Four Things We’re Hearing

- Consumers have shifted credit card rewards preferences away from travel rewards and towards cash back on non-travel categories such as groceries

- Lending executives are generally finding the “work from home” model to be more effective than previously thought

- Alternative lenders continue to be absent from new customer acquisition markets

- Lenders continue to back away from select products, including HELOC’s and private student loans

Today’s newsletter takes 2 minutes to read

Consumer Credit Card Behaviors

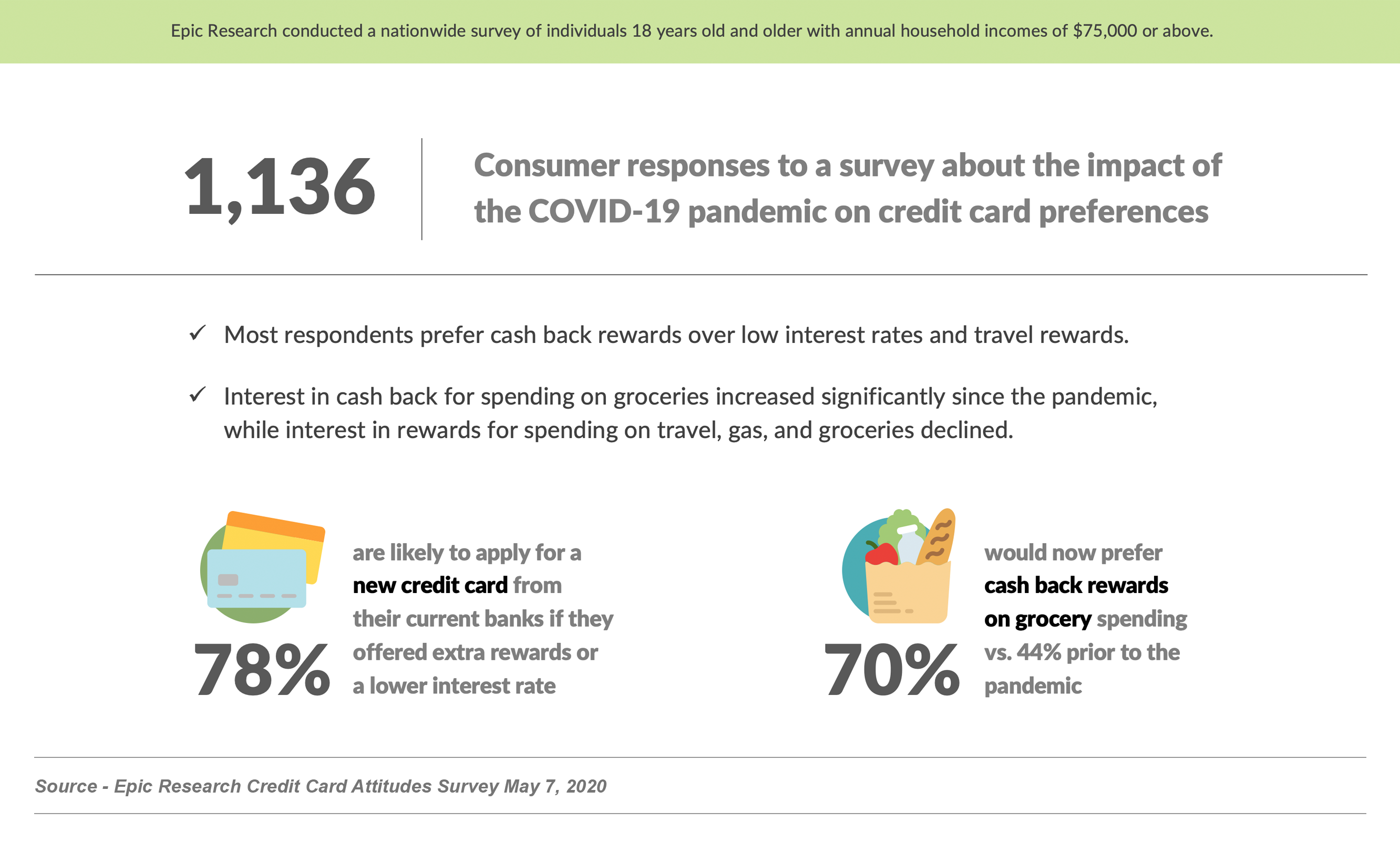

- Epic fielded research this week on consumer preferences regarding credit card features

- The results show a shift towards the cash back feature, with over half selecting cash back as their preferred feature

- In a nod to the impact of stay at home orders, we’re seeing a significant shift in preferences away from travel, gas, and dining and towards groceries

