Three Things We’re Hearing

- Big credit card opportunity for retail banks!

- Financial services digital advertising grows

- Credit card metrics returning to “normal”

A two-minute read

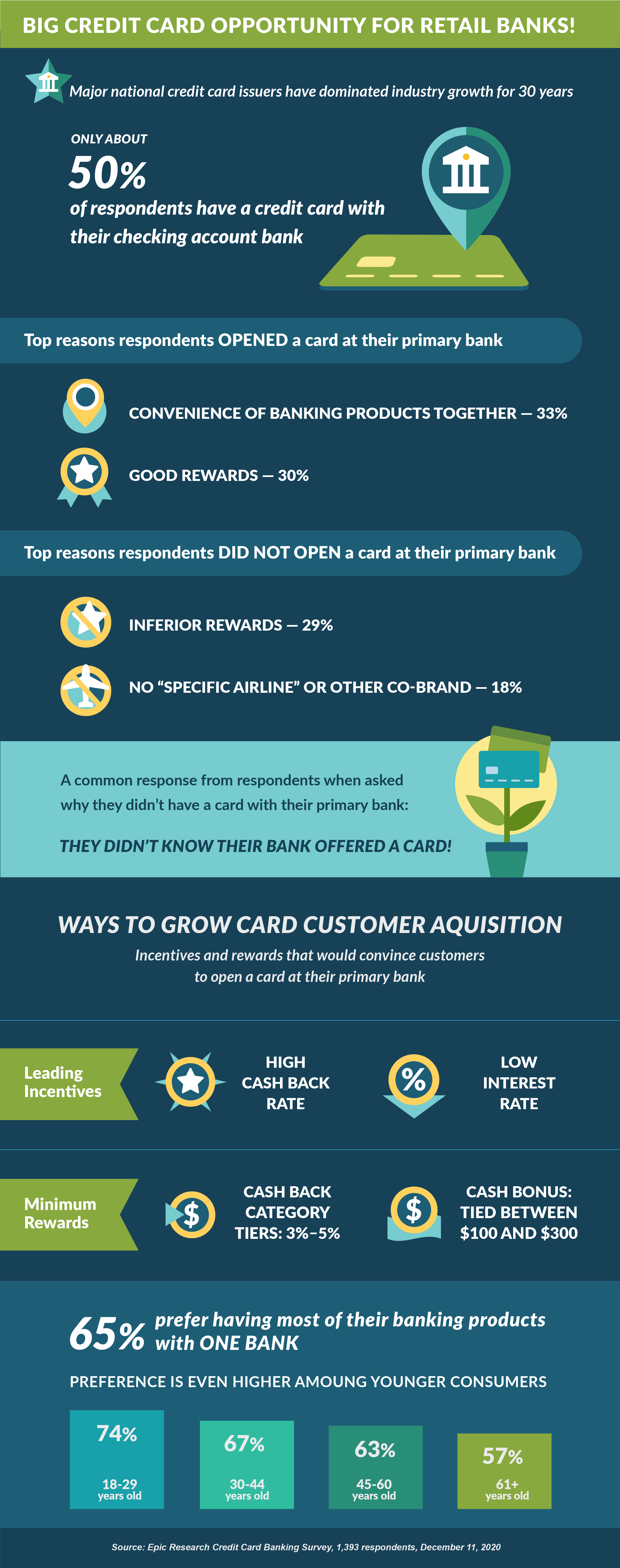

Big Credit Card Opportunity for Retail Banks!

- Epic recently conducted a survey of nearly 1,400 consumers, which revealed a large marketing opportunity for local banks to offer a competitive cash back/rewards card to their customer bases

- Click here to request the full survey report.

