Three Things We’re Hearing

- Credit card spending is rebounding from a late March dive

- Acquisition marketing for consumer financial products continues to drag

- Forbearance rates are up, soon delinquency rates will be too

Today’s newsletter takes 4 minutes to read

Credit Card Spending is Rebounding from Earlier Dips

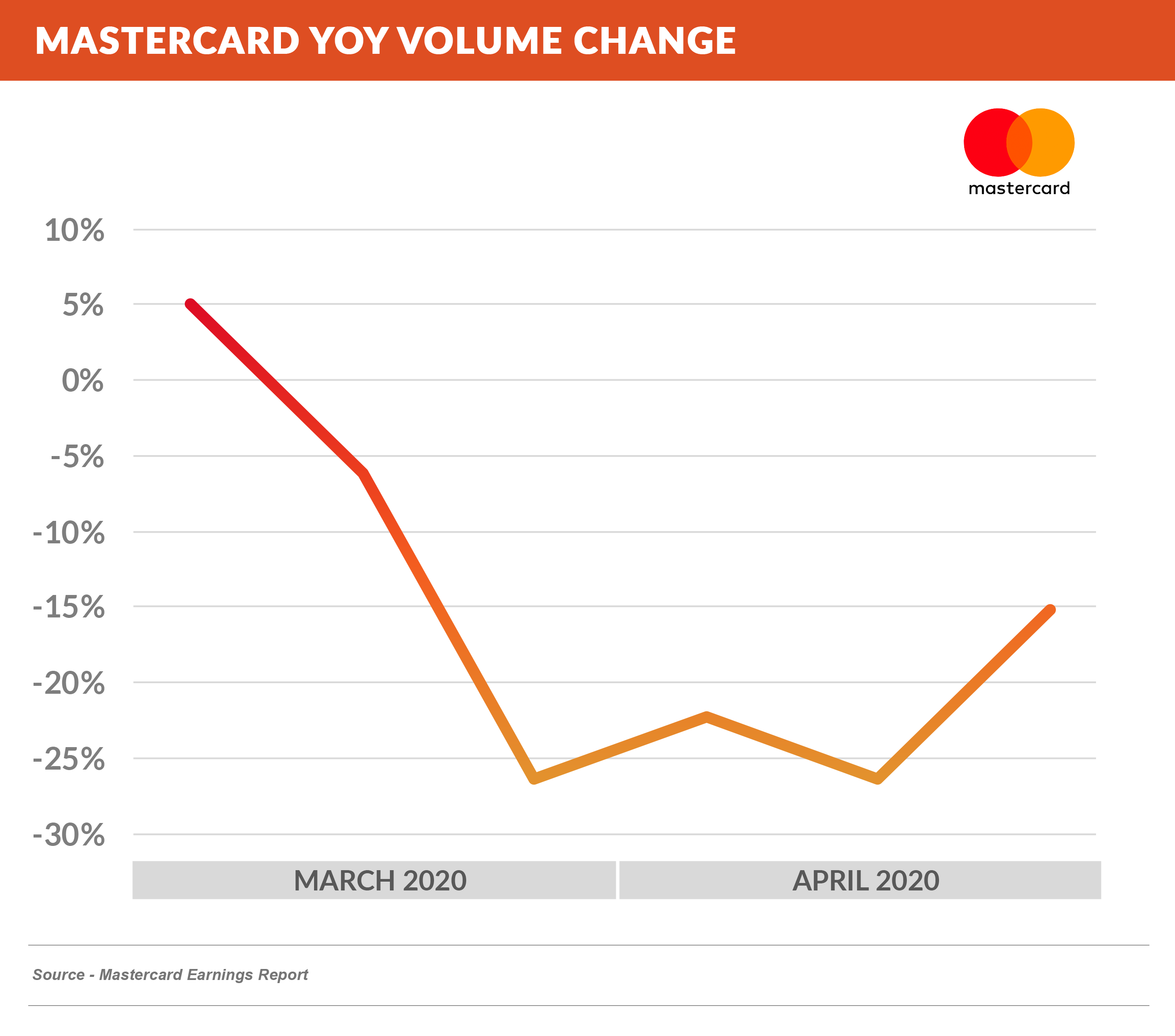

- Visa, Mastercard, and Discover all reported year-over-year charge volume dropping over 25% by late March

- As of early May, spending had recovered somewhat to a level ~10% below May 2019 levels

- PayPal, driven primarily by its online centric payment platform and Venmo, showed year-over-year purchase volume up over 20% in April

