Four Things We’re Hearing

- Loan asset quality is deteriorating rapidly

- Consumers are contacting lenders for help with payments

- Capital markets based fintechs continue to suffer

- Consumers have varying opinions on “when life will resume as before”

Today’s newsletter takes 2 minutes to read

We are monitoring trends in the consumer and small business lending segment in light of the unprecedented impact of the COVID-19 pandemic. Following is data we are watching along with anecdotal information we have gathered in discussions with industry contacts. Please email us with your ideas for future research or commentary.

Asset Quality

- As banks report first quarter earnings, impairment numbers are rising dramatically

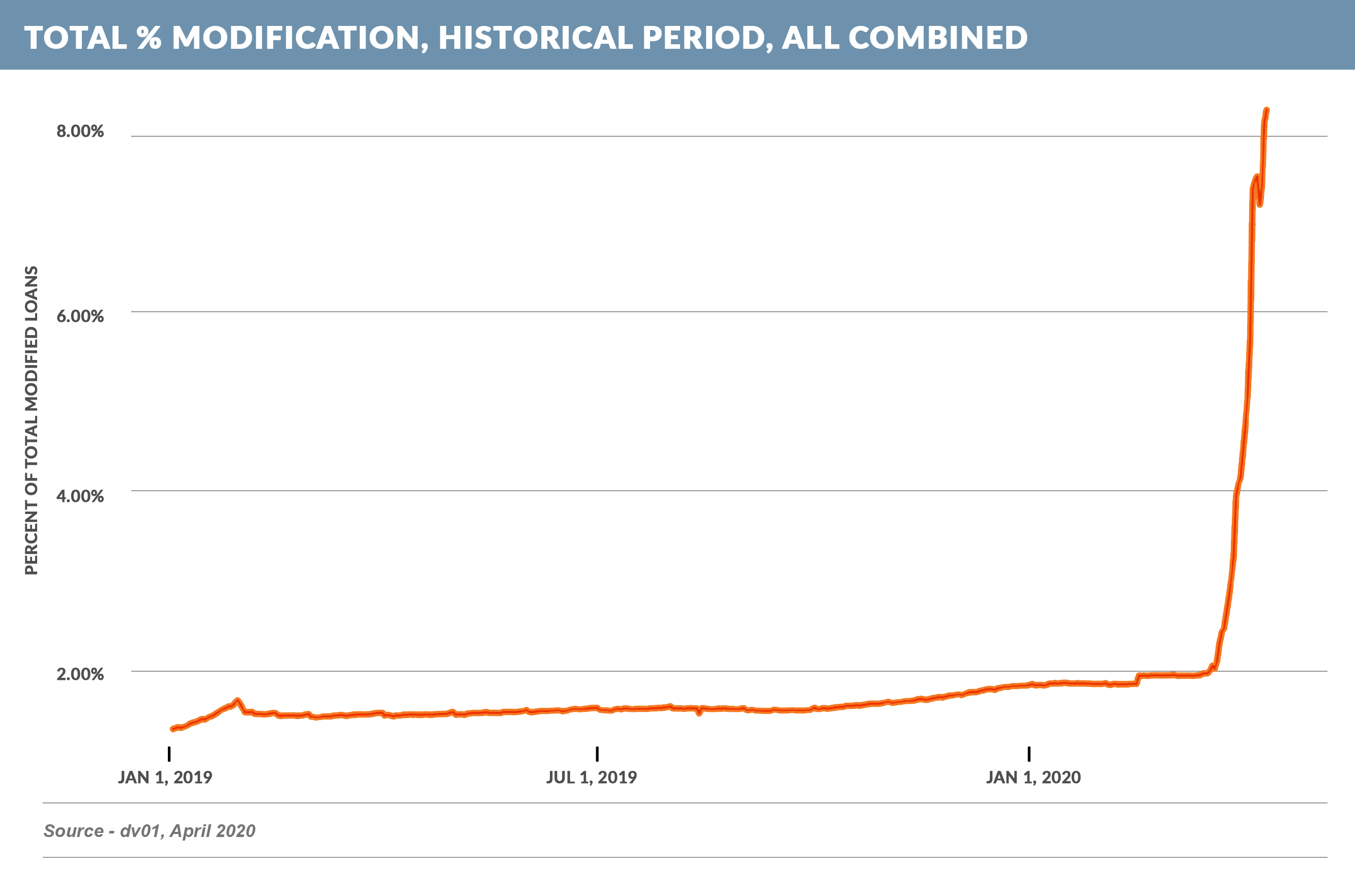

- Online lenders have recently had a “noticeable” increase in modified loans

- “Ally said that about 25% of its accounts requested forbearance…[and] 70% of those accounts have never had any payment delinquency with Ally. Does that mean most people in forbearance are solid borrowers just taking advantage of the break—or that even solid borrowers are finding themselves in trouble?” (source: “Consumer Lenders Enter Fog of Uncertainty”, Wall Street Journal, April 21, 2020)

- Discover announced that 4% of its cardholders had entered a program to skip two card payments, and Sallie Mae said that it had an 11.8% forbearance rate on private student loans

