Four Things We’re Hearing

- Credit card acquisition marketing (unsurprisingly) plummeted in April

- As did marketing for Personal Loans

- Why do we talk about Direct Mail so much?

- The student lending market is heating up

Today’s newsletter takes 4 minutes to read

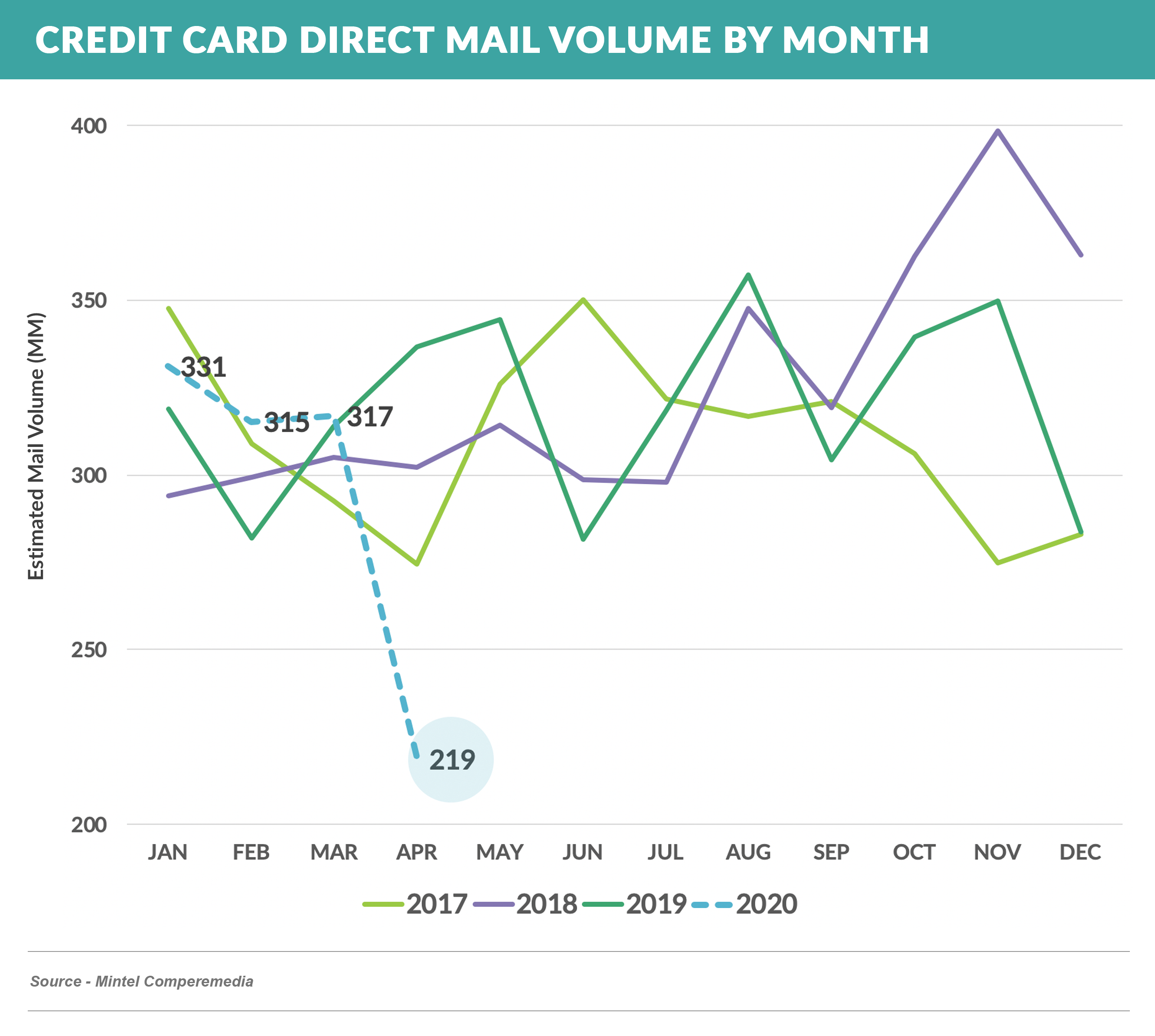

Consumer Credit Acquisition Marketing Volume was Down in April

- Mail volume in April for consumer financial products was down 35%-45% depending on the product

- This understates the massive decrease in direct mail due to trailing activity from early March programs that were either in flight or committed

- May volumes will more fully reflect the pause in consumer credit mail solicitations