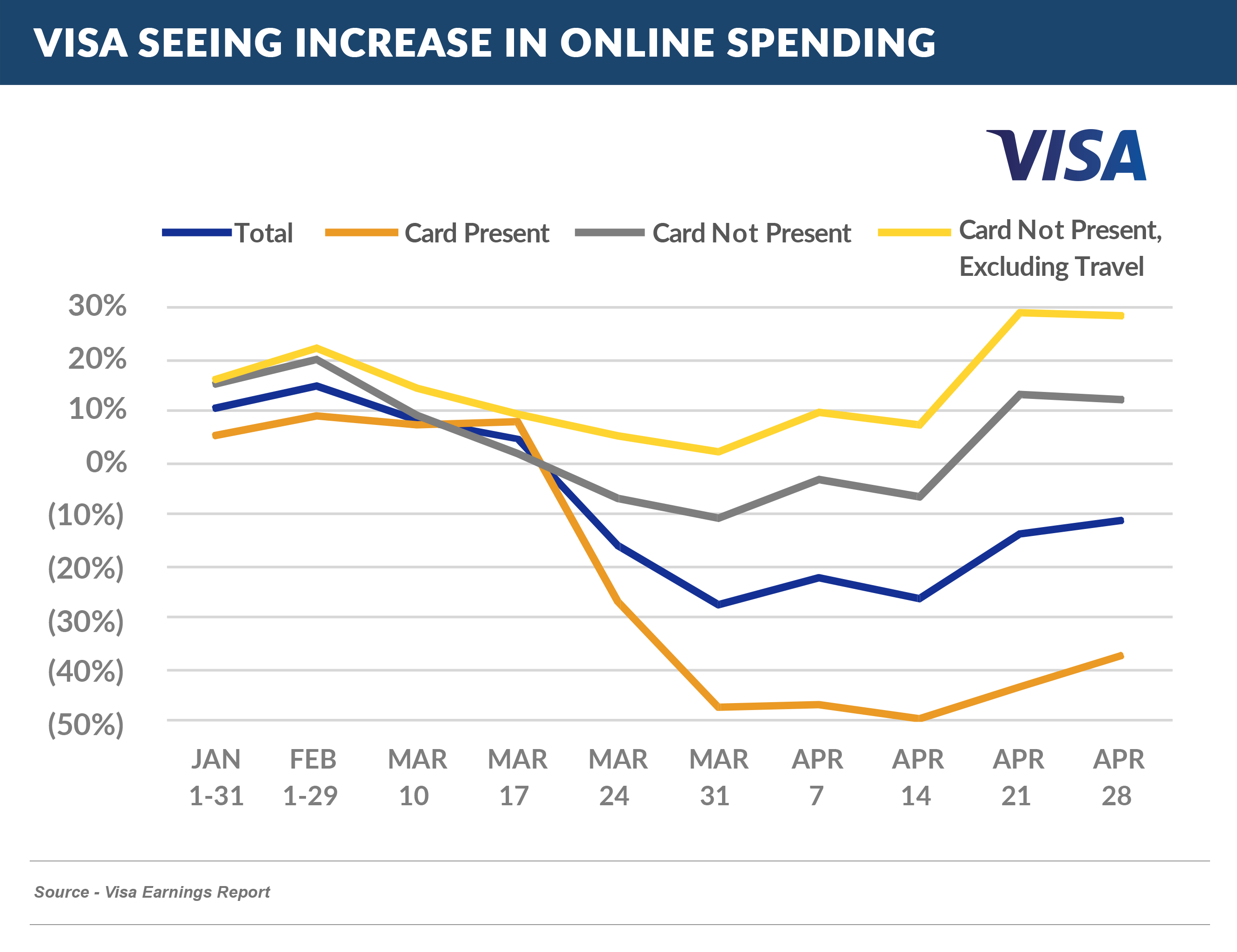

- Reflecting the increase in online shopping, Visa showed a 30% increase in “Card Not Present” transactions (excluding travel) vs. a 50% decline in “Card Present” transactions