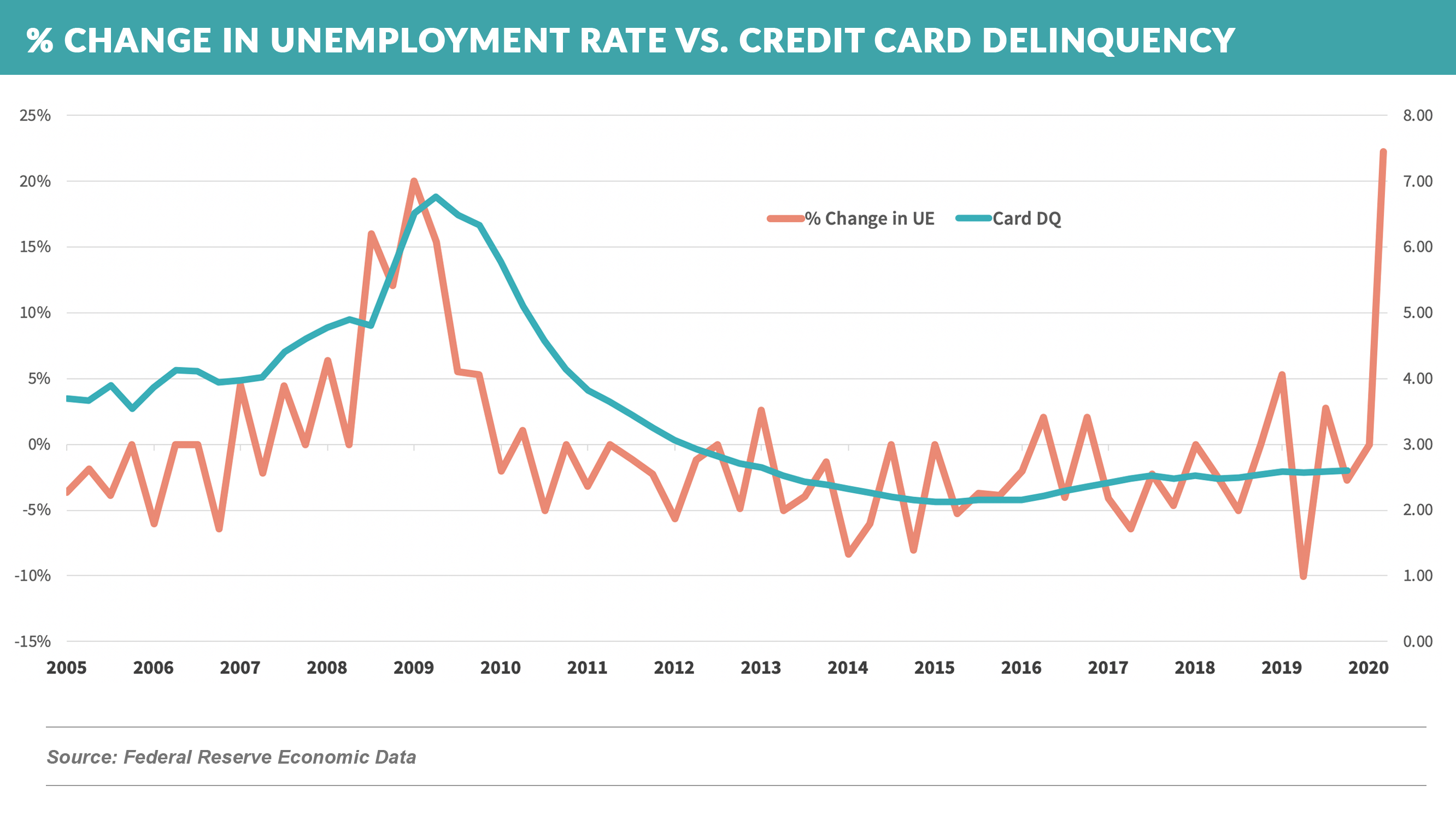

- Delinquency and bankruptcies have historically moved in lock step with unemployment. It will be interesting to see how long the record level of unemployment lasts and the magnitude of its effect on asset quality.

- It’s a good time to focus on existing customer marketing!

