Three Things We’re Hearing

- American Express sets the pace

- Personal loan mail volume lags

- What’s on the horizon for asset quality?

A three-minute read

American Express Sets the Pace

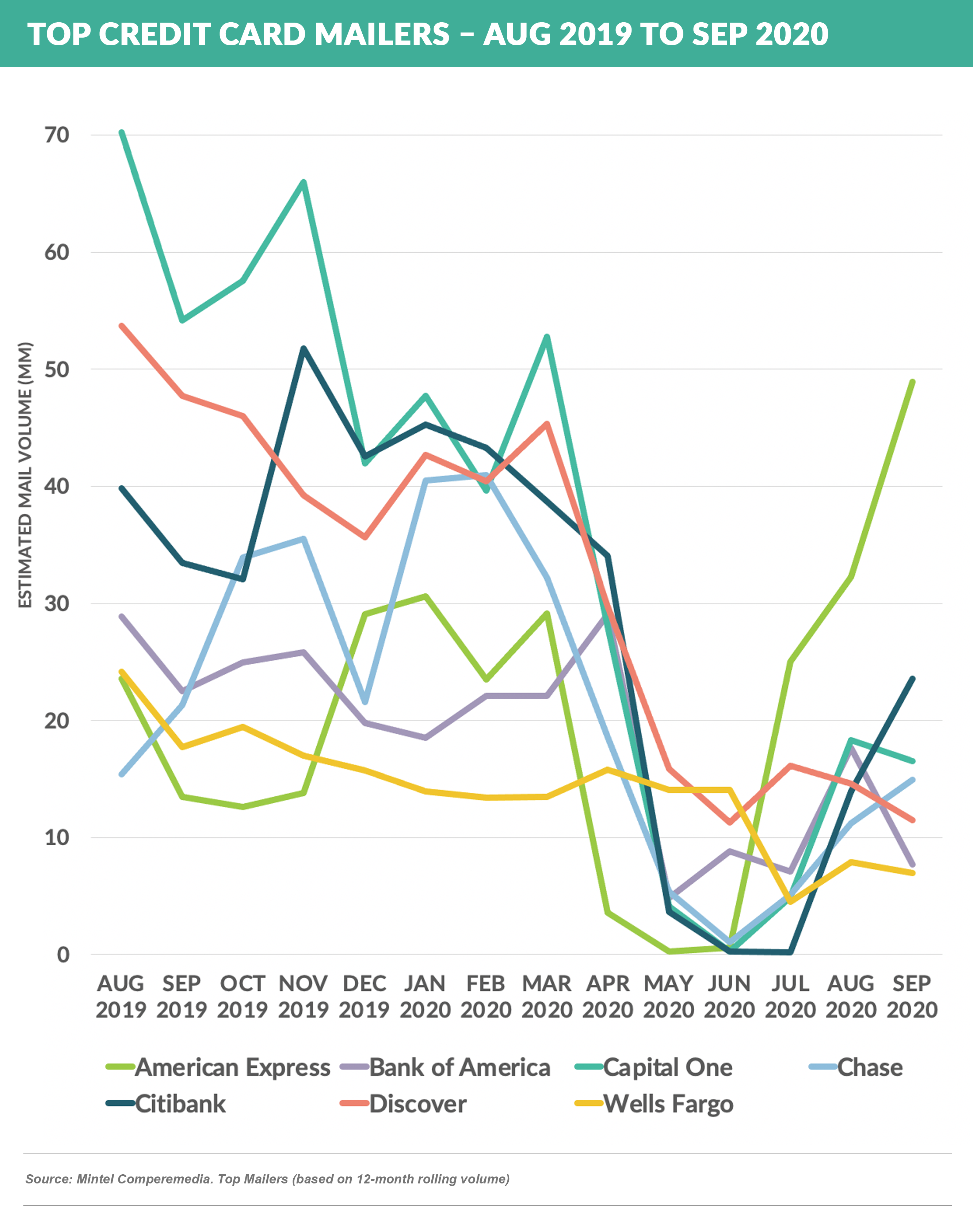

- American Express has boldly re-entered the market as the largest card mailer for the third straight month, mailing a robust, pre-COVID-like, 50 million pieces

- Amex primarily mailed cash back and Hilton offers and their third quarter earnings call mentioned that higher marketing costs should be expected through the fourth quarter

- Citi, Capital One, and Chase have also shown signs of returning to normal mailing volumes in the past two months

