Three Things We’re Hearing

- Credit card mail volume at lowest level in decades?

- Personal loan volume plunged as well

- $2 trillion growth in deposits since the coronavirus hit

Today’s newsletter takes 3 minutes to read

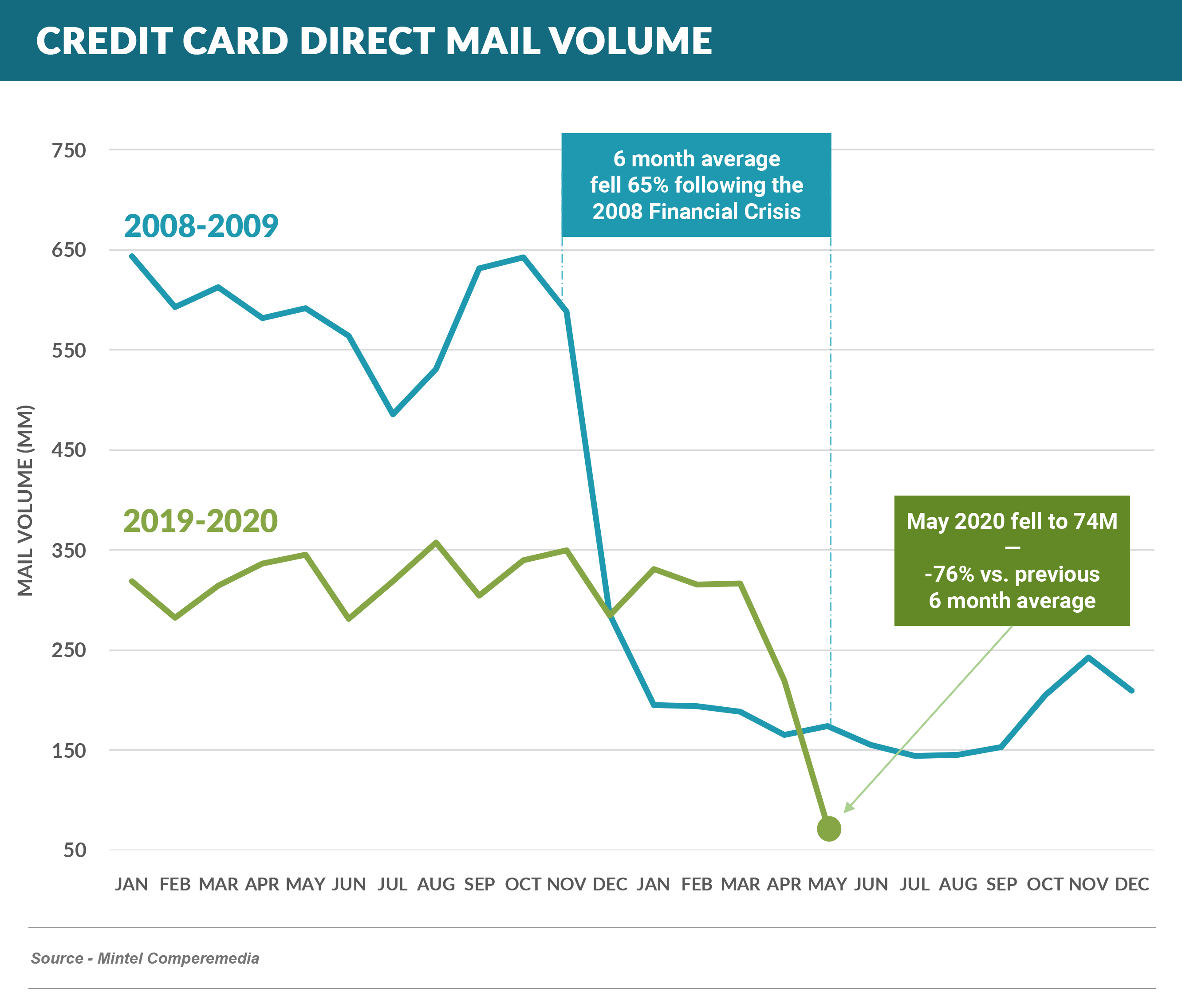

Card Mail Volume Lowest on Record?

- We’ve been tracking credit card mail volume as the best measure of competition since 1990

- When the financial crisis hit in 2008, credit card mail volume dipped 65% from a monthly run rate of 550-600 million to around 150-200 million mail pieces