Consumer Payment Research

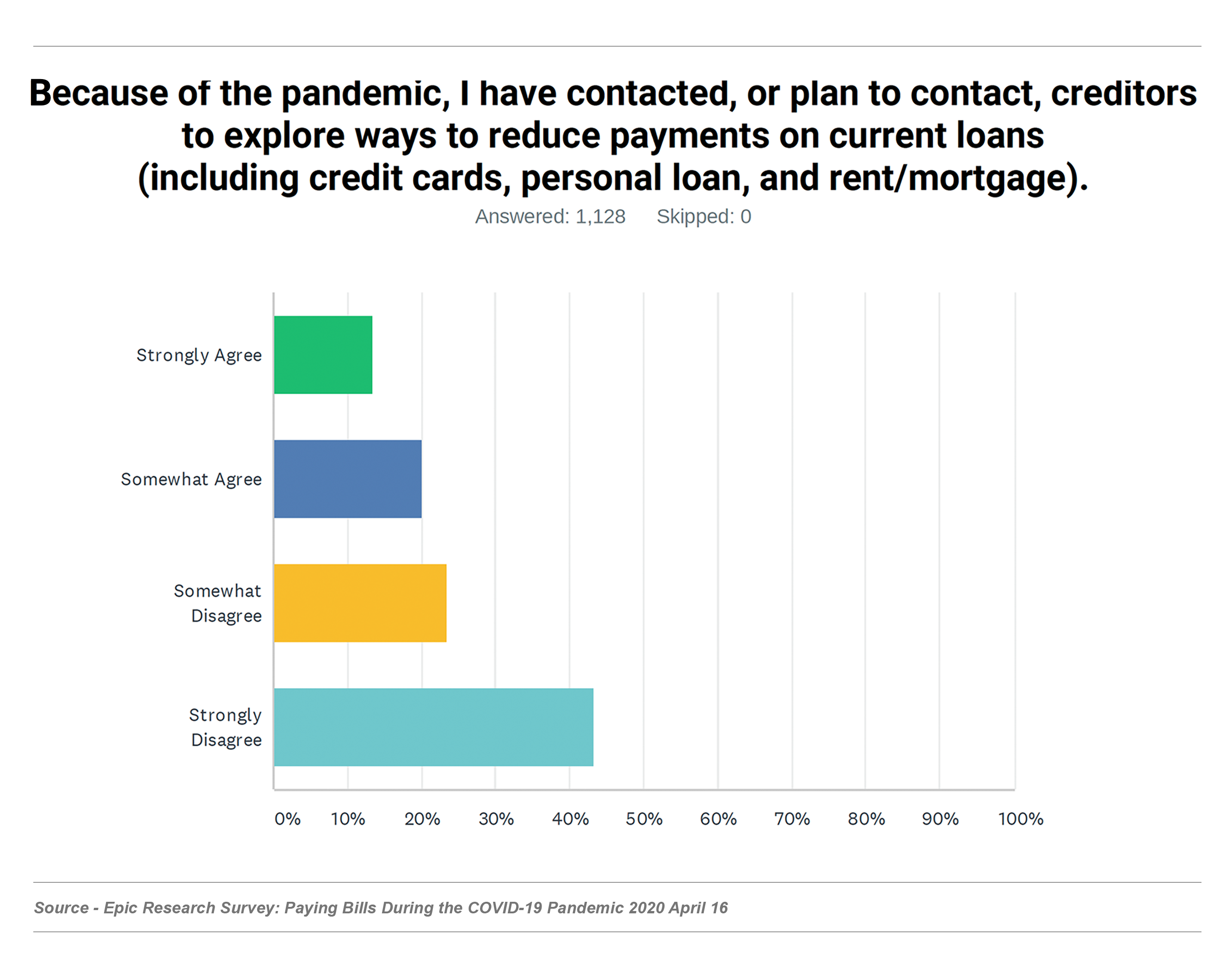

- We surveyed adults regarding their ability to pay their bills during COVID-19

- 24% of respondents (with incomes of $75,000 or higher) have plans to contact creditors to explore ways to reduce payments on current loans

