Four Things We’re Hearing

- Lending Executives are cautious, but optimistic

- Demand for lending products has rebounded slightly, but is still below prior trends

- Alternative lenders continue their retreat from new loan acquisitions

- Travel rewards cards search volume continues to be soft

Today’s newsletter takes 3 minutes to read

Following is information on COVID-19’s impact on trends in consumer and small business lending gathered from various data sources and discussions with industry leaders. Please contact us with your thoughts or ideas for future research.

Banking Executive Survey

- An informal survey of lending executives indicates consensus in several areas:

- Most have either paused or significantly reduced new customer acquisition efforts

- Where still active, customer programs are taking precedence over non-customer campaigns, with many lenders continuing to field cross sell campaigns to existing customers in an effort to deepen those relationships

- Many banks have rapidly accelerated efforts to enhance their digital capabilities

- All are looking at credit criteria, with a specific focus on employment type (salaried vs. hourly) and industry; and some have begun targeted employment verification

- Some are considering their criteria by geography; while the economic impacts are widespread, certain areas will be faster to recover based on their exposure to the pandemic and their industry concentration

- There have yet to be widespread layoffs in the industry

- Most are on the lookout for potential acquisitions of fintechs

- While most of those surveyed expect to resume marketing in Q3 2020, some are planning to ramp up in June, while others not until 2021

- All want to be positioned to “come out strong” when appropriate

- Capital-markets-dependent lenders are dealing with an additional set of issues around the availability and cost of funding

- Acquisition campaign response rates are down 10% - 30%, with HELOC holding up the best (although closing challenges are noted for those still relying on a face-to-face interaction), and credit card and personal loan the worst

- As measured by net response, customer acquisition campaigns are performing better than non-customer

