Three Things We’re Hearing

- Consumers prefer to have most banking products with one bank

- Mega mailers leave growth opportunity for regional banks

- Consumer financial marketing maintains upward trend

A three-minute read

If the Epic Report was forwarded to you, click here to add your name to the mailing list

Consumers Prefer to Have Most Banking Products with One Bank

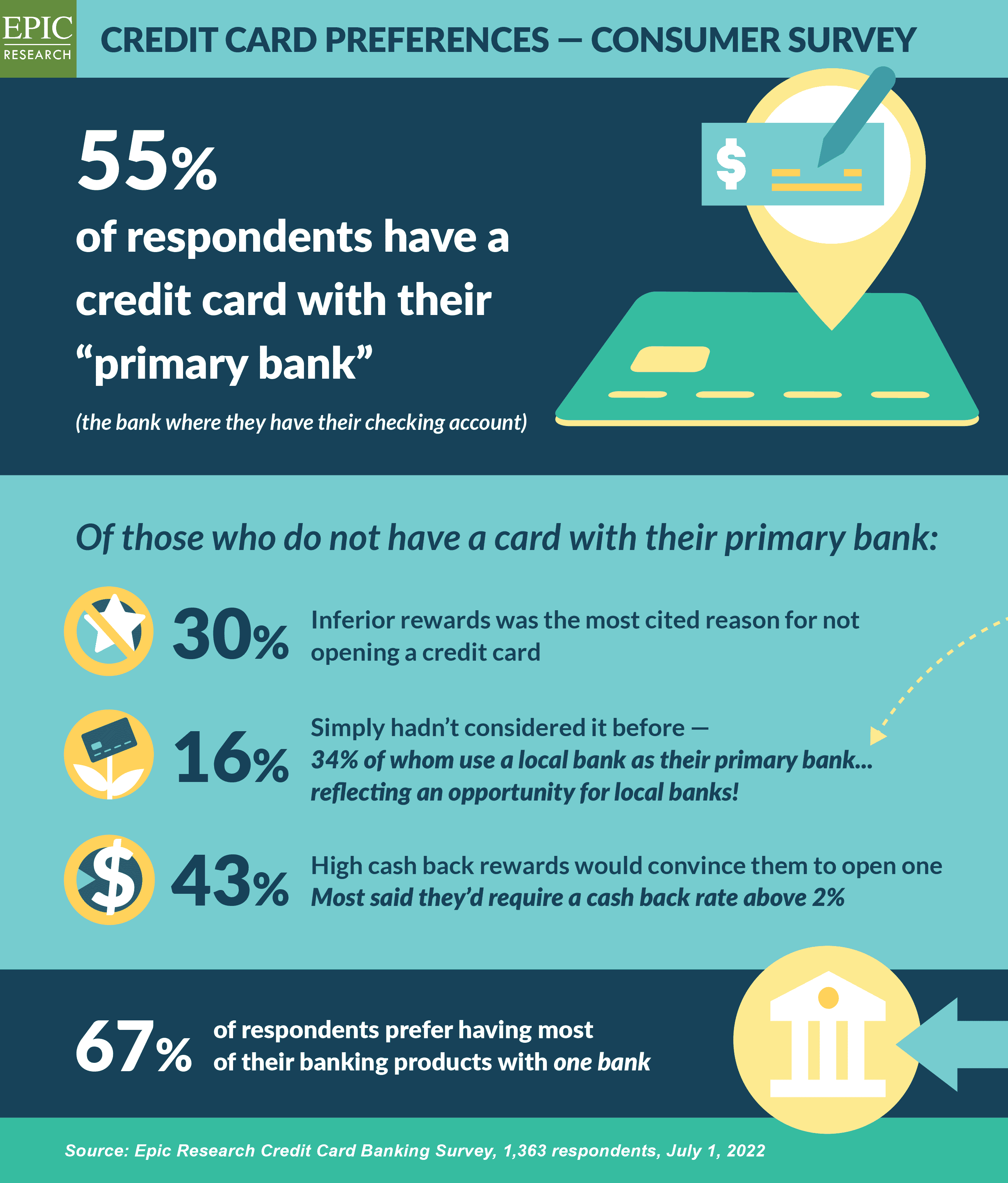

- Epic recently surveyed 1,363 consumers regarding their credit card banking preferences, which revealed that most consumers prefer to have most of their banking products with one bank

- Although 57% of respondents who use a local bank as their primary bank preferred to have most of their banking products with one bank, they were only half as likely to have a credit card with their primary bank as those banking with larger institutions

- While many may presume that the “mega mailers” – Capital One, Chase, Citi, American Express, etc. – are vastly preferred by consumers, our survey reveals that many consumers may prefer a card issued by their primary local bank, but may have not opened one due to lack of awareness or non-competitive products

Mega Mailers Leave Growth Opportunity for Regional Banks

- The findings above reveal an opening for regional banks to grow their credit card portfolios

- Additionally, branch-based banks frequently have a large brand affinity advantage over their national competitors within their market area