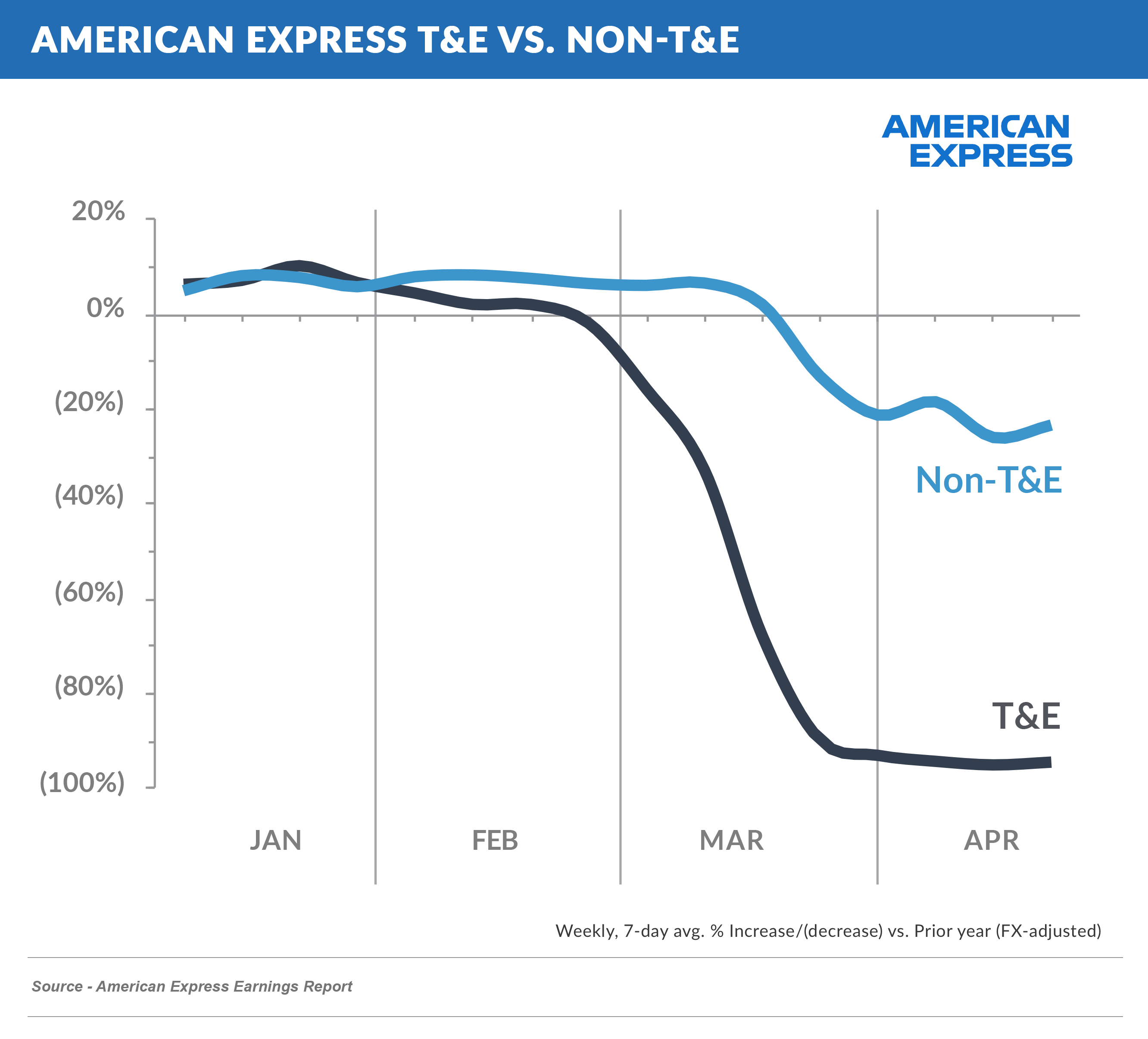

- T&E segment dependent American Express reported a spending decrease over 40% below prior years, with travel and entertainment spending almost disappearing

