Four Things We’re Hearing

- Credit card mail volume continues to drop

- Personal loan mail volume is also low

- Student and education refi volumes are a bright spot

- Lower marketing expense will impact future growth

A three-minute read

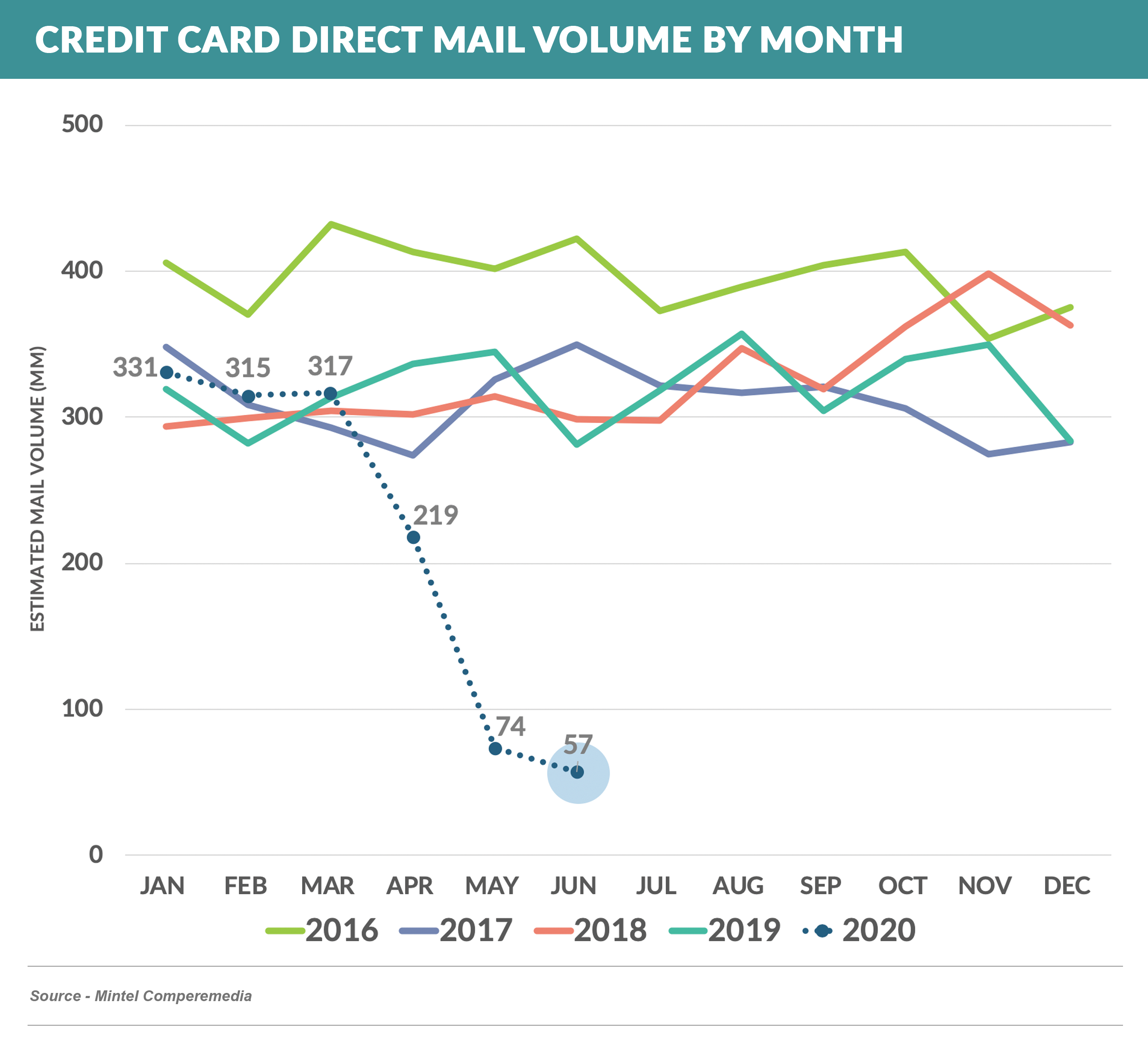

Credit Card Mail Volume Continues Decline