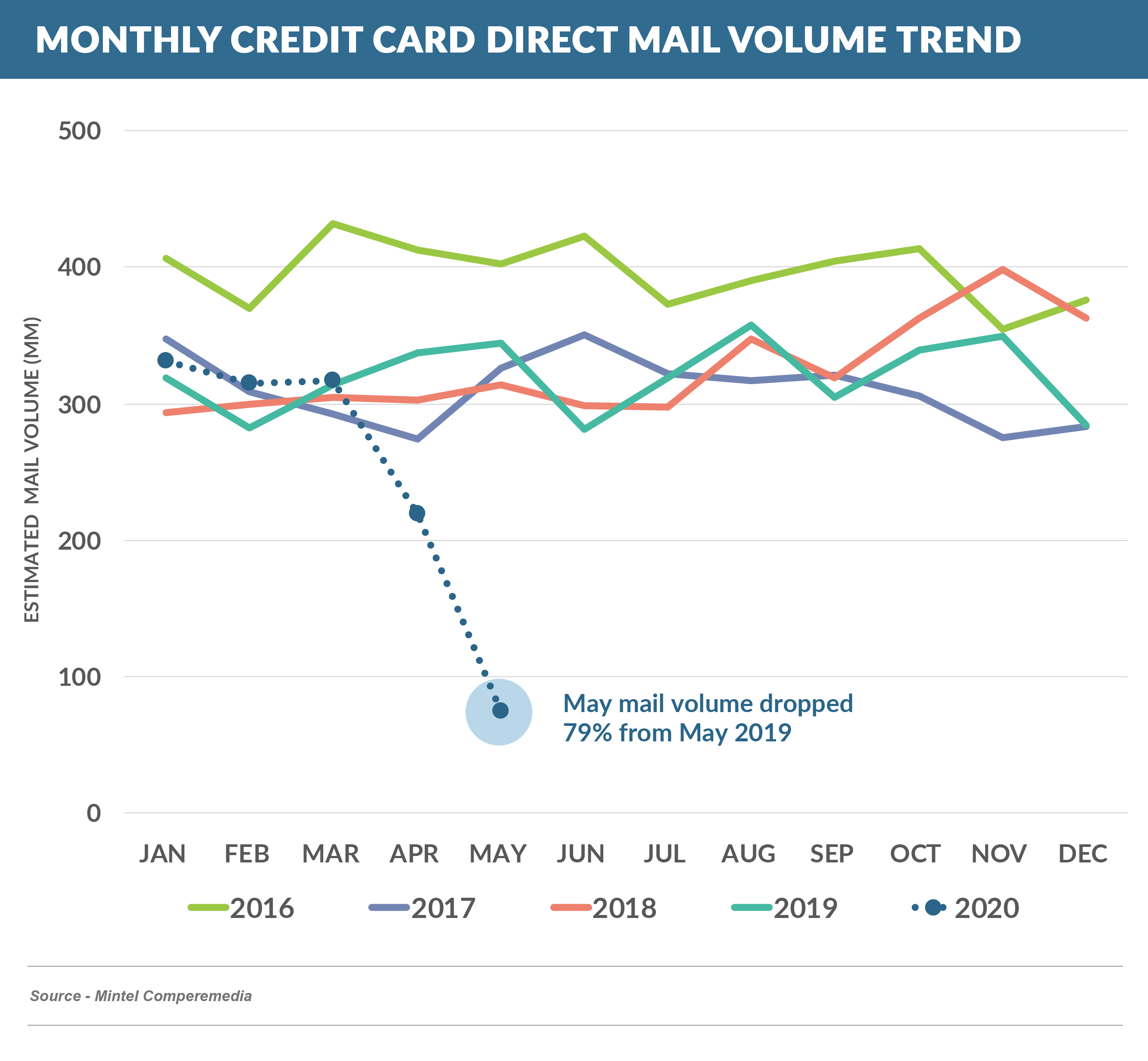

- Card mail volume in May 2020 was the lowest on record at 74 million pieces, falling 79% from May 2019 and even lower than the post financial crisis period

