Three Things We’re Hearing

- BNPL-ooza

- BNPL growth continues

- Bank-branded cards dominate the mail

A Four-minute read

If the Epic Report was forwarded to you, click here to subscribe

BNPL-ooza

- Each month, the frenzy surrounding buy now, pay later (BNPL) programs reaches new heights, and no topic comes up more frequently in our industry conversations

- Despite the recent attention, the BNPL concept has been around for decades

- Citizens Bank’s successful “iPhone Upgrade Program”, launched with Apple in 2015, finances iPhones through Apple retail stores and online

- American Express has offered its “Pay Over Time” feature for many years, which allows cardmembers to designate purchases for installment-like treatment after the purchase has been made

- The current iteration of BNPL has several general characteristics:

- Small ticket – generally $500 or less, sometimes higher

- Short term (e.g., four months)

- No consumer finance charges (unless the consumer “busts” and doesn’t pay within the stated term)

- Lender revenue comes primarily from the merchant discount rate (MDR), supplemented by consumer late fees and the occasional finance charges on busted loans

- One issue for lenders is that the profit on BNPL loans is significantly less than that of traditional installment loans

- The primary lever to increase lender revenue is via a higher MDR

- However, with the current competitive mania amongst lenders, increasing MDR rates may be challenging

- A second, potentially more pressing concern is the lack of data on the long-term asset quality of these loans

- Many BNPL loans are made without pulling a credit bureau report

- While surveys show that more than one-third of consumers who have taken a BNPL loan have missed a payment and that many consumers have multiple BNPL loans, most BNPL loans are not reported to credit bureaus

- The U.S. is less penetrated with BNPL offerings than many other countries and is currently dominated by fintechs such as PayPal, Affirm, Afterpay, and Klarna

- However, many traditional lenders, like Citi and other card issuers, offer similar “after purchase” installment programs

- Retailers are getting into the game, generally with a lending partner – this year alone, 20+ BNPL deals have been announced with retailers such as Apple, Target, Amazon, and Walmart forging alliances with leading BNPL players

- Despite the swarm of activity, BNPL is still in the early adoption phase, representing perhaps 1% of U.S. loan activity, with analysts estimating that it will reach a steady state market share between 2% - 4% over time

- A recent TransUnion survey showed that BNPL customers still use traditional forms of credit such as credit cards

- BNPL shows signs of a bubble, with most lenders lacking experience with anything other than the historically benign credit quality environment of the past 12 years

- As competitive pressure and the inevitable upswing in consumer delinquencies stress the BNPL segment, consolidation is likely on the horizon

BNPL Growth Continues

- Epic recently surveyed over 1,000 consumers regarding their experiences with BNPL loans, and the data provided some interesting comparisons with a similar survey we ran in September 2020

- Email us for the full results of our recent BNPL survey

Bank-Branded Cards Dominate the Mail

- Consistent with recent months, credit cards and student loans remain the only products that have recovered to pre-pandemic levels of mail volume

- As in prior months, proprietary branded cash back and rewards cards dominated card mail volume – September saw all of the top 20 mailed offers falling into these categories

- Another interesting development is that four venture-backed “near prime” issuers – Mercury, Mission Lane, Avant, and Ollo – are behind the top 13 products mailed

- Through focus and the hiring of top-notch risk management talent, niche players such as these four and others have effectively dominated this sector

- The near prime space has been largely ignored by traditional banks as “too risky,” however it may be beneficial for them to consider a thoughtful entry via acquisition

- Digital acquisition costs have continued to rise with “cost per click” rates for HELOC, student loans, and education refinance loans reaching pre-pandemic levels

- Following the rise in digital ad costs, some advertisers moved ad spend to other channels, including TV and direct mail