Financial Services Digital Advertising Grows

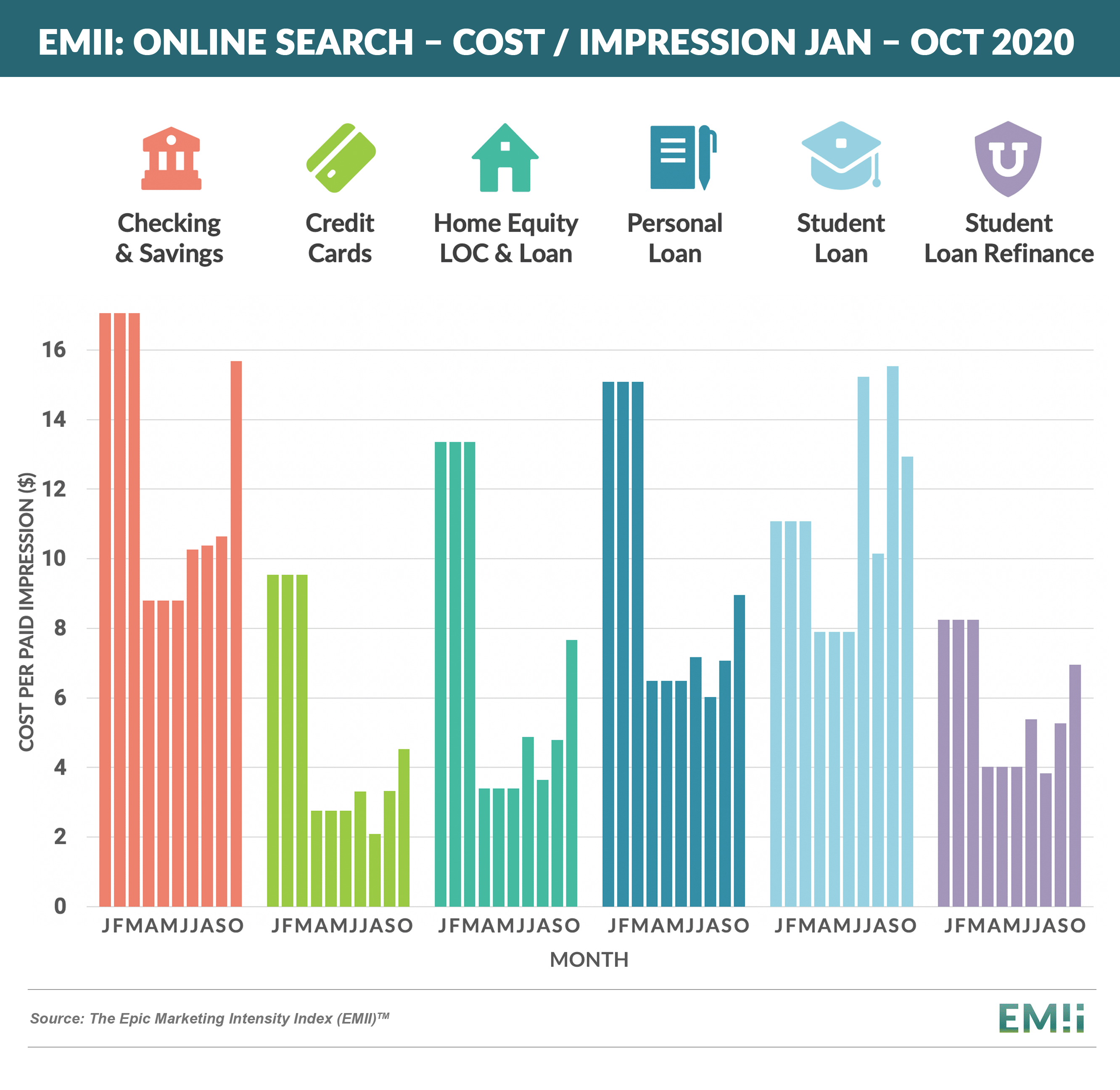

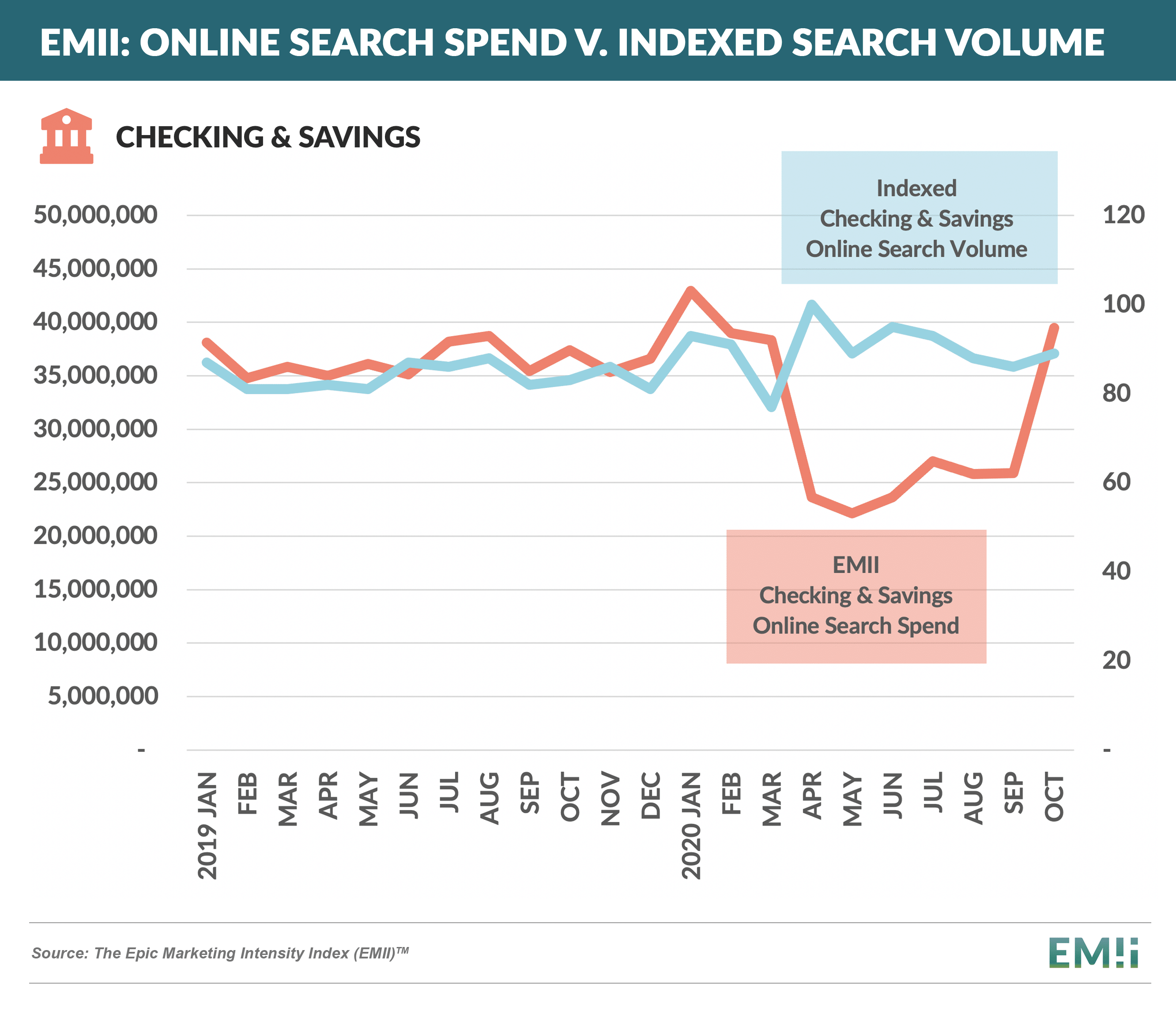

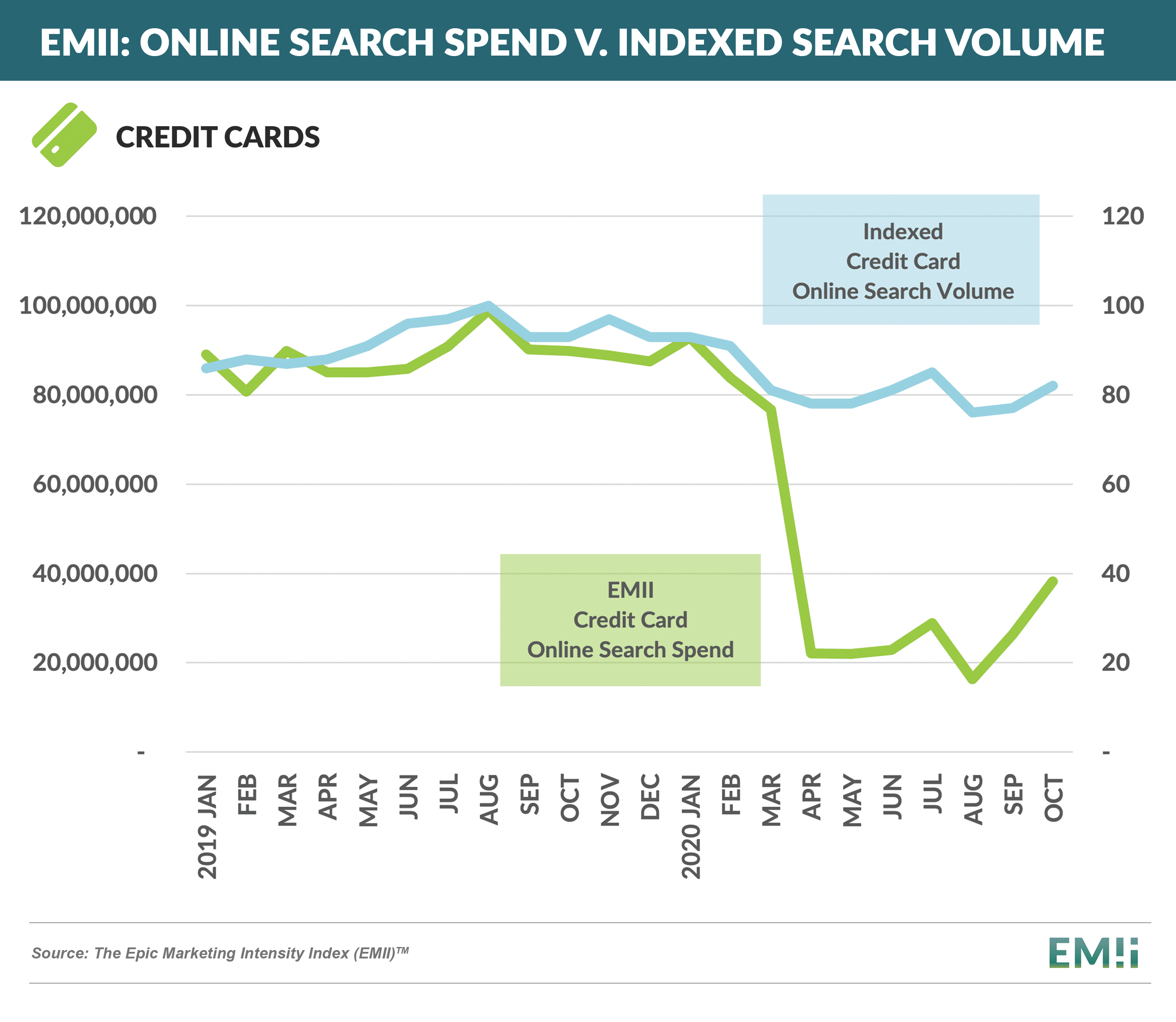

- Mirroring the rebound in financial services direct mail volume, digital advertising has increased in the past few months as indicated in the increase in cost-per-click across a number of products

- The Epic Marketing Intensity Index (EMII) measures acquisition spending for consumer finance products (cards, loans, deposits, home equity, education) and channels (direct mail, search, paid digital)

- Checking and savings lead the way in the online recovery, with search spend now approaching pre-pandemic levels

- Consumer demand, as shown in the blue search traffic line, has stayed steady

- While credit card mail volume has rebounded close to pre-pandemic levels, online spending still lags

Credit Card Metrics Returning to “Normal”

- Recent commentary from some of the top card issuers indicates several consistent trends:

- Spending is back to pre-shutdown levels or above

- Balances remain 5% - 15%+ below the same period last year

- Delinquencies remain favorable

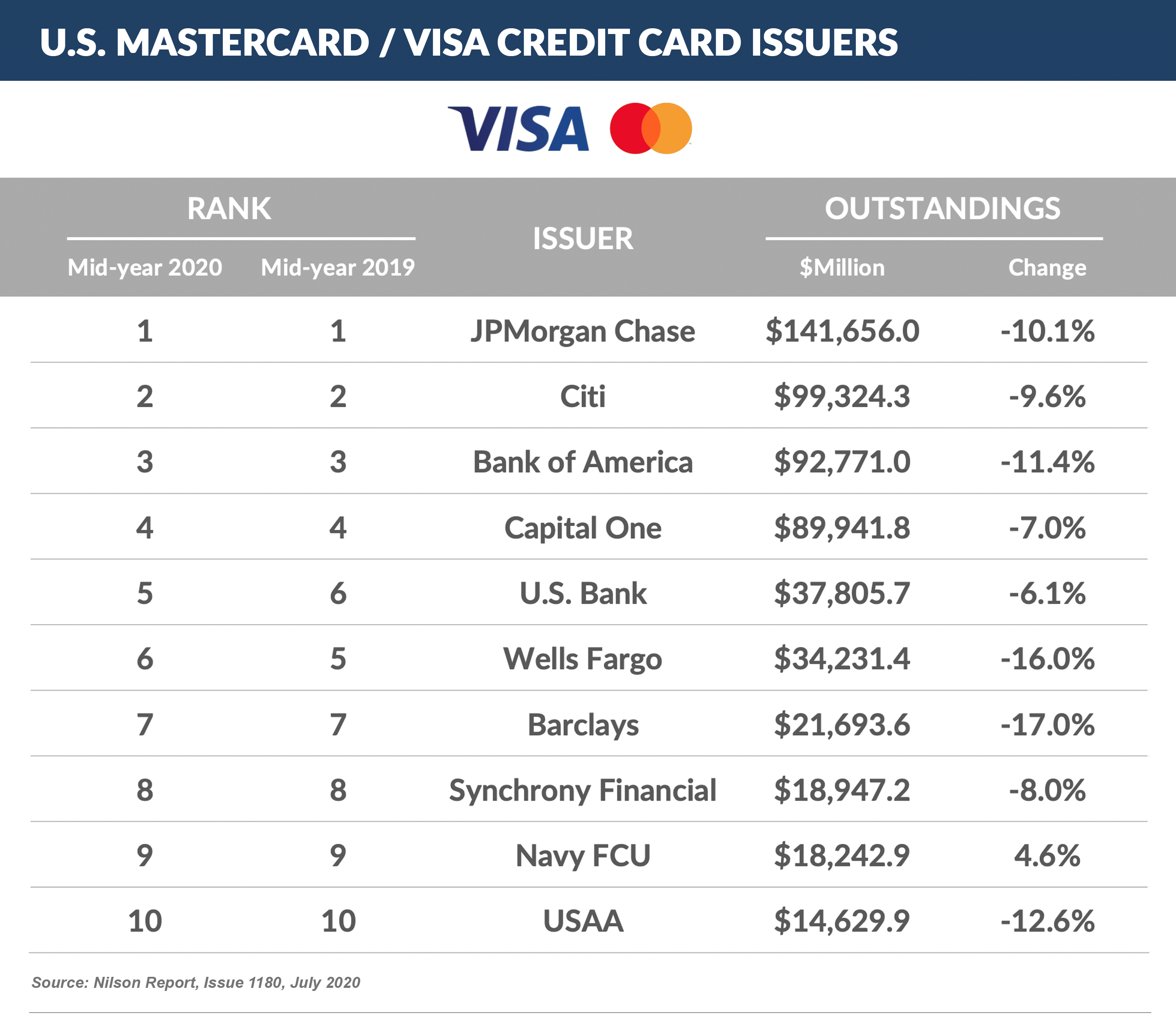

- Mid-year rankings of the top issuers did not change much from 2019 and reflect across-the-board balance shrinkage

- Recent increases in marketing spending for new customer acquisition should help bring growth back to card portfolios in 2021

Quick Takes

- The student loan payment pause has been extended to January 31st, causing many education refinance lenders to scale back their programs until payments resume

- Buy-now-pay-later products are seeing a dramatic surge in consumer adoption with Bank of America predicting 10-15x growth by 2025

- Going against this trend is Capital One, which is ending the buy-now-pay-later feature on its cards, deeming them as “too risky”

Thank you for reading.

The next Epic Report will publish in three weeks on January 9th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.