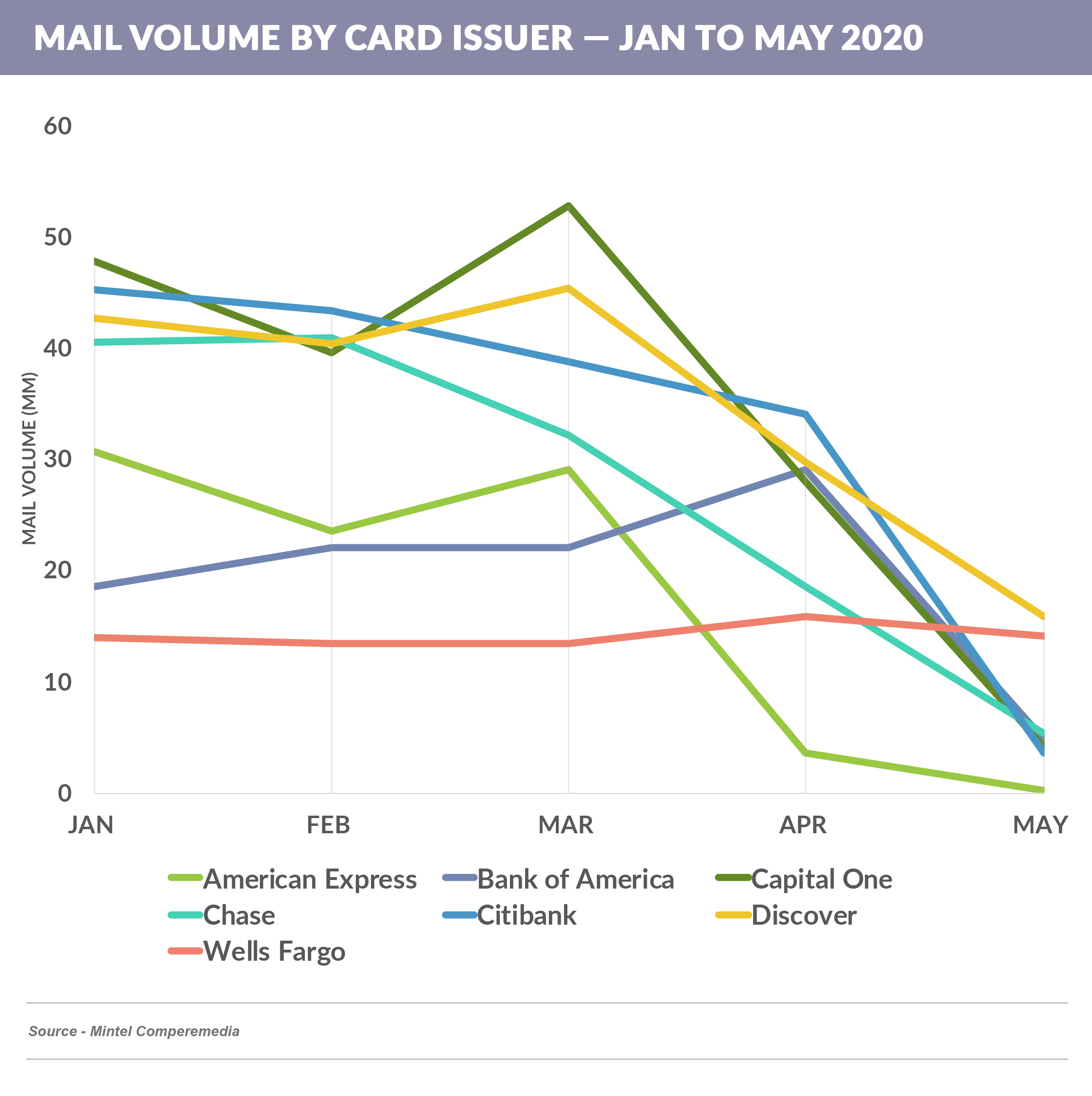

- Other than Wells Fargo, May saw a sharp drop across all major mailers

- Given the advanced planning required for mail campaigns, as well as the one-month delay in reporting, May mail volume reflects lender sentiment of early to mid-April, near the peak of the lock-down

- We would expect June mail volume, reflecting early to mid-May decision making, to show similarly low volume

- Despite a recent increase in customer cross sell programs, we would not expect volumes to reach pre-COVID levels for quite some time