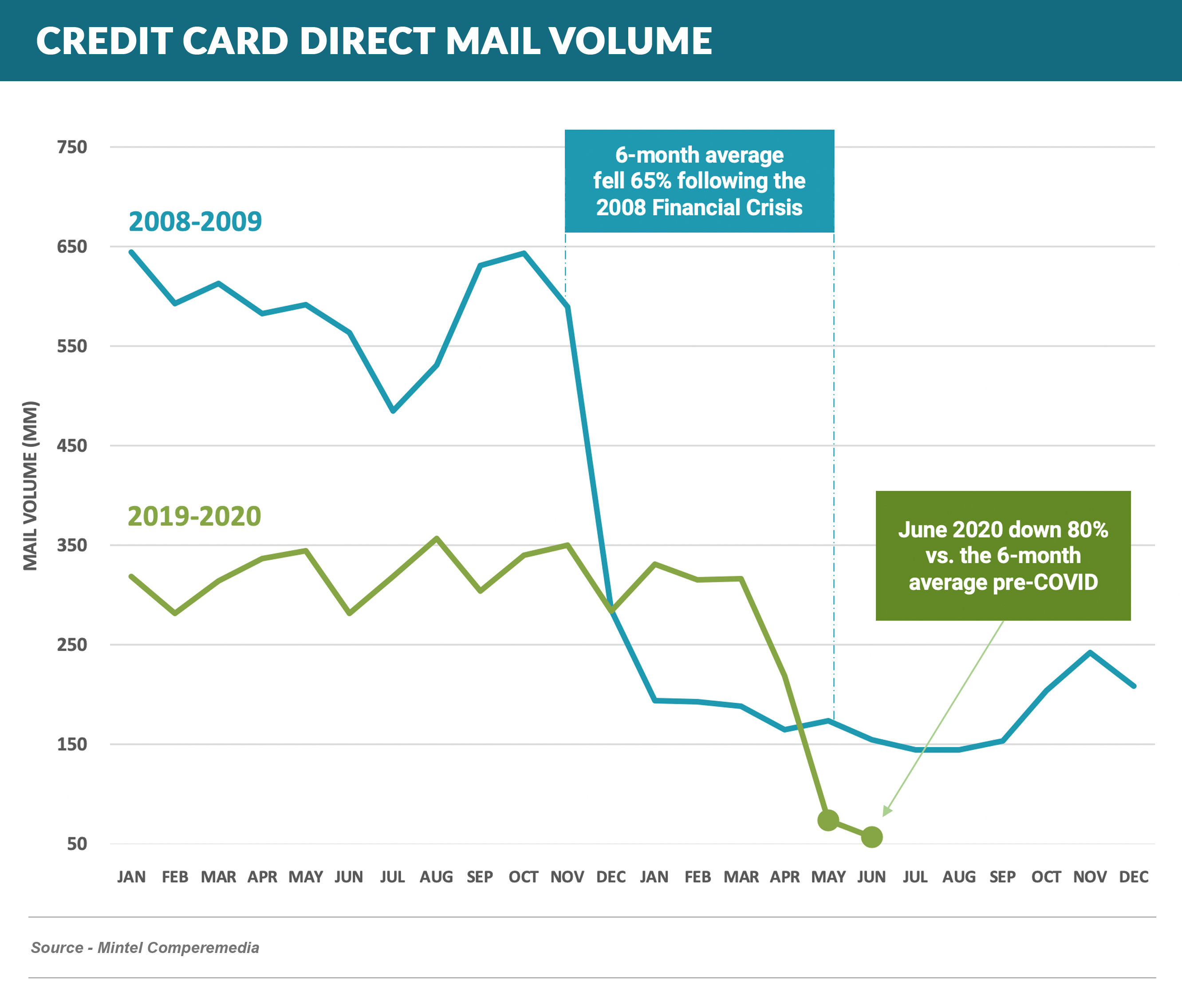

- June mail volume fell from May’s historic lows, dropping to 57 million pieces – over 80% below pre-COVID levels which averaged ~325 million pieces per month

- As reported last month, May mail volume fell to levels lower than even those of the post-’08/’09 financial crisis, and June volume dropped even further