- Digital card acquisition programs shut down much faster

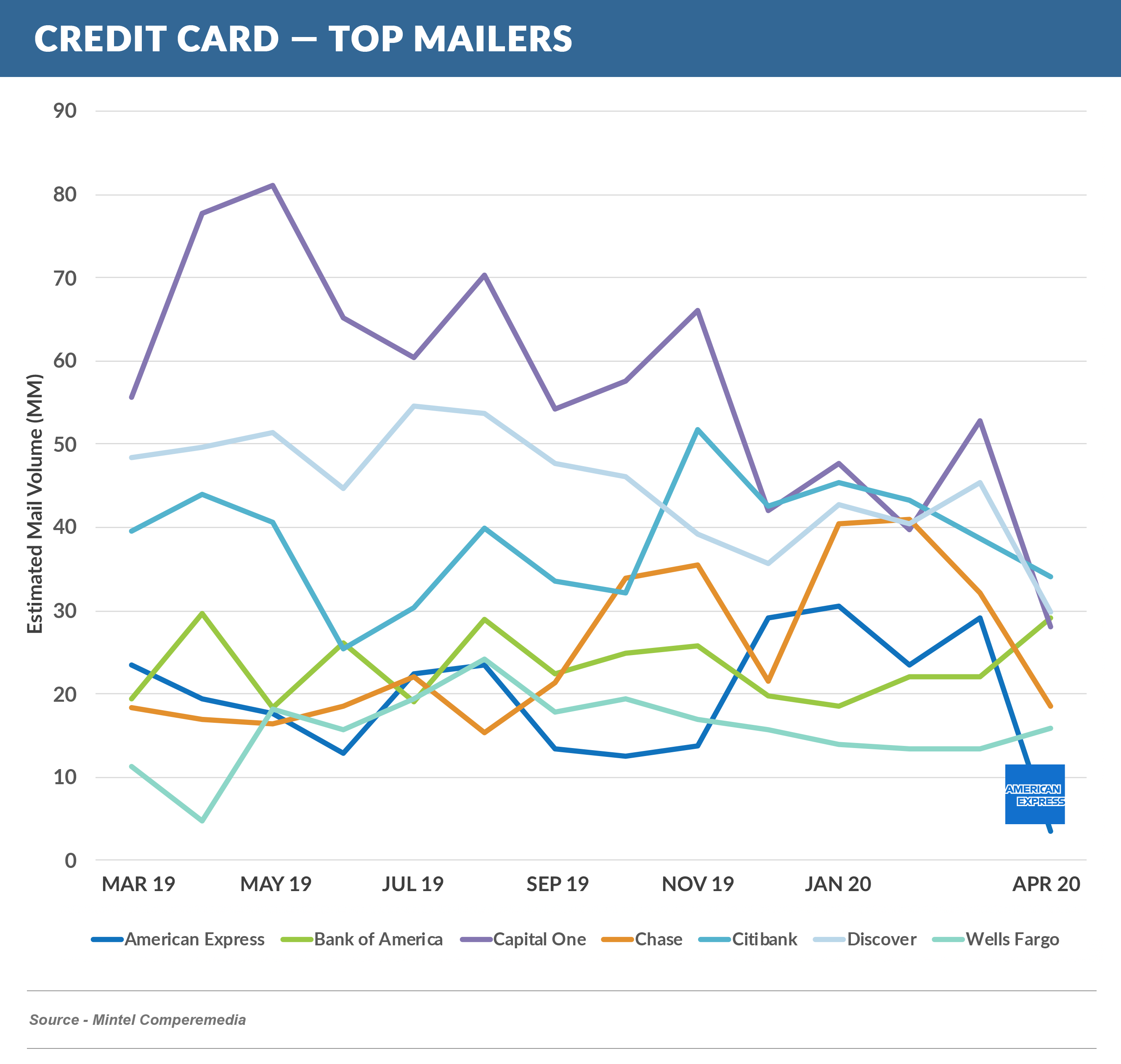

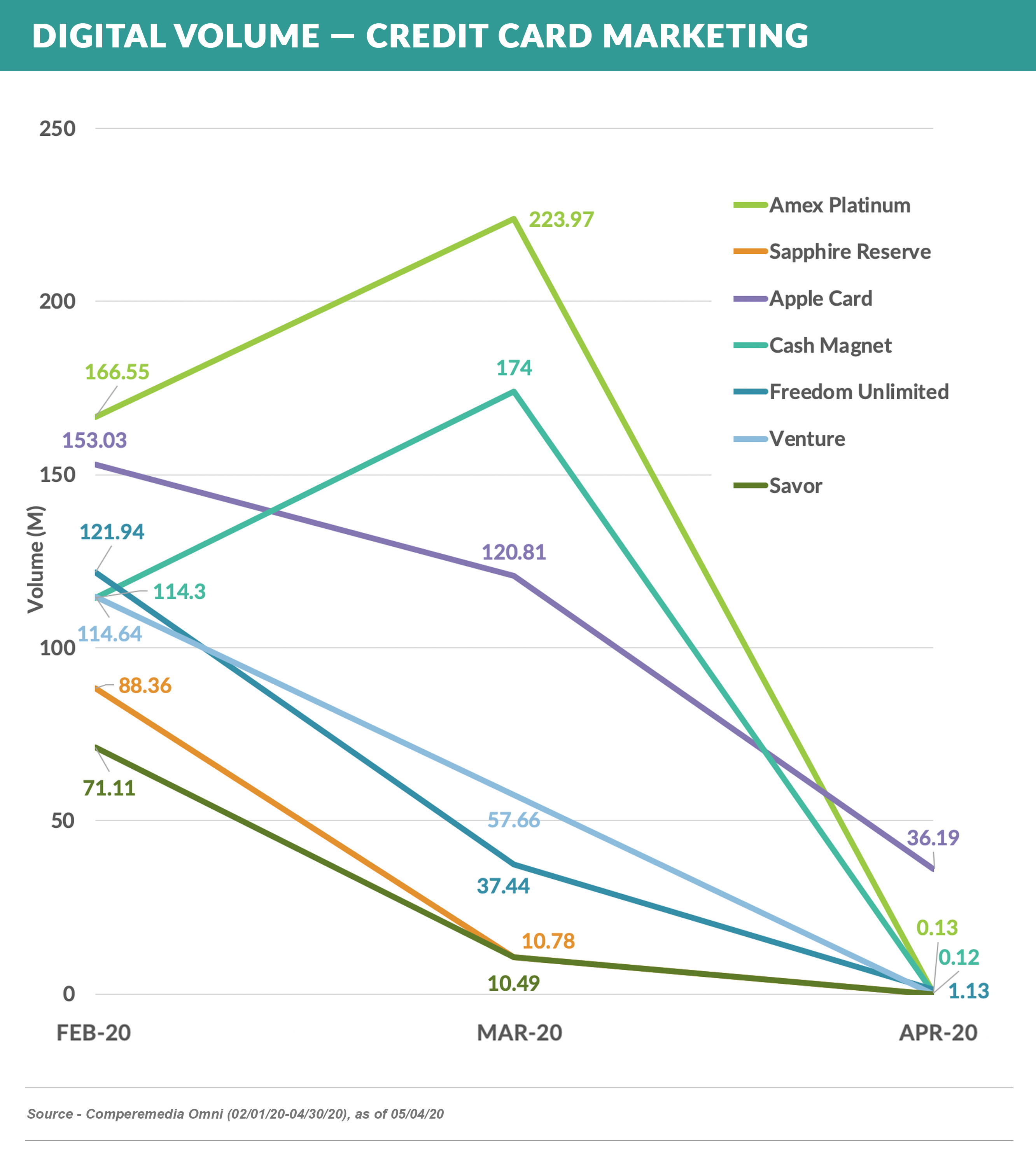

Credit Card Acquisition Programs were Down Across both Mail and Digital

- Credit card direct mail was down 36% in April vs. April 2019

- You can begin to see reductions in individual issuer volumes, especially American Express