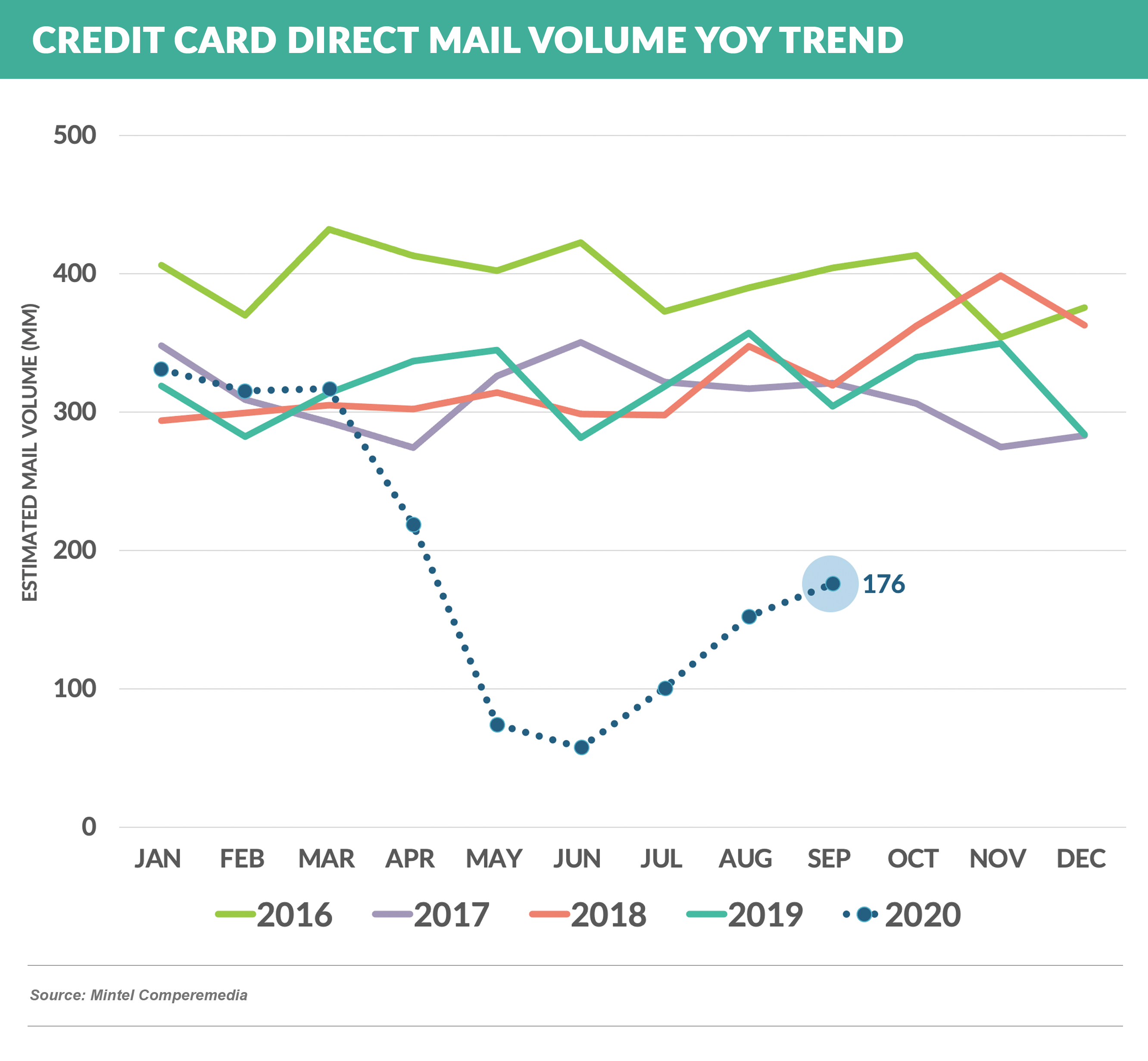

- Since bottoming out in June, overall credit card mail volume has maintained a slow recovery, with September numbers showing a continuation of that trend

- 176 million pieces were mailed in September, which was up 16% from the 152 million mailed in August, but still down 41% from September 2019 levels