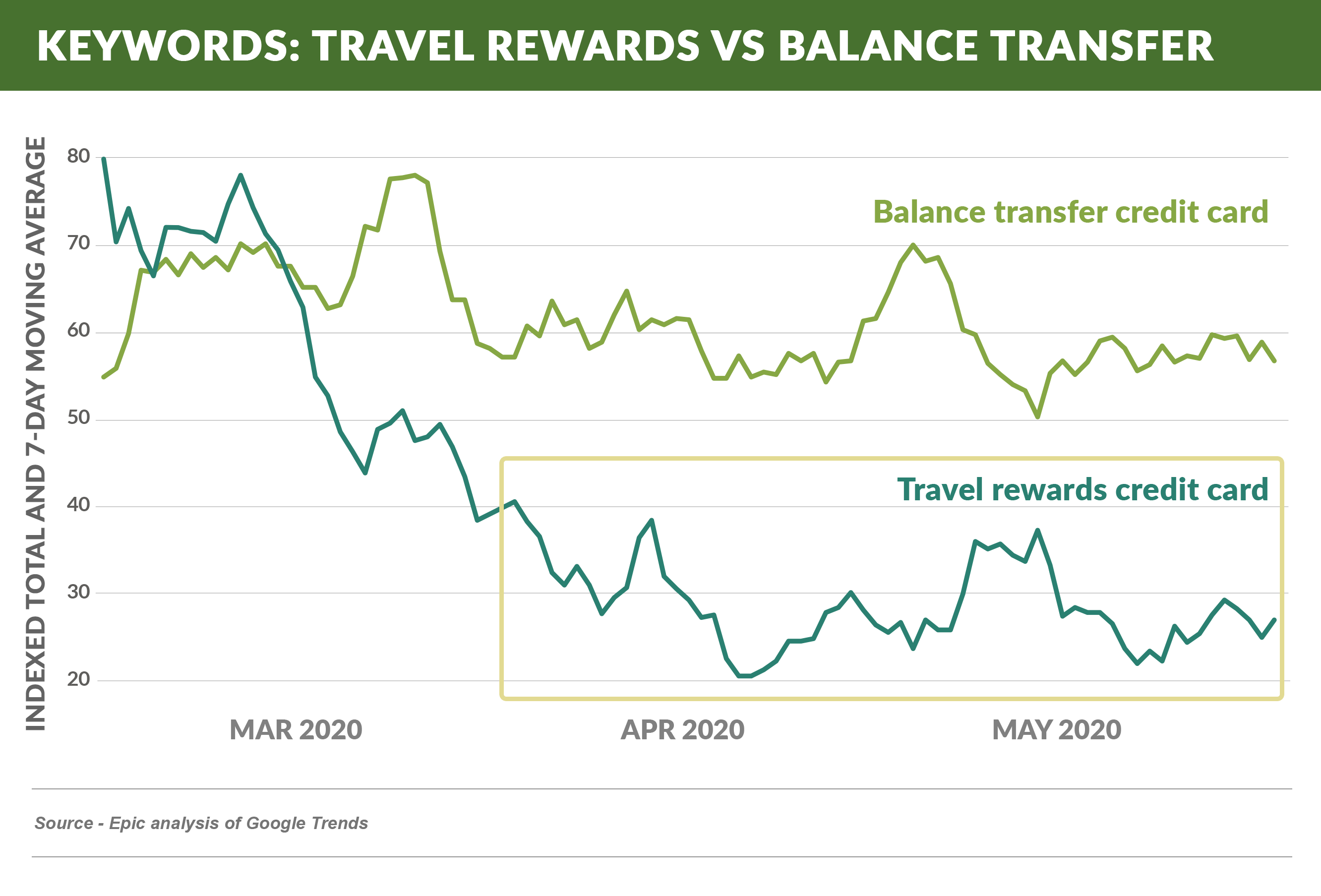

- Reflecting the precipitous drop in travel, consumer online search volume for “Travel Rewards Cards” dropped by two-thirds from early March