- Online acquisition volume paused even more substantially in April

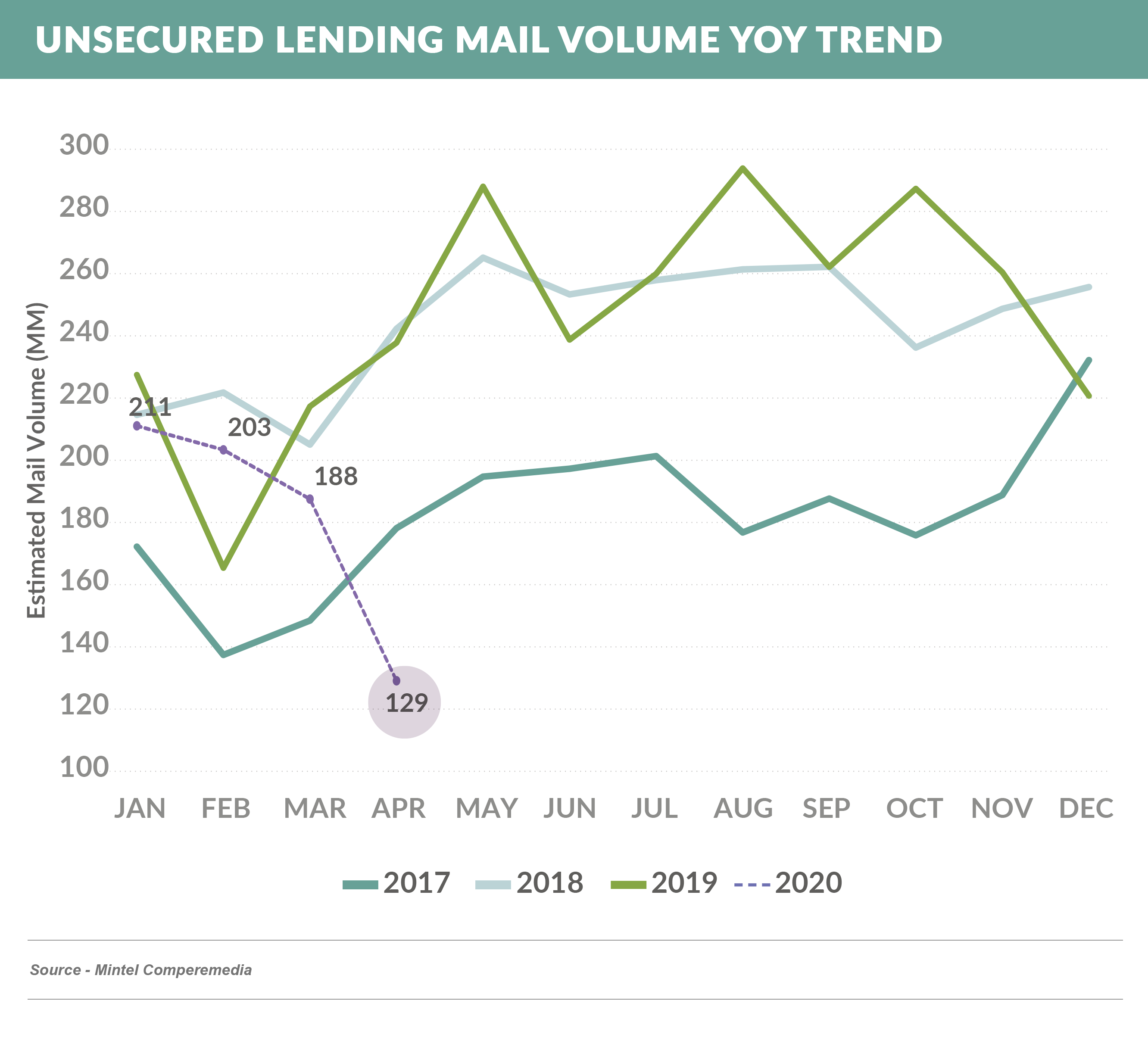

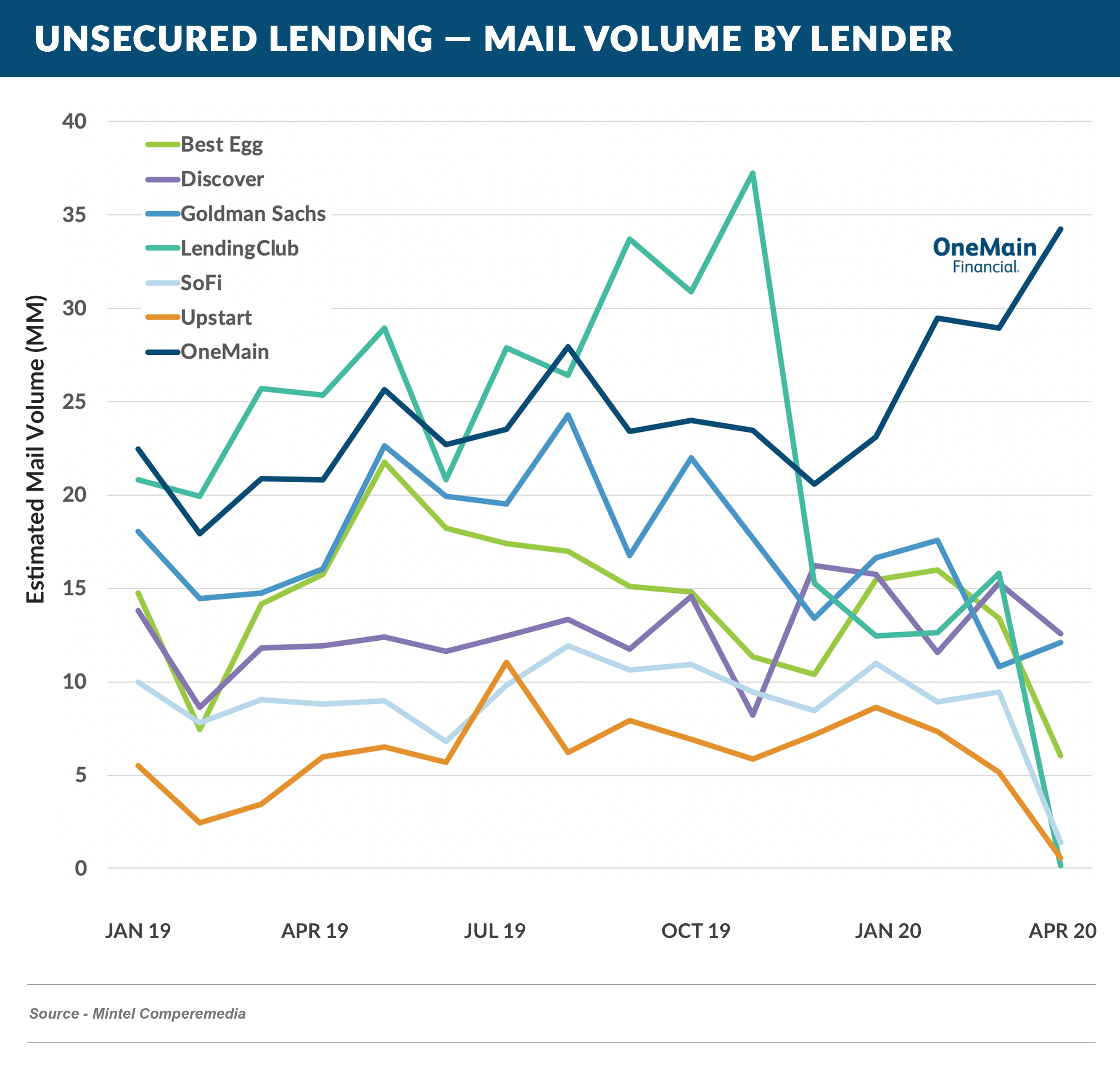