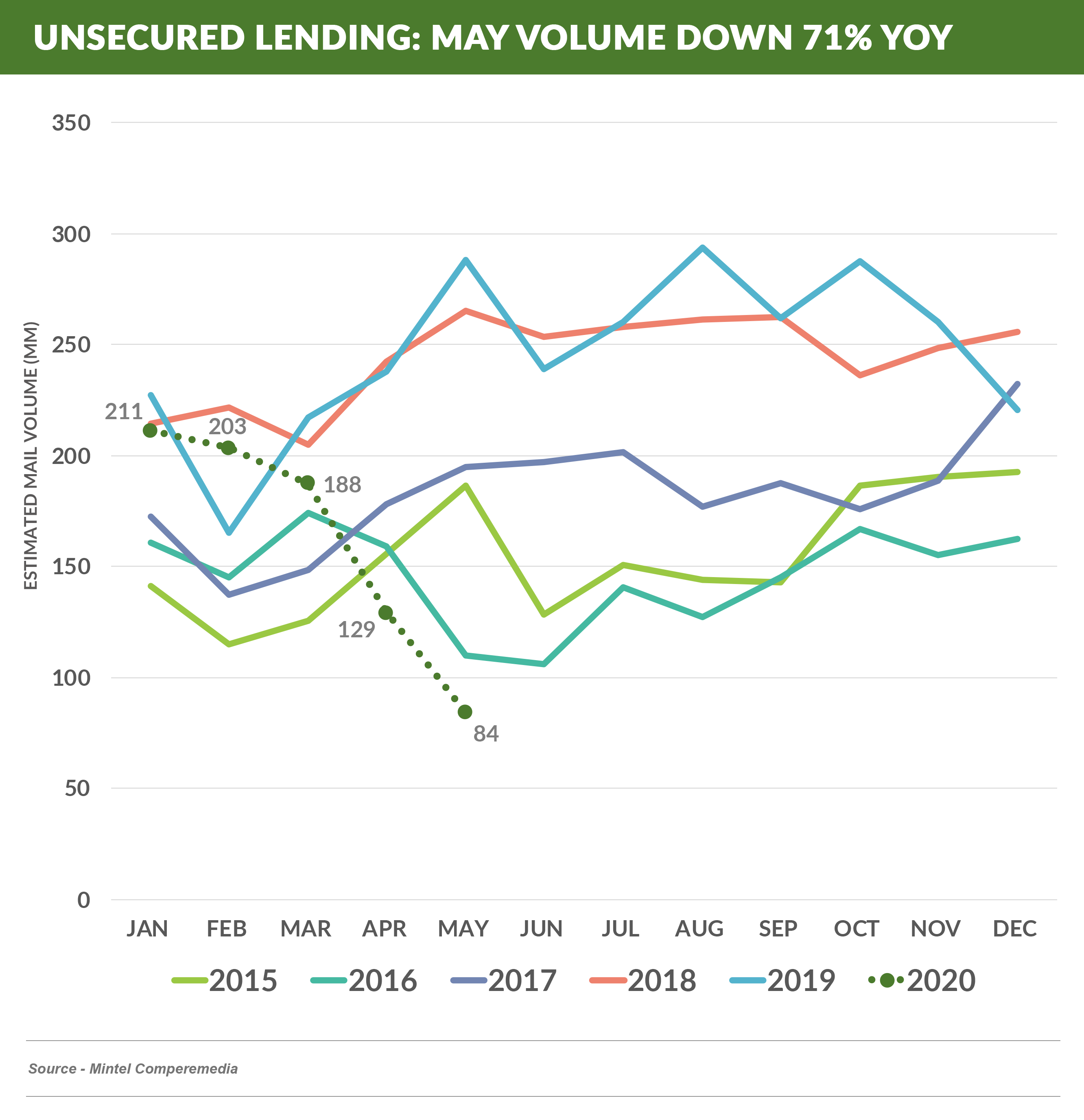

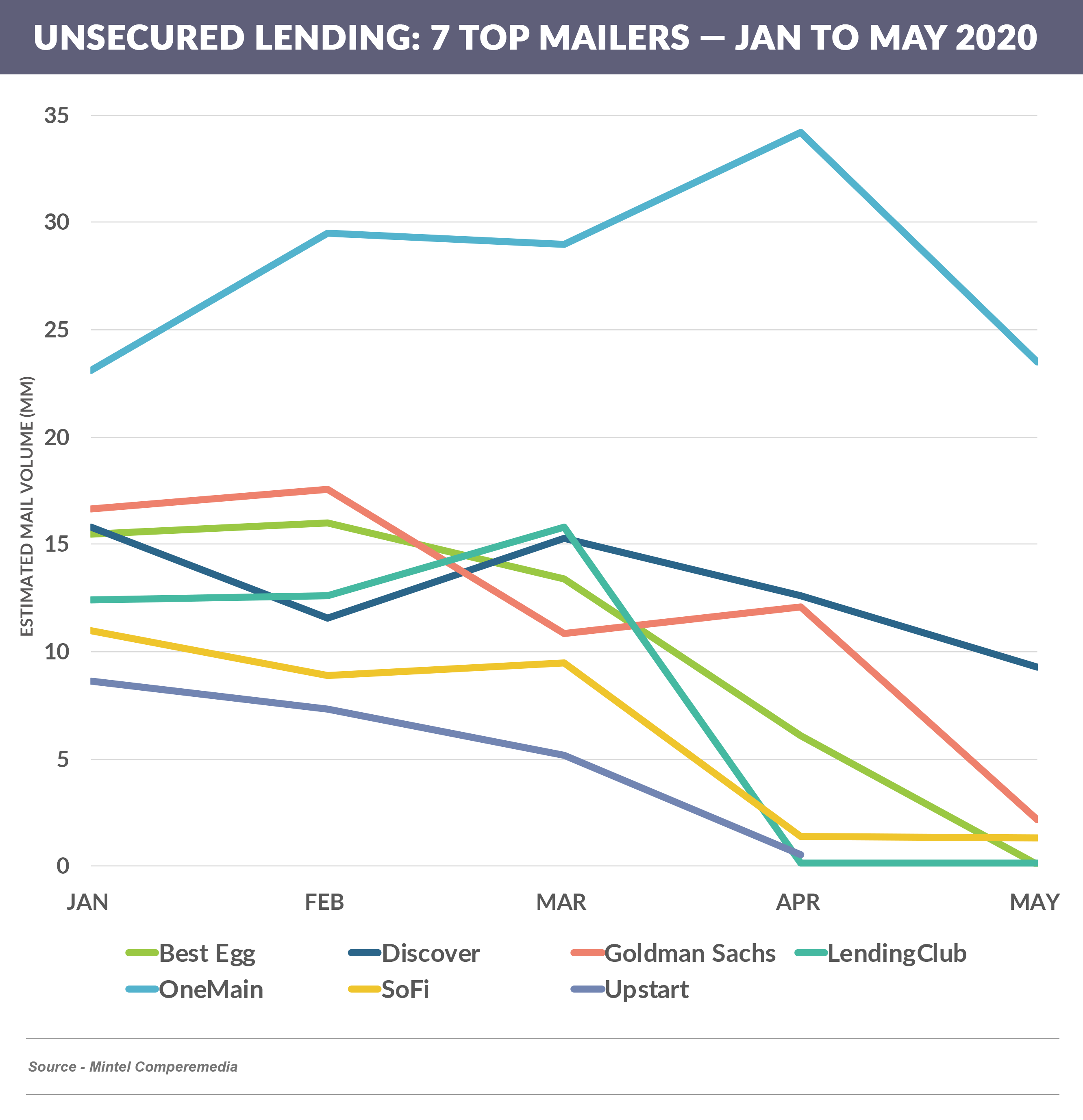

Personal Loans also Down

- May personal loan mail volume also plunged and was down 71% from May 2019

- May’s volume decrease was consistent across the largest mailers, with the exception of OneMain and Discover, which maintained recent months’ volumes