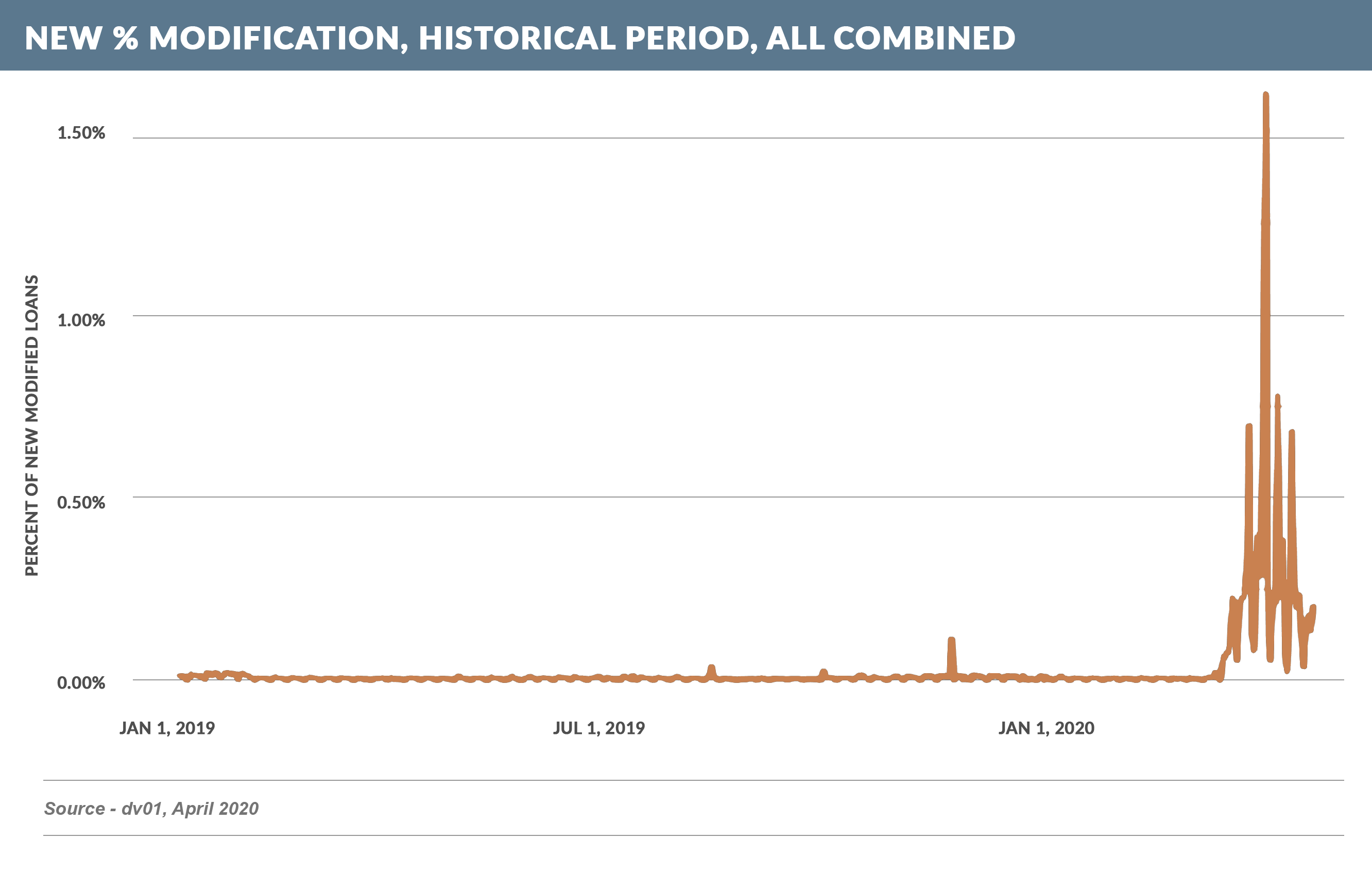

- Many are implementing short-term payment programs to help their customers and mitigate credit losses, although the volume of new loan modifications is decreasing after an initial spike