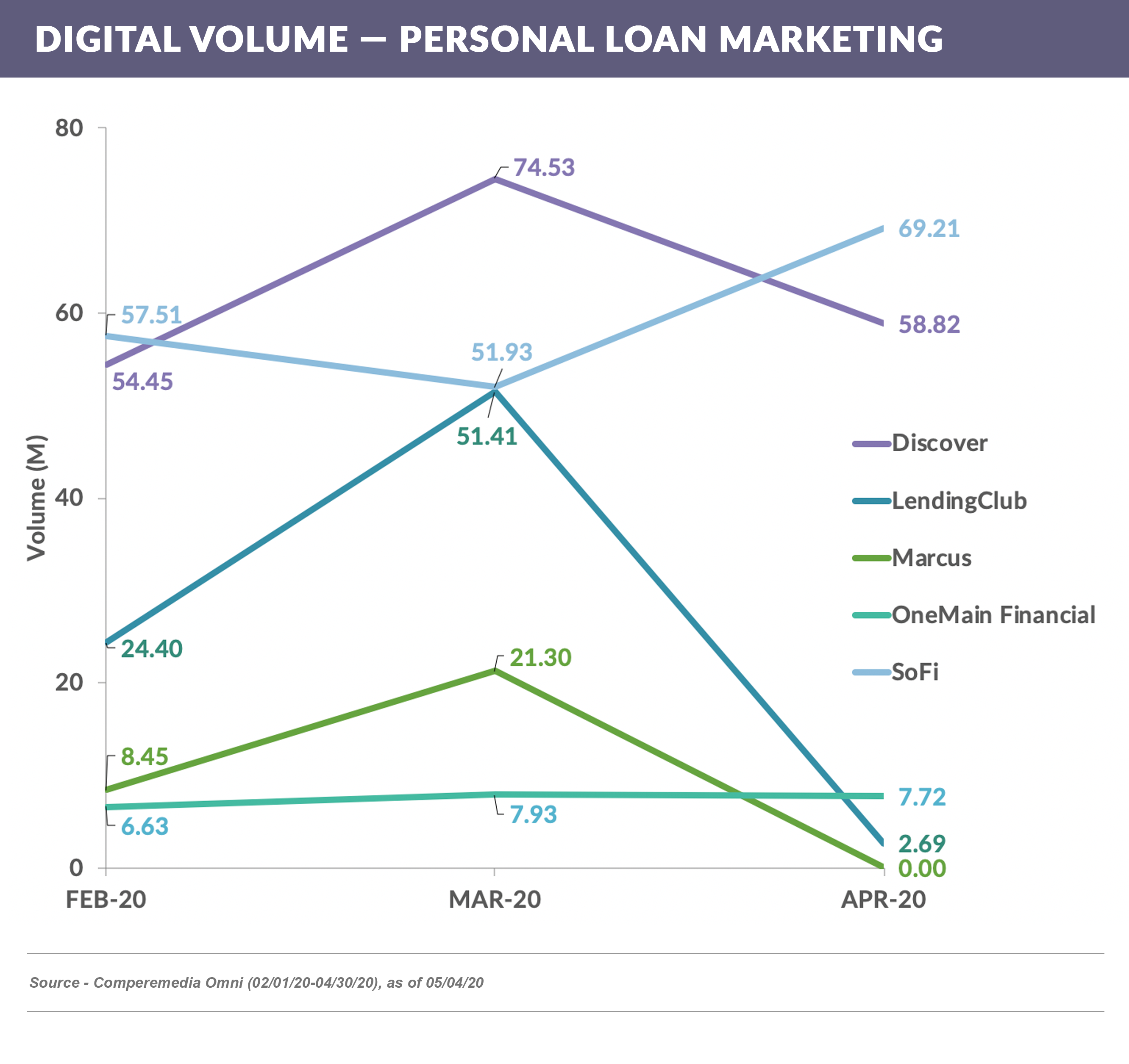

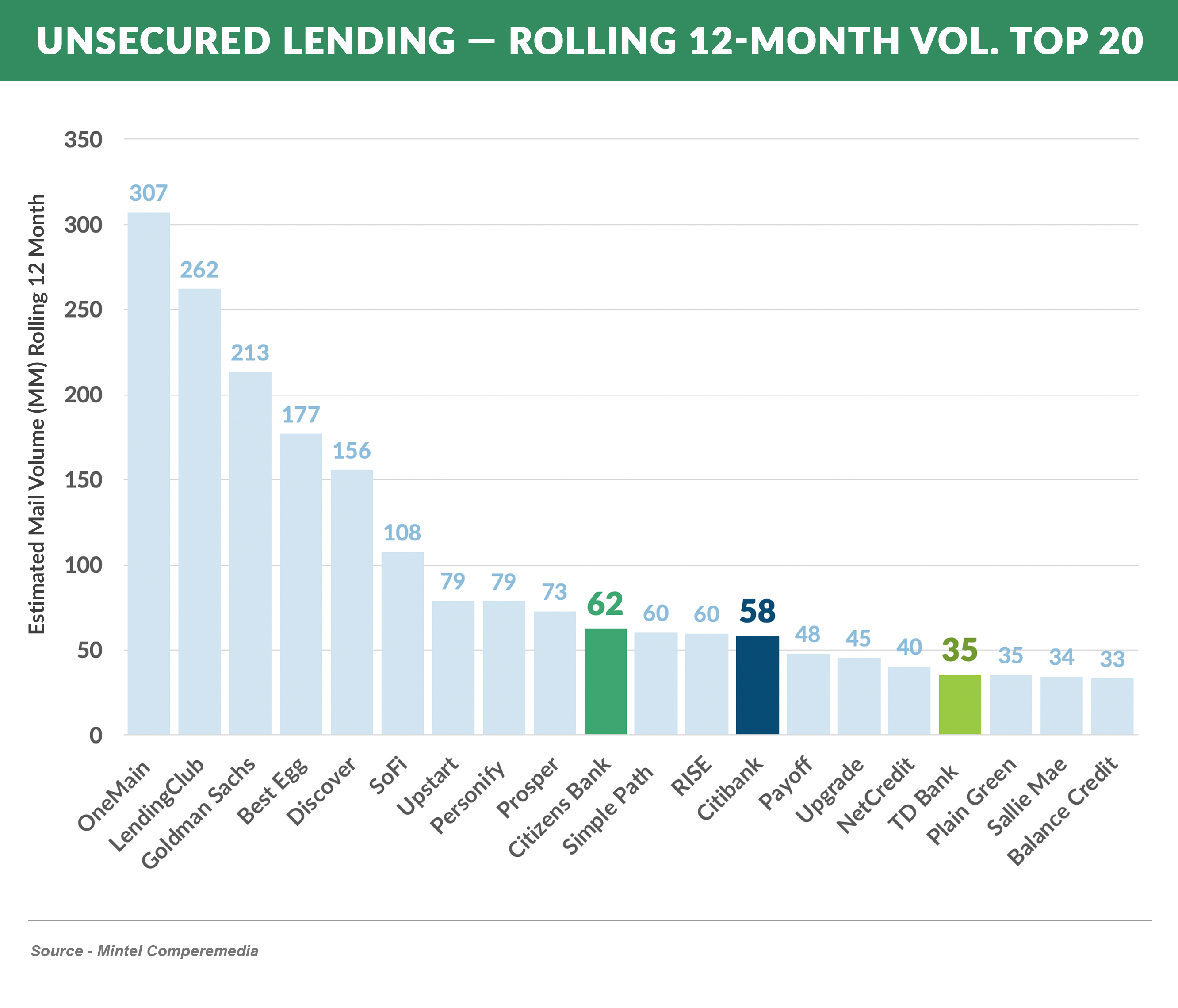

Personal Loan Acquisition Volumes were Down Even More

- Personal Loan mail volume was down 45% in April

- There were consistent large reductions in mail volume among the top mailers, with the notable exception of OneMain