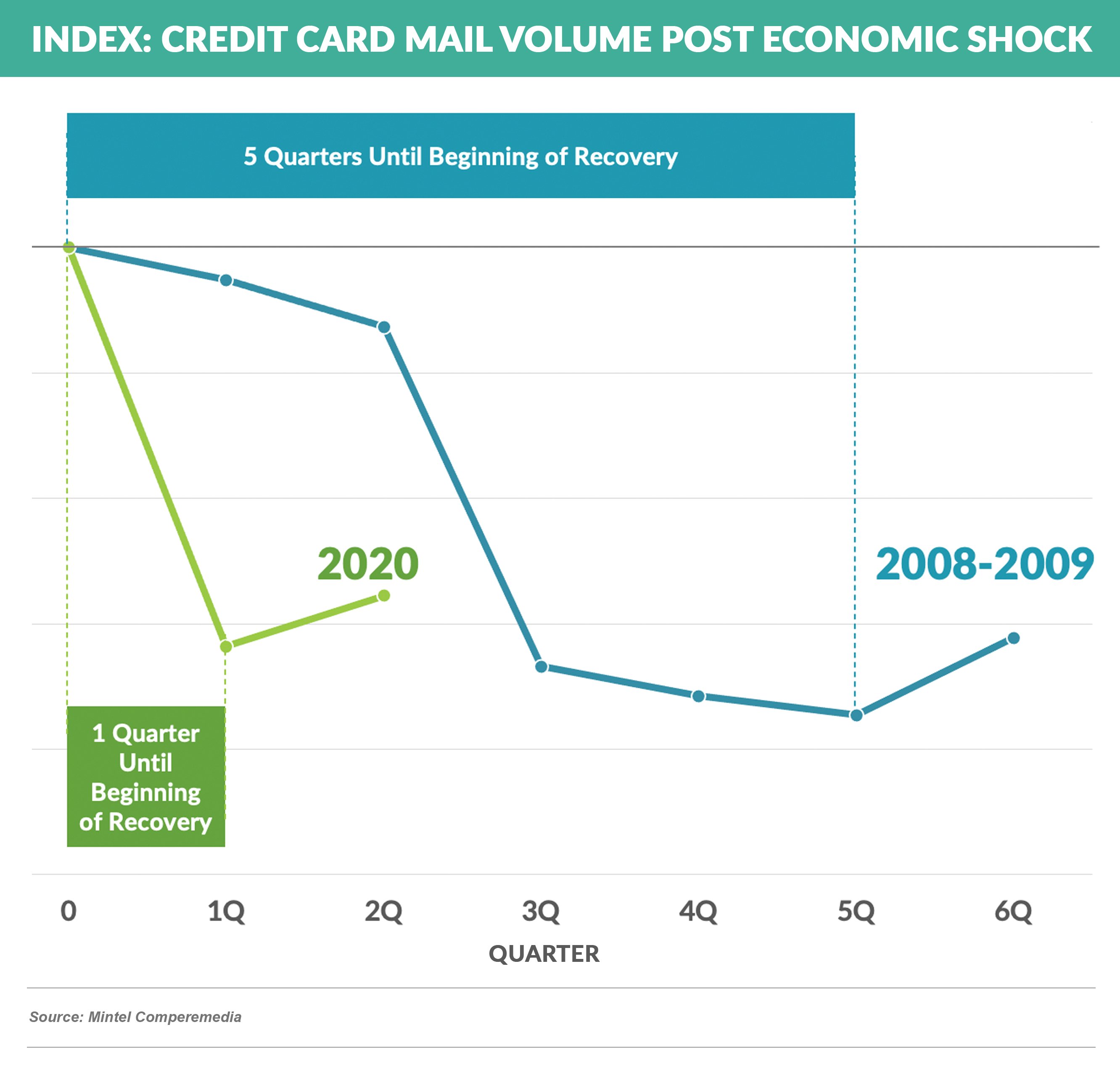

- Despite the lower numbers, the rebound of mail volume post-economic shock (March 2020) came much sooner than the rebound following the prior significant financial event of 2008-2009

- Following the ’08/’09 economic downturn, credit card mail volume dropped for five quarters following the initial economic shock, while the 2020 pandemic volume began recovering after only one down quarter