Quick Takes

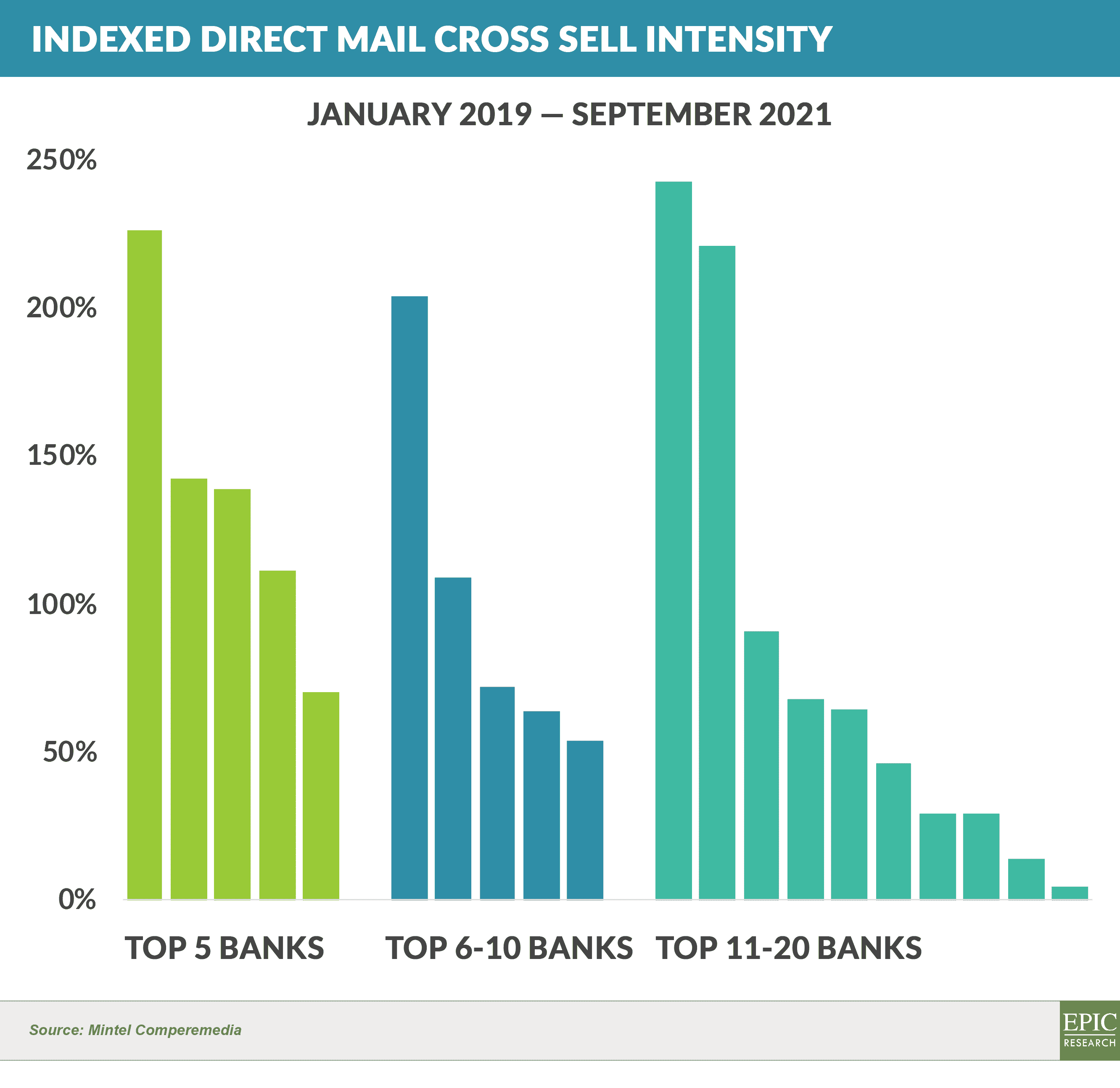

- Epic has recently examined cross sell intensity – the rate at which lenders send other product offers to their existing customers

- As shown in the above chart, cross sell rates vary widely across institutions, with larger banks generally having somewhat higher volumes than smaller ones; however, this data reflects direct mail offers only, with many banks cross selling to their customers via email and other digital channels

- Advertisers and printers are reporting widespread paper shortages, along with increased costs for paper and freight, and allocations among customers that could have a material effect on financial product mail volume

- Ally Financial announced that it agreed to acquire Wilmington-based near prime card issuer Fair Square Financial for $750 million

- Ally previously announced an ultimately unsuccessful acquisition of CardWorks

- Fair Square has 650,000 “Ollo” branded card accounts, with $750 million in loans outstanding

- BNPL firm Klarna unveiled a “super app” that consolidates shopping, payment management, and support for products, delivery, and returns, intended to help transform Klarna from a payments platform into a shopping hub

The Epic Report is published monthly, and we’ll distribute the next issue on December 4th.

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here. To subscribe to our newsletter, click here.