- While reductions in digital volume were not as widespread

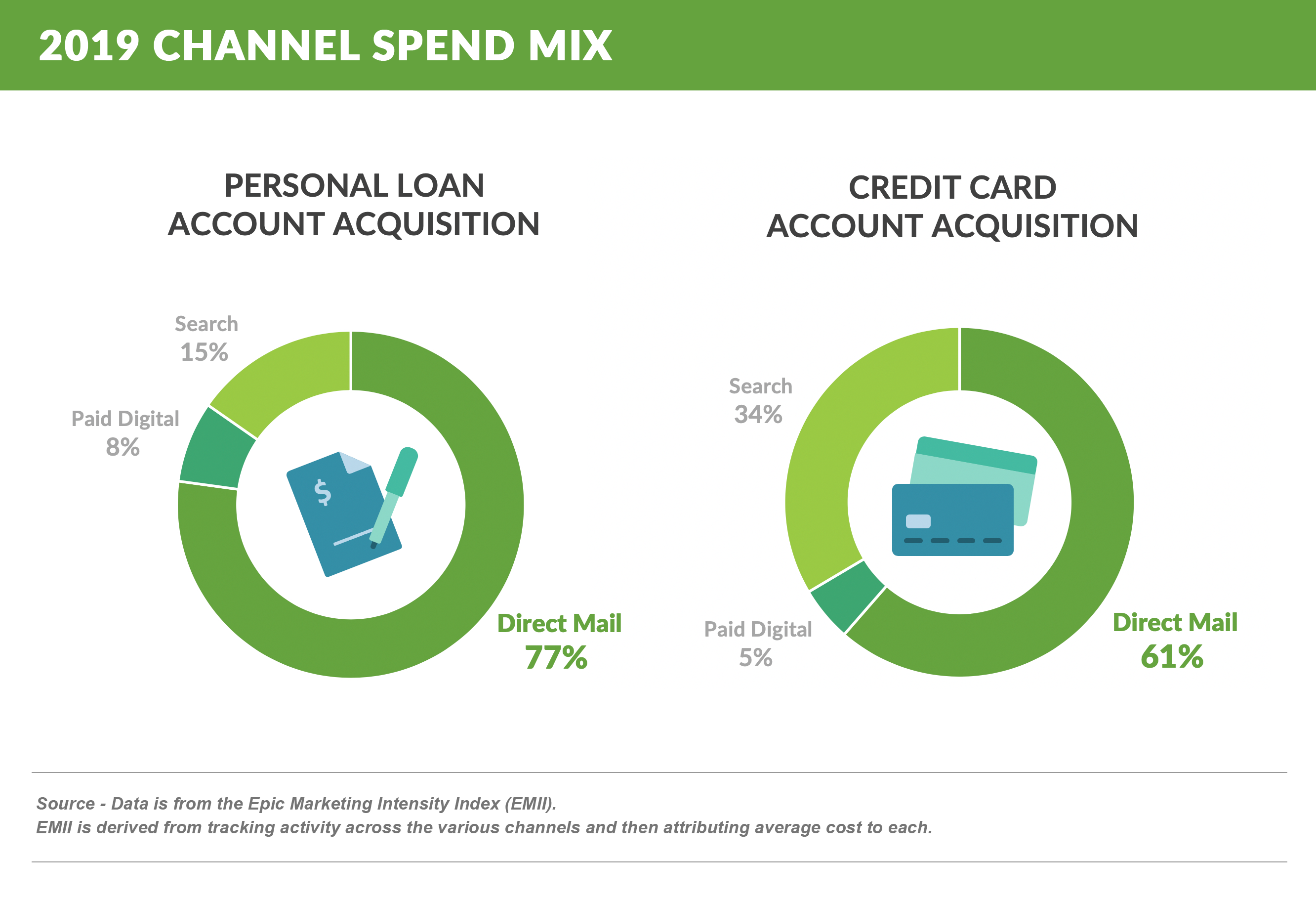

Why do we Talk About Direct Mail so Much?

- We have been asked why we focus so much on direct mail activity – isn’t it obsolete compared to digital? The answer is no, no it’s not obsolete – and for good reason

- We estimate 77% of personal loans and 61% of credit card acquisitions spending came from direct mail in 2019

- Over the past several years, Credit Card mail has averaged between four and five billion pieces per year

- Personal Loan mail volume has been growing in recent years, exceeding three billion pieces in recent years

- 22 of the top 25 mailers in the personal loan segment are non-banks, with only three commercial banks among the top 25 mailers

- Why all this mail?

- Lists for credit products are most efficiently produced from credit bureau data, which requires the delivery of a firm offer of credit to access

- Direct Mail is the only channel through which you can guarantee a firm offer is made to each individual sourced from the bureau

- Therefore, mail is the most effective way to drive credit-qualified volume in new customer acquisitions