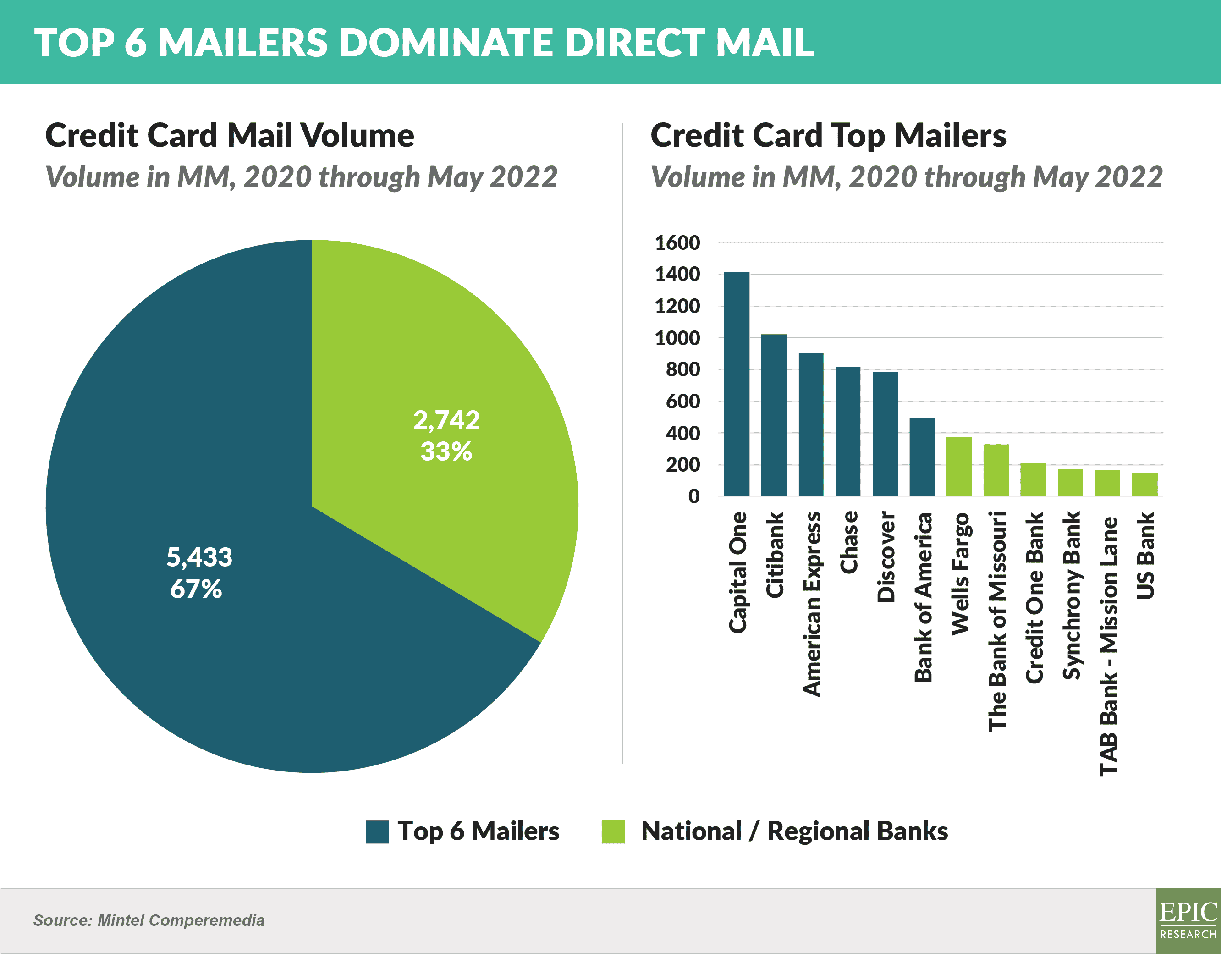

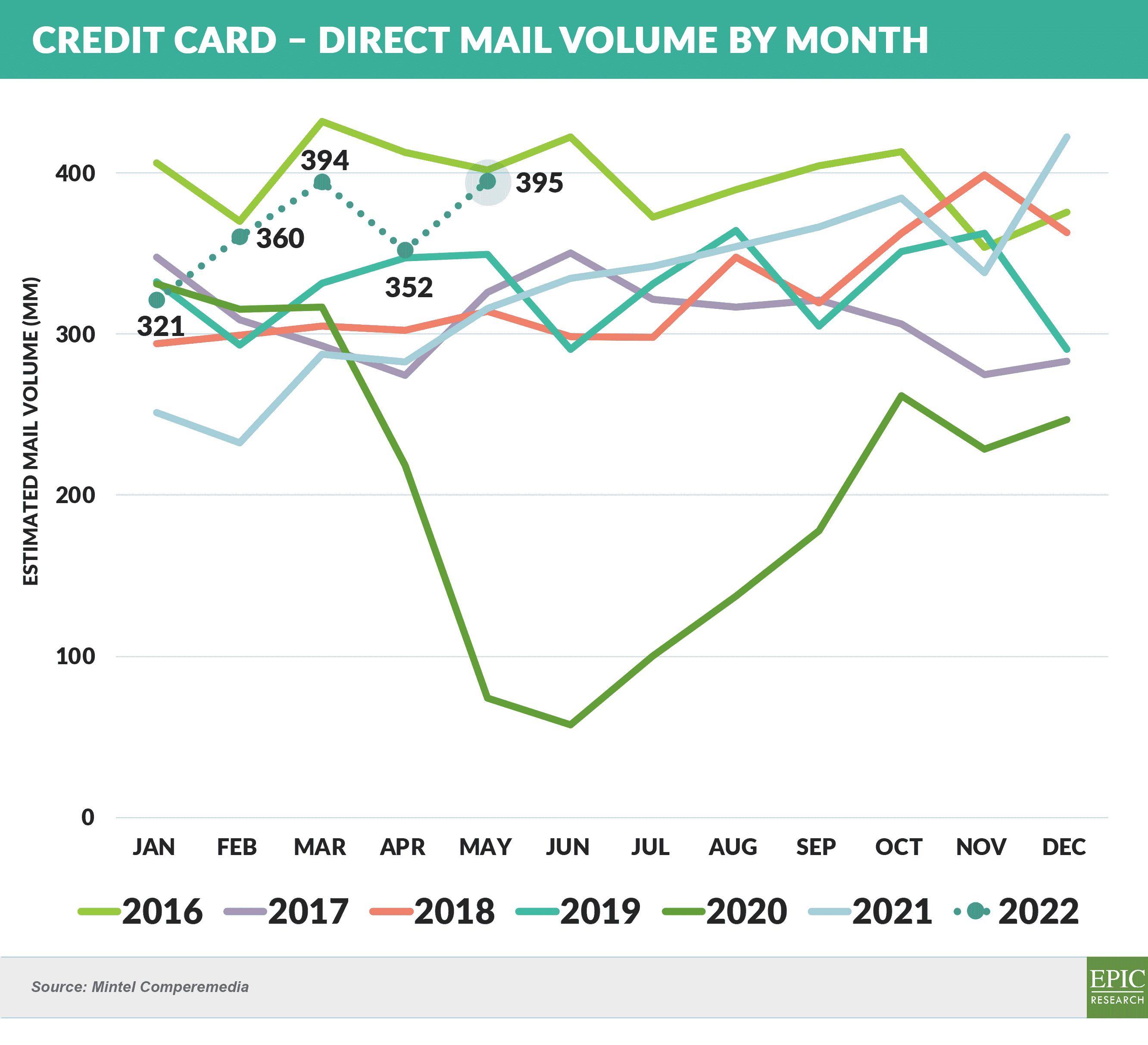

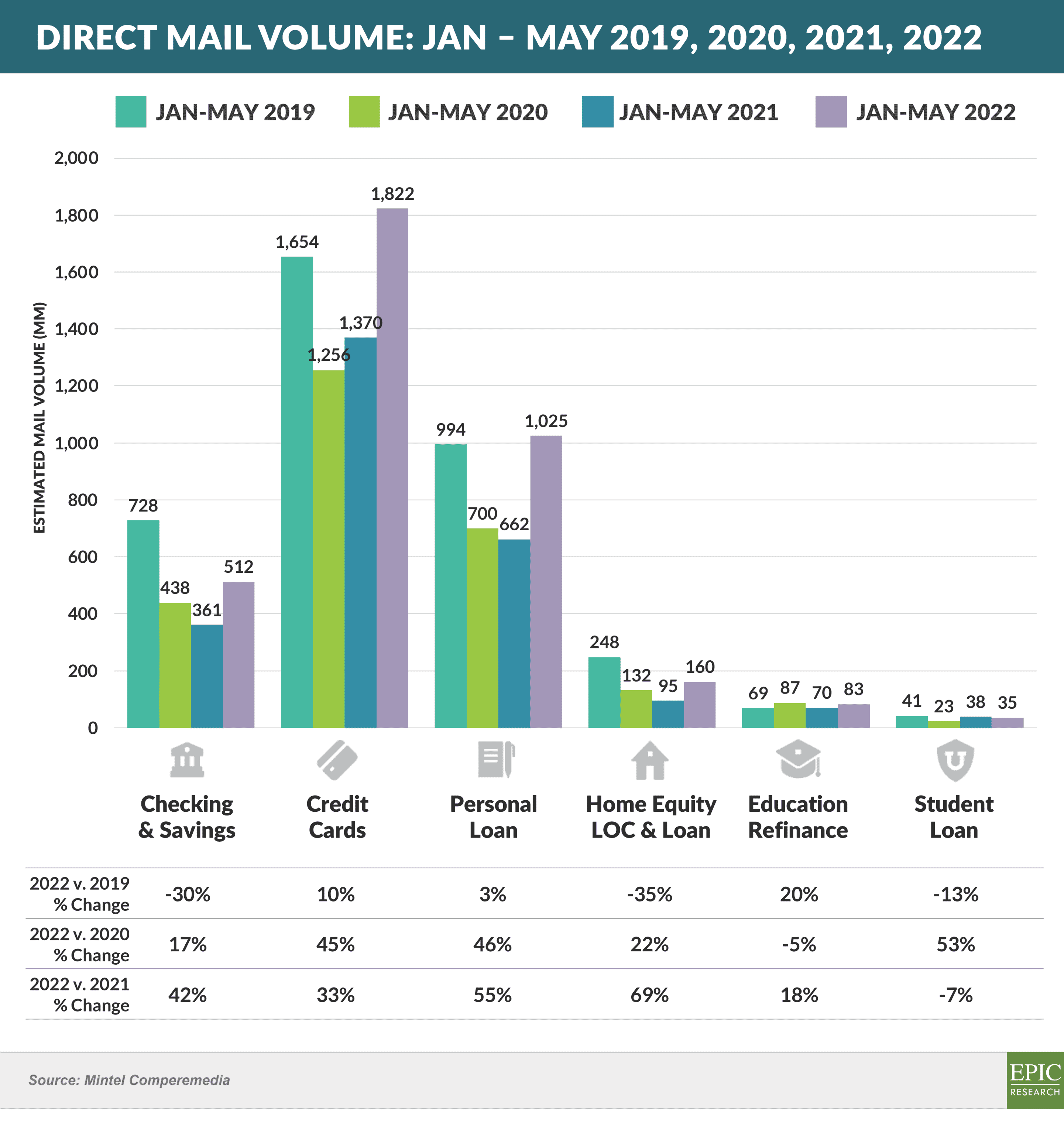

- The current direct mail landscape, which accounts for 60%+ of new credit card account generation, shows that the top six mailers account for two-thirds of the volume YTD through May 2022 – a consistent trend across all regions