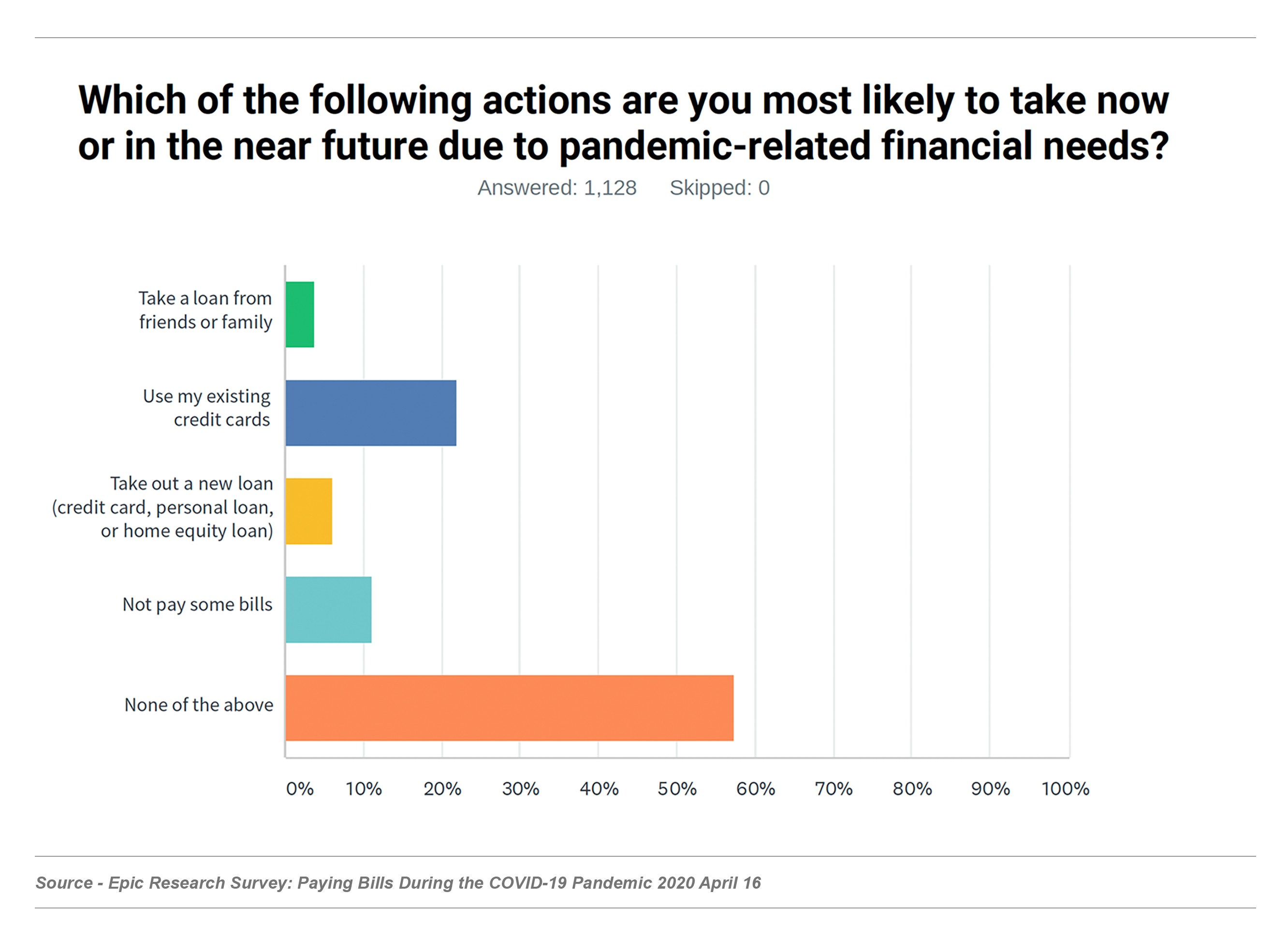

- Only 6% plan to take out a new loan to help with pandemic-related needs

Alternative Lenders

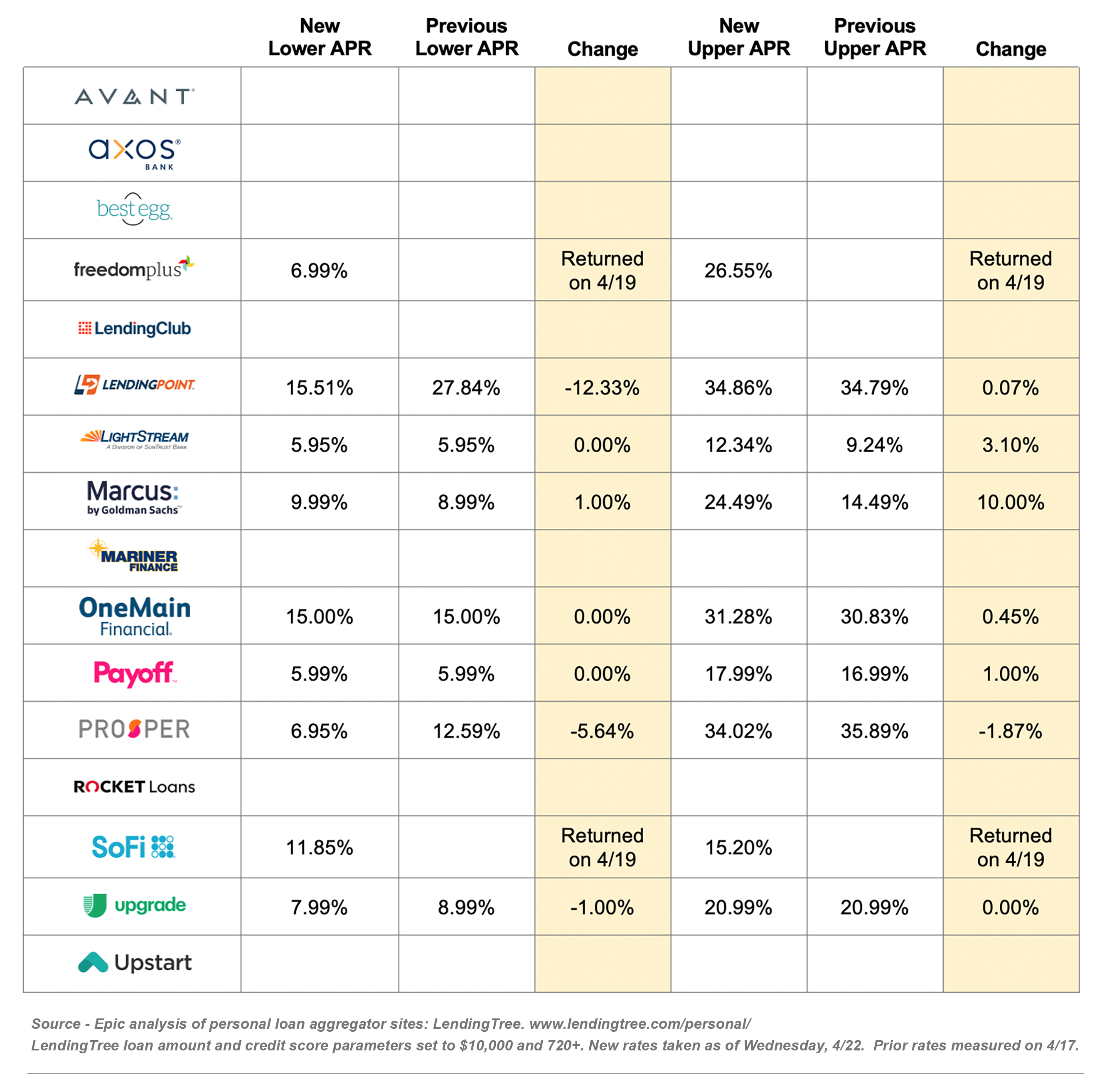

- Several lenders returned to the LendingTree table this week, but the trend of less activity by capital-markets-funded lenders continues