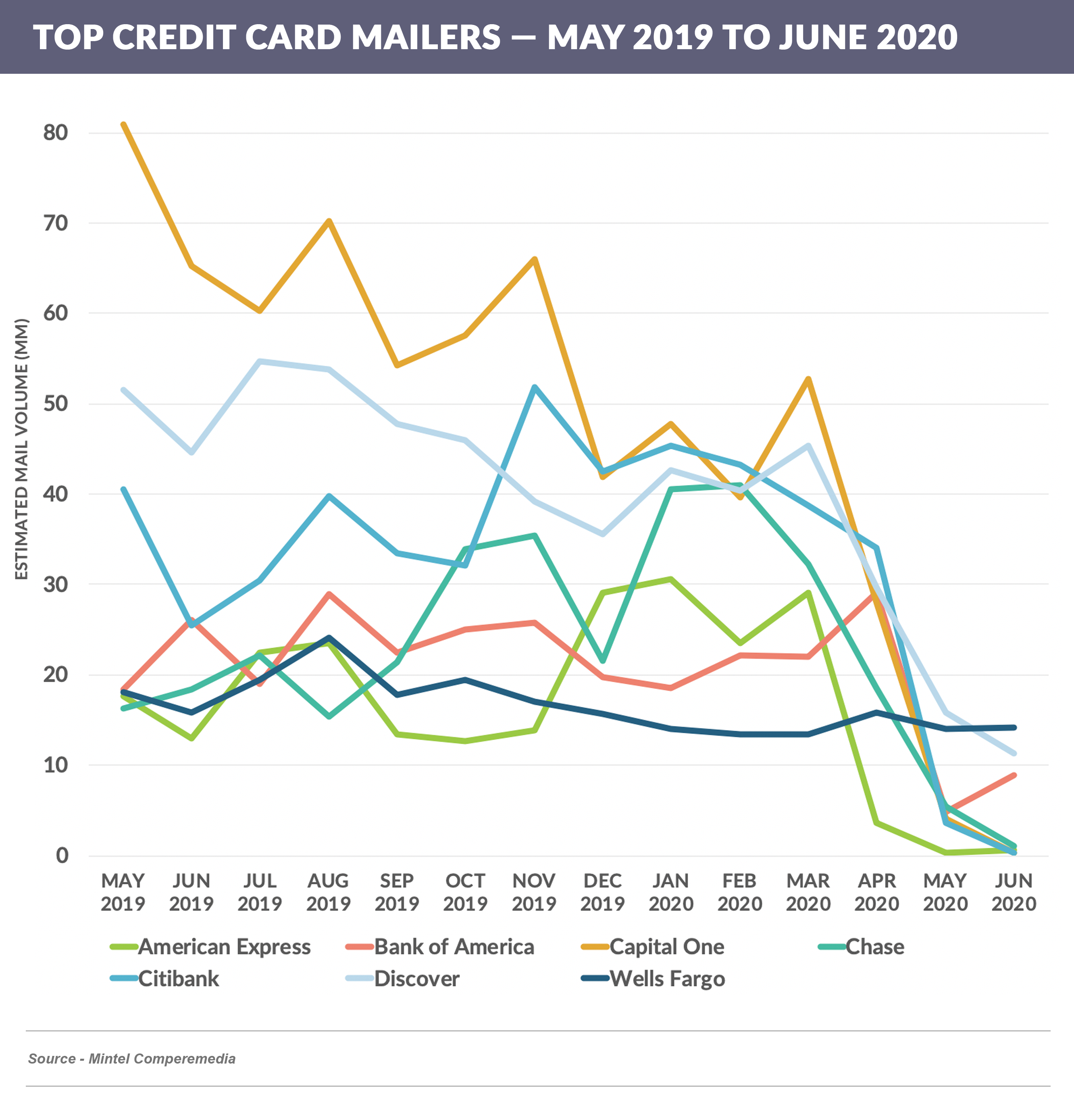

- Wells Fargo and Discover were the largest mailers in June, although at levels (14 and 11 million, respectively) far below normal for the top mailers