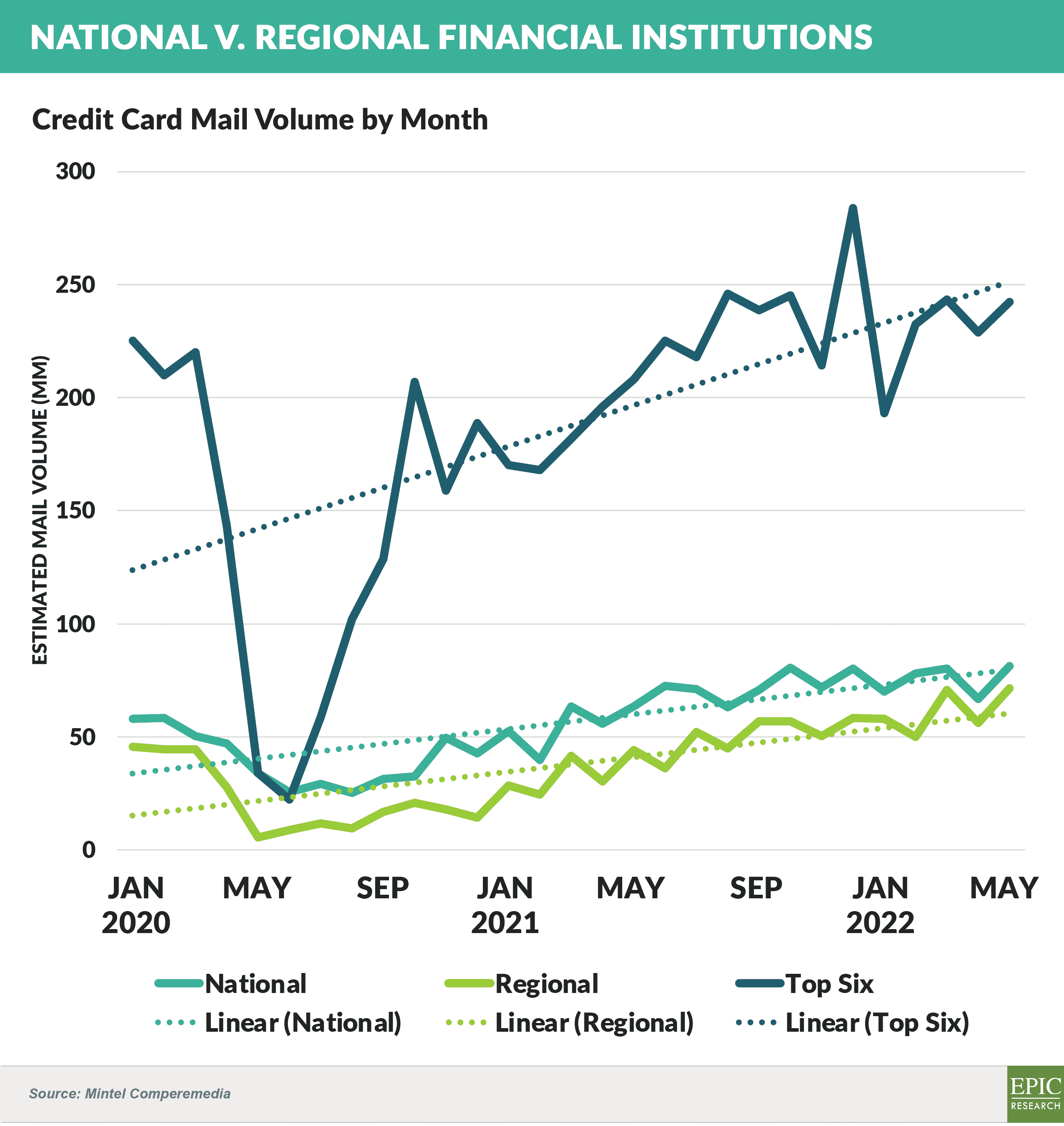

- While mail volume among all issuer categories fell sharply in the early part of the pandemic, all recovered to volumes higher than before COVID

- Volume for the top six mailers fell signficiantly more than the others, possibly because existing customer mailings, which constitute a higher proportion of mail volume for branch-centric banks, remained less affected by the pandemic than prospect (non-customer) mailings