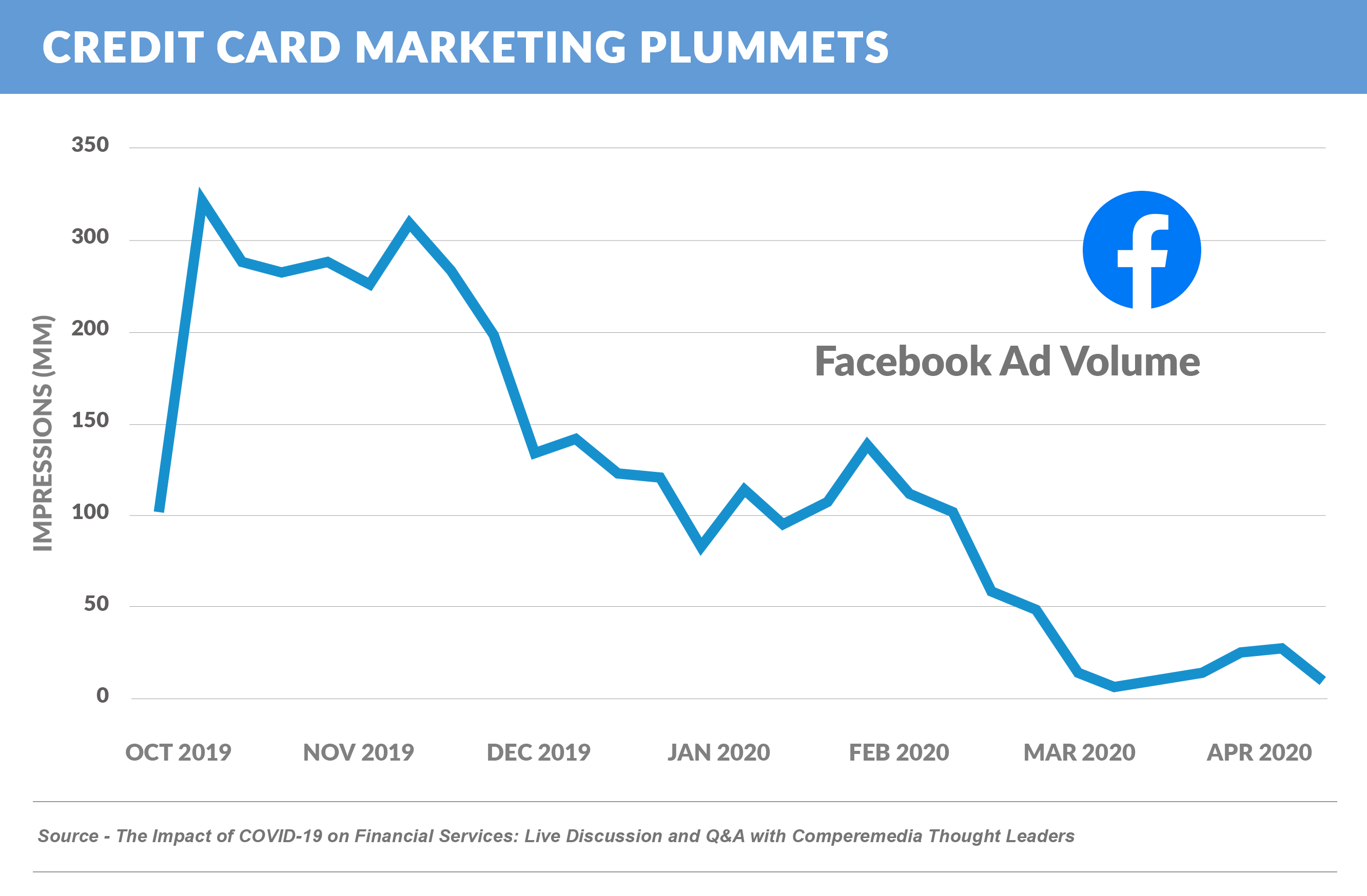

Acquisition Marketing for Consumer Financial Products Continues to Drag

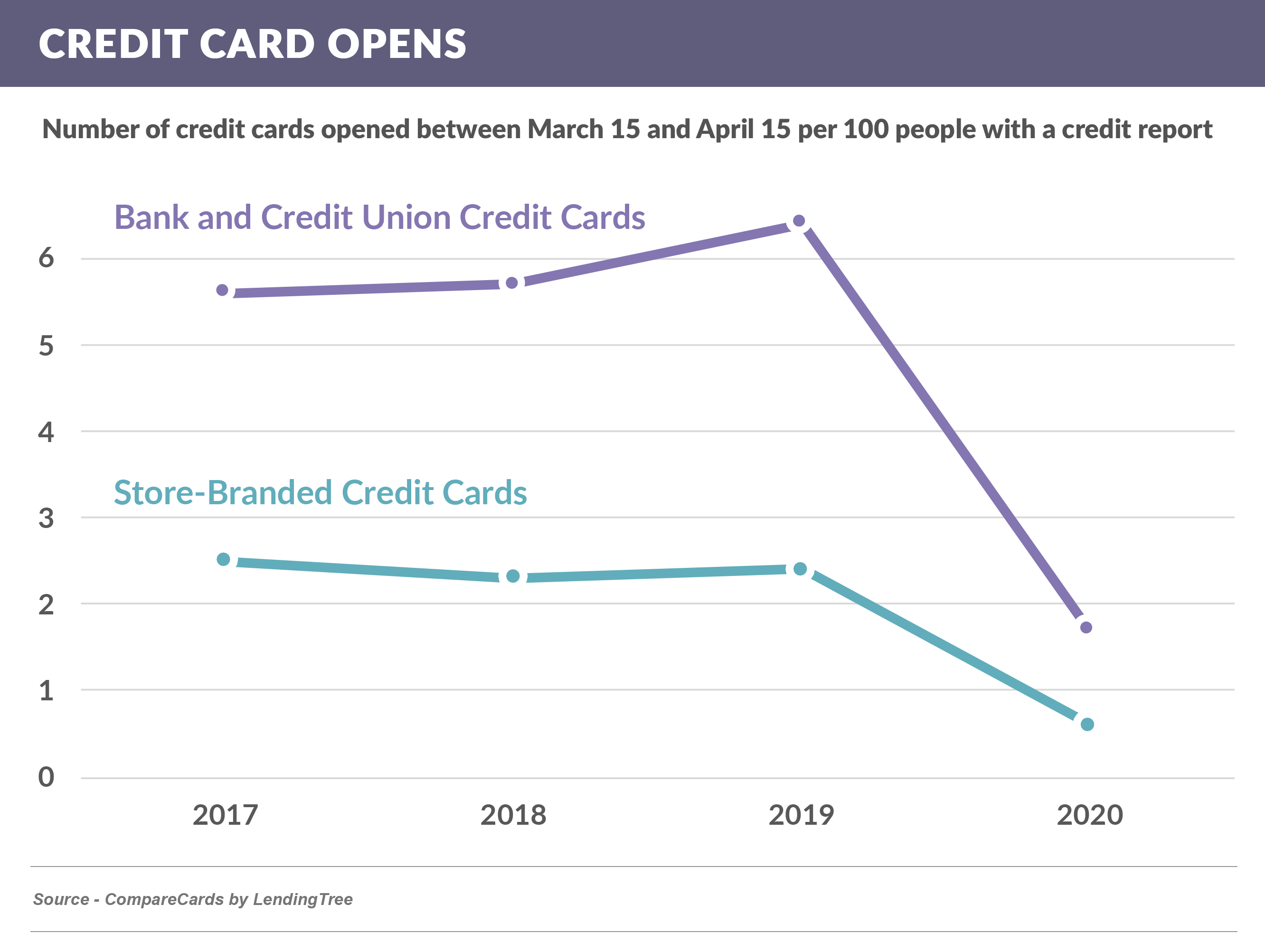

- Online credit card marketing has all but disappeared based on data from Comperemedia

- Unsurprisingly, the number of credit cards opened from March 15th through April 15th this year was down 73% from the prior three years’ average

- While direct mail programs have dramatically decreased, the few anecdotal data points we have show a few categories still mailing, with response rates in April having rebounded to pre-COVID levels

- Personal loan issuance dropped 60% year-over-year in April, with weighted average FICOs and debt-to-income ratios improving (source: dv01, May 2020 report)