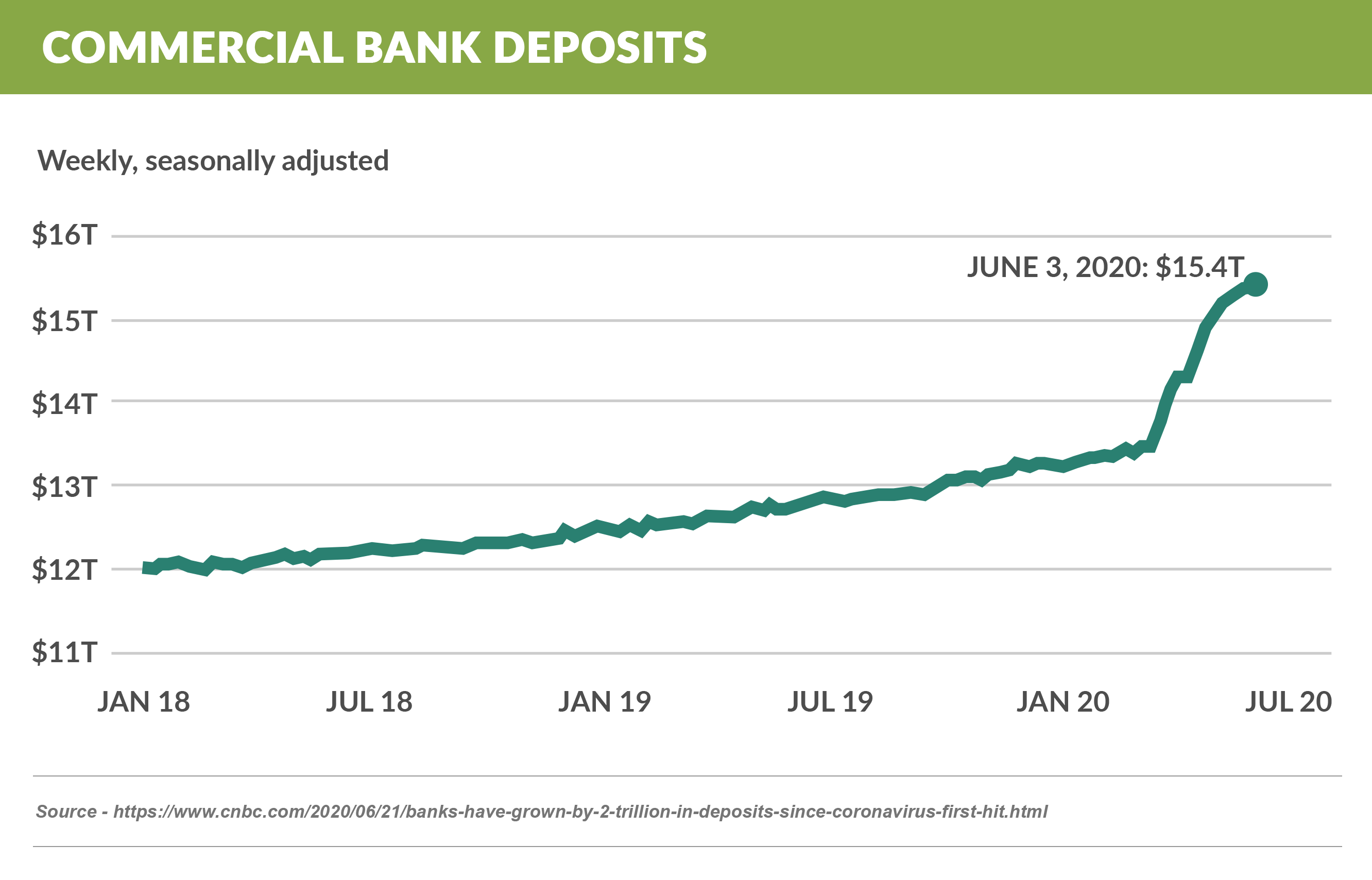

$2 Trillion in New Deposits Drives Rates Down

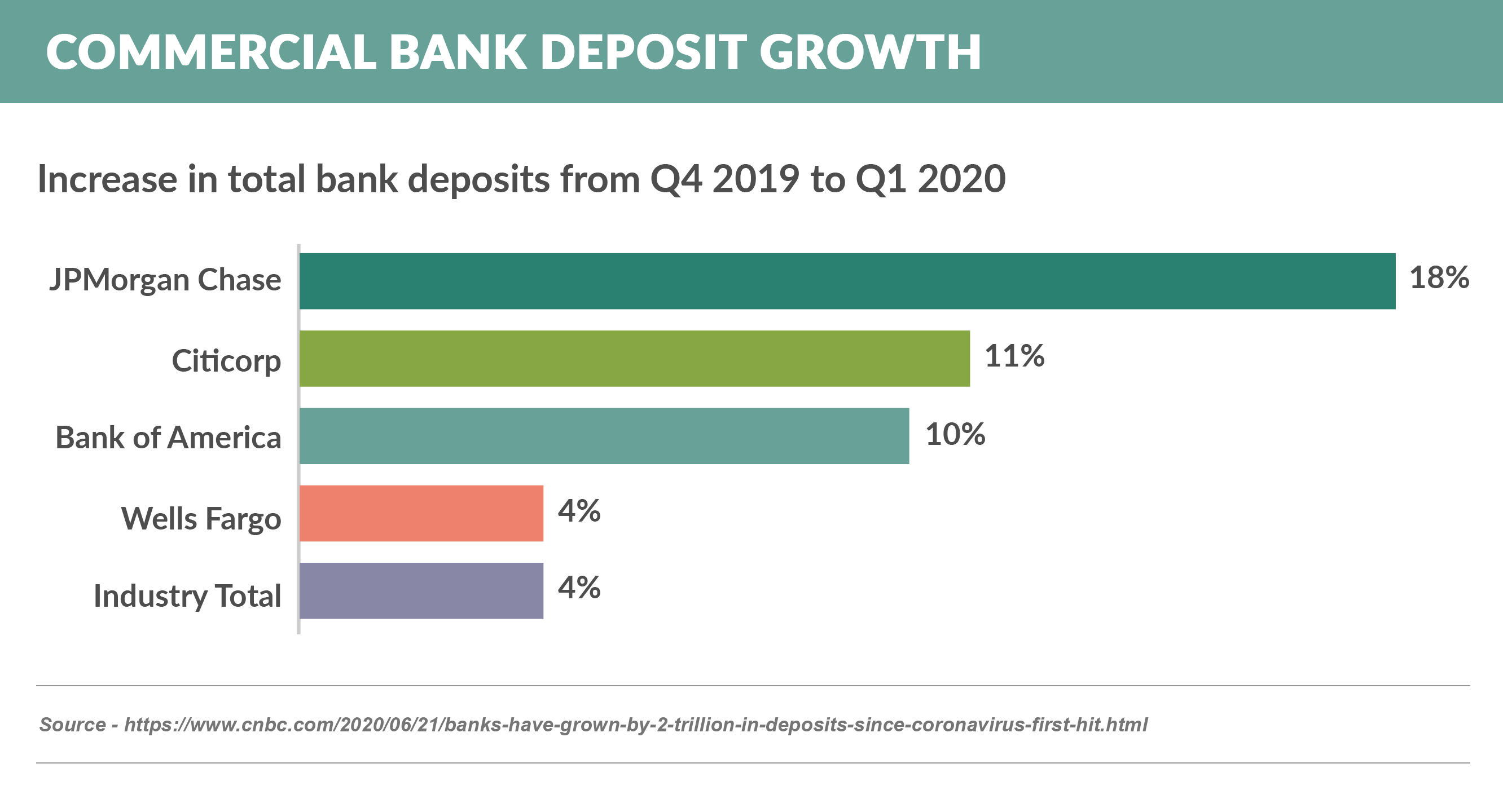

- 2020 has seen an unprecedented growth in bank deposits, with $2 trillion in new volume since January