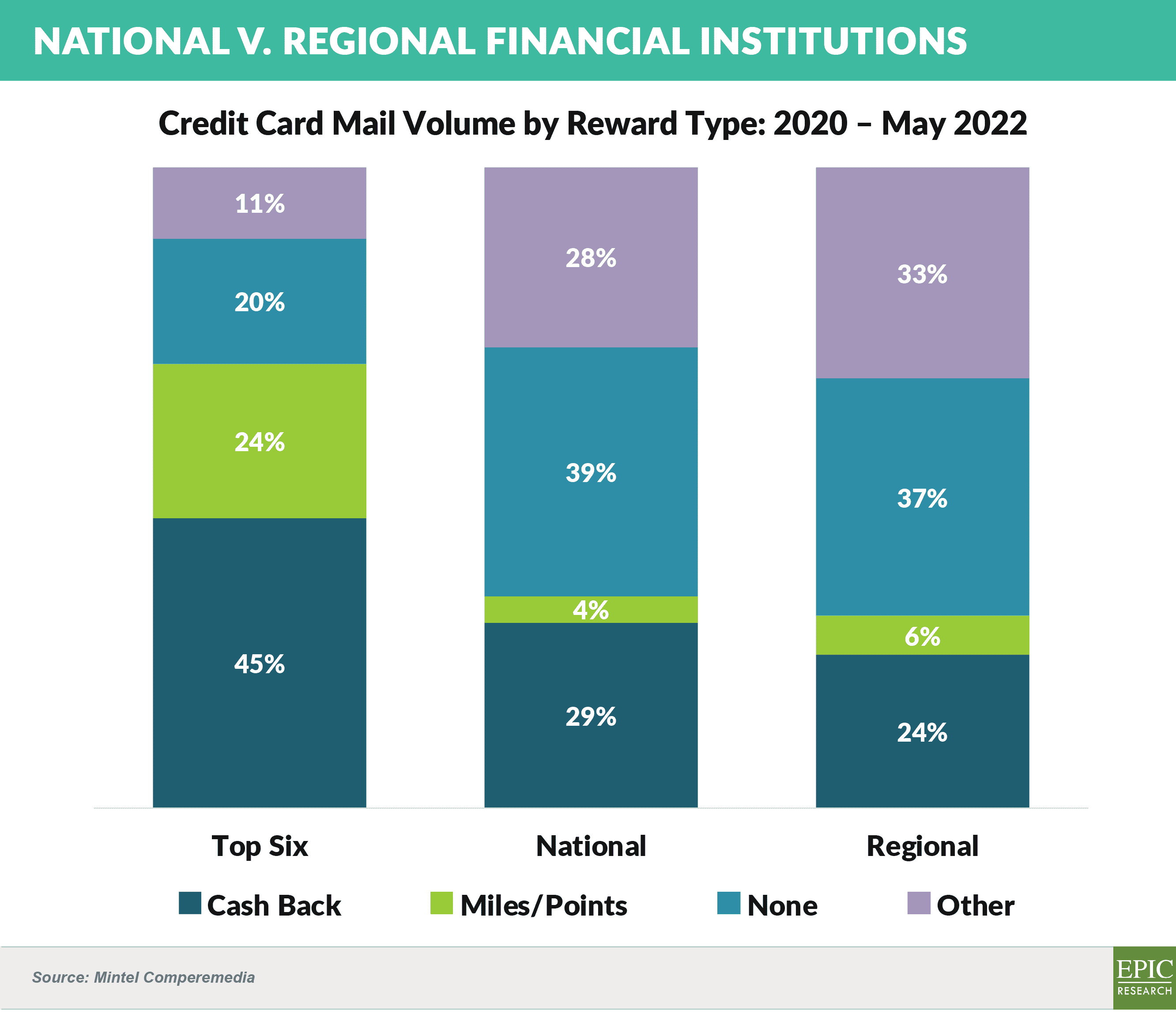

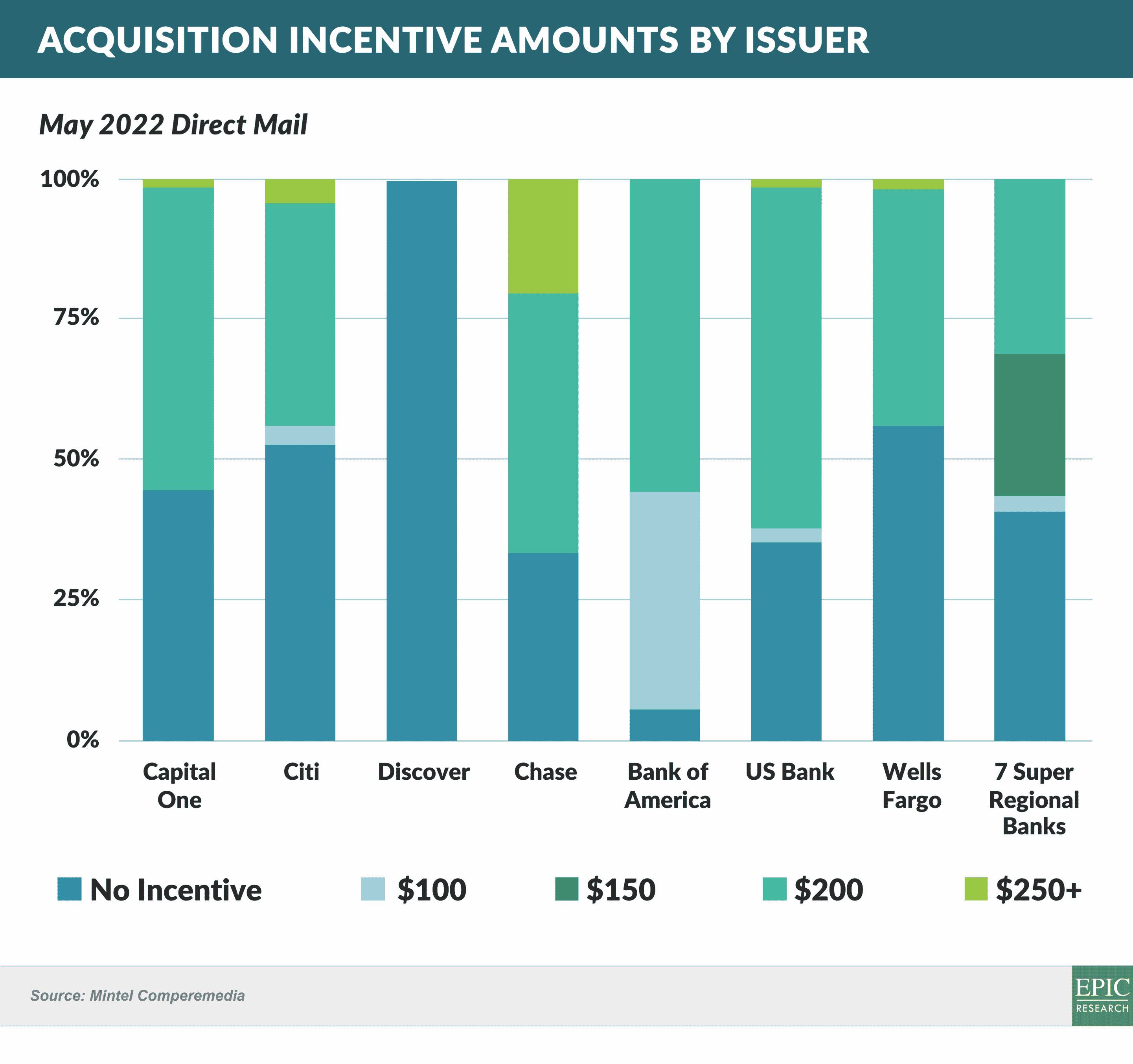

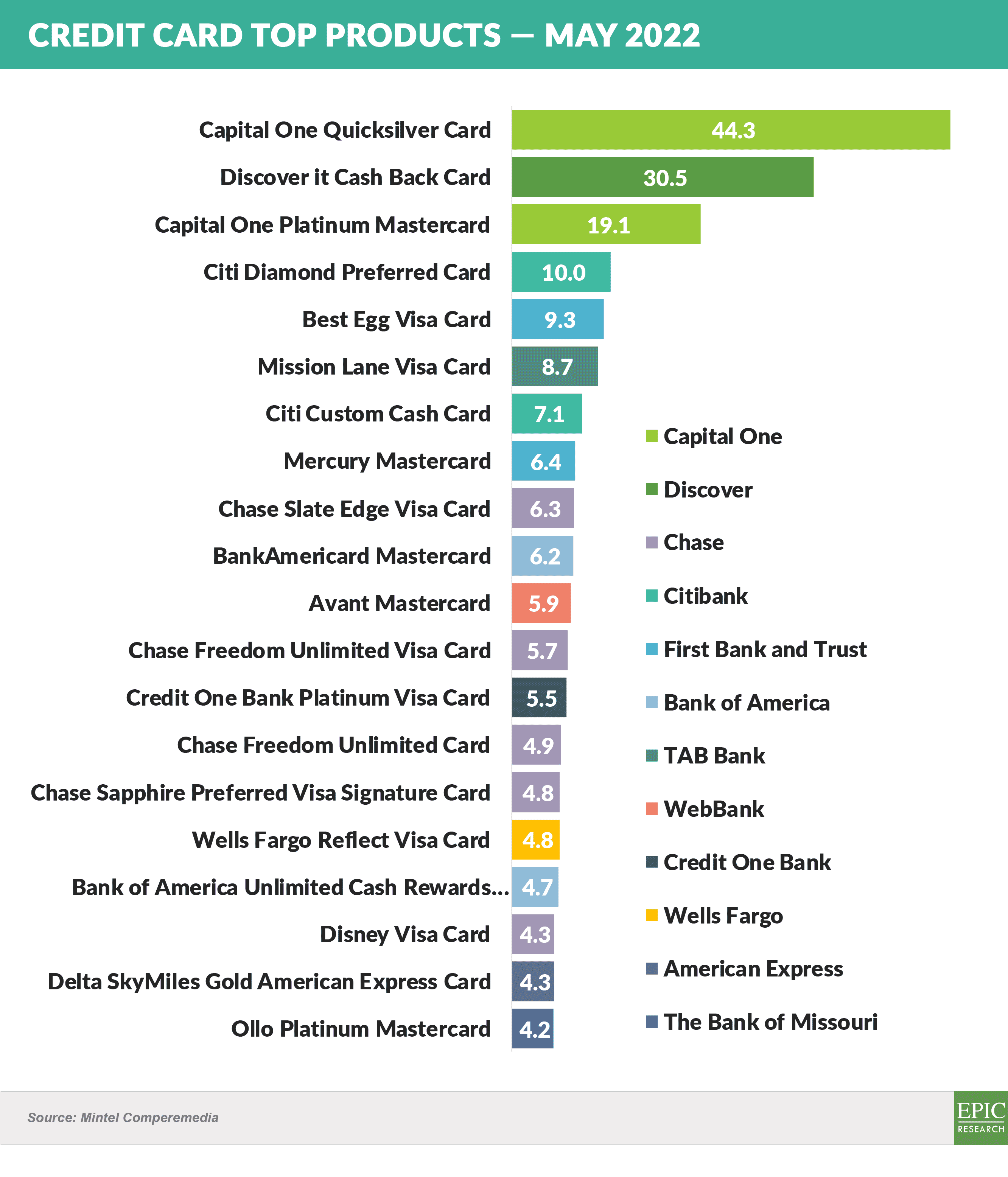

- Cash back credit cards, which scored highly in our consumer preference survey, comprise nearly half of the mail volume for the top six mailers but only around 25% of regional bank offers

- When looking at the competitive landscape for cash back cards, some regional issuers offer products competitive with those of the top six, while others do not

- Many regional banks face barriers to effectively competing in the credit card market, including:

- The absence of testing capabilities (e.g., testing the incremental response and usage lift for various rebate categories or introductory rates), hampering the ability to optimize trade-offs in product features

- Systems limitations within application processing platforms

- The lack of a credit card specific risk management capability

- An absence of expertise in “prospect” (i.e., non-customer) mailing

- Challenges in delivering various offers within the branch itself

- Despite the barriers, regional banks have a significant growth opportunity marketing a competitive cash back credit card product

Consumer Financial Marketing Maintains Upward Trend

- Credit card mail volume continues to approach the highs of 2016 and is up 33% vs. 2021