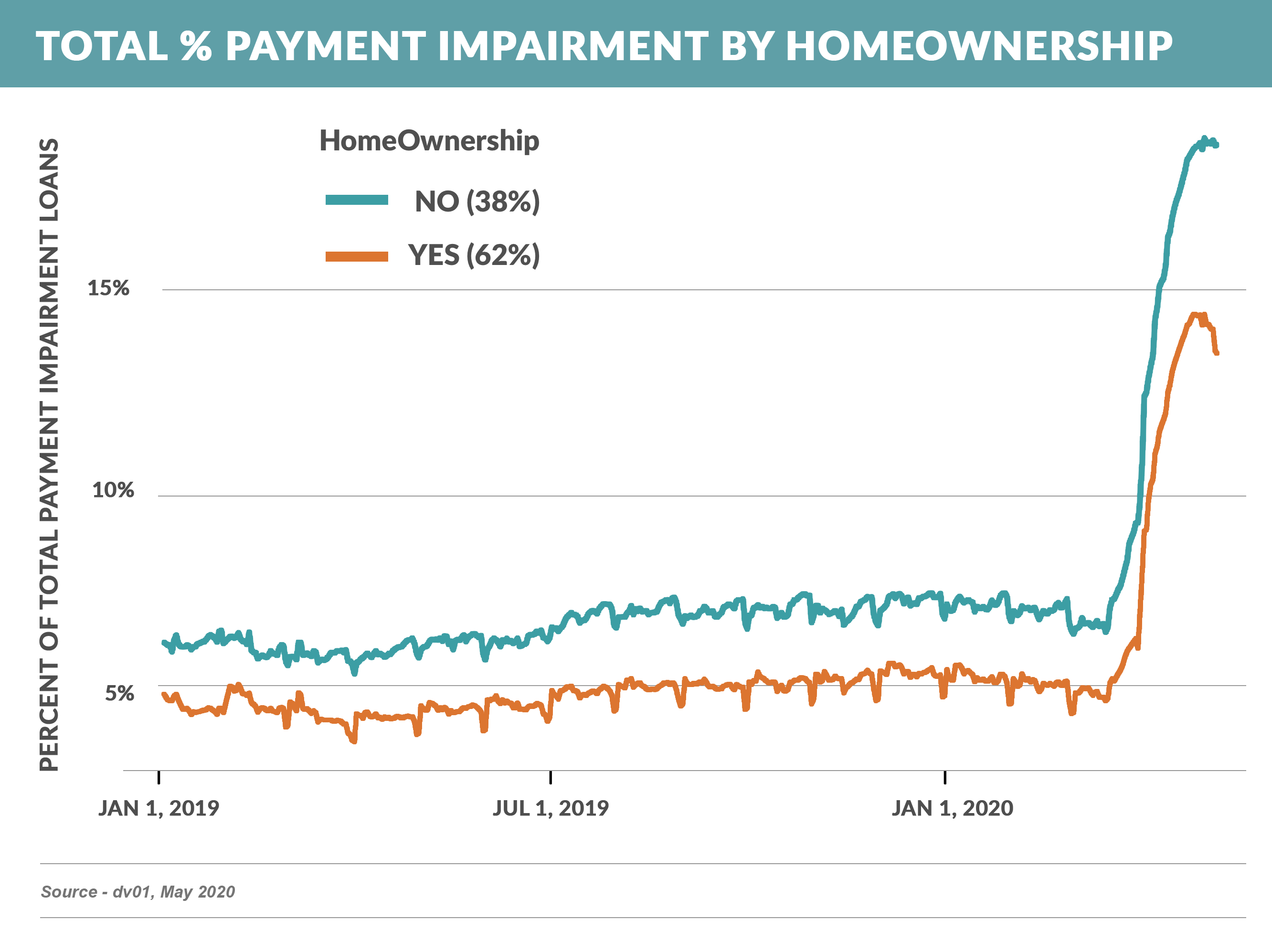

A Delinquency Wave is Undoubtedly in the Offing

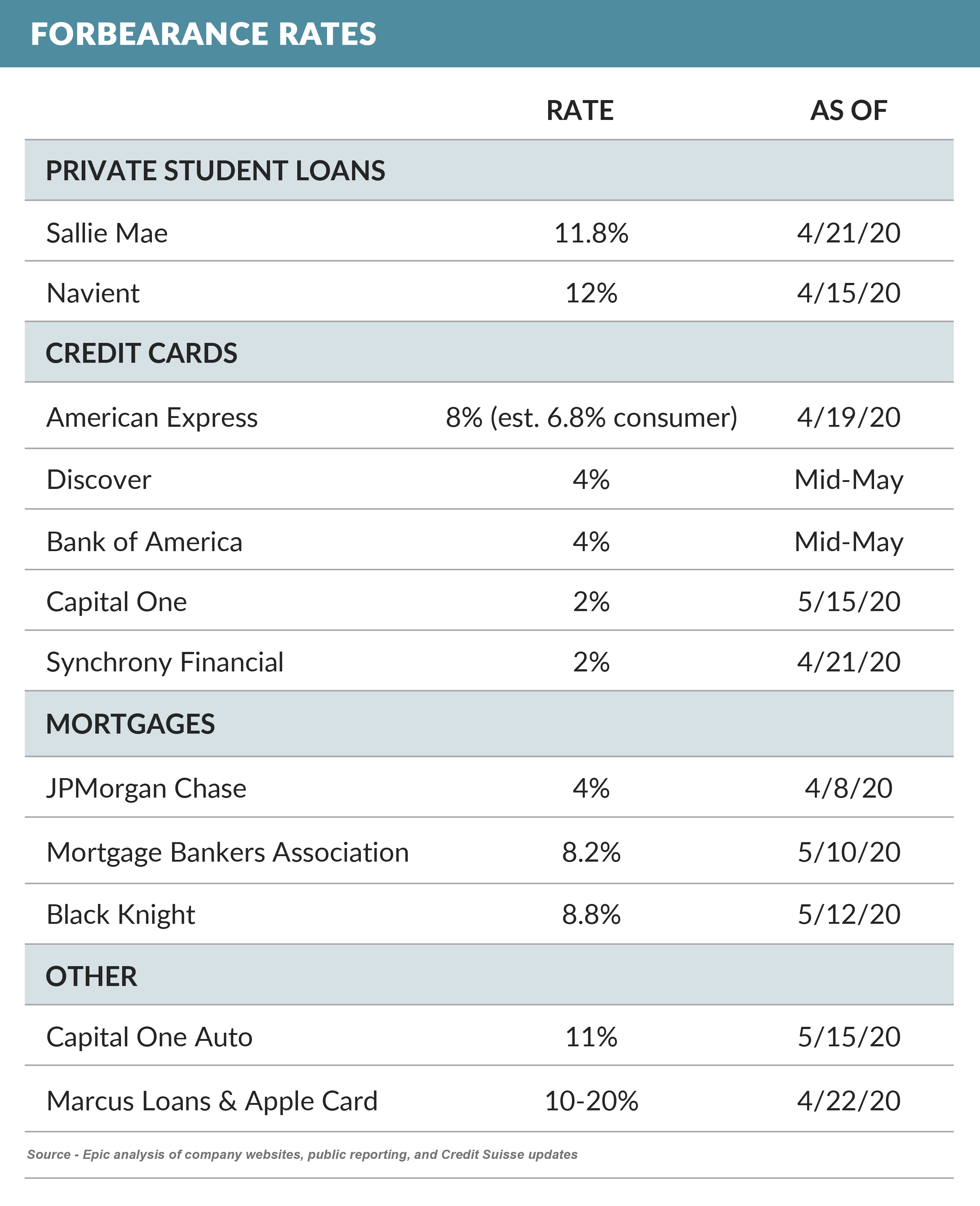

- Widespread forbearance policies for all loan categories have masked the ultimate level of asset quality

- Following a huge spike in March, payment impairment levels have begun to drop slightly, with homeowners performing significantly better than non-homeowners

- While April losses in card securitization trusts were down slightly, the true test will come this summer when forbearance ends, especially if federal unemployment benefits and other stimulus efforts are not continued