- Warehouse lines are full, and securitizations have all but stopped as buyers have better options

- LendingClub laid off 460 people this week, including its President

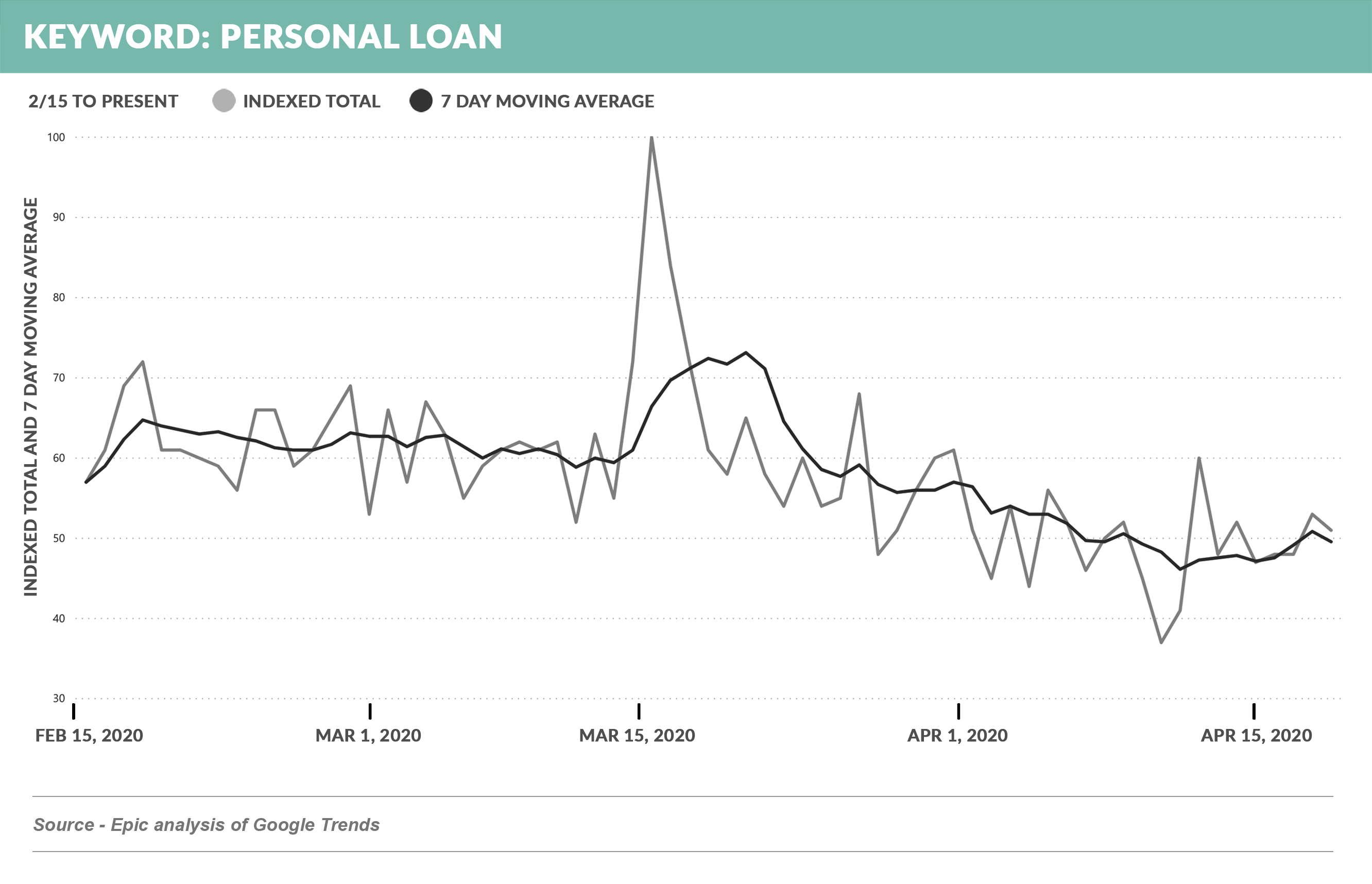

- Online search traffic for “personal loan” continues to trend downward

When Will We Re-Open?