Consumer Demand

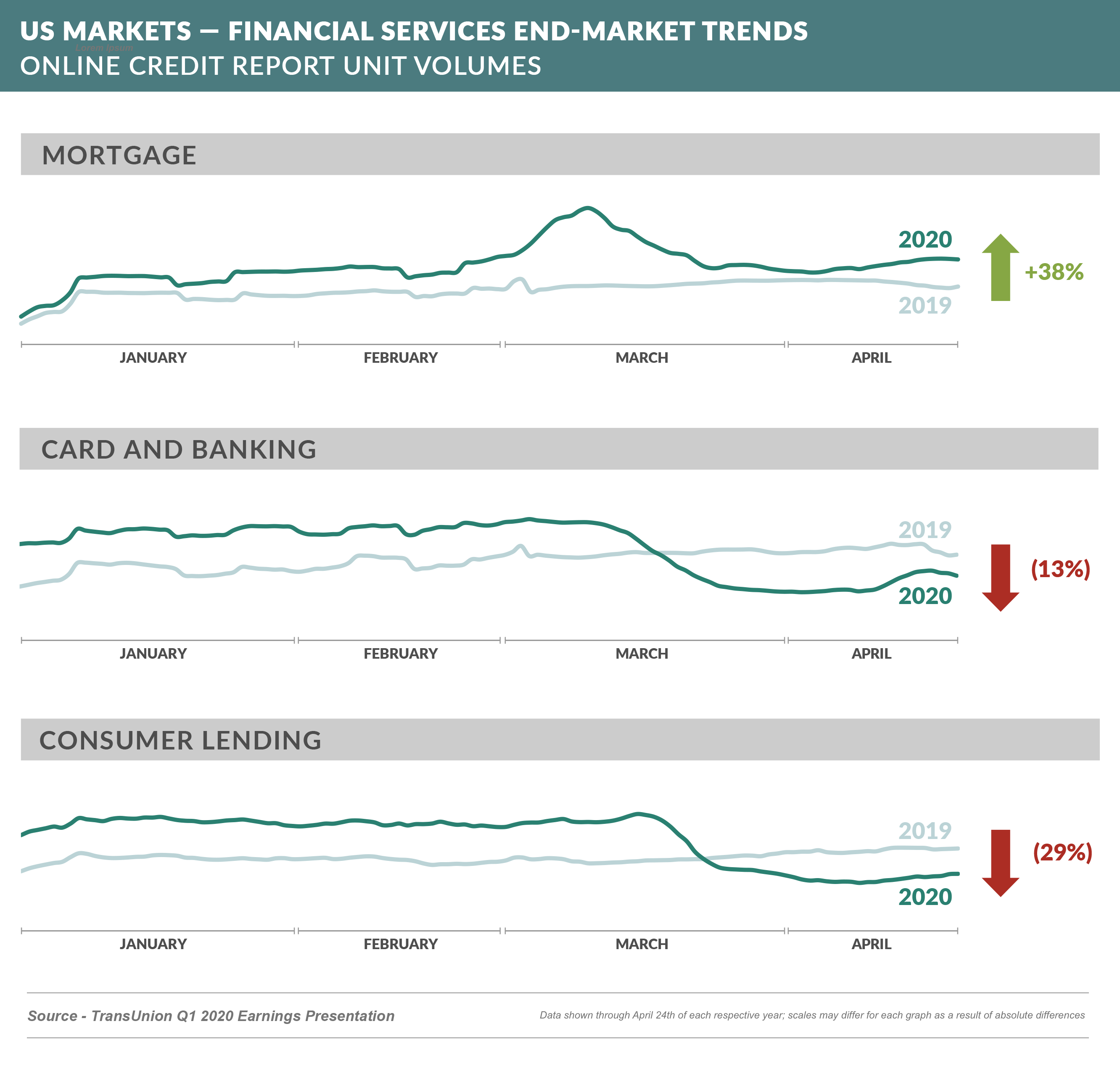

- A report from TransUnion somewhat corroborates our anecdotal information regarding consumer demand:

- HELOC/mortgage holding up

- Cards and loans lagging

- Comperemedia’s most recent reports on mail volume are for the month of March, which are primarily a snapshot of a more “normal” cycle