- Several issuers have signaled plans for larger 4Q card campaigns

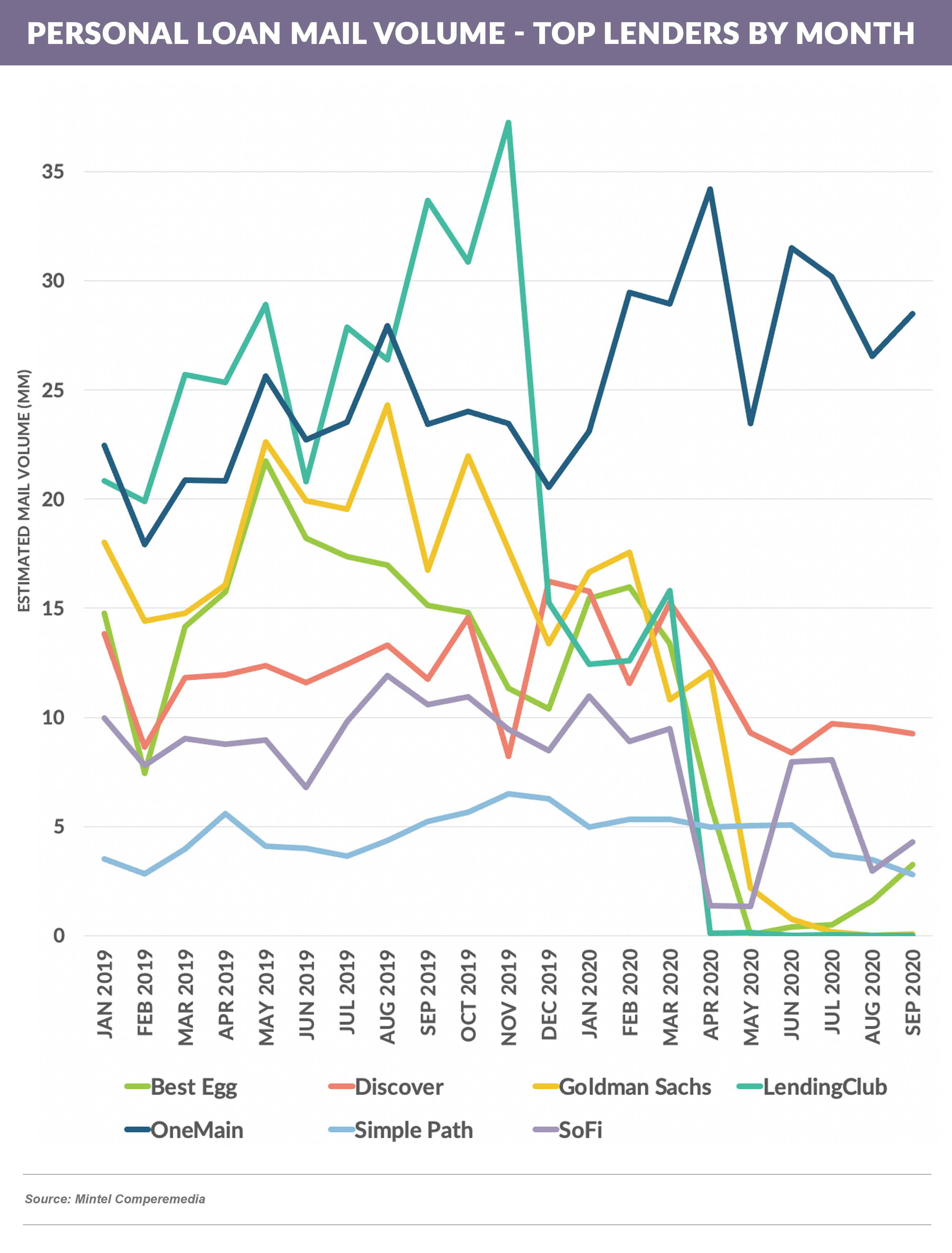

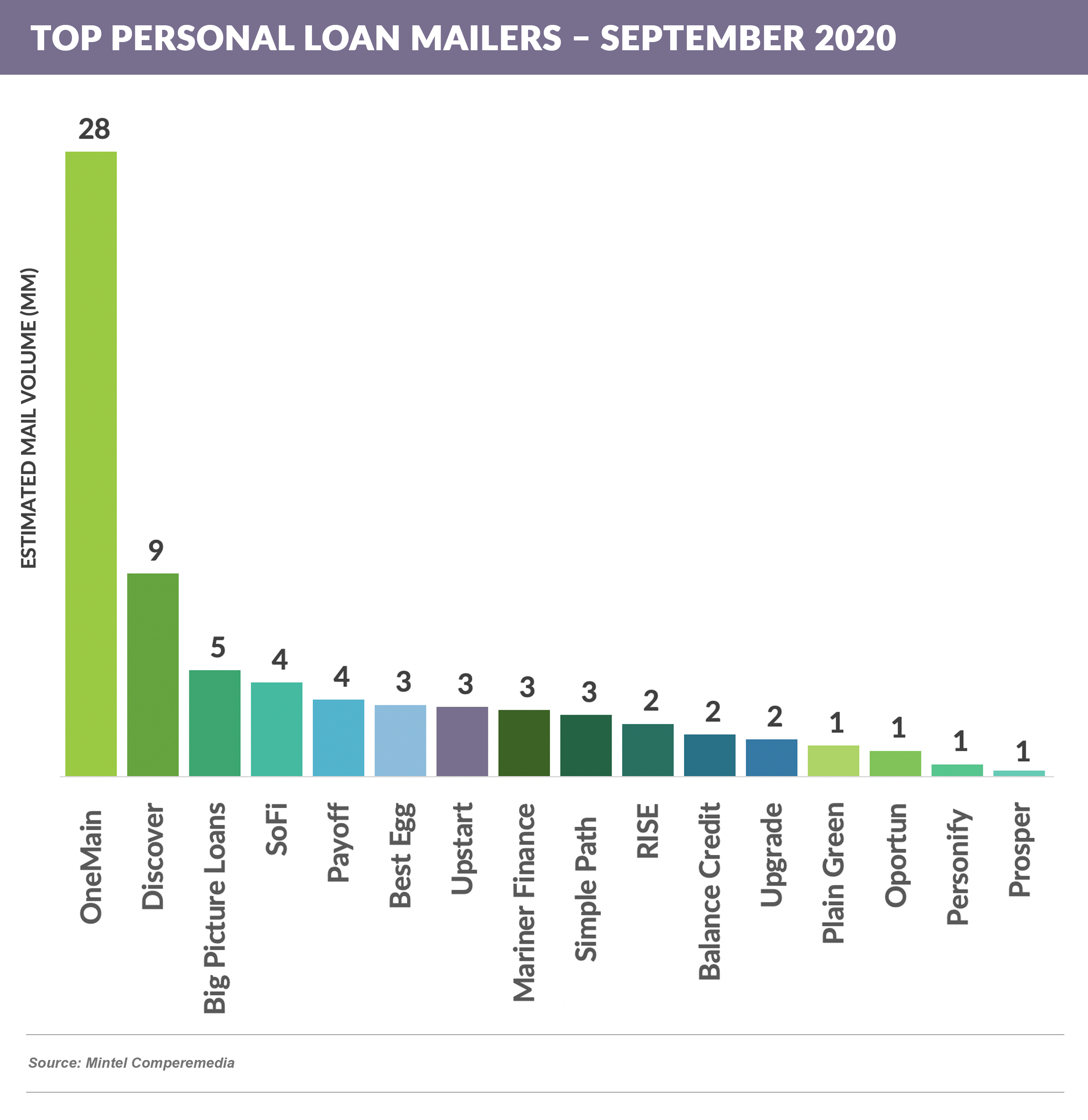

Personal Loan Mail Volume Lags

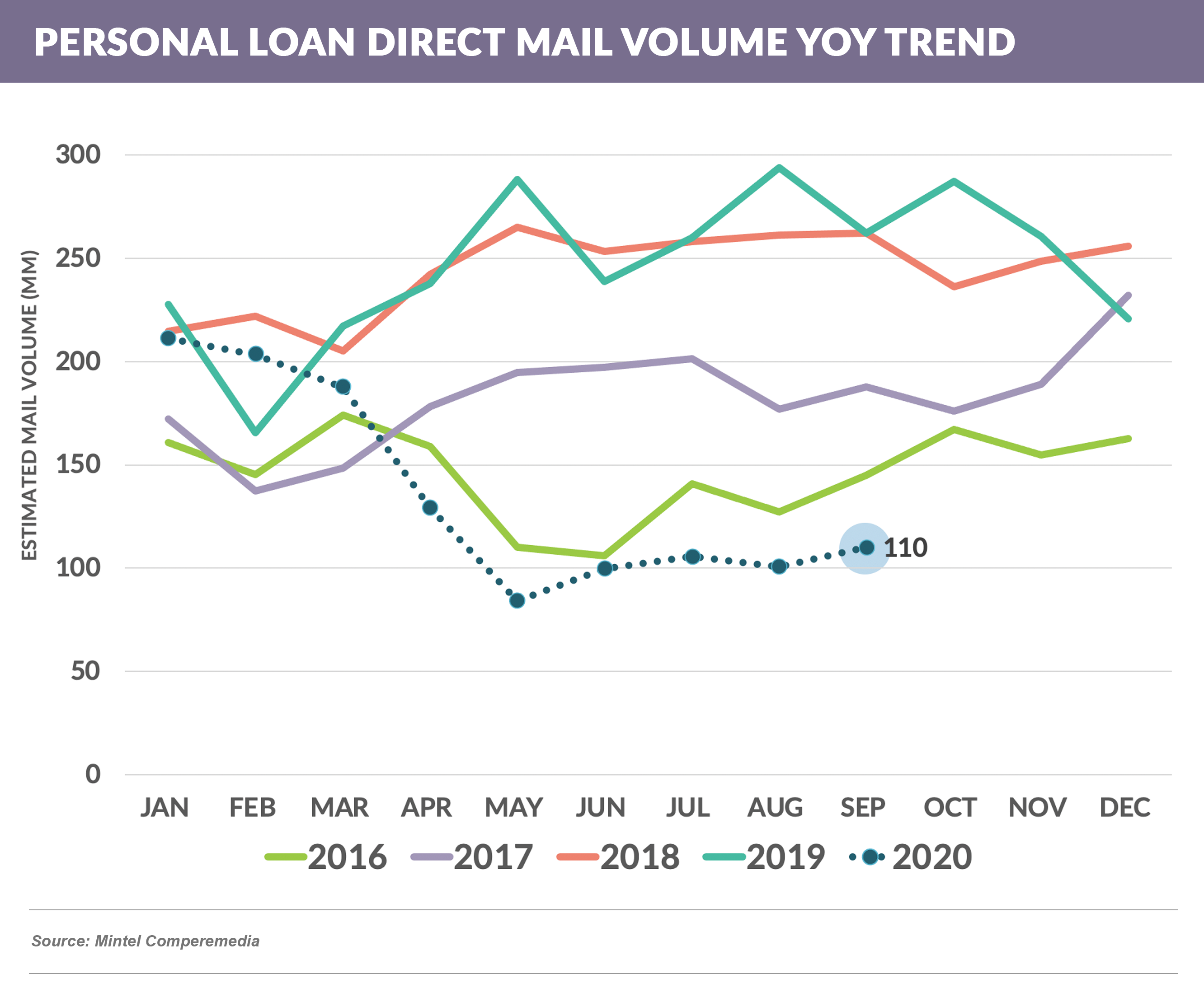

- Personal loan mail volume has had a slower recovery than credit cards