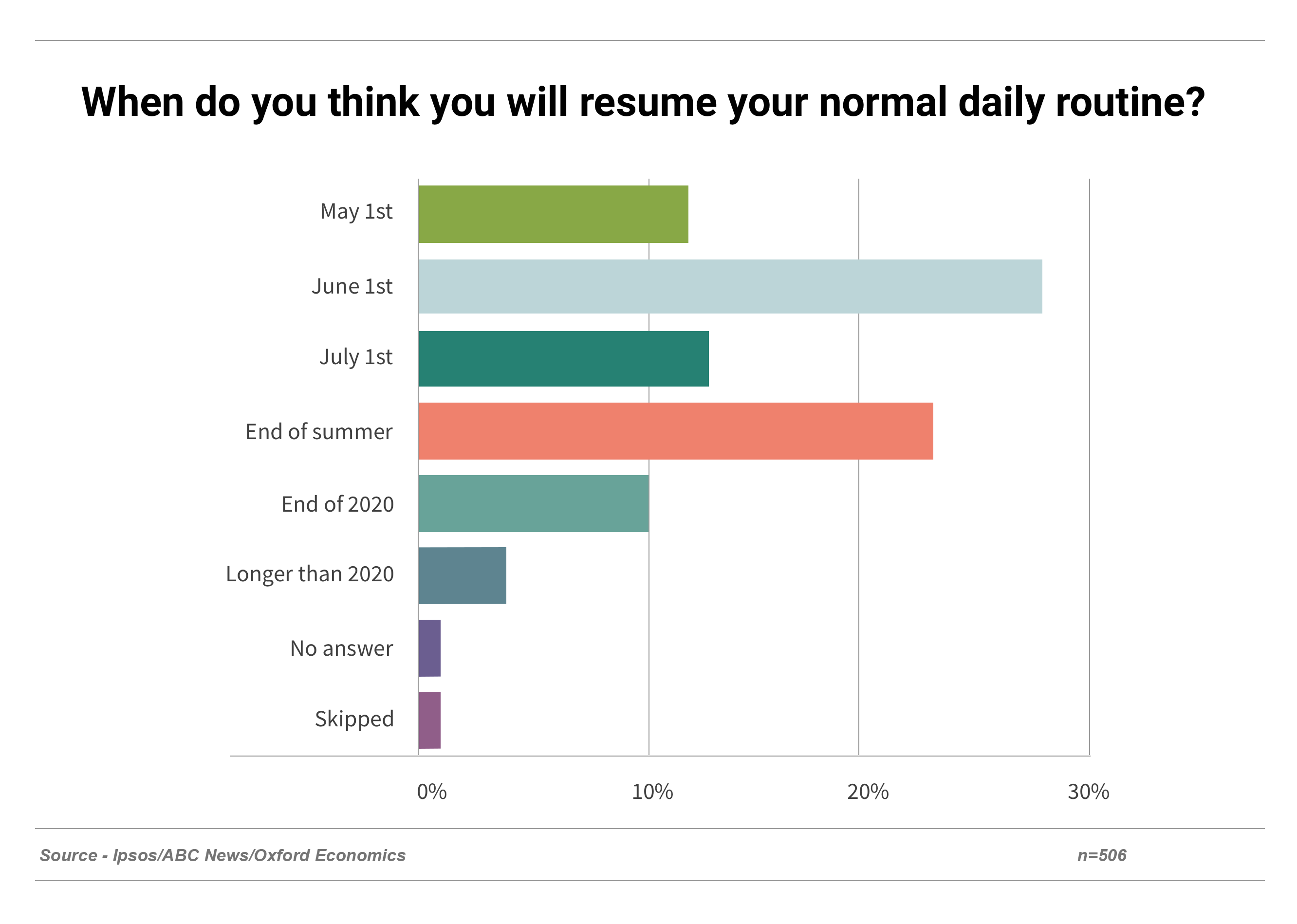

- Consumers have varying opinions about when they will “resume their normal daily routine”

- “When will banks resume lending” was not on the survey

Going Forward

Let’s hope that lenders don’t repeat this classic cycle:

- “It will be okay, we’re positioned to emerge in a strong position.”

- “It’s worse than I thought.”

- “STOP MARKETING!”

Thank you for reading.

Jim Stewart

www.epicresearch.net