- The bulk of the new deposits has flowed to the larger banks, primarily due to their prominence in the PPP program, large corporations drawing down on lines of credit, and the Fed’s bond purchase program

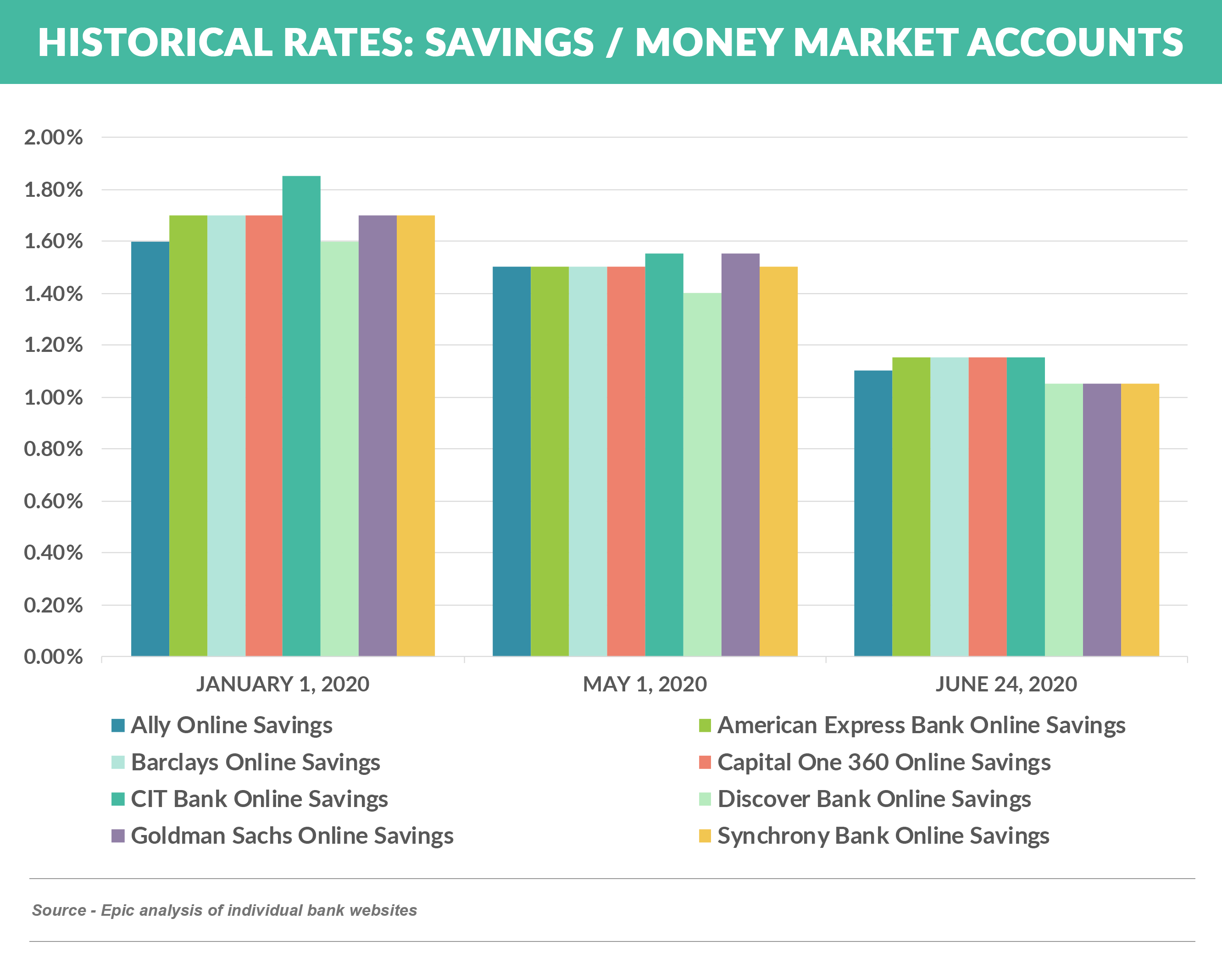

- This influx has furthered the downward pressure on rates, with recent numbers showing a 40-50 basis point decline since May 1st