- September mail volume was 7% higher than August, but still down 58% vs. September 2019

- OneMain remains the mail volume leader for the 9th straight month, and is up 22% vs. September 2019

- Traditional banks have been absent from the top mailer lists, with none appearing in the top 15 mailers in September

What’s on the Horizon for Asset Quality?

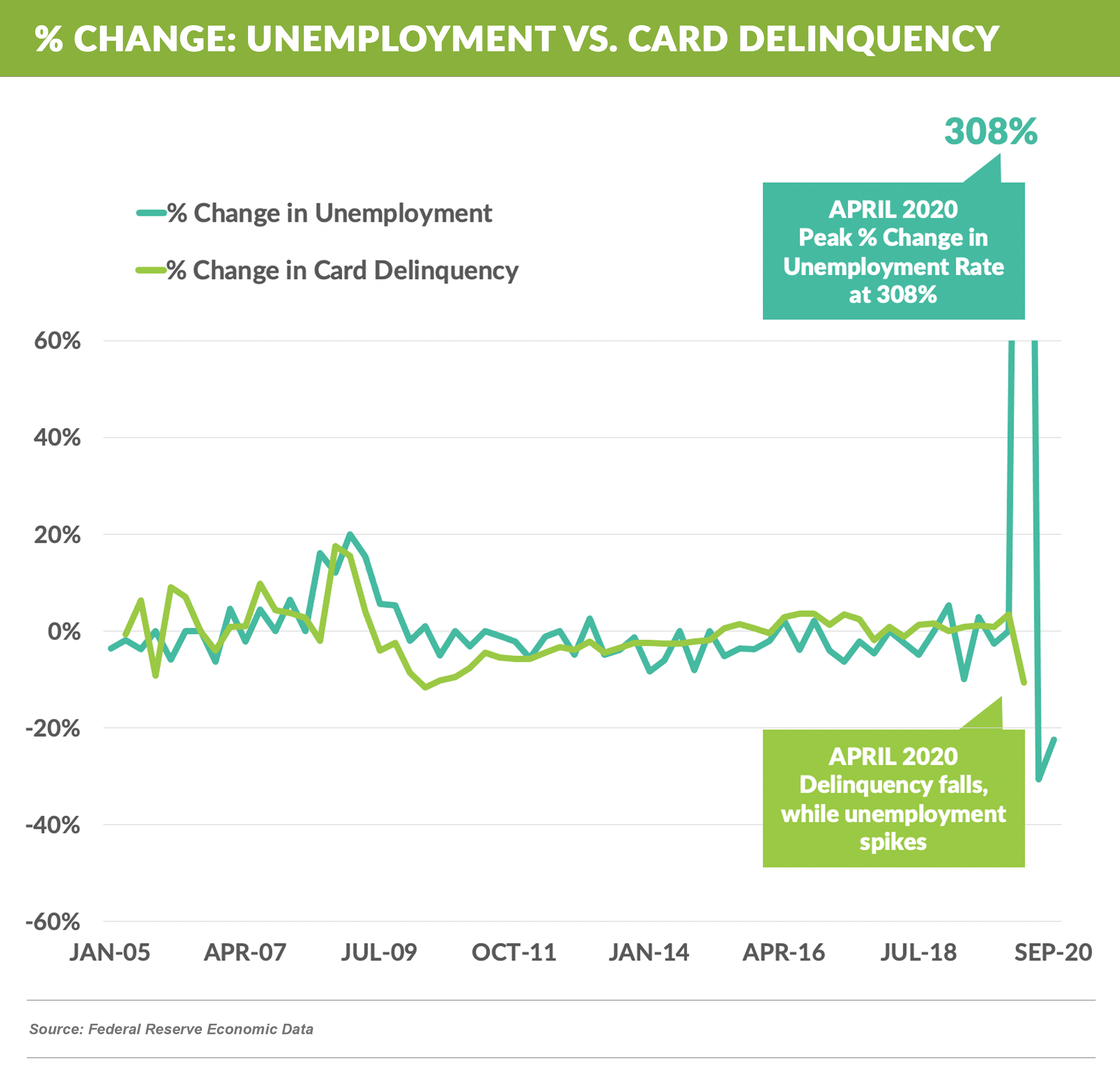

- In the last Epic Report, we noted the continuation of record low levels of delinquency in both credit card and personal loan portfolios