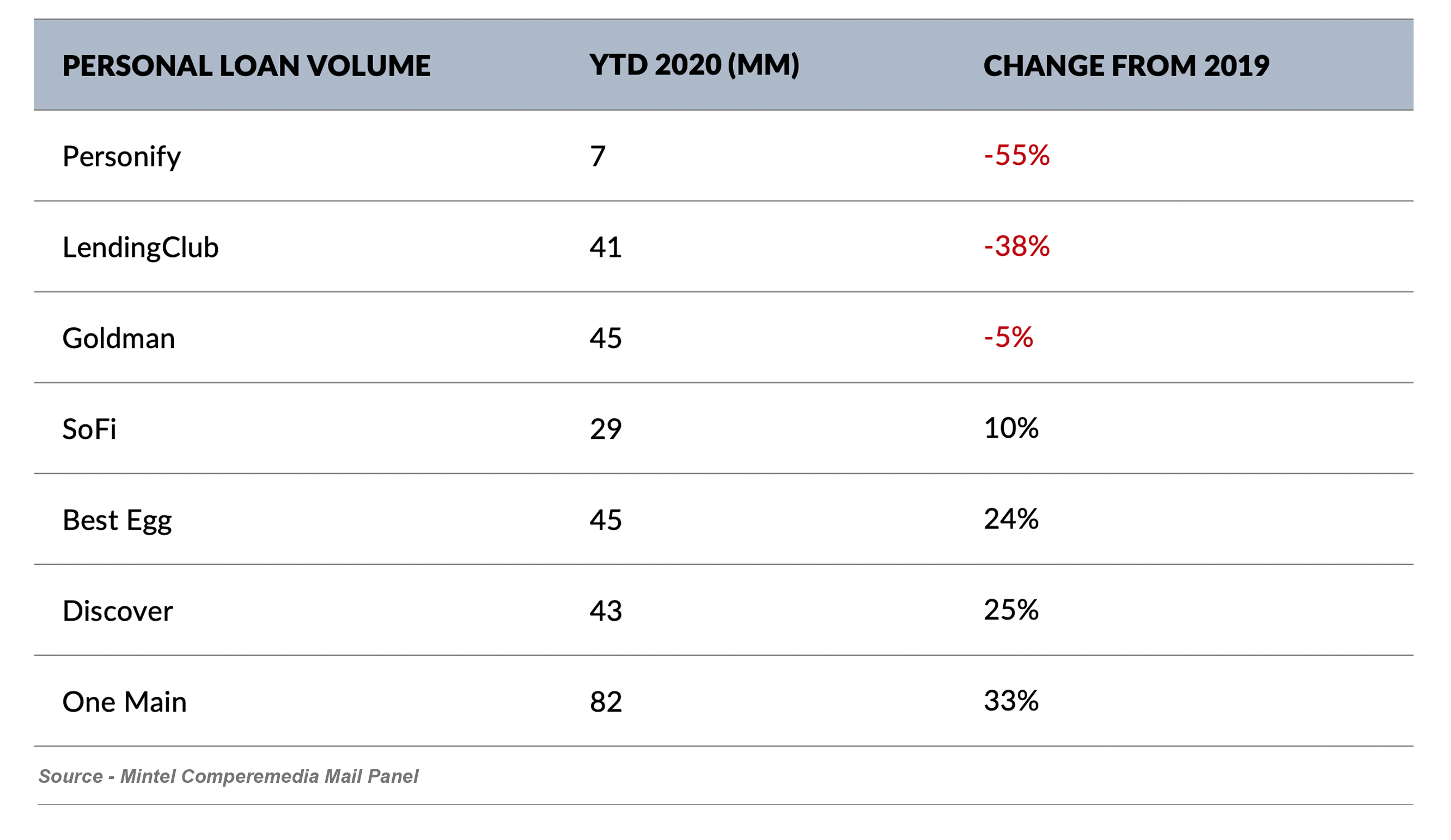

- Personal loan mail volume through March 2020 remained flat with 2019, but LendingClub had a 38% decrease