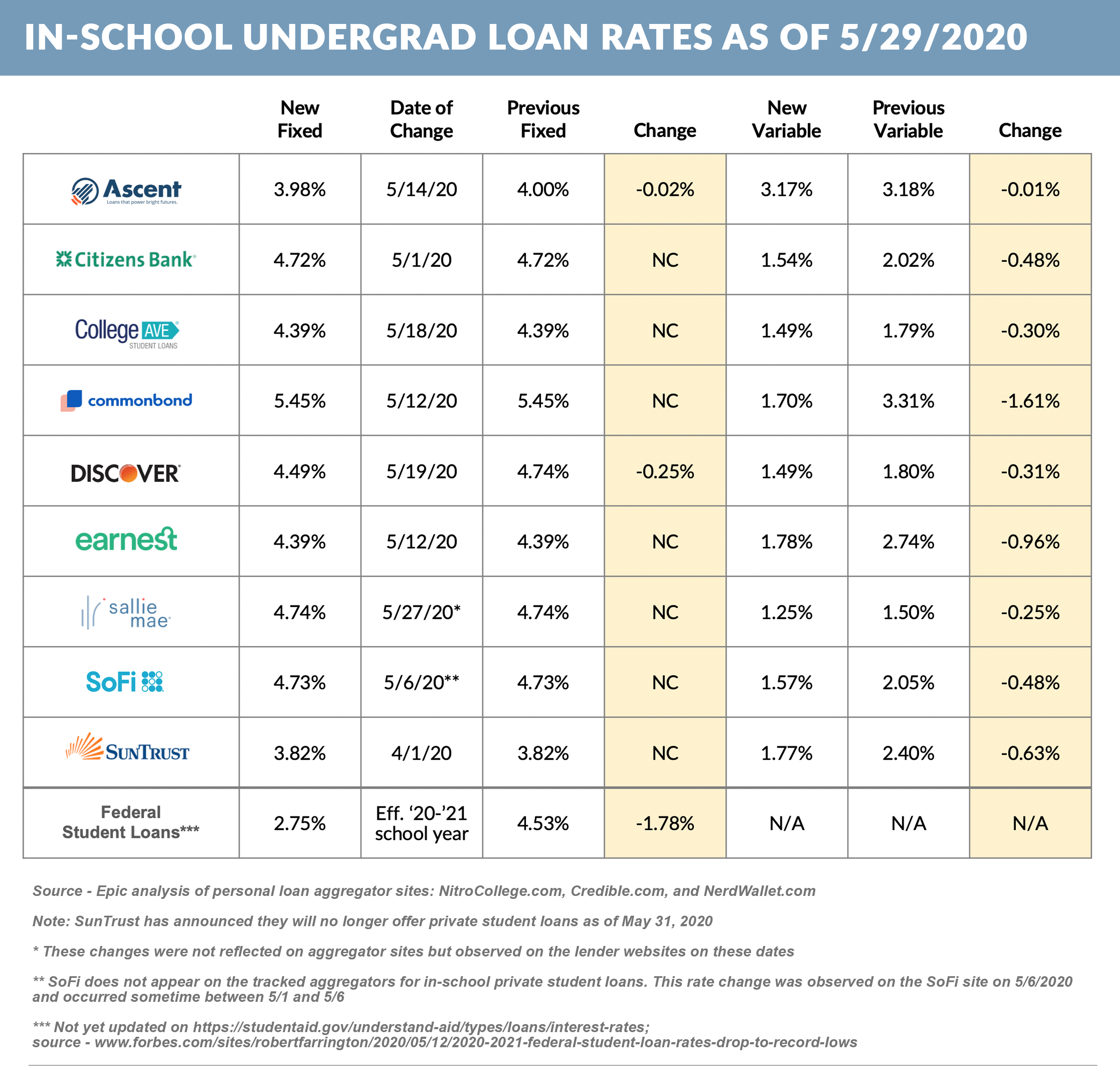

Student Lending Heats Up

- As student lending “peak season” approaches, the market is beginning to take shape

- Sallie Mae has reduced its variable rate 25bps to 1.25%, which leads the market as of now

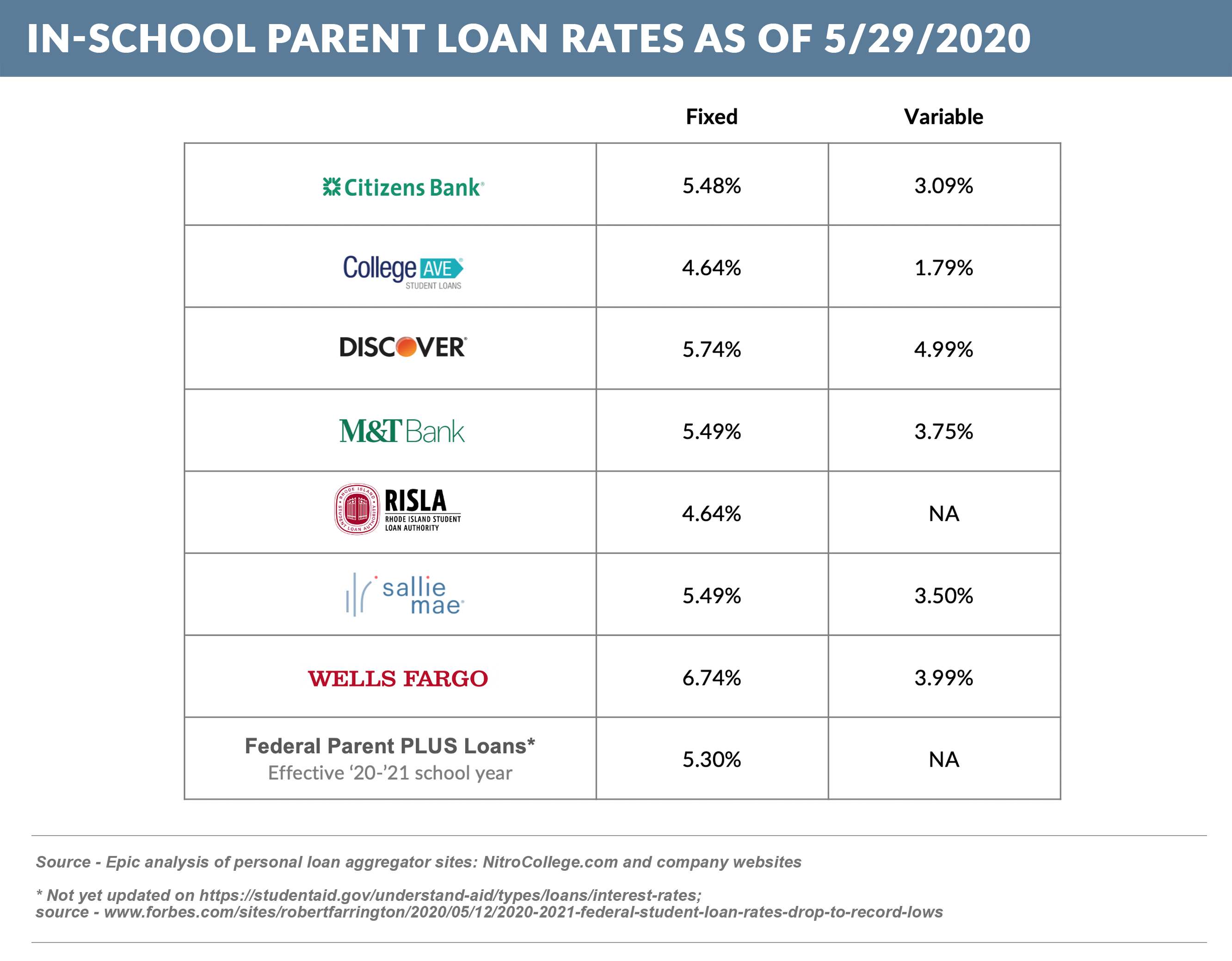

- And Parent Loans from College Ave and RISLA now have fixed loans 66bps lower than Federal Plus Loans, and without the 4.25% origination fee

Going Forward

- Most acquisition volume measures are lagging indicators of current activities

- We are now seeing activity slowly picking up in select segments

Thank you for reading.

Email me with your comments and suggestions on future topics.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.