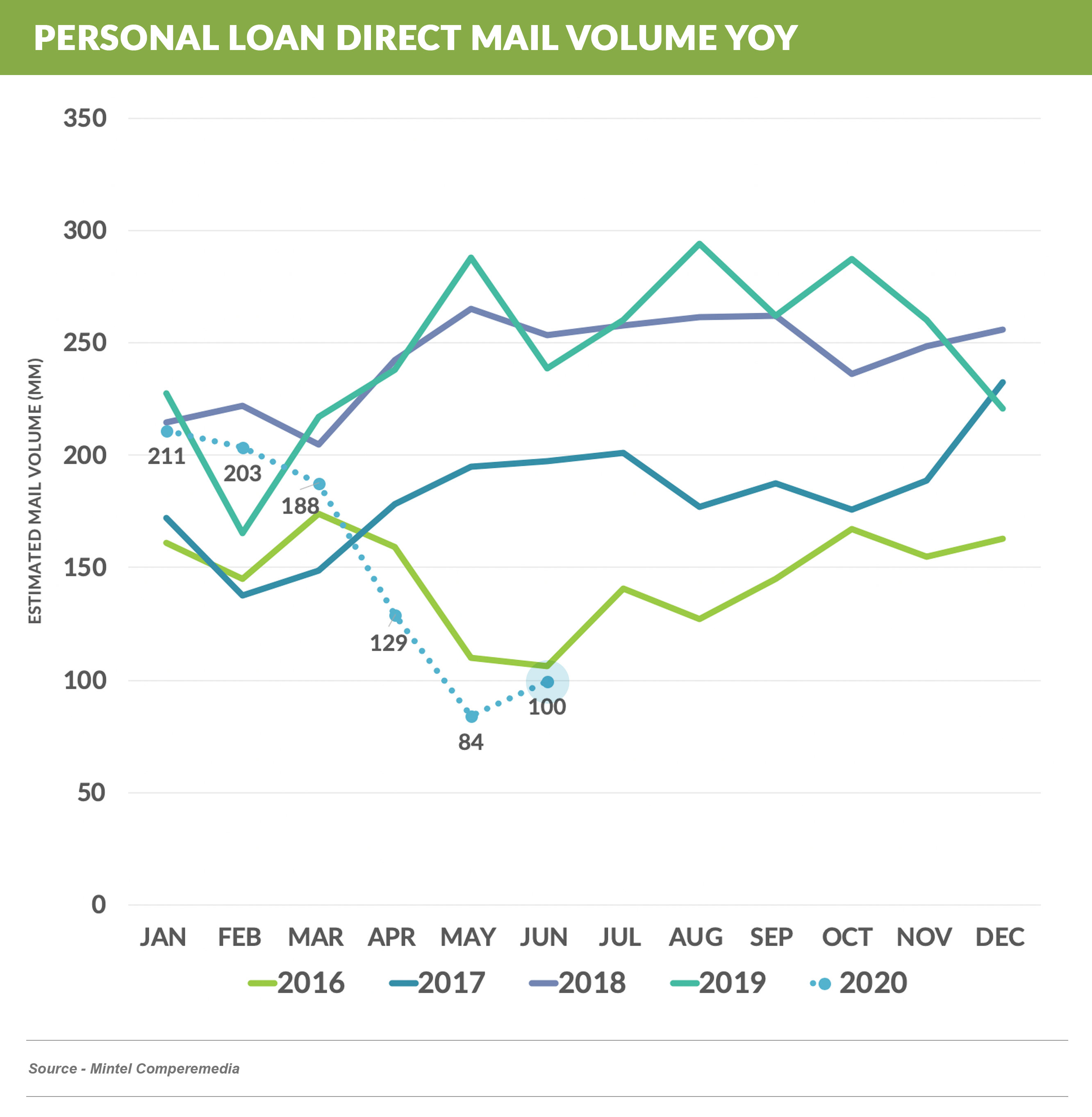

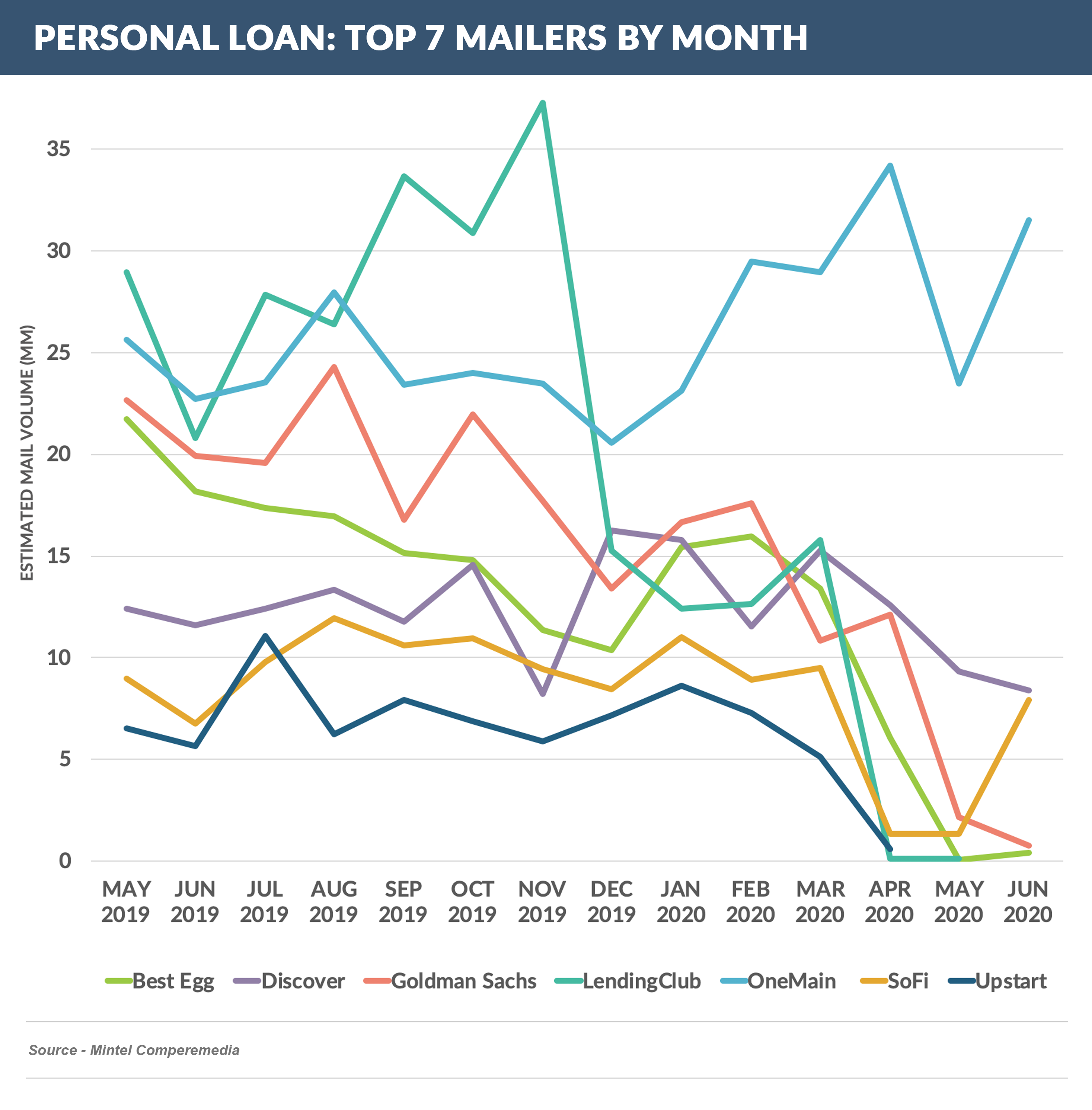

Personal Loan Mail Volume also Down

- Personal loan mail volume in June was 100 million pieces, down 33% vs. June 2019, maintaining the low levels set in May

- Most mailers have lowered mail volume substantially in the past few months, with the exception of OneMain, which has maintained a steady volume throughout the first half of 2020