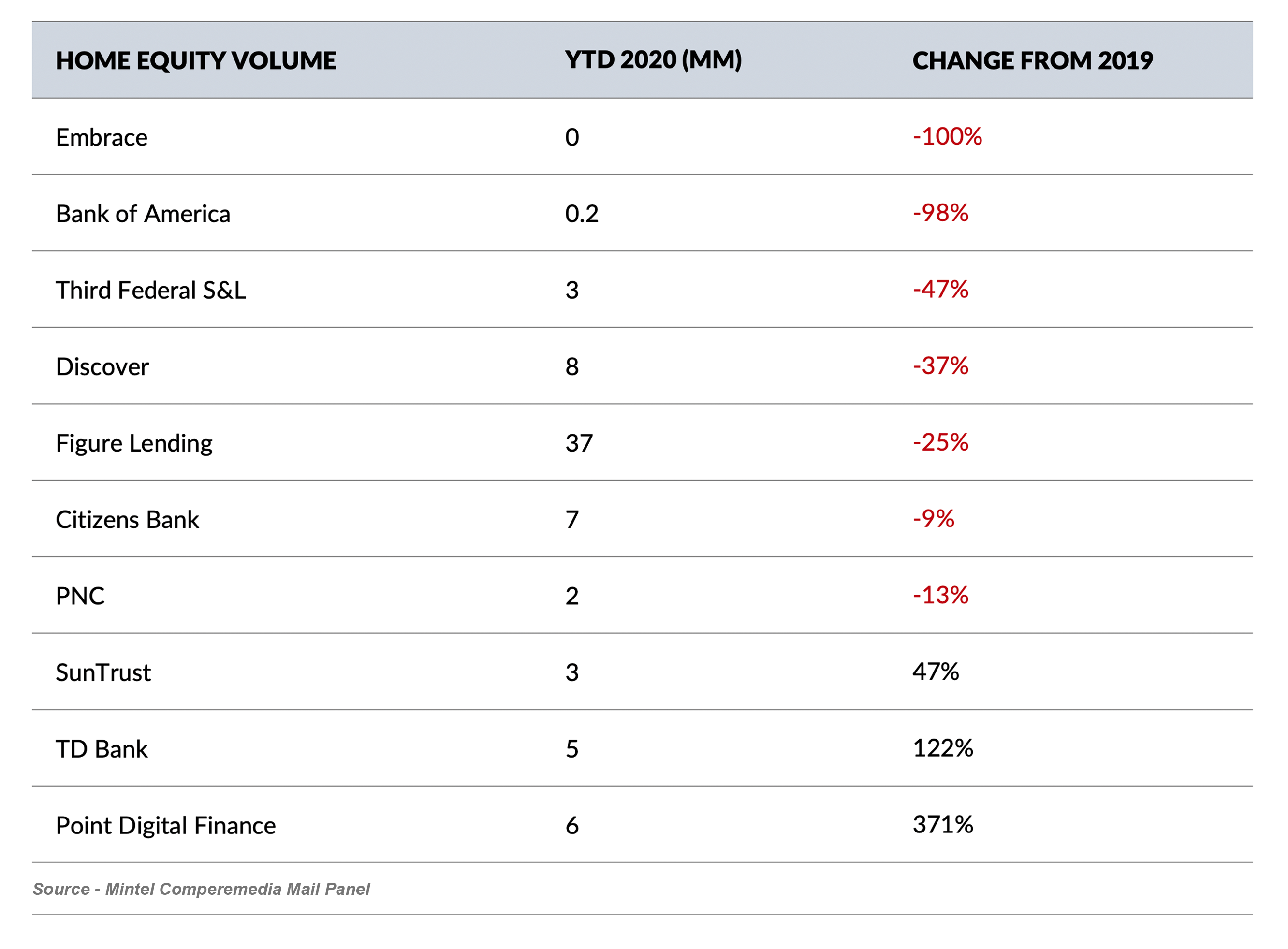

- HELOC mail volume was down 22% from 2019

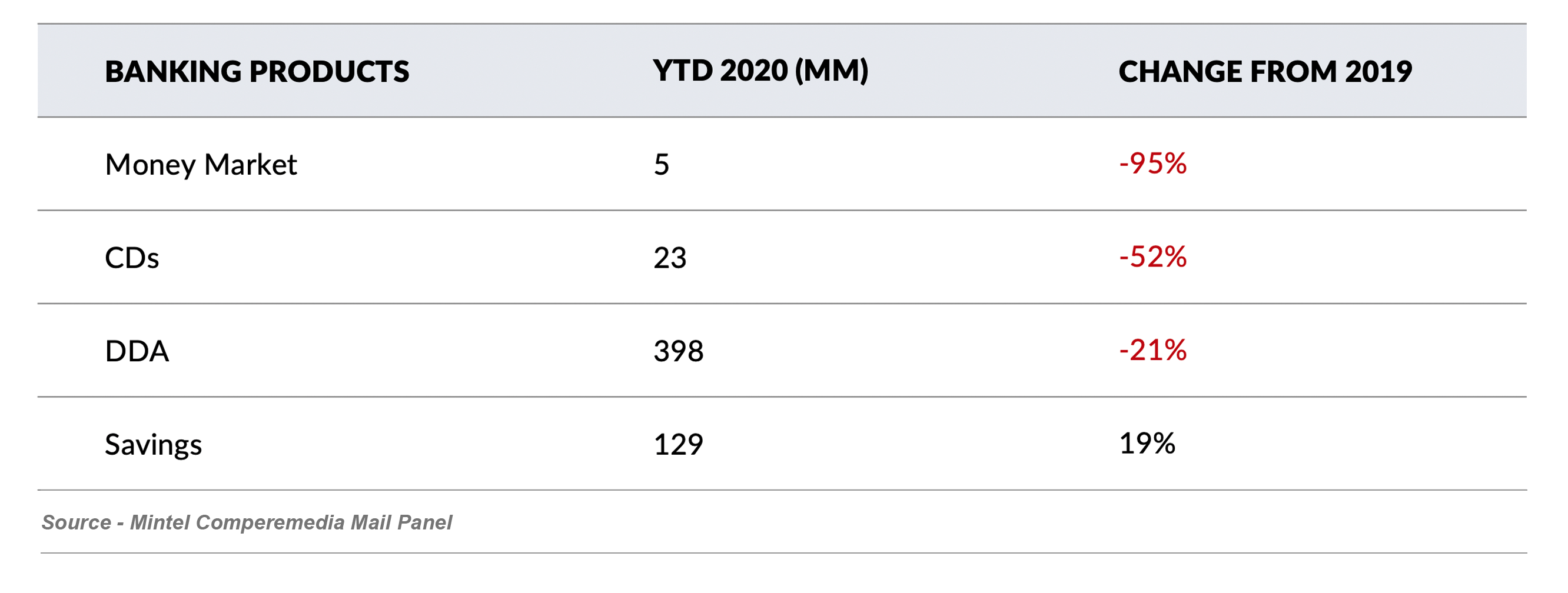

- DDA, CD and money market mail volumes were down from 2019, while savings mail volume was up 19%

- Home Equity Trends

- Several banks, including Chase and Figure, have suspended new HELOC acquisition programs

- Credit Card Spending

- MasterCard reported domestic spending was down 30% in late March, rebounding to a 20% decline in April