Random Gossip

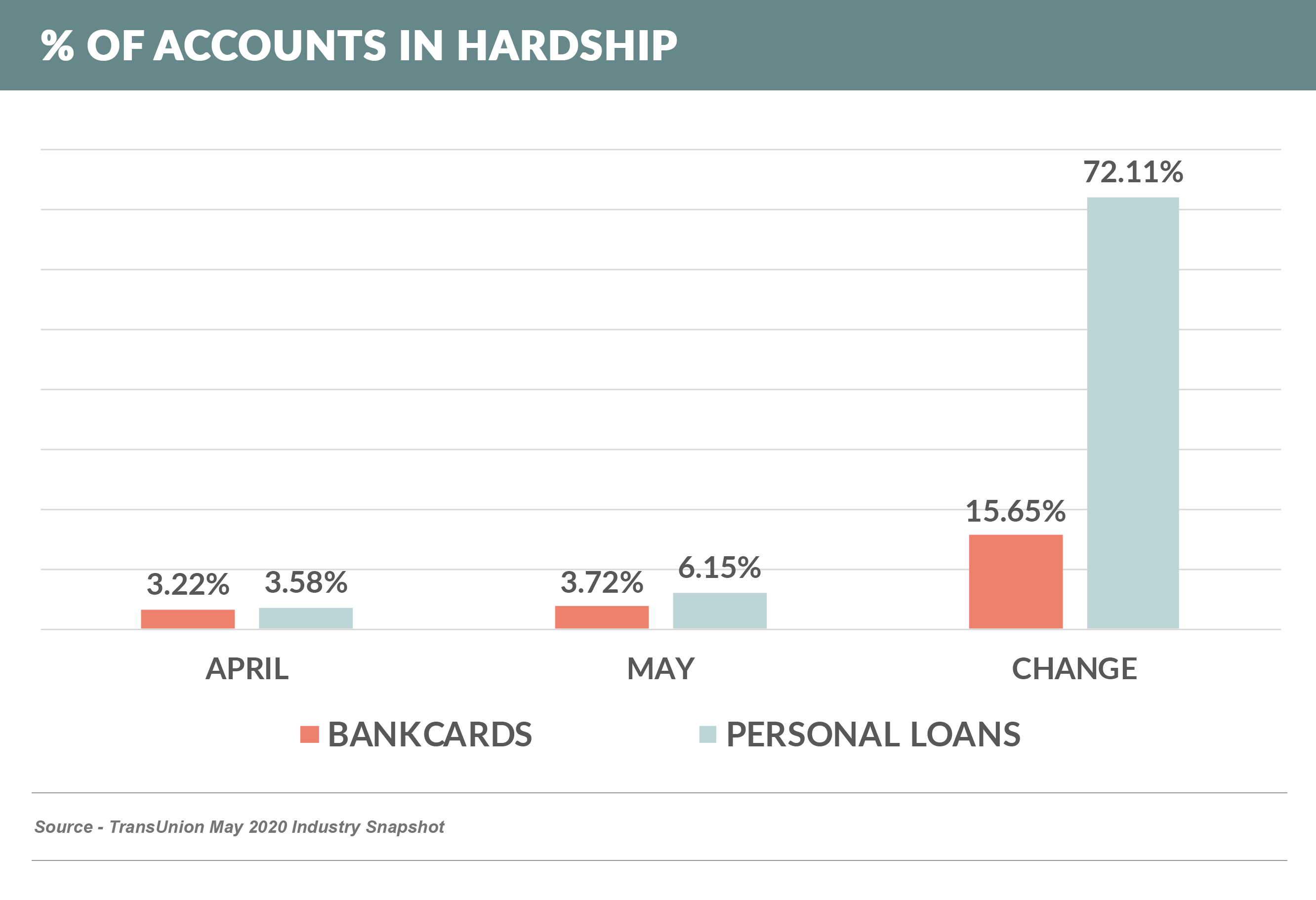

- TransUnion reports that bankcard and personal loan hardship rates rose in May

- American Express has discontinued its payment deferral program

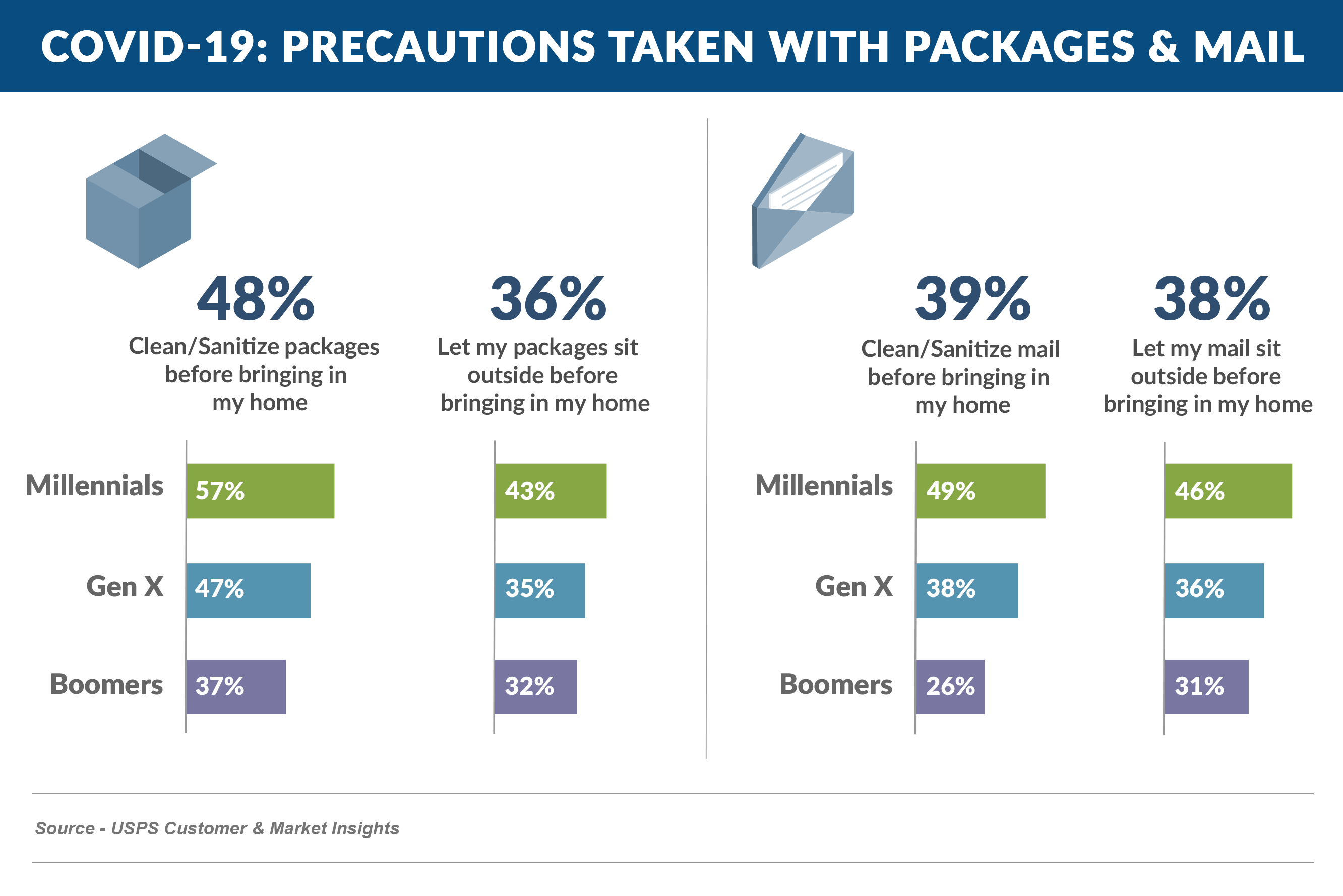

- The USPS reports that half of Americans are sanitizing mail and packages prior to bringing them into the home