- Cash back and near-prime offers dominated May mail

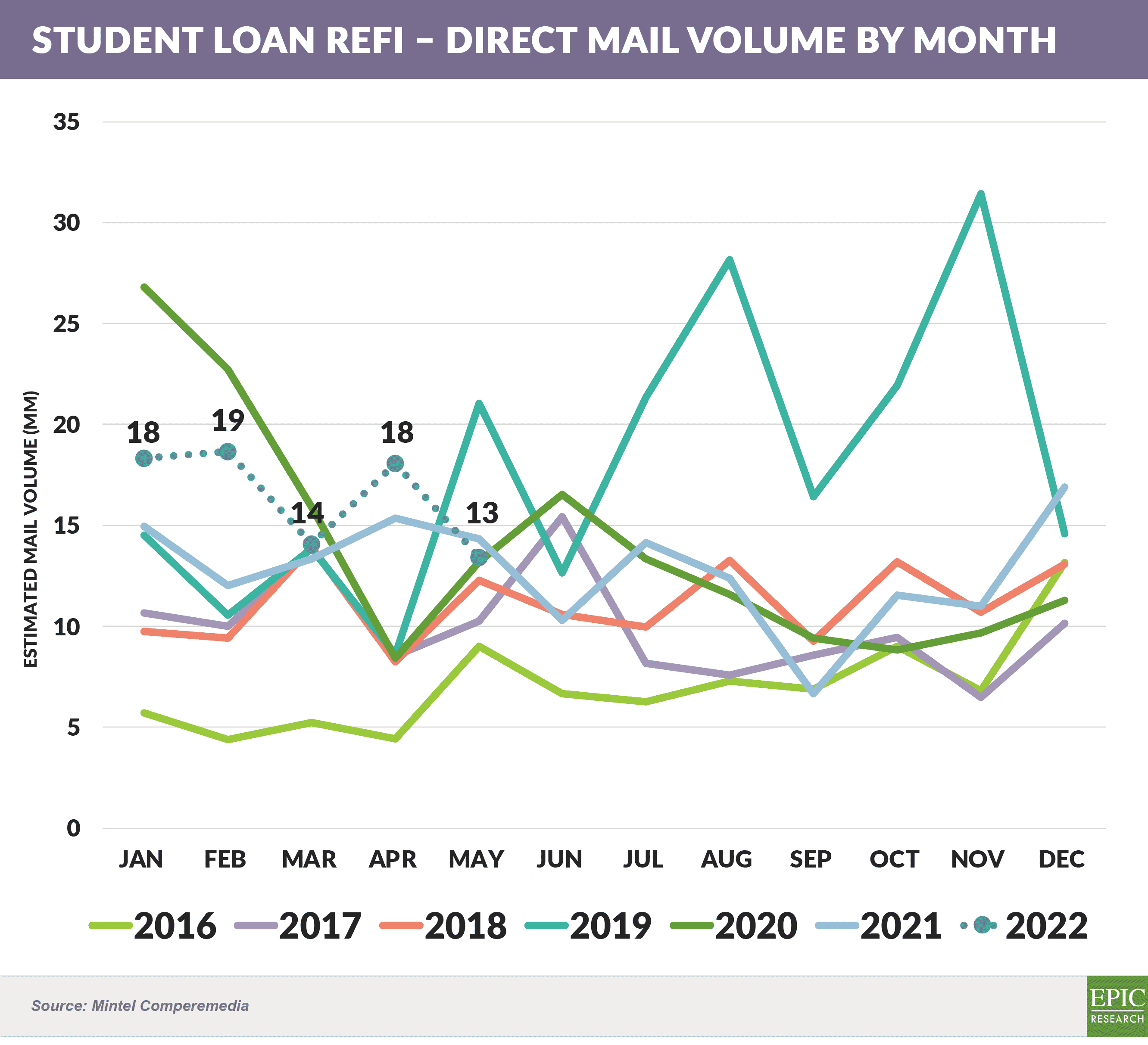

- Despite the fact that many lenders have scaled back education refinance marketing due to the government’s extension of CARES Act forbearance, mail volume remains up 21% vs. 2021

- Credit card, personal loan, and education refinance mail volumes YTD through May 2022 exceeded pre-pandemic 2019 levels

Quick Takes

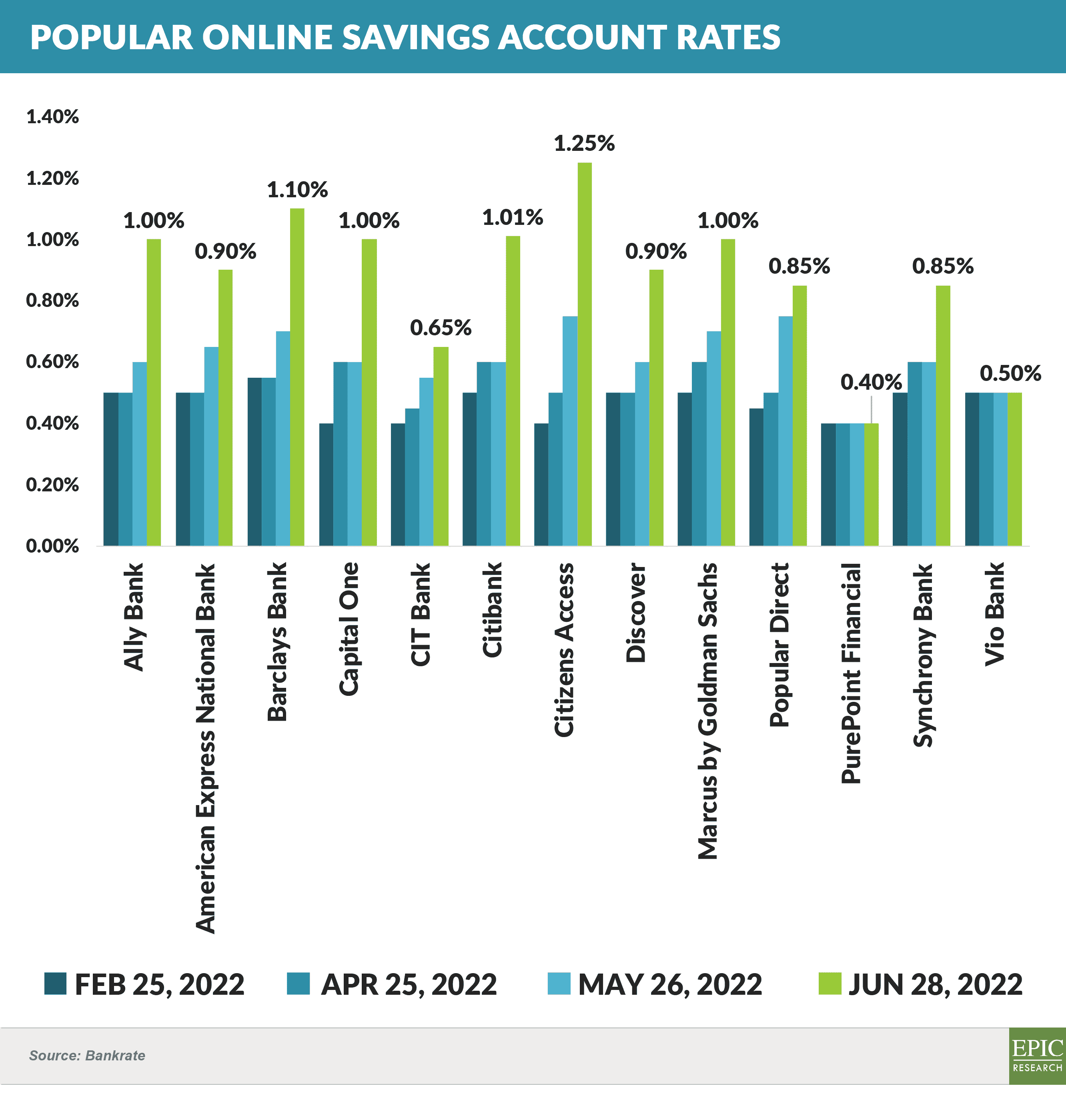

- Online savings rates continued their recent climb, with top APY’s reaching 1.25% and higher – triple the rates of just three months ago