Search Trends

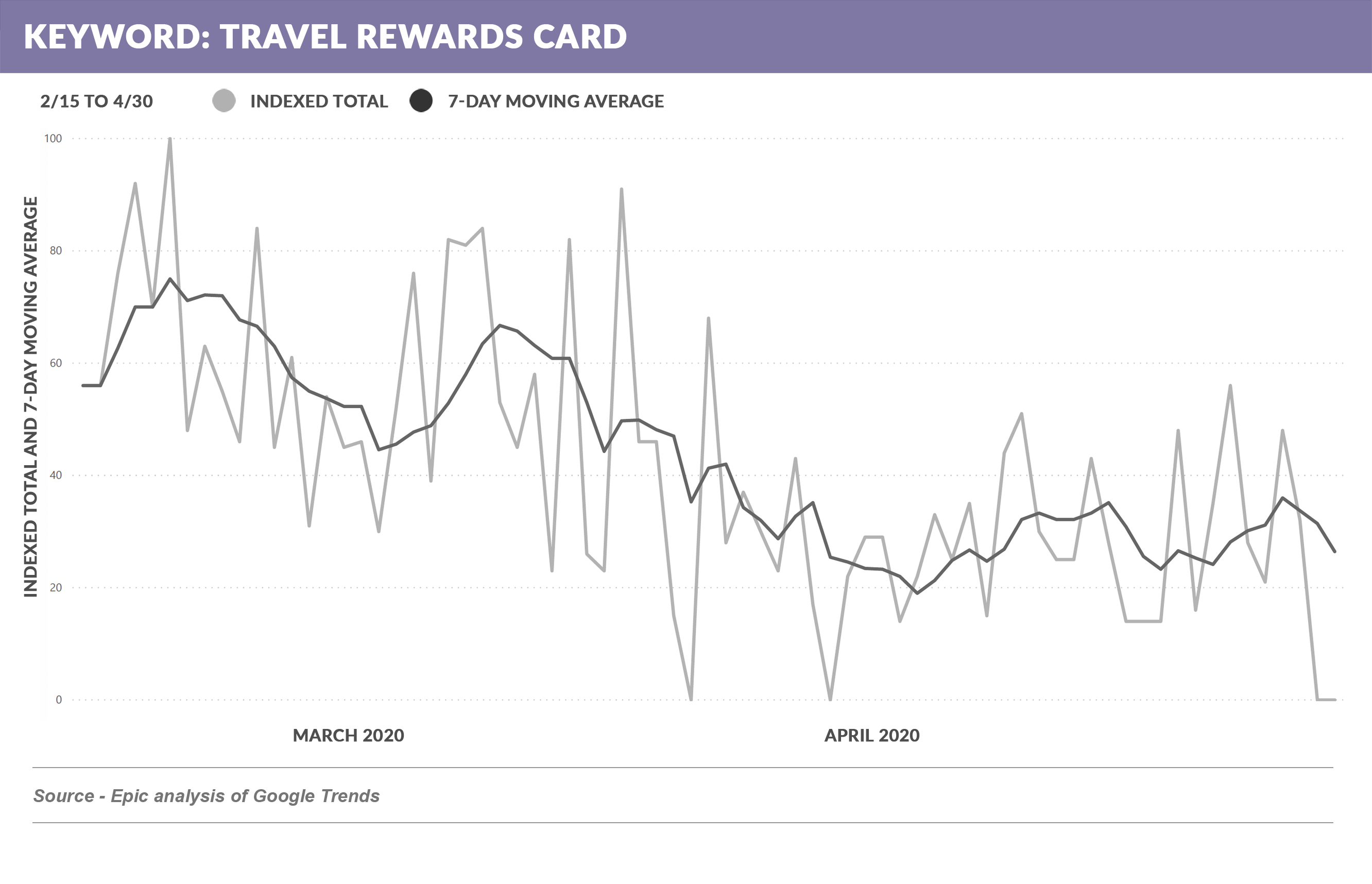

- Not much change in online search trends

- “Travel Rewards Card” search volume continues to decline

Alternative Lenders

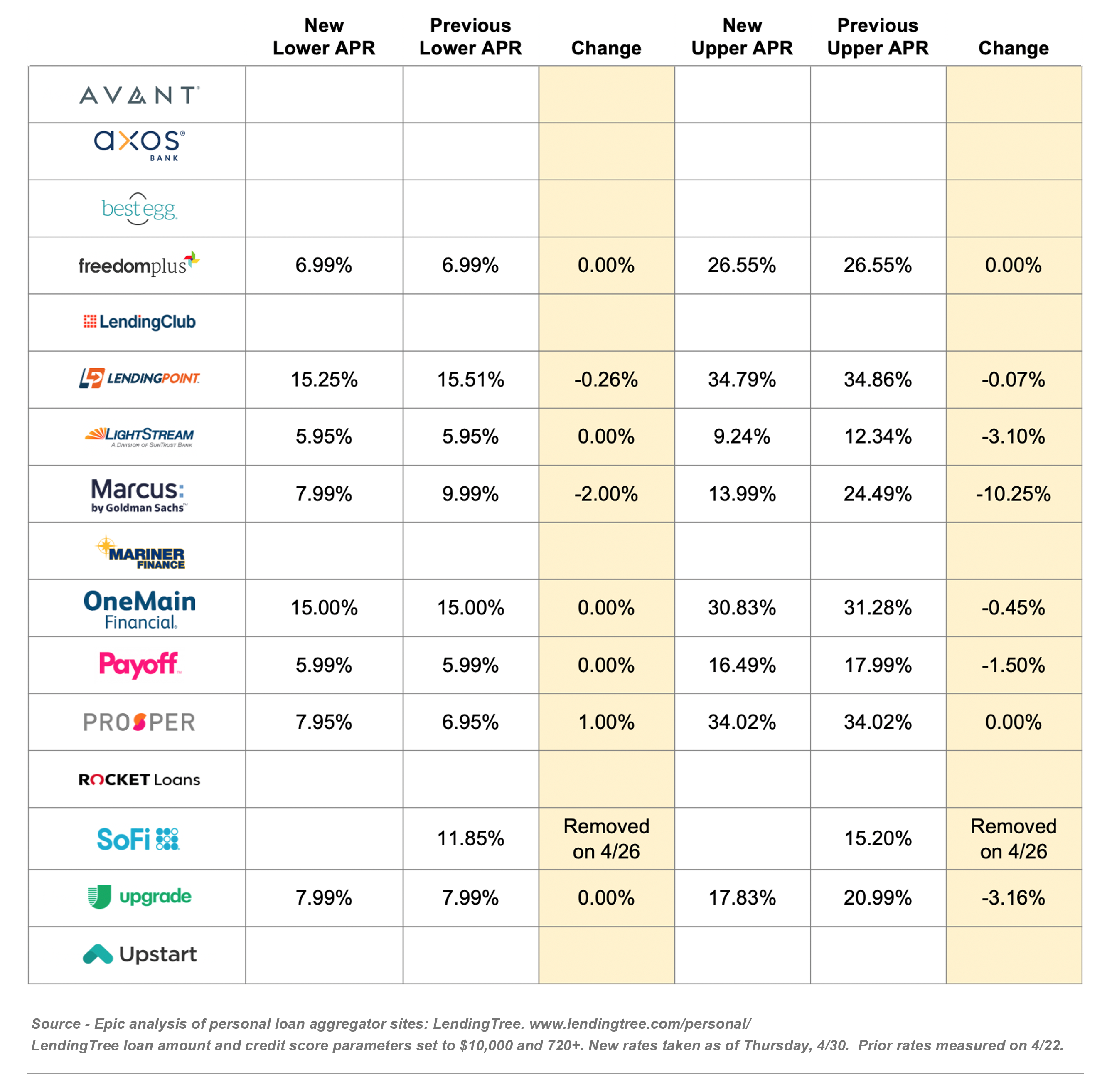

- Many capital-markets-dependent lenders remain absent from the aggregators

- SoFi has raised its minimum loan amount on LendingTree to $10,001

- Marcus has reduced its advertised rate by 200bp to 7.99%, while its upper rate has been reduced by over 10.00% to 13.99%, likely indicating a focus on lower-risk borrowers.

Going Forward

- While we remain in “wait and see” mode, most are trying to strengthen their operations for an eventual re-opening

- The magnitude of future credit losses is yet to be felt

Thank you for reading.

Jim Stewart

www.epicresearch.net