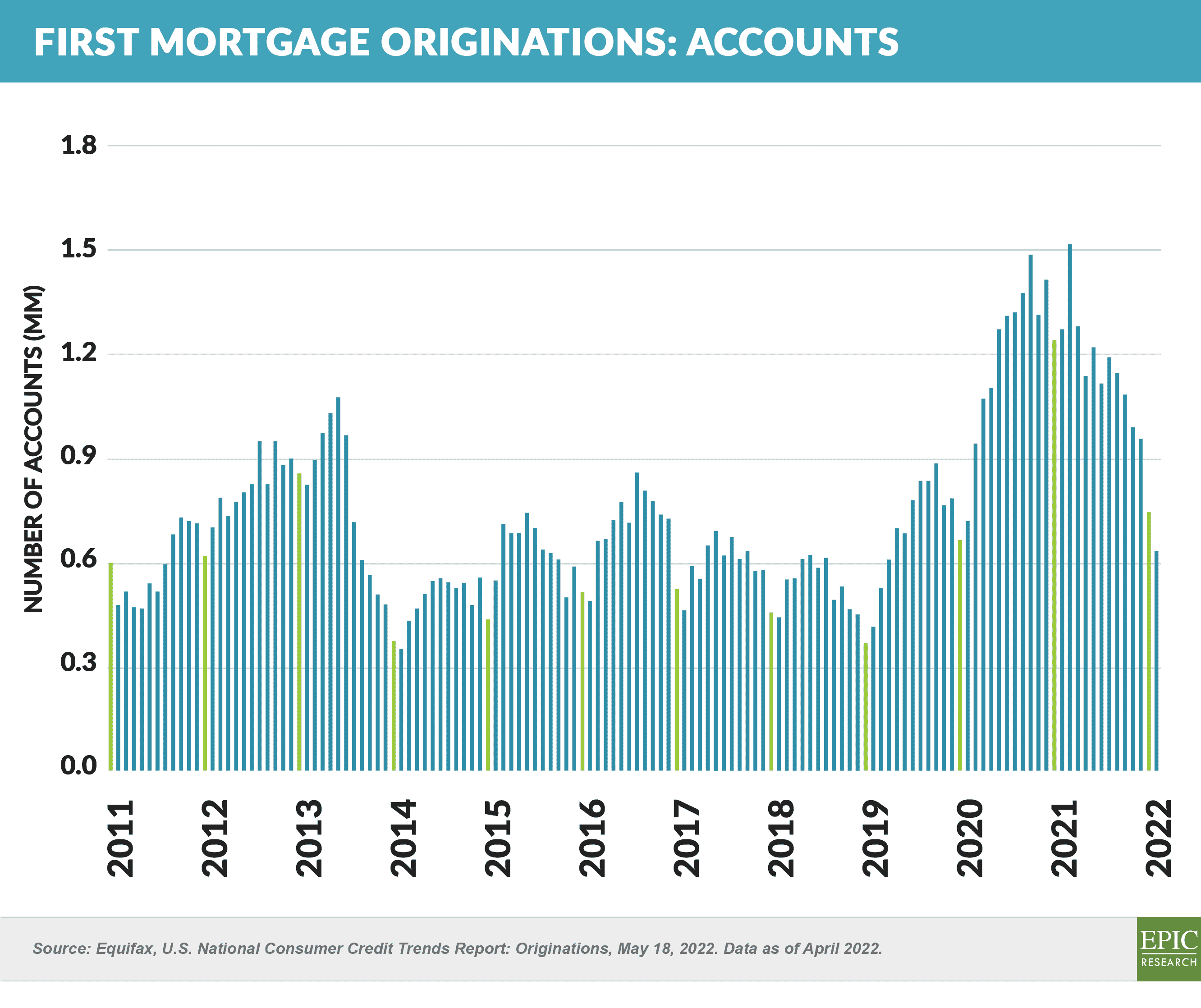

- First mortgage originations in Q1 2022 were down 44% from Q1 2021

If the Epic Report was forwarded to you, click here to add your name to the mailing list.

The Epic Report is published monthly, with the next issue publishing on July 9th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.