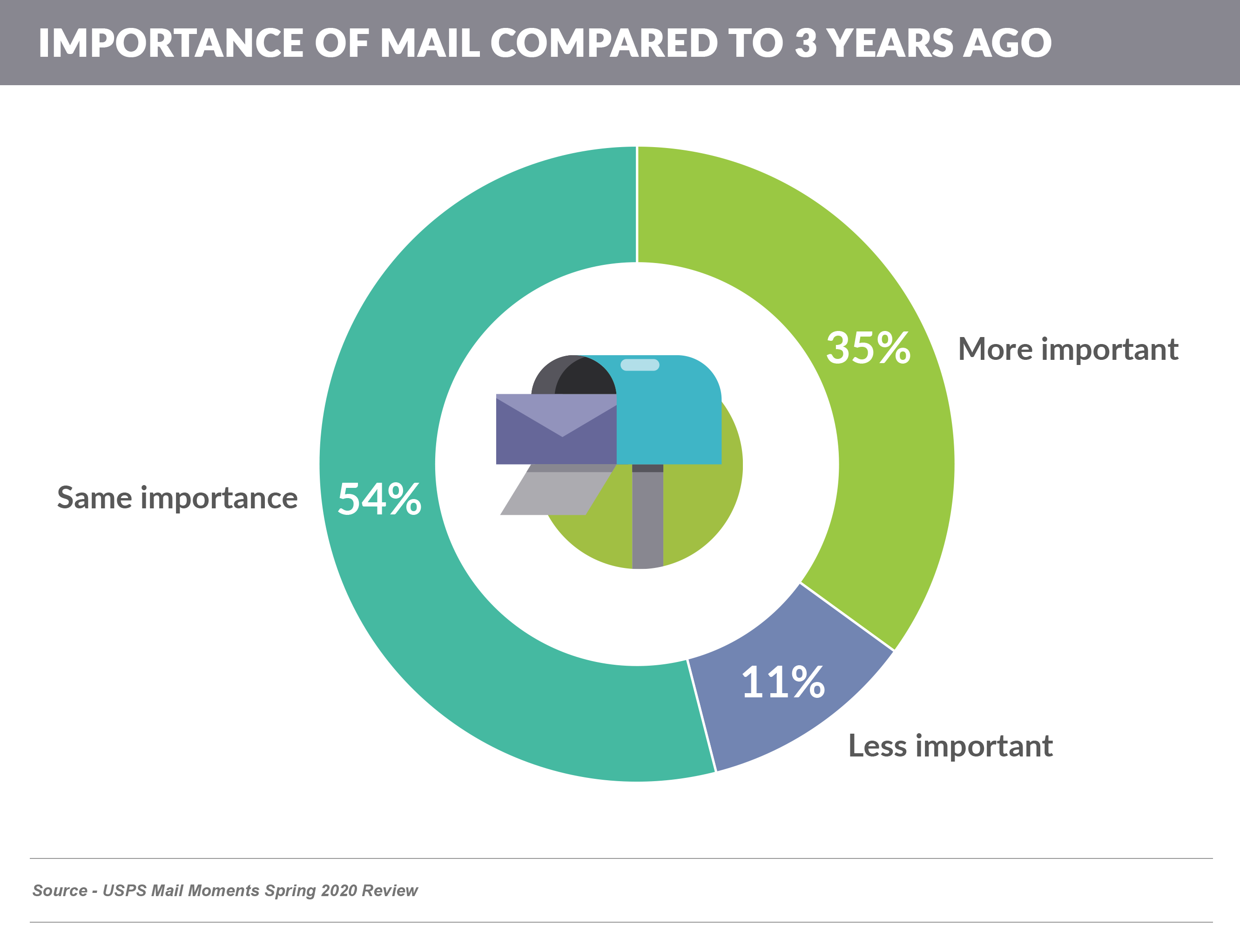

- And one third of consumers think mail is “more important” than it was three years ago

Going Forward

- Despite some signs of life, consumer credit acquisition programs remain in low gear

- How will recent spikes in infection rates affect lenders plans to re-emerge?

Thank you for reading.

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.