Click here to view the full report

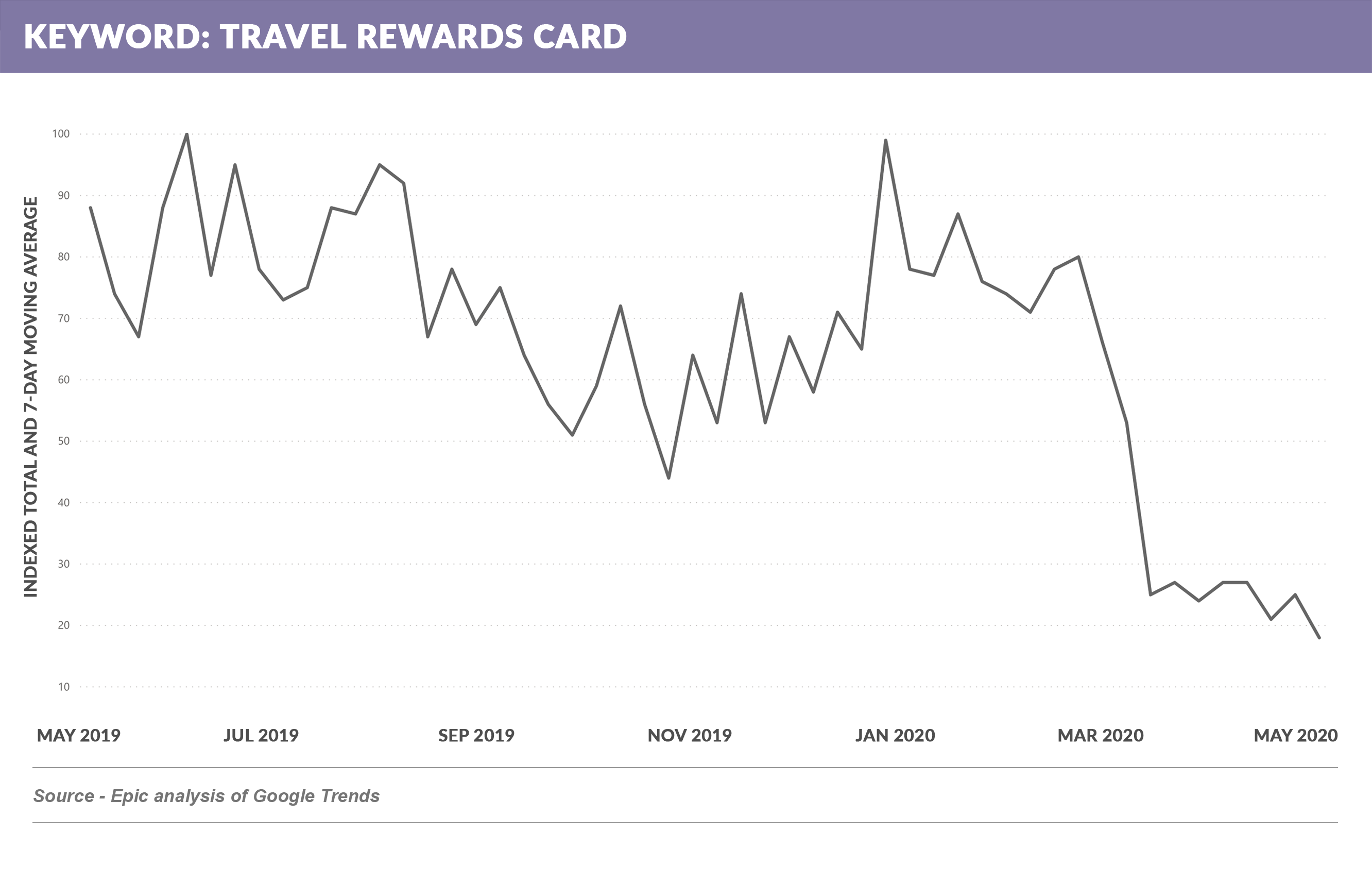

- The continued decline in online search volume for “travel rewards card” further reflects this shift, with a decline of over 80% since February

Lending Industry Developments

- Lenders’ ease of transition to a “work from home” model has varied, with some doing so seamlessly and others having more of a problem

- Some established banks with a traditional call center model have had more difficulty maintaining service levels

- “Newer” companies with more agile outsourced servicing models have tended to fair better

- Executives appear to be in no rush to return to centralized offices, with some, such as Barclays’ Jes Staley questioning the “large downtown headquarters” model’s long-term viability

- Capital One CEO Richard Fairbank announced that non-essential workers in the U.S., Canada, and U.K. will not return to the office until after Labor Day

- Banks are actively planning for a return to branch banking by removing seating in lobbies to discourage loitering, providing masks for customers, and erecting additional physical barriers such as plexiglass

- While the physical modifications are straightforward, the issue of identifying customers wearing masks continues to be a debate without obvious solutions