- This data is inconsistent with the historic trend of delinquency spiking within a quarter of the beginning of rises in unemployment

- The more relevant question remains, where does asset quality go from here? Many lenders are anxious to take advantage of low rates and relatively low competitive levels to aggressively re-enter the market, however there is an open question of whether deterioration in asset quality has been prevented by trillions of dollars in stimulus payments, or if it has only been delayed

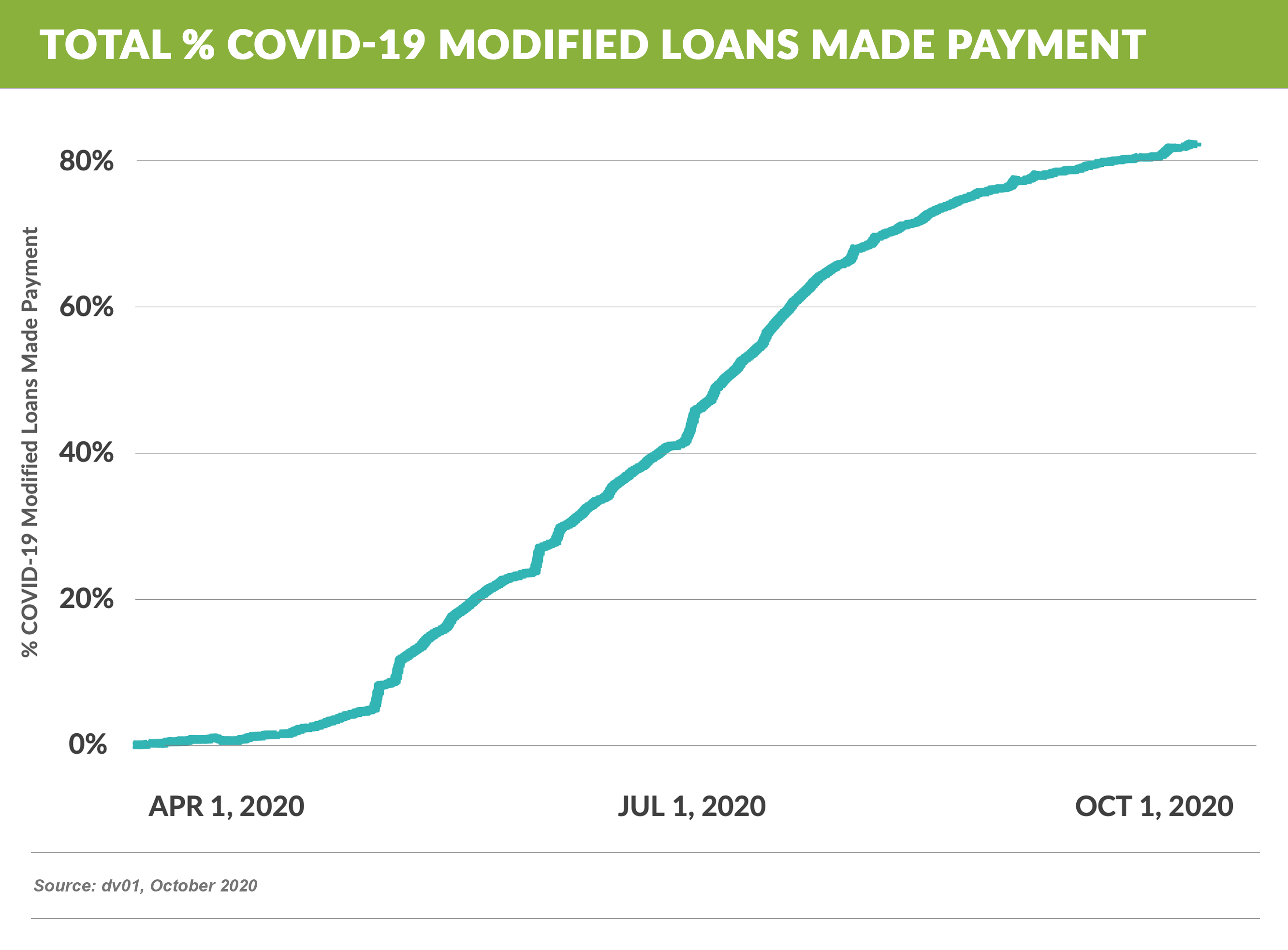

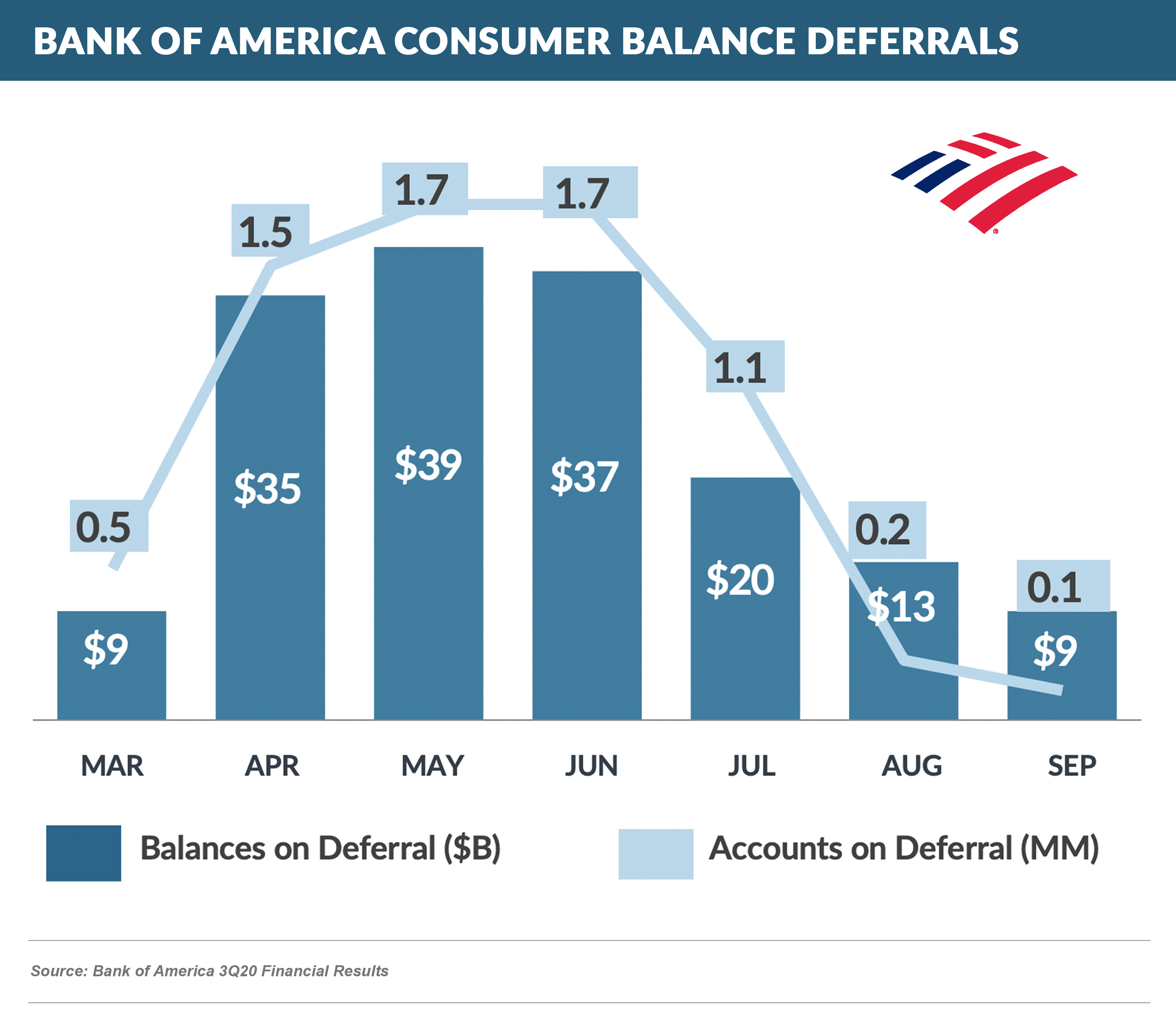

- A look at forbearance trends might indicate that consumers have, for the most part, weathered the storm, as shown in the chart below, which indicates 81% of personal loan accounts that were in forbearance have now resumed making payments

- Bank of America reported last week that forbearance across its consumer portfolio (credit cards, auto loans, mortgages, HELOC, and small business) had dropped 77% since the May peak, and now represented only 2.8% of that combined portfolio

- Additionally, Bank of America announced that card spending in September, and for the first nine months of 2020, was higher than that of 2019, while Citi and Chase showed improvements in customer spending, but were still down from 2019 YTD likely due their concentration of T&E cards, which have lagged in spending over the past seven months

- While remaining an unknown, many bank executives and analysts feel that most banks have adequate loan loss reserves to deal with future projected increases in net credit losses