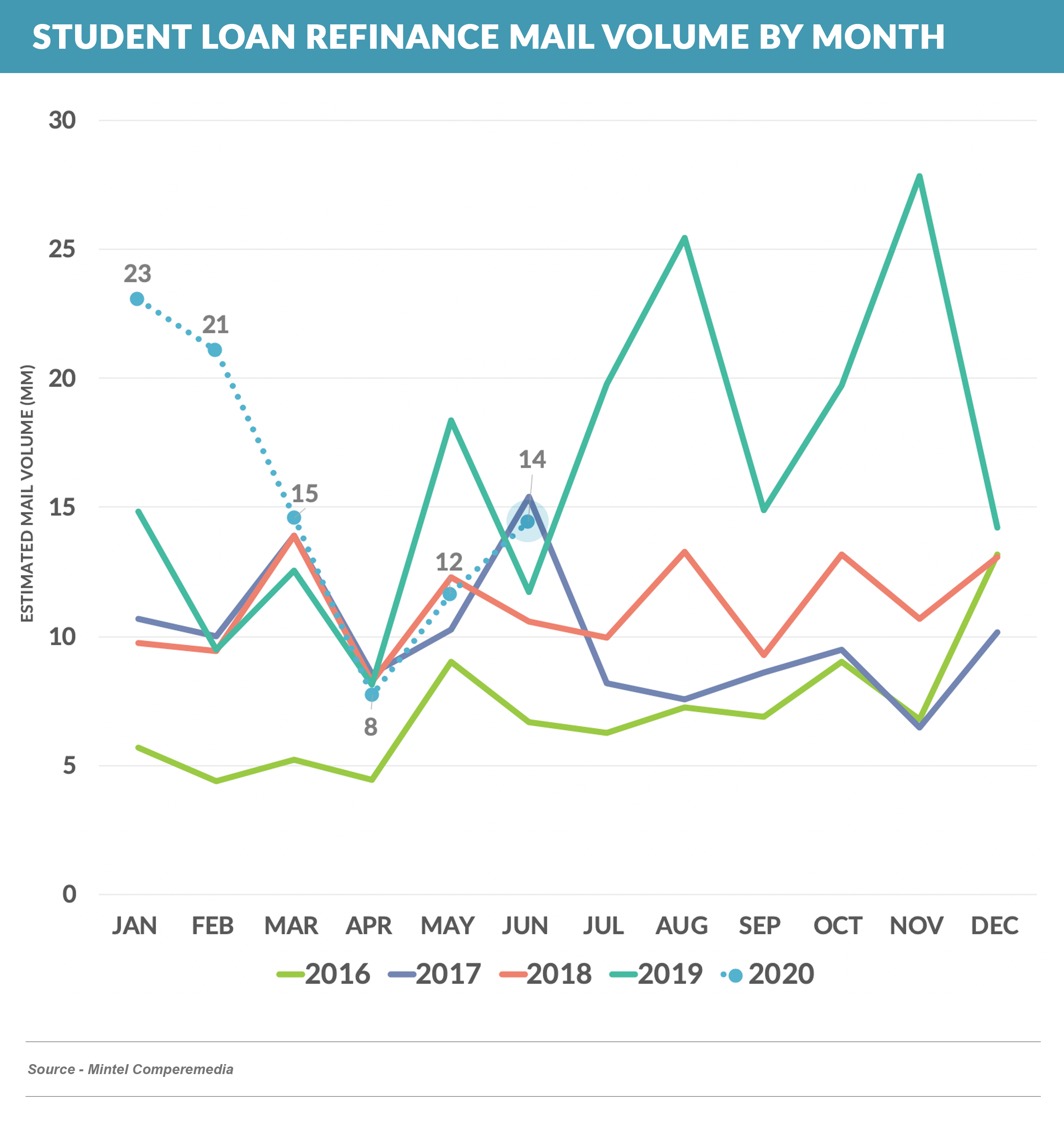

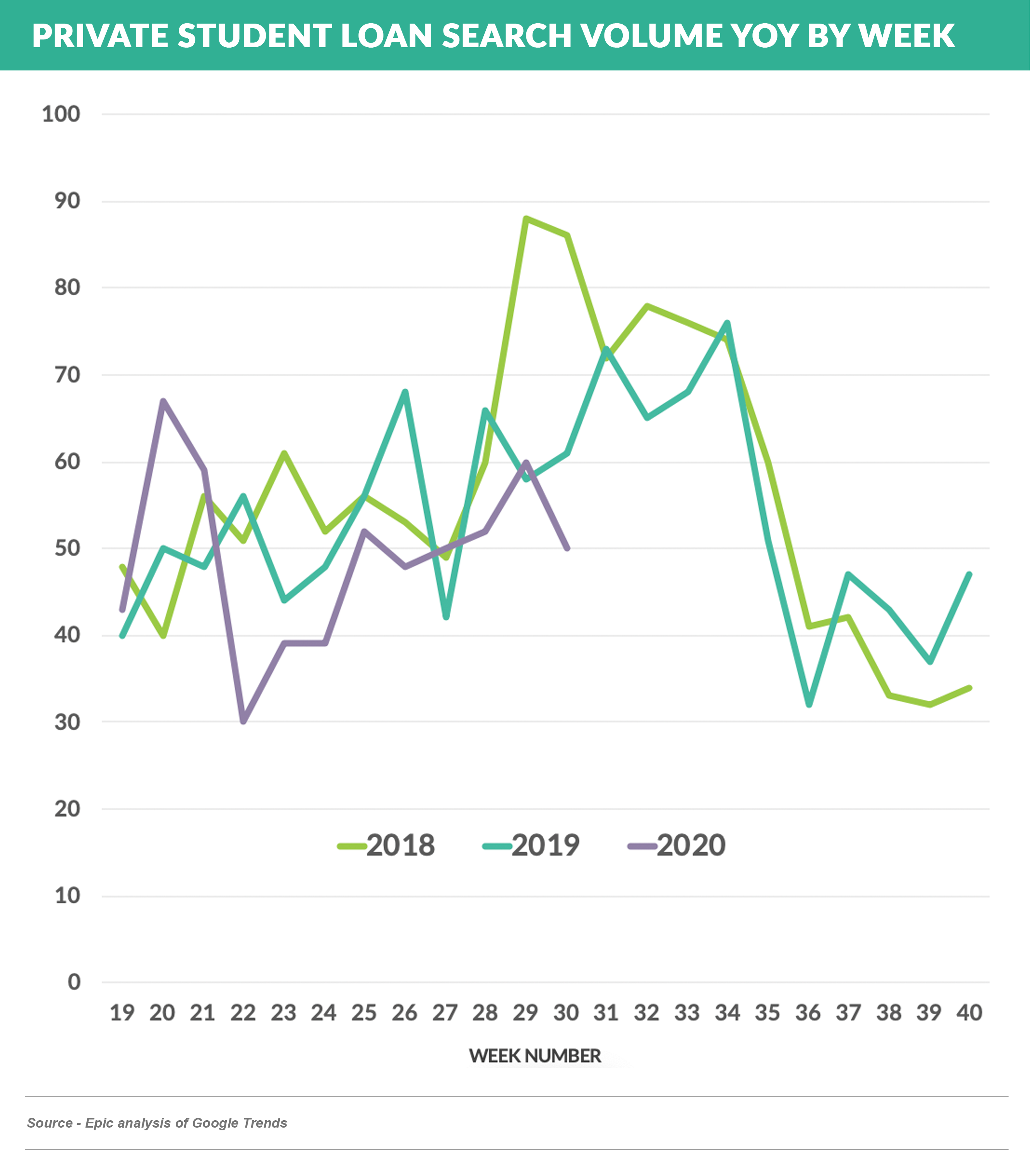

Education Lending Bucks the Trend

- Education Refinance Loan and Private Student Loan activity were the exceptions in June, with Education Refinance mailings running slightly higher than June 2019

- And, after a slow start, June Private Student Loan mail volume rebounded slightly ahead of 2019

- This increase is not yet reflected in online search volume, with consumer uncertainty causing search volume to trend lower than in prior years

Lower Marketing Spend will Hurt Future Growth

- Lower mail volume and digital activity reflect a dramatic cut in marketing expense at the large lenders

- Marketing reductions are prudent given uncertainty around the rapid rise in unemployment, and the cuts also help offset the cost of increased loss provisions

- The obvious trade-off in lower marketing expense is slower growth, and even as the consumer credit environment improves, lenders will be challenged to rapidly increase marketing expense in the face of additional provision expense (Epic can help with financing structures that offset this)