- PayPal announced the PayPal Business Cashback Mastercard for small businesses

- The new card offers unlimited 2% cash back on purchases

- The card will be integrated into PayPal’s merchant platform and issued by WebBank

- BNPL du Jour

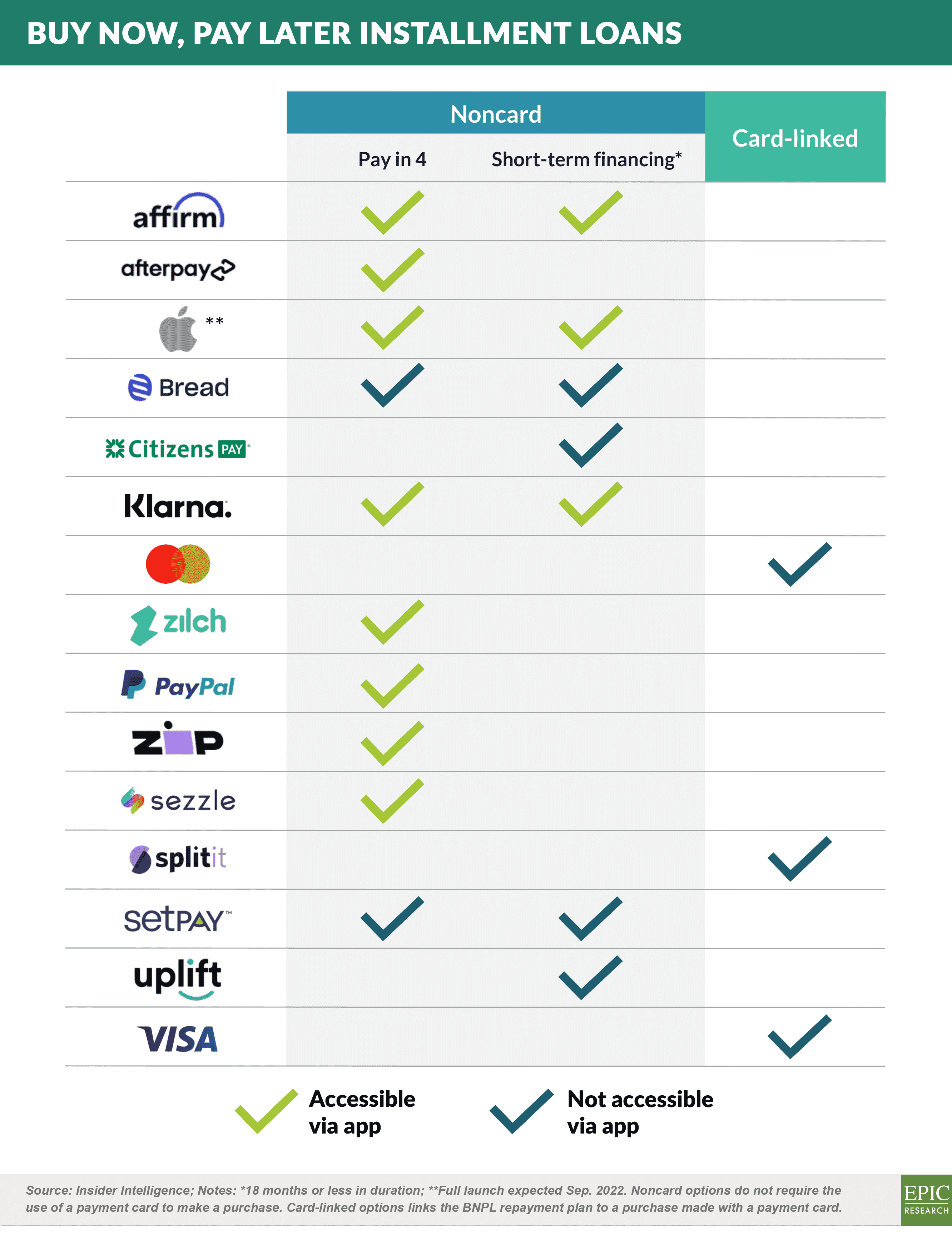

- Apple announced its BNPL offering “Apple Pay Later” in partnership with Goldman Sachs

- Consumers manage the feature through the Apple Wallet and can split purchases into four interest-free installments over six weeks

- Apple Pay has 45 million users in the U.S., but is currently accepted at only 1 million of the 10.7 million U.S. merchants that accept credit cards

- Apple’s offering joins a very crowded BNPL space

- The Epic team has conducted many product, offer, and creative tests over the past three decades, and one of the more interesting findings resulted from a test involving consumer options

- One bank-branded credit card offered a check box allowing respondents to choose either a Visa or Mastercard

- While thinking the choice would make the offer more attractive to the consumer, we tested the choice option against a Visa-only offer with all other product features being the same (we also tested a Mastercard-only offer against the choice offer)

- We were shocked when both the Visa and Mastercard-only offers generated significantly higher response rates than the creative offering a choice

- The lesson: the fewer decisions a consumer has to make, the more likely they are to choose your product

If the Epic Report was forwarded to you, click here to add your name to the mailing list.

The Epic Report is published monthly, with the next issue publishing on July 9th.

Thank you for reading.

Jim Stewart

www.epicresearch.net

Email me with your comments and suggestions on future topics or to have someone added to our distribution list.

Epic Research is a marketing company that helps our financial services clients acquire new customers via organic growth. Click here to find out how we can help you.

To read our previous newsletters, click here.