Quick Takes

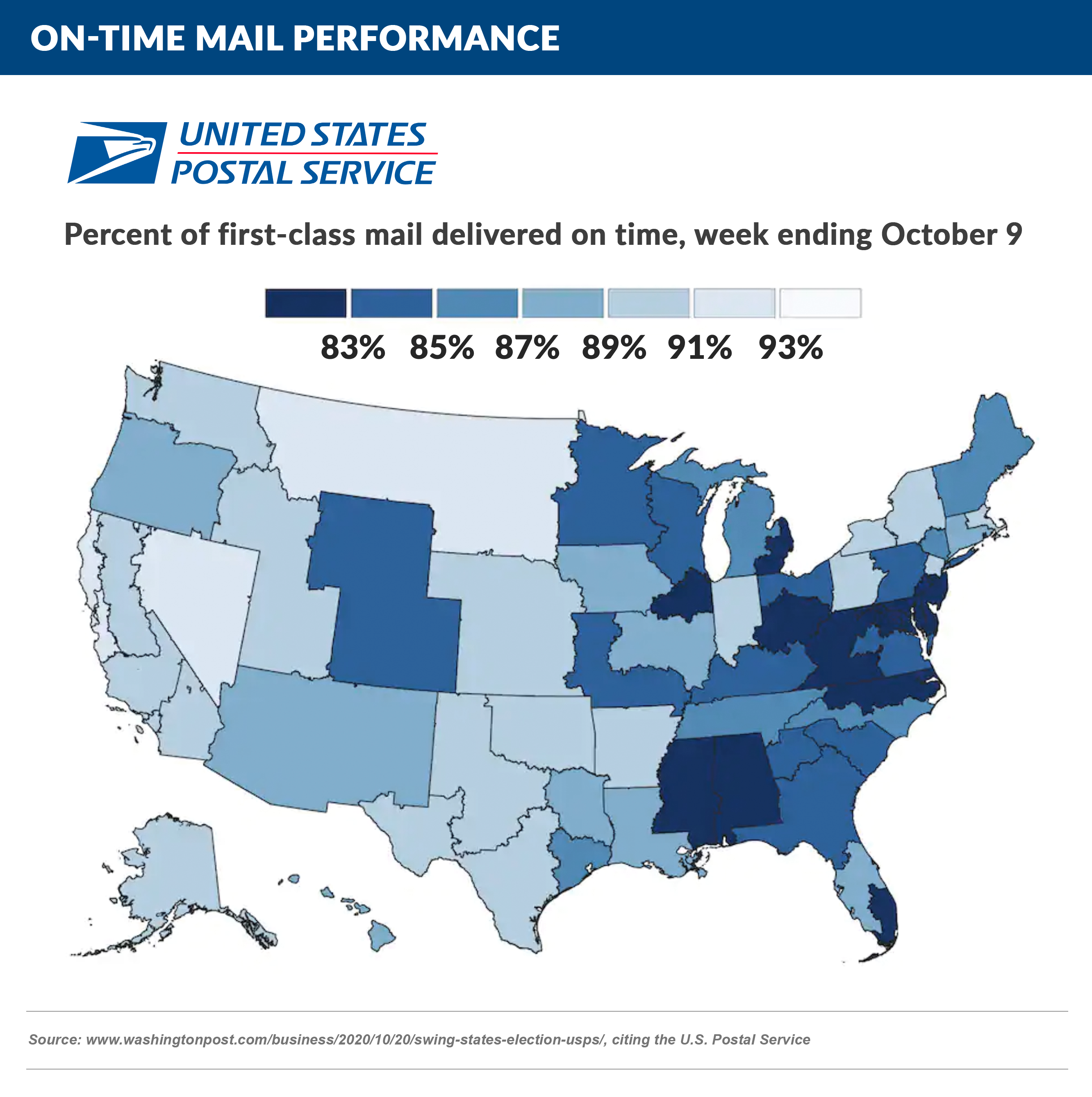

- We’ve seen renewed evidence of slow response curves in several recent direct mail campaigns

- As we noted in the August 22nd Epic Report, mail speed in June lagged considerably when compared to earlier months

- The Washington Post reported that “[c]onsistent and timely delivery remains scattershot as the mail service struggles to right operations after the rollout, then suspension, of a major midsummer restructuring”

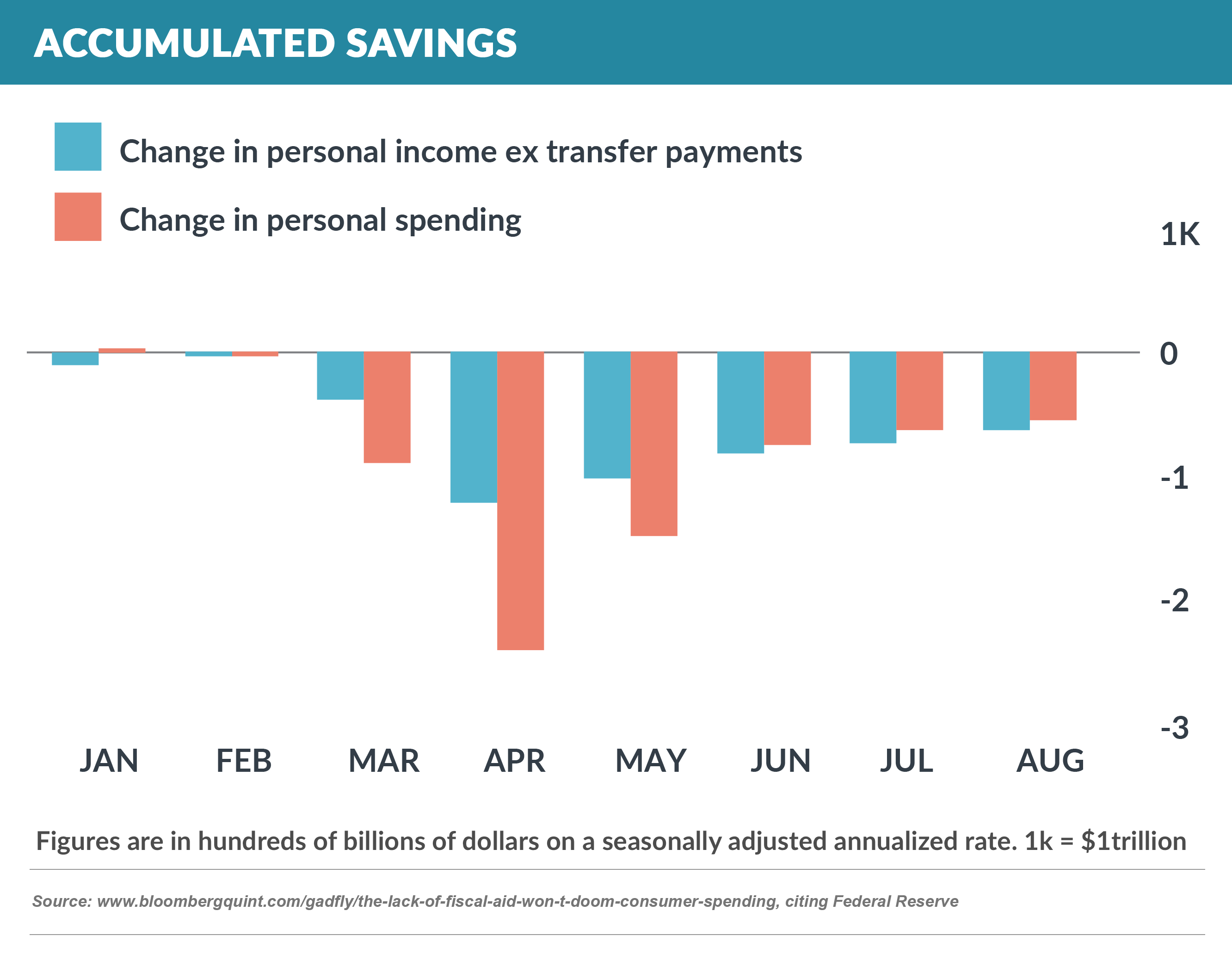

- Federal Reserve numbers reveal another factor in why payment rates are up and delinquency has remained low – there’s much less to spend money on!

- The reduction in personal spending has so far outpaced the decline in personal income

Thank you for reading.

The next Epic Report will publish in two weeks on November 7th.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.