Quick Takes

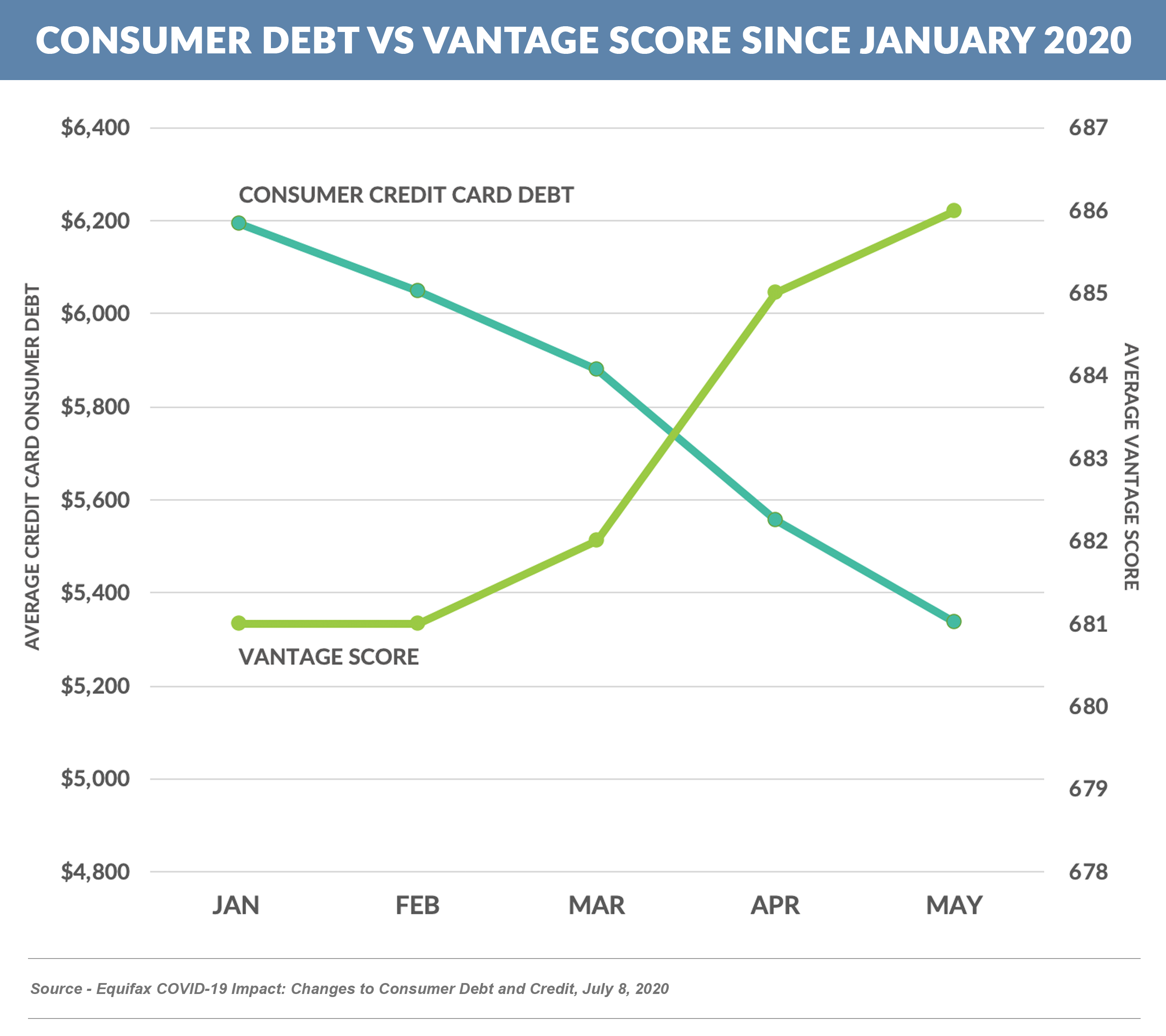

- Experian reports that average credit card debt is down since January – some of which is seasonal, but it’s also reflective of the observed increase in payment rates

- Lower balances are accompanied by an increase in average Vantage Score

- We expect these trends will change when incremental unemployment benefits expire and communities re-open further, providing more opportunities for consumers to spend

- The capital markets have seen recent activity, with late July/early August securitizations in the works for Affirm, Freedom, and Navient

Going Forward

- We are interested to see if the selective increase in marketing activity expands to other products

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.