- There have not yet been widespread layoffs in the lending industry

Alternative Lenders

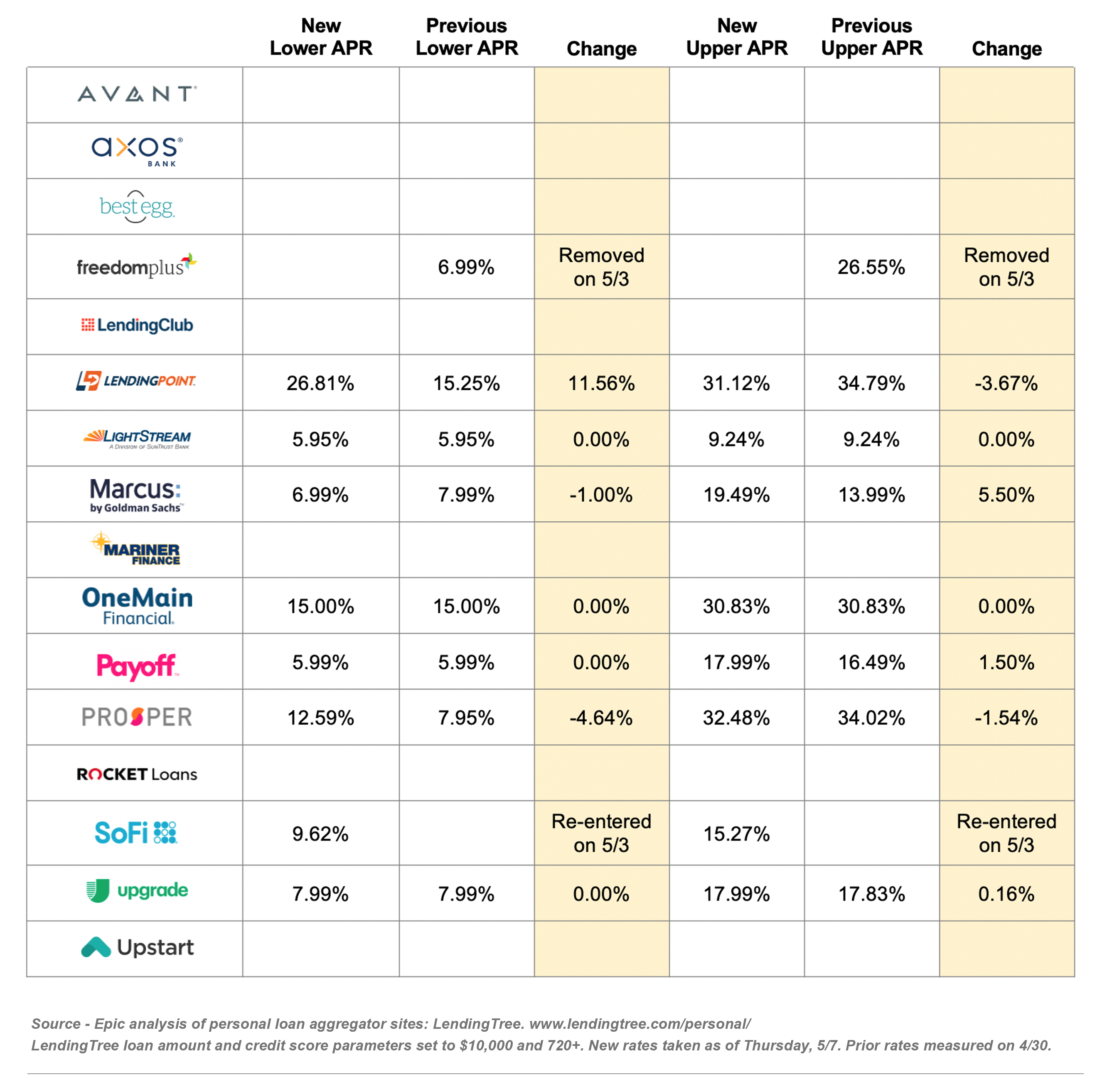

- Many alternative lenders continue to be absent from the personal loan table on LendingTree

- Most of those still present have higher rates than the competition

Lenders Continue to Back Away

- In addition to JPMorgan Chase and Figure, Wells Fargo stopped accepting new HELOC applications as of May 1st

- Bank of America has raised its FICO cutoff for HELOC’s from 660 to 720

- SunTrust has also discontinued making private student loans

Going Forward

- After a dramatic shift in lending markets and work environments, lenders are settling into the new paradigm

- As states begin to re-open, changes in employment and economic trends will further impact the lending markets

Thank you for reading.

Let us know what you think.

Jim Stewart

www.epicresearch.net

To read previous newsletters, click here.