- Most policies allow consumers to miss up to three payments, with a new request required every 30 days

- Customers who are current remain current, interest accrues but late fees are waived

- Card issuers are reporting 2% - 7% of their balances are now in forbearance, with personal loan servicers reporting levels over 10%

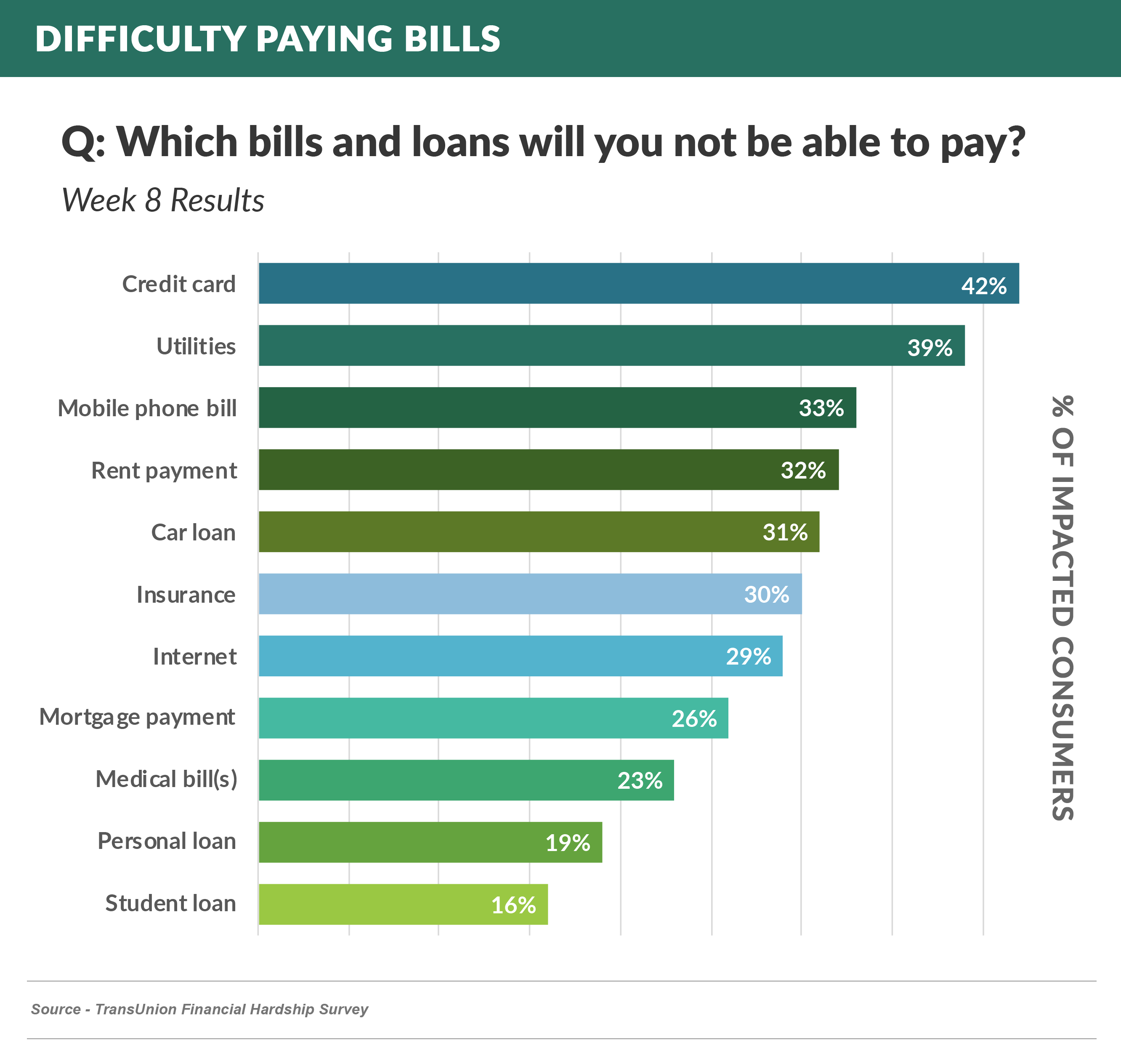

- A recent TransUnion study of consumers indicates that credit cards top the list of difficult-to-pay bills

Going Forward

- While all lenders are preparing for a wave of delinquencies and losses in Q3, no one knows the ultimate level they will reach

- Smart institutions are focusing on refining their digital channels for collections, rather than the knee-jerk ineffective strategy of hiring more collectors

Thank you for reading.

Email me with your comments and suggestions on future topics.

Jim Stewart

www.epicresearch.net

To read our previous newsletters, click here.